Navigate

Article List

- Editorial

By Albert Cheng, CEO, Singapore Bullion Market Association

- The Golden Future of Thailand’s Bullion Industry

By Pawan Nawawattanasub, CEO, YLG Bullion International

- LBMA/LPPM Conference: Gràcies Barcelona

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Central Bank Gold Buying Reaches Record Levels

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Why Platinum is a Strategically Important Metal

By Edward Sterck, Director of Research, the World Platinum Investment Council

- A Paradigm Shift in Japan’s Gold Market

By Bruce Ikemizu, Representative Director, Japan Bullion Market Association

- Gold’s Rush to the East

By Ronald-peter Stöferle, Managing Partner, Incrementum AG

- SBMA News

By SBMA

Article List

- Editorial

By Albert Cheng, CEO, Singapore Bullion Market Association

- The Golden Future of Thailand’s Bullion Industry

By Pawan Nawawattanasub, CEO, YLG Bullion International

- LBMA/LPPM Conference: Gràcies Barcelona

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Central Bank Gold Buying Reaches Record Levels

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Why Platinum is a Strategically Important Metal

By Edward Sterck, Director of Research, the World Platinum Investment Council

- A Paradigm Shift in Japan’s Gold Market

By Bruce Ikemizu, Representative Director, Japan Bullion Market Association

- Gold’s Rush to the East

By Ronald-peter Stöferle, Managing Partner, Incrementum AG

- SBMA News

By SBMA

Why Platinum is a Strategically Important Metal

Edward Sterck, Director of Research, the World Platinum Investment Council

The hydrogen economy is building momentum, with green hydrogen electrolysis expected to increase 30-fold to around 500 gigawatts by 2035. There are not many established commodities that offer the prospect of significant growth in demand from a new end-use segment, as platinum does through its importance to the hydrogen economy. The pressing need to decarbonise is widely recognised and platinum-based proton exchange membrane (PEM) technologies are playing a significant role in the energy transition. While hydrogen-related demand for platinum is currently relatively small, it is expected to grow substantially throughout the remainder of the decade and beyond, reaching as much as 35 per cent of total annual platinum demand by 2040.

In this regard, platinum’s strategic and economic importance is acknowledged, with the United Sates, United Kingdom, European Union and China identifying its critical mineral status, while legislative drivers, including the US Inflation Reduction Act, further support platinum demand from PEM technologies by accelerating growth in green hydrogen production and fuel cell electric vehicle (FCEV) adoption. The need for energy independence is also spurring on investment in hydrogen that is beneficial for platinum. Notably, reflecting the importance of green hydrogen, government incentive packages have increased from US$50 billion in 2021 to almost US$300 billion only two years later.

Platinum & PEM

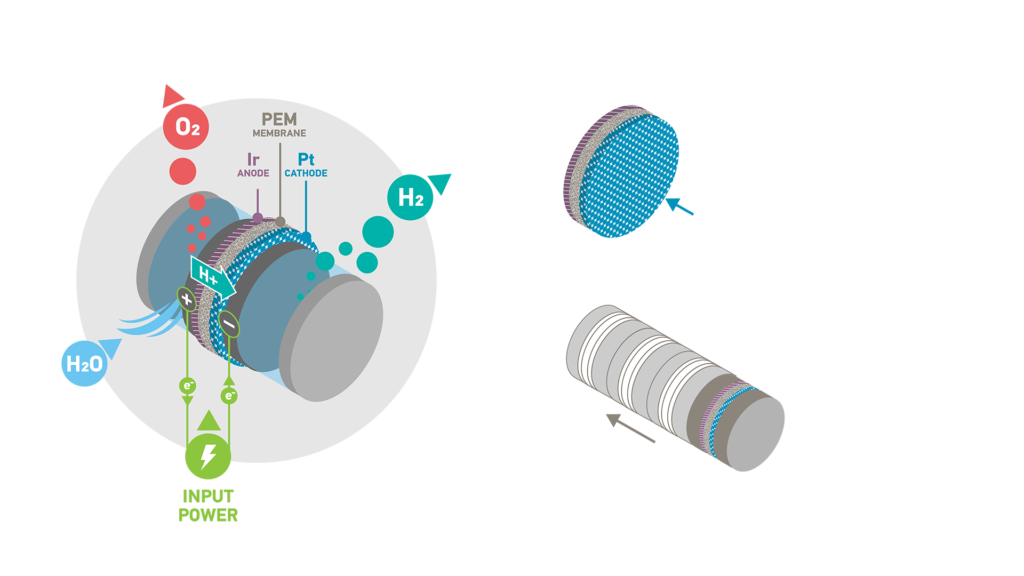

Platinum is essential to PEM applications due to its unique chemical and physical properties. PEM technology is used in both electrolysers to produce hydrogen and in fuel cells, which power FCEVs, as well as providing power for stationary applications.

Hydrogen – the most abundant element in the universe – is already used as a fuel source in industry. As it contains no carbon, it produces zero emissions, only water. However, its credentials as a truly sustainable fuel source depend upon the way in which it is made. To produce hydrogen through electrolysis, an electric current is used to separate water into its component elements – hydrogen and oxygen. When the electric current is derived from a renewable source – solar photo voltaic panels or wind turbines, for example – it is known as ‘green’ hydrogen, an energy carrier that can be used in a wide range of applications to replace fossil fuels. For example, green hydrogen can be used as a feedstock in the production of fertilisers instead of natural gas and as a fuel to power hydrogen FCEVs.

Platinum, in conjunction with iridium, is used as a catalyst in PEM electrolysers, one of the two leading electrolysis technologies available in the market. PEM electrolysis was developed in the 1960s but only commercialised at scale relatively recently, offering advantages over other electrolysers, being compact and more able to cope with the intermittent nature of electricity from wind or solar sources.

A PEM fuel cell works by combining hydrogen and oxygen to generate electricity, with heat and water as the only by-products. Molecules of hydrogen and oxygen react and combine using a PEM which is coated with a platinum catalyst.

Platinum is especially suited as a fuel cell catalyst as it enables the hydrogen and oxygen reactions to take place at an optimal rate, while being stable enough to withstand the complex chemical environment within a fuel cell, as well as the high electrical current density, performing efficiently over the long-term.

Fuel cells share many of the characteristics of a battery – silent operation, no moving parts and an electrochemical reaction to generate power. However, unlike a battery, PEM fuel cells need no recharging and will run indefinitely when supplied with hydrogen. A fuel cell can have a battery as a buffer to store the electricity it is generating.

A single fuel cell alone only produces a few watts of power; several fuel cells can be stacked together to create a fuel cell stack. When combined in stacks, the fuel cells’ output can vary greatly, from just a few kilowatts of power to multi-megawatt installations. Fuel cell stacks that do not use platinum-based PEM technology need to be much bigger to achieve similar power outputs. This makes platinum essential to the efficiency of end-user mobile applications and its use ensures that the fuel cells are compact enough for use in FCEVs.

Critcal mineral status

WPIC research indicates that, given proposed PEM electrolyser build-out, platinum’s role in enabling the achievement of global decarbonisation targets could be highly significant. In fact, platinum-based PEM technology could alone deliver up to eleven per cent of global CO2 emissions-reduction targets as set out in the Paris Agreement, by 2030, if all the currently planned hydrogen projects come to fruition.

It is increasingly being appreciated that having a secure stake in the value chains of climate-safe energy technologies, such as green hydrogen production, can boost a country’s economic competitiveness, energy independence and national security.

For example, the US defines critical minerals as ‘those nonfuel minerals which have a supply chain that is vulnerable to disruption and which serve as an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economic or national security of the US’. Its critical mineral list features the platinum group metals (PGMs) platinum, palladium, iridium, rhodium and ruthenium as individual elements, reflecting the importance of PGMs as raw materials in technologies that support the clean energy transition.

In Europe, the European Commission’s Action Plan on Critical Raw Materials, 2020, focuses on developing secure, resilient, diversified and sustainable supply chains that foster the transition towards a green and digital economy. The plan incorporates a list of 30 critical raw materials, designated as such based on economic importance and perceived supply risk, which include the same PGMs as those listed in the US, citing their use as chemical and automotive catalysts as well as their use in electronic applications and fuel cells.

In China, platinum is recognised as a metal of strategic importance for its use in automotive and industrial applications as well as in PEM technologies. This is accentuated by the lack of domestic platinum production in China. Along with lithium, nickel and cobalt, platinum is specifically mentioned in the China State Council’s New Energy Vehicle Industrial Development Plan (2021-2035), which encourages Chinese companies to improve their capacity to secure long-term supplies of these rare and in-demand elements.

Legislative drivers

The US Inflation Reduction Act (IRA), 2022 further consolidates the strategic importance of hydrogen technologies and, consequently, platinum. The IRA aims to see investment of US$369 billion over ten years into energy and climate programmes, injecting significant sums into clean energy and electric vehicle incentives and programmes.

Following on from the IRA, the US’s National Clean Hydrogen Strategy was announced earlier this year, with the stated ambition of enabling multi-gigawatt scale electrolyser manufacturing capacity. In parallel, the US’s Infrastructure Investment and Jobs Act (IIJA), enacted on 15 November, 2021, has a variety of initiatives to stimulate new markets for clean hydrogen, including US$1 billion of funding for a clean hydrogen electrolysis programme, aimed at improving the efficiency and cost-effectiveness of electrolysis technologies by supporting the entire innovation chain – from research, development and demonstration to commercialisation and deployment – to enable US$2/kg clean hydrogen from electrolysis by 2026. The IIJA also provides US$8 billion of funding for the provision of Regional Clean Hydrogen Hubs.

European energy independence

Global energy prices, which were already rising due to strong demand caused by the post-pandemic economic recovery, surged to record highs last year – and remain volatile – following recent geopolitical events. Countries are now looking at ways to establish energy independence

In Europe, the ‘REPowerEU: Joint European action for more affordable, secure and sustainable energy’ plan, states that the case for a rapid clean-energy transition under the European Green Deal has never been stronger and clearer.

REPowerEU calls for the creation of a ‘Hydrogen Accelerator’ to develop integrated infrastructure, storage facilities and port capacities.

Among other actions, REPowerEU calls for the creation of a ‘Hydrogen Accelerator’ to develop integrated infrastructure, storage facilities and port capacities. It estimates that, with the right investment, green hydrogen could replace between 25 and 50 billion cubic metres per year of imported Russian gas by 2030. This would require a doubling of the 5 million tonnes of green hydrogen production already targeted for 2030 under the European Green Deal, bringing the new target to 10 million tonnes. It is expected that the balance would come from imports of green hydrogen.

Clearly, electrolyser capacity will need to grow if the intentions of REPowerEU for green hydrogen production are to be met, and the EU is looking to install some 80 gigawatts of electrolyser capacity by 2030, up from a pre-crisis plan of 40 gigawatts. The electrolyser capacity required to achieve the intentions of REPowerEU could lead to a significant, incremental increase in platinum demand.

PEM technologies and platinum demand

While PEM electrolysers are a key technology for the production of green hydrogen, fuel cells have higher platinum loadings and are expected to be a far bigger driver of hydrogen-linked demand for platinum. Electrolysis and fuel cell markets are expected to account for up to 20 per cent of total platinum demand by 2030, reaching as much as 35 per cent of total annual platinum demand by 2040.

As hydrogen-linked demand for platinum grows through the decade, platinum is likely to be increasingly seen as a proxy for investment exposure to green hydrogen, given that green hydrogen itself is not a directly investible commodity.

EDWARD STERCK is the director of research at the World Platinum Investment Council (WPIC). Prior to joining WPIC, Edward spent over 15 years in sell-side equity research, where he focused on the mining sector, including coverage of major global platinum producers and diversified miners.

In addition to researching mining equities, he has conducted supply/demand analyses for platinum, diamonds, and uranium. Edward studied geology at the UK’s Royal School of Mines, Imperial College, and is a fellow of the Geological Society.