Navigate

Article List

- Strategic Expansion & Market Adaptation: YLG Bullion’s Journey Into Dubai’s Gold Arena

By Pawan Nawawattanasub, CEO, YLG Bullion International

- HISTORY OF GOLD IN AUSTRALIA & FUTURE TRENDS

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- KIS GOLD PRICES PLAYING CRUCIAL ROLE IN DEVELOPMENT OF ASIA GOLD HUB

By Kallanish Index Services

- THE WORLD GOLD COUNCIL’S VISION FOR THE GOLD MARKET

By Chen Qinghan, Central Banks and Public Policy Lead, World Gold Council

- LAOS’ GOLD RUSH: A GOLDEN OPPORTUNITY FOR ECONOMIC GROWTH

By PTL Holding Company Limited

- US ELECTION DYNAMICS A POSITIVE FOR GOLD, WITH MIXED IMPACT ON KEY COMMODITIES

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securities

- BUILDING ASIAN BULLION TIGERS

By FINMET PTE LTD

- The ASEAN Gold Market – A 2024 Update

By Nikos Kavalis, Managing Director, Metals Focus Singapore Pte Ltd

- LBMA & SBMA: A Golden Partnership

By Ruth Crowell, Chief Executive, LBMA

- SBMA News

By SBMA

Article List

- Strategic Expansion & Market Adaptation: YLG Bullion’s Journey Into Dubai’s Gold Arena

By Pawan Nawawattanasub, CEO, YLG Bullion International

- HISTORY OF GOLD IN AUSTRALIA & FUTURE TRENDS

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- KIS GOLD PRICES PLAYING CRUCIAL ROLE IN DEVELOPMENT OF ASIA GOLD HUB

By Kallanish Index Services

- THE WORLD GOLD COUNCIL’S VISION FOR THE GOLD MARKET

By Chen Qinghan, Central Banks and Public Policy Lead, World Gold Council

- LAOS’ GOLD RUSH: A GOLDEN OPPORTUNITY FOR ECONOMIC GROWTH

By PTL Holding Company Limited

- US ELECTION DYNAMICS A POSITIVE FOR GOLD, WITH MIXED IMPACT ON KEY COMMODITIES

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securities

- BUILDING ASIAN BULLION TIGERS

By FINMET PTE LTD

- The ASEAN Gold Market – A 2024 Update

By Nikos Kavalis, Managing Director, Metals Focus Singapore Pte Ltd

- LBMA & SBMA: A Golden Partnership

By Ruth Crowell, Chief Executive, LBMA

- SBMA News

By SBMA

US ELECTION DYNAMICS A POSITIVE FOR GOLD, WITH MIXED IMPACT ON KEY COMMODITIES

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securities

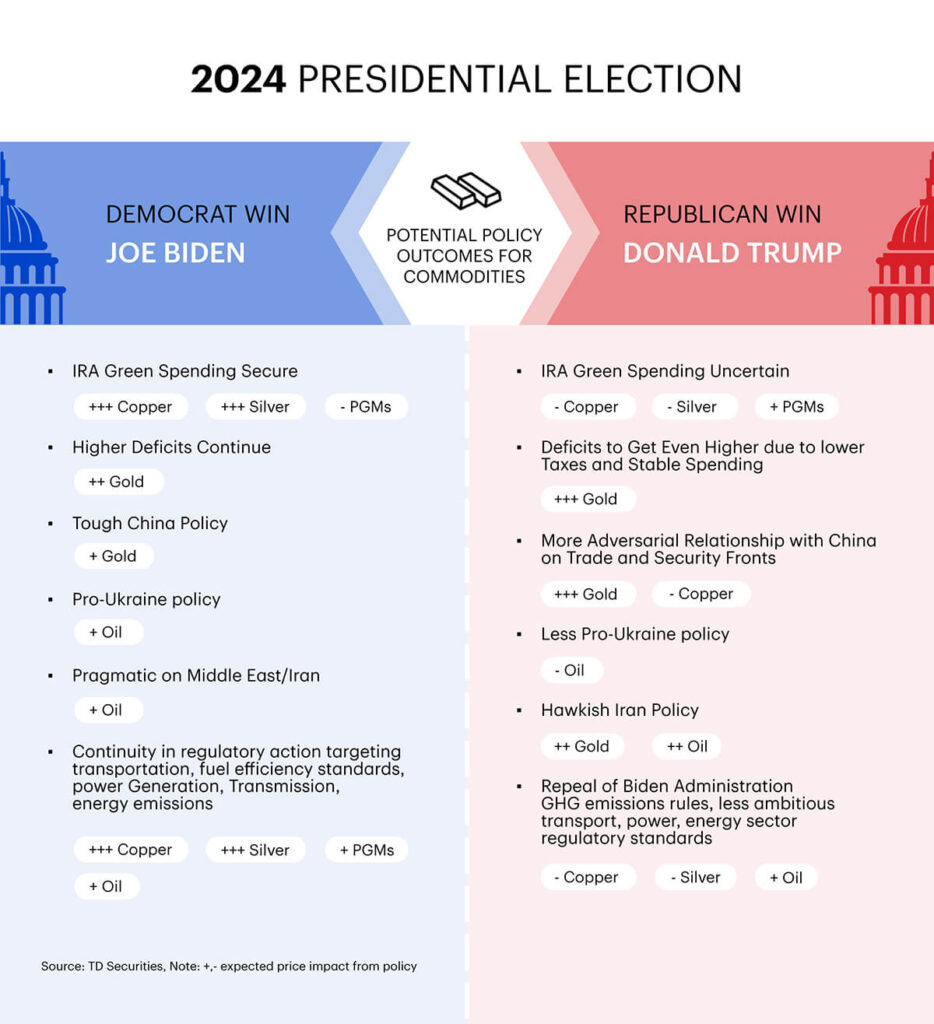

- The results of the upcoming US presidential election are set to be very consequential to energy and climate, international relations, industrial and fiscal policies. Even if President Joe Biden remains in power and the Senate and House are controlled by the same parties as they are now, political debate in the coming months, along with policy drift in response to opinion polls, are sure to occur. This already is shaping, and will no doubt continue to shape, the market outlook for gold, silver, PGMs, copper and crude oil.

- A regime change in the White House and Senate has the potential to reduce spending for environmental initiatives financed by the allocations under the Inflation Reduction Act (IRA). This would be a modest negative for copper and silver, but a positive for Platinum Group Metals. Crude oil and fossil fuels should also benefit. Of course, the degree to which these markets are impacted will depend on the exact policy adjustments pertaining to key sectors such as transportation, power transmission and generation, after the election. That, in turn, will be a function of the final political realities in Congress and the White House.

- A Republican administration is likely to push lower taxes, with spending largely unchanged. The resulting higher deficit projections, from the already very high numbers, should help gold, as it suggests higher inflation, lower real rates and continued central bank buying. A likely even more adversarial stance toward China and Iran by a Republican administration would also contribute to gold’s good fortune and should see oil well supported.

LESS ROBUST ENVIRONMENTAL POLICY A MODEST NEGATIVE FOR SILVER AND COPPER, BUT GOOD FOR PGMS

Less Ambitious Green Spending to Moderate Copper Demand in US

| Copper Loadings Per Vehicle | |

| ICE Vehicle | 25kg |

| Hybrid | 50kg |

| BEV | 75kg |

| Copper Loadings Per Electricity Source | |

| Conventional Grid | 1,500 kg/MW |

| Nuclear | 2,000 kg/MW |

| Onshore Wind | 3,500 kg/MW |

| Offshore Wind | 9,550-12,000 kg/MW |

Source: Precious Metals Commodity Management LLC, IEA, TD Securities

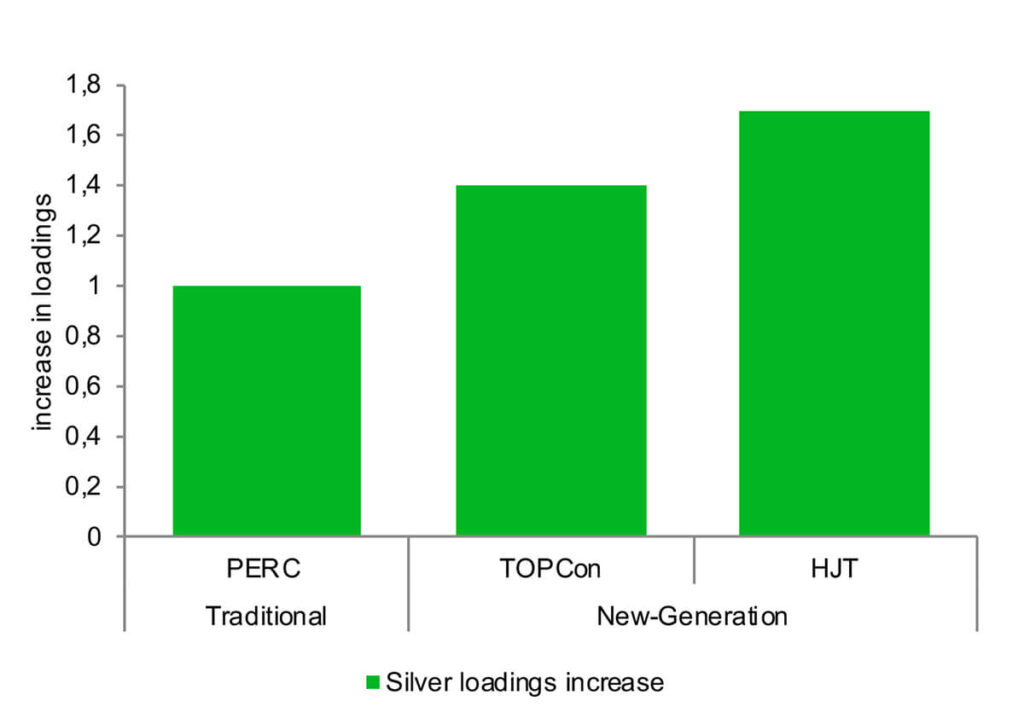

Silver to Benefit from Spending on Next-Gen Solar Technology

SKY-HIGH DEFICITS AND MORE ADVERSARIAL US-CHINA RELATIONS A MANNA FOR GOLD

Very Strong Central Bank Buying Activity to Continue Regardless — But More Under GOP

Plenty of Room For China to Grow Reserves

GOLD A GOOD SANCTION-PROOF PRIVATE AND CENTRAL BANK PORTFOLIO DIVERSIFIER

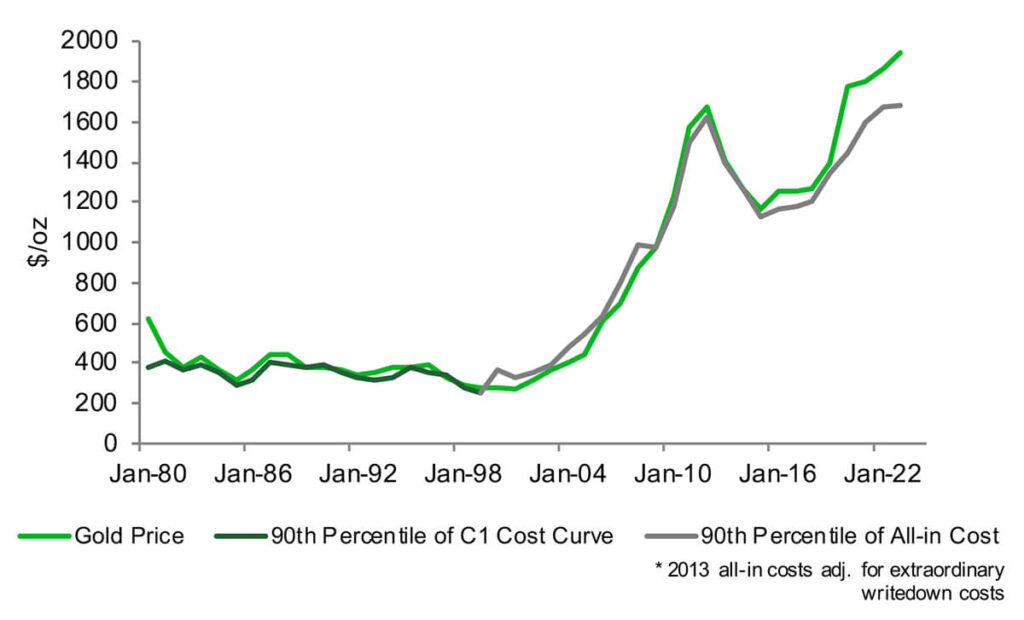

Marginal Cost Rises Along with Higher factor Costs— Making Gold a Good Inflation Hedge

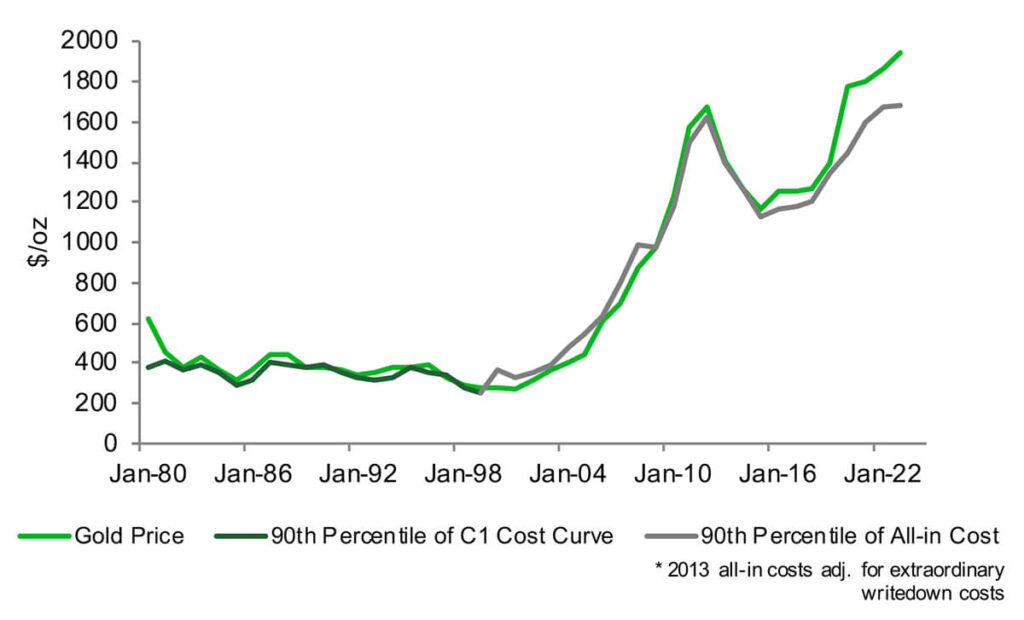

Growing Debt Increases Appetite For Hedge

BART MELEK has over 20 years’ experience analysing precious metals, base metals, energy, financial markets, as well as key economies. He has worked closely with commodity, equity and FX trading desks around the world, and has several forecasting distinctions and top global rankings. Bart contributes to the TD Securities strategic view on commodity, various other markets and macroeconomics. Bart is also a sought-after media commentator. Before joining TD, he held senior roles in equities, commodities and risk.