Navigate

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

Gold has traditionally been considered a safe haven for investors due to its reputation as a store of wealth and hedge against inflation. This appeal is drawing investors across Asian markets, with Singapore emerging as Southeast Asia’s leading gold trading hub. There’s little sign of this slowing down as Singapore has ambitious plans to grow its share of worldwide gold sales from just 2% currently to between 10% and 15% by 2025.

However, financial institutions globally, including those in Singapore, are under increasing pressure to be transparent about their Environmental Social and Governance (ESG) strategy. Investors increasingly want more than just returns from their investment portfolios and seek investments that align with their values, and ESG investments have become the gold standard.

When it comes to ESG considerations, the transportation of gold poses challenges. Flying vast amounts of gold around the world, in its physical form, requires significant energy consumption. Tokenisation, however, presents an opportunity for gold to shine even brighter in the ESG space. Currently, investors in Asia only attribute 7% of their portfolio to digital assets, but as ESG takes centre stage across the continent, it’s likely that we’ll see more and more investors piling into the space.

So just what are the downstream benefits of tokenised gold for the E, the S and the G?

Environmental

Securely moving around gold bullion bars around the world is time-consuming, extremely environmentally unfriendly, and at times unnecessary. With London Good Delivery trading in 400 oz bars, physical gold is not exactly practical. However, gold doesn’t need to weigh heavy on the shoulders of investors.

When it comes to gold, reducing movement of the physical commodity benefits the environment significantly. Tokenisation reduces gold’s ESG transportation footprint by 99.5% because one does not have to constantly fly the asset around the world. Whilst some gold is needed in its physical form and transportation of it cannot be eliminated completely, tokenisation can eliminate the need for physical delivery of that used for investment purposes, by allowing it to be transferred digitally and to be held in a secure digital vault, otherwise known as a wallet. While its accessibility through tokenisation will inevitably increase trading volumes, the footprint of owning the asset will not.

Social

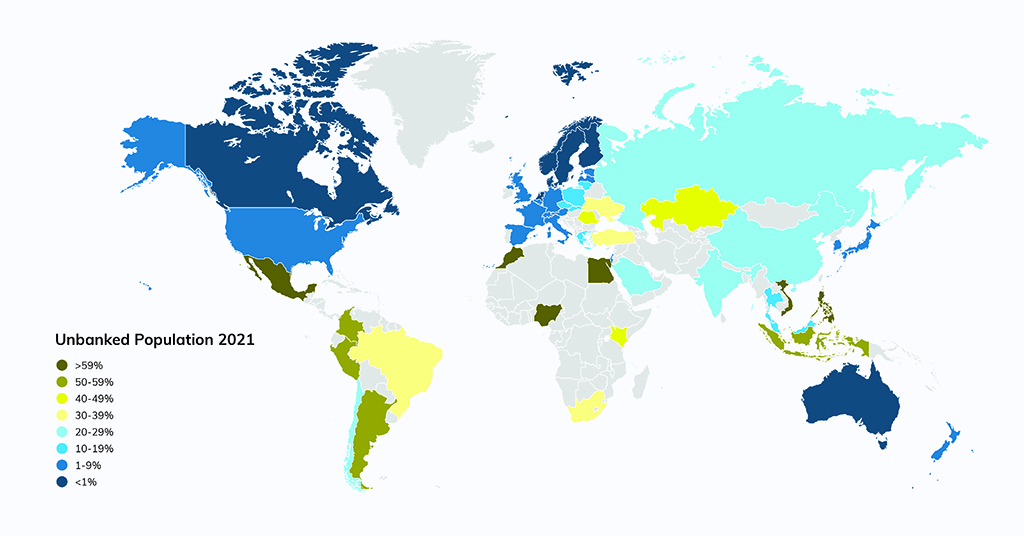

Globally, 1.4 billion adults remain unbanked, meaning they do not have access to traditional banking services. The tokenisation of gold can benefit unbanked communities by providing them with access to a digital asset, which can lower barriers to investment and participation in the digital economy. Furthermore, tokenisation allows for fractionalisation, enabling investors to own small portions of investment grade assets. Why shouldn’t the retail investor have access to assets to protect their purchasing power and hedge against inflation, just like a central bank?

The precious metal also offers developing nations well-needed stability. Zimbabwe is an example of a country prone to hyperinflation, but it has benefitted immensely from the adoption of gold-backed currency. The reserve bank attributes a 30% drop in month-on-month inflation to the issuance of gold coins. Tokenisation can make this even more inclusive, accessible and transparent.

Governance

Tokenisation enables much-needed governance and increased transparency in the gold supply chain. By using distributed ledger technologies and smart contracts, tokenised gold is transparent, faster and more efficient. Investors can track the origin and movement of gold from the mine to the final product, ensuring that they invest in ESG-compliant gold that meets responsible mining standards.

A Bright Future?

The Investment Association (IA) and the World Gold Council have suggested reweighting gold within investment portfolios, recommending an increase from 2% to as much as 8%. However, this increase in demand for gold investment must be balanced against the intense ESG ratings pressure that investors face. Although the mobilisation of gold via tokenisation is unlikely to revolutionise ESG investing overnight, the technology is available and where there is an investment will, there is always a way.

ANOUSHKA RAYNER leads the growth division for commodities at Paxos. She joined the company in 2020 to drive innovation in the precious metals market both in settlement and infrastructure and to lead the effort for transformation into commodities tokenisation. Rayner has also been in the financial markets for 20+ years, with a range of roles covering electronic execution, post-trade and settlement infrastructure in the foreign exchange market.