Navigate

Article List

- Artificial Intelligence Application in Algorithmic Trading: Two-day Workshop

Organised by SBMA, 16 & 18 October 2018

- Malaysia’s Precious Jewellery Market

By Ermin Siow, President, Federation of Goldsmiths and Jewellers Association of Malaysia, 2014-2018

- Why Do Turkish Banks Hold Gold at the Turkish Central Bank?

By Aslı Şahin, FX & Precious Metals Specialist

- The Impact of Artificial Intelligence on Trading and Finance

By Gordon Cheung, Deputy Chief Executive, SBMA and Avirath Kakkar, Head of Strategy, EIS Global Capital Management

- Gold and Blockchain: A Win-Win Combination

By Nikita Knyazev, Head of Commerce, A-Ventures

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Artificial Intelligence Application in Algorithmic Trading: Two-day Workshop

Organised by SBMA, 16 & 18 October 2018

- Malaysia’s Precious Jewellery Market

By Ermin Siow, President, Federation of Goldsmiths and Jewellers Association of Malaysia, 2014-2018

- Why Do Turkish Banks Hold Gold at the Turkish Central Bank?

By Aslı Şahin, FX & Precious Metals Specialist

- The Impact of Artificial Intelligence on Trading and Finance

By Gordon Cheung, Deputy Chief Executive, SBMA and Avirath Kakkar, Head of Strategy, EIS Global Capital Management

- Gold and Blockchain: A Win-Win Combination

By Nikita Knyazev, Head of Commerce, A-Ventures

- SBMA News

By Albert Cheng, CEO, SBMA

Malaysia’s Precious Jewellery Market

By Ermin Siow, President, Federation of Goldsmiths and Jewellers Association of Malaysia, 2014-2018

Published on September 19, 2018

Ermin Siow graduated from University Malaya in 1981 with Bachelor of Science (Hons). He joined Poh Kong Jewellers as its managing partner in 1989 and was elected as one of the Executive Directors when Poh Kong Holding Bhd became a public listed company in Bursa Malaysia in 2004. He was the President of Kuala Lumpur, Selangor, Negeri Sembilan and Pahang Goldsmiths and Jewellers Association from 2010 to 2014, and the President of the Federation of Goldsmiths and Jewellers Associations of Malaysia from 2014 to 2018.

The precious jewellery market (PJM) comprises gem-set jewellery and plain precious metal jewellery. In Malaysia, it is predominantly a plain gold jewellery market, which takes at least 85% of the total PJM. As for gem-set jewellery, diamonds set in 18K or 750 yellow gold or white gold are more popular. The other popular gems sold here are ruby, blue sapphire, emerald, pearls and jade.

Unlike some other countries, especially neighbours like Thailand, Indonesia and Philippines, silver jewellery is not popular in Malaysia. When the price of gold hit an all-time high of US$1,900/oz in 2011 after a ten-year bull run in prices, efforts to promote silver and gem-set jewellery in silver were not successful. The intrinsic value of gold jewellery still remains a major factor behind the purchase of gold jewellery.

Zero-rated GST on precious metals

The General Election held on 9 May 2018 saw the incumbent party, which has ruled the country since its independence in 1957, being overthrown by the opposition. With the new government sworn in, changes were put into place, following its election manifesto. True to its promise, GST for precious metals was zero-rated in June 2018, and the government promised to take steps to abolish the GST once the parliament is convened in August.

Though a new tax regime known as Sales and Service Tax (SST) will be introduced, it is generally acknowledged that the PJM will be exempted. In fact, the new finance minister has already announced verbally in a function held on 4 August 2018 that SST will not be imposed on the precious metal industry when it is fully approved by the parliament in September 2018.

Exports

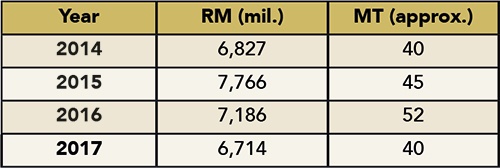

Malaysia exports quite a fair bit of plain gold jewellery (mainly 22K) to the world market. In fact, Malaysia exports more than it consumes (Table 1).

Table 1: Plain gold jewellery exports

Gold jewellery exports have averaged about 50 tonnes annually for the past four years. The main export markets are Middle Eastern countries and Singapore, from where they are re-exported. About 85% of gold jewellery factories are located in the northern peninsular state of Penang with the remaining in Kuala Lumpur and Johor. Exports took off in the early ‘90s, and when the state lifted the 10% import duty on gold bullion, exports really boomed. This move has proved pivotal in helping the industry grow.

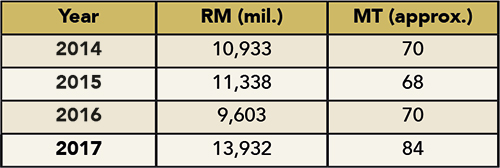

As Malaysia only produces a limited quantity of gold from its very small gold mine operations, it imports gold bullion as raw materials for manufacturing (Table 2).

Table 2: Annual gold bullion imports

After enjoying tax-free status for more than a decade, the government finally introduced Goods and Service Tax (GST) on precious metals in April 2015. With the introduction of GST, only LBMA-accredited gold bullion or kilo bars were exempt from the 6% tax. Diamonds and precious stones were also subject to GST at 6%. This negatively impacted the whole industry. Exports were hampered by new GST-related rules and regulations, and domestic sales of precious metal jewellery were also significantly affected, especially during the first year of its introduction.

Since the introduction of GST, the PJM, through the Federation of Goldsmith and Jewellers Association of Malaysia (FGJAM) worked very hard to lobby the government and engaged with the relevant authorities, especially the Customs Department, to help to iron out issues related to the implementation of GST.

Domestic jewellery market

The domestic market for PJM is estimated at approximately RM6 billion per year. This is based on an annual consumption of approximately 25 metric tonnes of gold. 22K or 916 gold jewellery makes up almost 90% of the total plain gold jewellery sold in the market. 24K or pure gold jewellery, which is more popular in the East Malaysian states of Sabah and Sarawak, has a small niche among Chinese consumers, particularly for weddings, and also caters to Chinese tourists from mainland China. 18K white gold mainly caters to the young, and is mostly used in gem-set jewellery for casings and machine-made chains.

There are approximately 3,500 retail stores, most of which are run by single-store operators. Almost 10% of the retailers are chain stores, and each chain has 15 to 100 outlets. As in other Southeast Asian countries, chain store outlets are usually located in large shopping malls in cities. The mushrooming of shopping malls since the early ‘90s has encouraged shops to be located within malls to tap on their heavy customer traffic and for security.

Currently, there are three publicly listed jewellery companies. All of them are chain store operators with more than 30, 70 and 100 outlets respectively. Their outlets are mostly located in shopping malls. Most of the products they carry, namely 22K yellow gold jewellery, are sourced from local manufacturers. The 24K, 18K and gem-set jewellery are mainly imported from Hong Kong, Italy and Turkey.

What’s in store?

Though free of taxes that would hamper both export and domestic growth, the industry is not without its problems. PJM is seeing strong competition for consumers from industries like tourism, electronics and more, which has greatly reduced its share of consumer dollars. A lack of innovative designs and poor marketing efforts have also contributed to the dwindling consumer demand among the young.

The rise of online jewellery sales, though common in China and becoming more popular in the United States, has not yet gained traction in Malaysia. It is hoped that with the tax-free environment and the brand-new government promising a business-friendly, clean and efficient economy, industry players will take the opportunity to venture out, develop more innovative products and learn from more advanced countries to boost the domestic market, which has been stagnant for some time. Likewise, exporters will explore new markets to boost export tonnage, which has been negatively affected by the introduction of GST. There is now a sense of optimism across the industry, and barring unforeseen circumstances, PJM in Malaysia can certainly look forward to a better future.

Ermin Siow graduated from University Malaya in 1981 with Bachelor of Science (Hons). He joined Poh Kong Jewellers as its managing partner in 1989 and was elected as one of the Executive Directors when Poh Kong Holding Bhd became a public listed company in Bursa Malaysia in 2004. He was the President of Kuala Lumpur, Selangor, Negeri Sembilan and Pahang Goldsmiths and Jewellers Association from 2010 to 2014, and the President of the Federation of Goldsmiths and Jewellers Associations of Malaysia from 2014 to 2018.