PLATINUM CORNER

Platinum Perspectives

Latest Update

30 May 2025

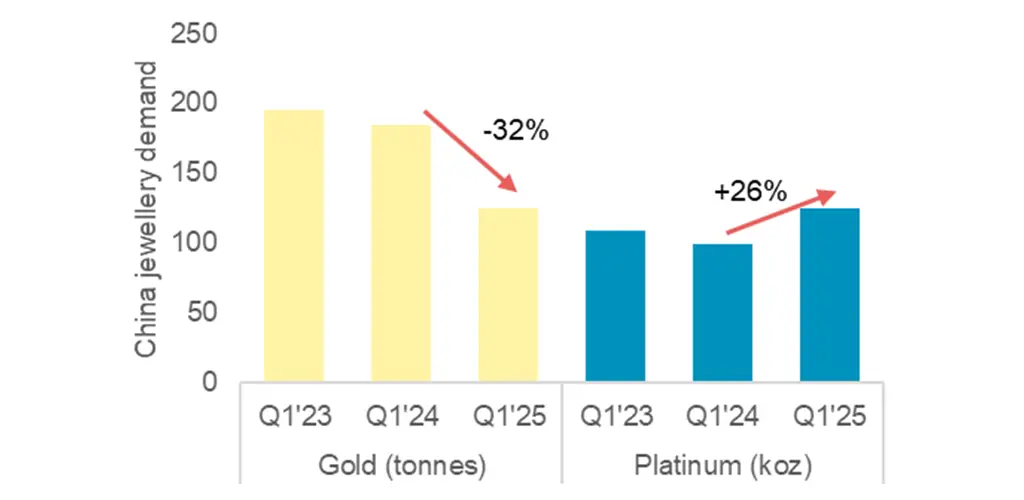

CHINESE PLATINUM JEWELLERY FABRICATION IS GROWING RAPIDLY AS CONSUMERS TURN AWAY FROM EXPENSIVE GOLD

Chinese platinum jewellery fabrication is showing signs of life after a decade long downturn. In 2024, China’s platinum jewellery reported 1% demand growth. However, with ten new platinum jewellery showrooms opening in Shuibei, China, so far in 2025, forecasts for China’s platinum jewellery fabrication demand have been revised upwards from 5% growth originally to 15% year-on-year growth to 474 koz in 2025f.