THE ASEAN GOLD MARKET – A 2024 UPDATE

By Nikos Kavalis, Managing Director, Metals Focus Singapore Pte Ltd

As the Singapore Bullion Market Association celebrates its 30th anniversary and the global bullion industry gathers in Singapore for the 7th Asia Pacific Precious Metals Conference, we take the opportunity to review how the ASEAN’s precious metals markets have evolved over the past few years and consider what the future may hold for the region.

A GROUP OF VIBRANT AND GROWING ECONOMIES

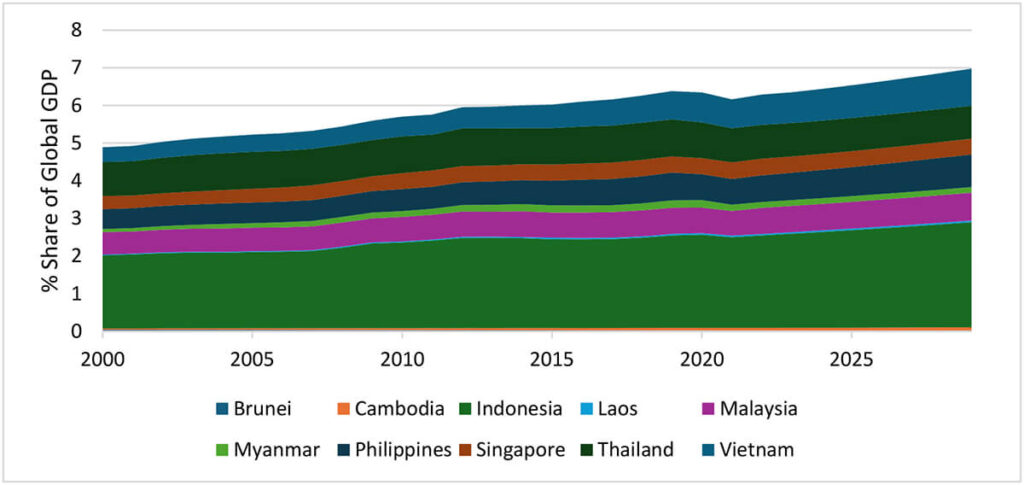

Home to nearly 680 million people, the ASEAN group comprises a number of vibrant and fast-growing economies. Most countries in the region have enjoyed robust economic growth in the past decade, in most cases exceeding the global average. Collectively, ASEAN countries’ GDP amounted to an estimated US$3.8 trillion in 2023. When measured in purchasing power parity (PPP) terms, combined ASEAN GDP during the year accounted for 6.4% of the global total and was equivalent to around one-fifth of that of emerging and developing Asia. The past decade has also seen most ASEAN countries enjoy robust per capita income growth. Real GDP per capita, again on a PPP basis, enjoyed cumulative gains over the period in all countries bar one in the group, ranging from 16% to 61%. It is worth noting that the economic data quoted here has been sourced from the International Monetary Fund’s (IMF) latest World Economic Outlook database, released in April 2024.

Looking ahead, these trends are set to continue for the foreseeable future. The IMF’s latest projections show decent economic growth across all member countries. By 2029, the organisation forecasts ASEAN’s combined GDP to have reached US$5.8 trillion in nominal terms, with its PPP contribution to global GDP reaching 7%. Crucially, per capita GDP within the group is also expected to enjoy healthy gains, underpinning the continued growth of the region’s middle classes.

ASEAN Countries’ Share of Global GDP, History & Forecast*

Source: IMF World Economic Outlook, April 2024

HOME TO KEY MID-TIER GOLD MARKETS AND A TRADING HUB

While the gold demand and supply within the ASEAN cannot compete in size with China and India, the group includes some important mid-tier gold markets. Indonesia, the Philippines, Thailand, Vietnam and Malaysia are all important sources of gold supply and/or demand. Meanwhile, through the efforts of the SBMA and the support of the country’s government, Singapore has evolved into a key regional trading, refining and vaulting hub, servicing Southeast Asian markets and fortifying the region’s links to the rest of the globe.

Indonesia is the ASEAN’s largest mine producing nation, with total output of 134 tonnes in 2023. It is home to Grasberg, which although a primary copper mine, was the world’s largest gold producing mine in 2023. Indonesia also has sizeable local bar and coin as well as jewellery markets and, as a result of the latter, generates large volumes of recycled gold. It is finally worth noting that the country also hosts one of the three LBMA-accredited refineries within ASEAN.

The Philippines is the other major source of primary gold supply in the region, with annual production of 41 tonnes in 2023. The country’s central bank has a long history of activity in the gold market, operating an LBMA-accredited refinery and supporting the local artisanal and small-scale mining sector. Gold demand in the Philippines is still relatively small, however it has been enjoying healthy growth in recent years.

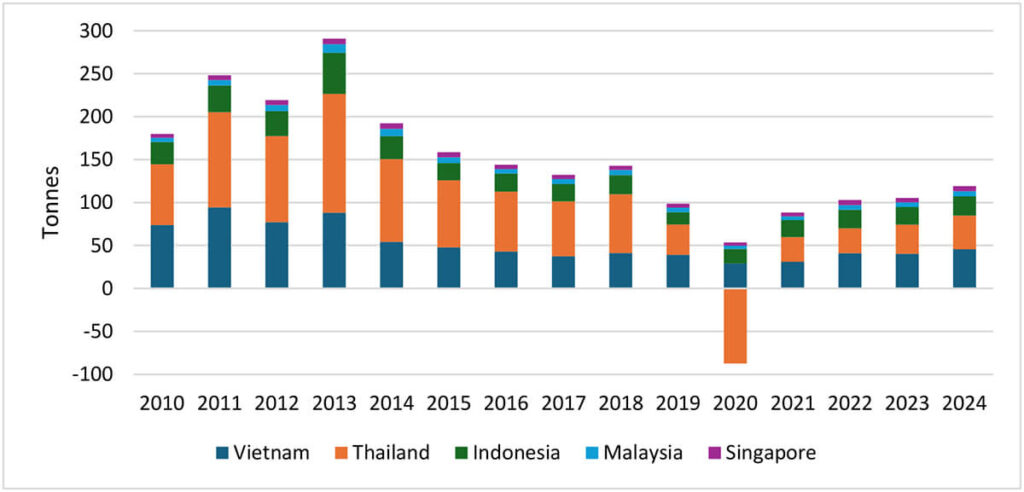

Thailand has a vibrant two-way gold market. At its peak, bar and coin demand in the country reached 135 tonnes. While last year’s figure of 34 tonnes may seem small in comparison, one needs to take into account the rise in electronic gold trading options available to Thai investors in recent years, which has cannibalised bar and coin sales. The much higher price, of course is another factor – the Thai baht-denominated gold price average was more than 50% higher last year than in 2013. Thailand can also be a major source of disinvestment and scrap.

Key ASEAN Countries Net Retail Investment Demand

Vietnam is another historically strong gold bar and coin market. Concerns about currency depreciation have underpinned demand for gold in the country. It is interesting to note, for instance, that in spite of Vietnamese income levels being far lower than in Thailand, at its 2011 peak of 94 tonnes, retail investment for physical gold in the country was only around 15% lower than Thai demand during that year. Government restrictions on gold imports, which have resulted in exceptionally high premiums, coupled with growing interest in real estate and equities among investors, have put pressure on demand volumes. However, the 40 tonnes of retail investment recorded last year still comfortably leaves Vietnam in the top-10 biggest markets globally.

Malaysia, finally, is a major jewellery fabricator and exporter, primarily to the UAE but also to a handful of Asian markets.

Last but not least, Singapore is the ASEAN’s trading, refining and vaulting hub. With a population of less than 6 million, it is no surprise that neither retail investment demand nor jewellery are significant in the country. However, due to its business-friendly environment and rule of law, Singapore has attracted a number of key precious metals market intermediaries, who have set up trading operations there. Its expansive network of flights connecting it to the region and the rest of the world, as well as its safety, have also attracted secure transport and vault operators. The development of vaulting facilities has also been helped by the country’s reputation as East Asia’s premier wealth management centre. Finally, a growing need for Asian processing capacity, coupled with government support saw the establishment of Metalor’s refinery, an LBMA-accredited operation, in the city-state, which has further boosted Singapore’s role as a regional hub.

STRUCTURAL CHANGES TO GOLD INDUSTRY AN OPPORTUNITY FOR ASEAN

The past two decades have seen a structural transformation take place in the precious metals industry, particularly the gold market. Some of the period has seen Asian demand experience breakneck growth, and the overall importance of the region has increased. Combining Metals Focus and GFMS data (as Metals Focus’ own series only goes back to 2010), we calculated that the share of global gold demand that East Asian jewellery fabrication and retail physical gold investment rose from 16% in 2003 to a peak of 37% in 2013 and has in recent years normalised a little lower, in 2023 at an estimated 25%. When including South Asia and the Middle East, the respective shares rose from 46% in 2003, to a 67% peak in 2013, reaching 57% last year.

Key ASEAN Countries Jewellery Fabrication

All this has also gradually shifted the centre of gravity for global precious metals trading and physical flows. What once was very much a London, New York and Switzerland-dominated market has evolved into a multilateral framework. To be clear, London remains the centre of precious metals liquidity, New York continues to play a leading role in price discovery and Switzerland continues to account for a large share of global refining throughput. However, regional exchanges have grown in importance, over-the-counter transactions between Asian counterparties are increasingly common, as are physical flows within the region, helped by the increase in local refining capacity. As the chart below illustrates, ASEAN’s two largest gold exporters, Indonesia and Thailand, have seen their share of exports with other ASEAN countries increase considerably over the past decade.

Share of Bullion Exports Shipped to ASEAN Countries*

Source: Thai Customs Department, Statistics Indonesia, Metals Focus

This has been transformational for ASEAN precious metals

industry players. We have seen numerous dealers, refiners

and fabricators with businesses originally limited to a single

country or small group of countries grow and develop a strong

international presence. The proximity, in terms of geography,

time zone and culture of the ASEAN region to China and the

opening up of the latter’s gold market through the International

Board of the Shanghai Gold Exchange have also helped. Last

but not least, the development of Singapore’s ecosystem has

provided the necessary framework to facilitate these changes.

While much has been achieved, there remains huge opportunity for growth for the region. Internally, the continued growth of ASEAN economies and local consumers and investors affinity for gold should underpin rising local consumption and investment demand. Meanwhile, as China’s gold market continues to evolve and as Dubai is also undergoing its own transformation, ASEAN precious metals industry participants have an opportunity to participate directly in this increasingly decentralised framework. Singapore’s hub will continue to play a decisive role in this, and we look forward to the next phase of the development of its precious metals ecosystem.

NIKOS KAVALIS is a founding partner of Metals Focus. He has over 20 years of experience in precious metals, having previously worked for the Royal Bank of Scotland and GFMS. Since September 2019, Nikos has been based in Singapore, where he also runs the local subsidiary of Metals Focus.

Read more: