Navigate

Article List

- SBMA Successfully Concludes First Virtual APPMC

By Albert Cheng, CEO, SBMA

- APPMC: Market Updates

By SBMA

- The Significance of SPDR Gold Shares Dual Currency Trading

By Geoff Howie, Market Strategist, Singapore Exchange

- Our Vision for the Gold Market

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- The New Investment Landscape is Green

By Vikas Shenoy, Head of APAC Origination & Partnerships, Trovio

- Gaining Exposure to Gold via Streaming and Royalty Companies

By Emil Kalinowski, Researcher, Wheaton Precious Metals

- There is Still Mettle Left in the Precious Metals

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- SBMA Successfully Concludes First Virtual APPMC

By Albert Cheng, CEO, SBMA

- APPMC: Market Updates

By SBMA

- The Significance of SPDR Gold Shares Dual Currency Trading

By Geoff Howie, Market Strategist, Singapore Exchange

- Our Vision for the Gold Market

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- The New Investment Landscape is Green

By Vikas Shenoy, Head of APAC Origination & Partnerships, Trovio

- Gaining Exposure to Gold via Streaming and Royalty Companies

By Emil Kalinowski, Researcher, Wheaton Precious Metals

- There is Still Mettle Left in the Precious Metals

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- SBMA News

By Albert Cheng, CEO, SBMA

There is Still Mettle Left in the Precious Metals

By Bart Melek, Global Head of Commodity Strategy, TD Securities

Published on June 10, 2021

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations. Previous to joining TD, Bart was a global commodity strategist and senior economist at another major global financial institution.

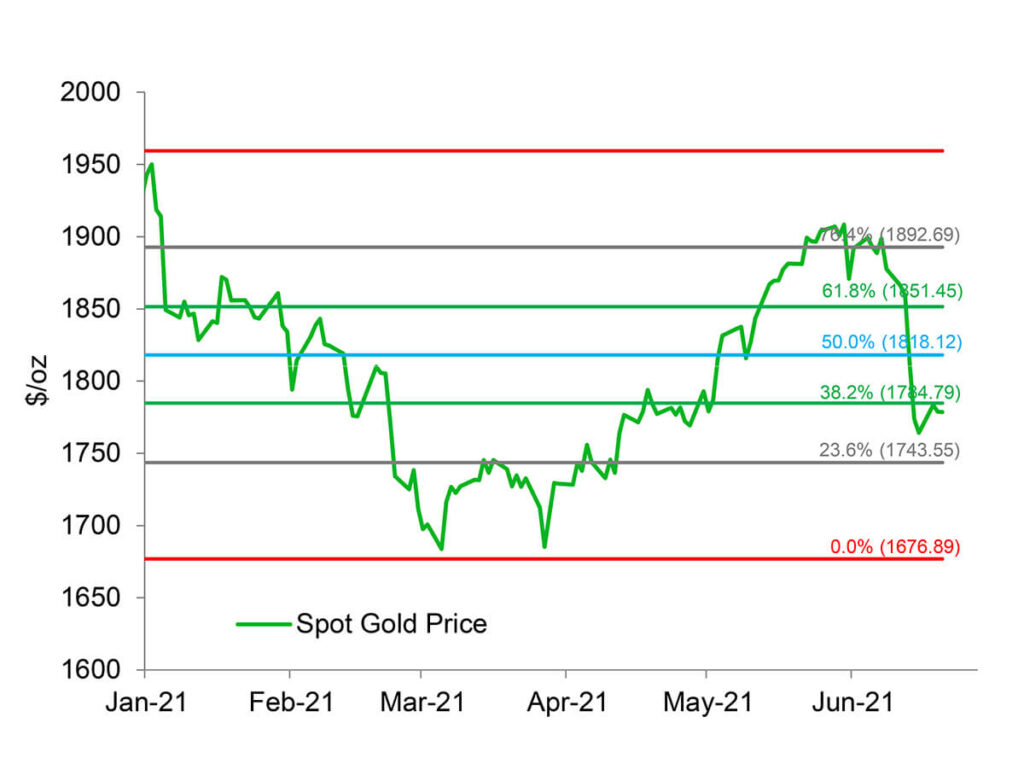

Just as gold rebounded over $200/oz from the late-March lows to trade in the $1,900/oz territory during early-June and market chatter turned bullish again, there was a significant Federal Reserve-driven reversal. As the yellow metal plunged back into the $1,770s/oz range in the days immediately after the June FOMC economic projections were released, the market delivered a sobering reminder to investors and analysts that the path to new highs is almost never a smooth one. A similar object lesson in market realities was also given to silver, platinum and palladium investors.

Despite the recent selloff, we judge that the Fed’s continued emphasis on its full employment mandate should see gold recover most of its recent losses. The relatively new flexible average inflation targeting policy framework and the implied willingness to overshoot inflation targets for a period, should the output gap remain wide, are just a few reasons why very easy monetary conditions are likely to persist well into 2023. In this context, the US central bank should keep real interest rate environment highly accommodative across the yield curve for a prolonged period, which is gold and precious metal complex supportive.

At the same time, various mine site disruptions and other constraints will continue to limit supply growth, as investment and industrial demand remain firm. As such, supply side developments will very likely help the precious metals complex, particularly the more industrial silver, platinum and palladium.

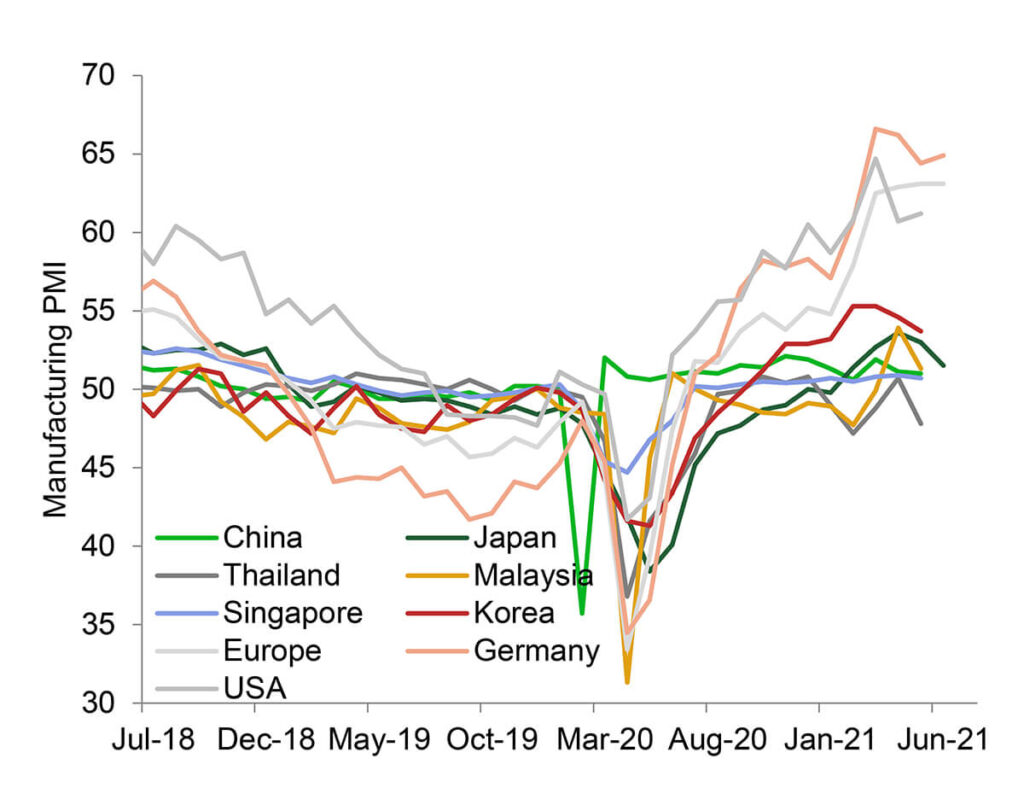

Industrial precious metals are also likely to get support from gold’s respectable performance, the ongoing post-Covid global economic recovery, and the positive sentiment generated by future efforts to decarbonise the global economy.

IN FED AND DATA WE TRUST

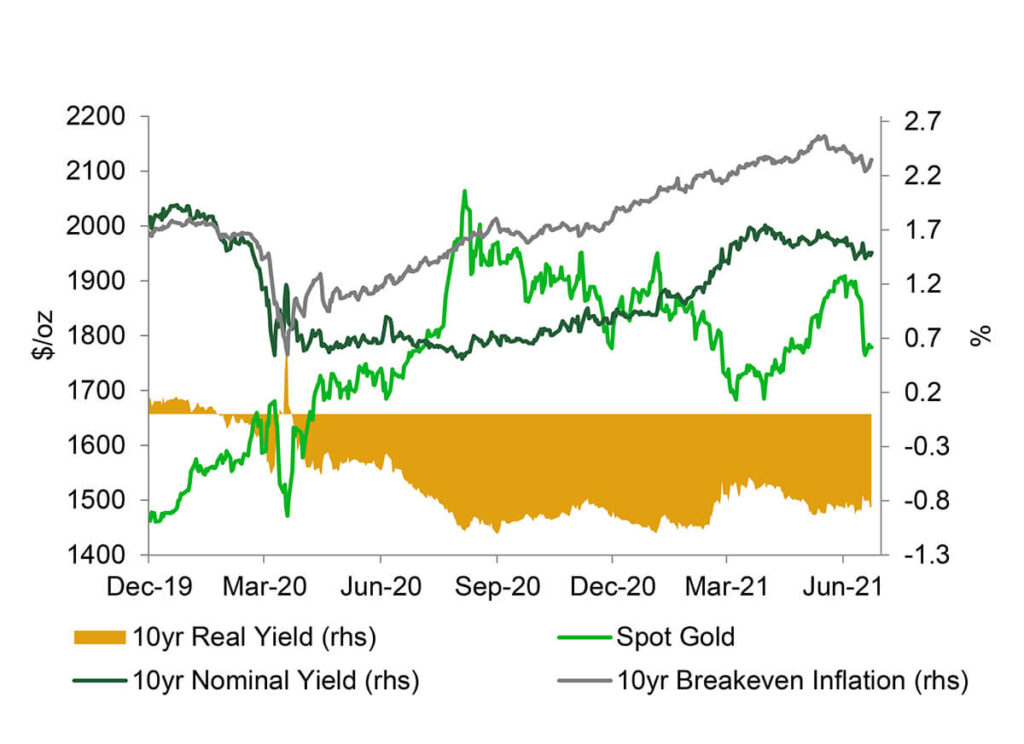

While positioning is not overly conducive to another sharp rally anytime soon following the post-June FOMC selloff, very low nominal and real yields and a stable USD are serving as a stabilising force for gold. Despite the fact that the FOMC dot plot shifted hike expectations forward to late-2023 (median showing a 50bp of tightening), with many traders expecting a much earlier tightening, and that Fed Chair Jerome Powell has started the process of preparing markets for QE tapering, we believe that the yellow metal is still in a position which makes a return to a $1,900/oz range possible into 2022.

Notwithstanding the massive US stimulus and the recent runup in prices, the negative impact of Covid-19 variants on growth around the world and the Fed’s recent hawkish tilts are raising doubts that inflation is about to get out of control. Indeed, base effects, recent non-energy commodity price reversals, limited long-term crude oil upside and the pending end to Covid-related supply chain disruptions in the global logistics and the microchip industries, should all start to convince markets that price increases should not get unwieldy. Consequently, the Fed is unlikely to be behind the curve anytime soon and be forced to tighten much earlier. Considering recent price action, it seems that precious metals traders are starting to agree with that conclusion, as do we.

With the US central bank projecting 2% core PCE inflation in 2022 and 2.1% in 2023, and considering that the US economy will need to create some 380,000 jobs per month for the next two years to reach full employment, there seems to be plenty of time to keep the zero-bound policy alive (with negative real rates), before any inflation target overshoot forces a tightening.

So far treasury markets don’t seem to be worried about out of control price increases. Even if there is a period of above expectation prices, we suspect that Mr Powell and friends would intervene in the Treasury market should yields rise to the point that they would erode financial conditions and threaten the Fed’s ability to deliver on its full employment mandate. This all likely means real rates remain at the lows along the longer end of the curve too, which is gold accretive.

Notwithstanding the likelihood inflation will migrate lower from current highs, uber easy monetary policy being practiced by the Fed and other central banks along with trillions added to fiscal stimulus at a time a recovery is underway, should still elevate long-term inflation expectations above what we have seen in the last few years. And with nominal rates anchored by the very low fed funds rate, the resulting real rate environment should help keep investment and industrial demand firm for a while yet.

While an inflation problem should not develop given the FOMC’s recent signaling that it will not sacrifice long-term price stability at the altar of full employment, there will be those who may see the world is less benign terms. They will worry about record public debt, purchasing power erosion and other potential catastrophes.

For all those reasons, the yellow metal has a good chance to again move into $1,900/oz territory for part of 2022-23. In addition to all the macro and monetary policy ducks having to be lined up in a row, there will need to be an improvement to physical demand in China and India for our optimistic view to play out.

Easy Money For Prolonged Period a Manna for Gold

Gold Can Shine When Nominal Rates Don’t Outpace Inflation Expectations Materially

So Far so Good on the Rebound Front — Technicals Not a Barrier to $1,900 Gold

Post-COVID Industrial Recovery Tightened Silver, Platinum and Palladium Markets

SILVER HAS GAME

Silver tends to do well when there is a favorable environment for gold. Considering that the white metal has a historical volatility roughly double that of gold, and given that it is directionally synchronised, it should outperform gold into 2022. Indeed, this is exactly what has happened in a dramatic way since June 2020, as the gold-to-silver ratio fell by roughly half from the bad days of March 2020 to just 68 currently. Given our robust gold outlook and considering silver’s supply-demand fundamentals over the next few years, history tells us that silver still has plenty of relative value to recapture.

TD Securities expects investors to favor silver for the same reasons as they do gold, but also desire it for its industrial bonafides.

In 2020, the investment community and traitional buyers of physical silver purchased some 531 million oz of the metal and we project that they will buy another 885 million oz by the end of 2023. In addition to benefitting from the monetary, FX and macro drivers like gold does, the white metal is projected to see an additional 115 million oz in industrial demand over the same period.

Since over 60% of demand comes from the industrial sector, silver should benefit from firmer industrial uptake, as the global economy continues to recover after the Covid-inspired deep global recession last year. The increase in demand should accelerate in the second half again, as the microchip shortage, which moderated auto and other industrial production, and other logistical issues get resolved.

Expenditures on green energy infrastructure, decarbonisation, and electrification should also help silver to rally, as it is intensively used in solar panels and electrical circuits. The intensity of silver use in the general economy is set to be sharply higher over the next decade, starting in 2021. Green initiatives under the Biden presidency, the European Green Deal, and China’s 2060 carbon neutral goal, are all initiatives that should increase demand and likely attract investment ahead of the pending supply-demand tightening.

Declining mined metal production in 2019 and 2020, a relatively modest recovery this year and only limited supply growth after that, along with strong investment interest suggests tighter physical markets and robust silver prices.

Given the state of supply, and considering the long-term positive demand prospects from investors and industrial users prompts us to say that silver should trade at around $30/oz over the next 12 months. The long-term may be even more impressive, as demand from green friendly sources, and limited capital investment in primary and secondary silver mine capacity tighten the fundamental outlook.

Silver Fundamentals to Remain Firm as Industrial Demand Strengthens, Investor Show Strong Interest

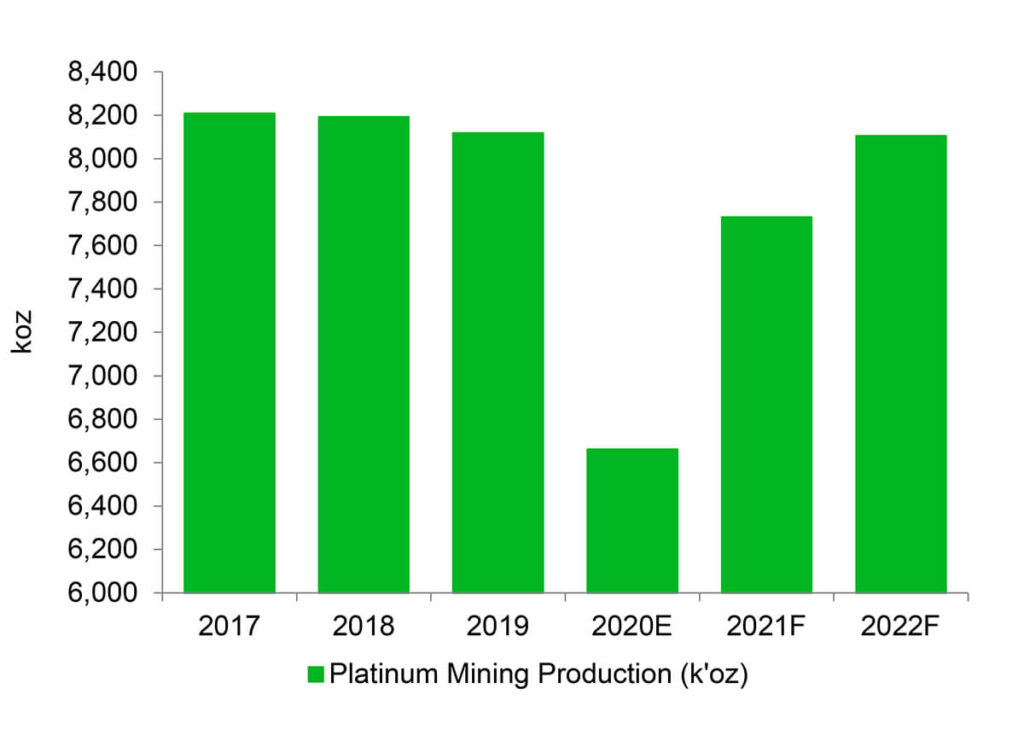

Now That’s What You Call a Supply Disruption

Continued PGM Tightness in the Cards

ENVIRONMENTAL REGULATIONS AND MINE SITE PROBLEMS AS MANNA FOR PGMS

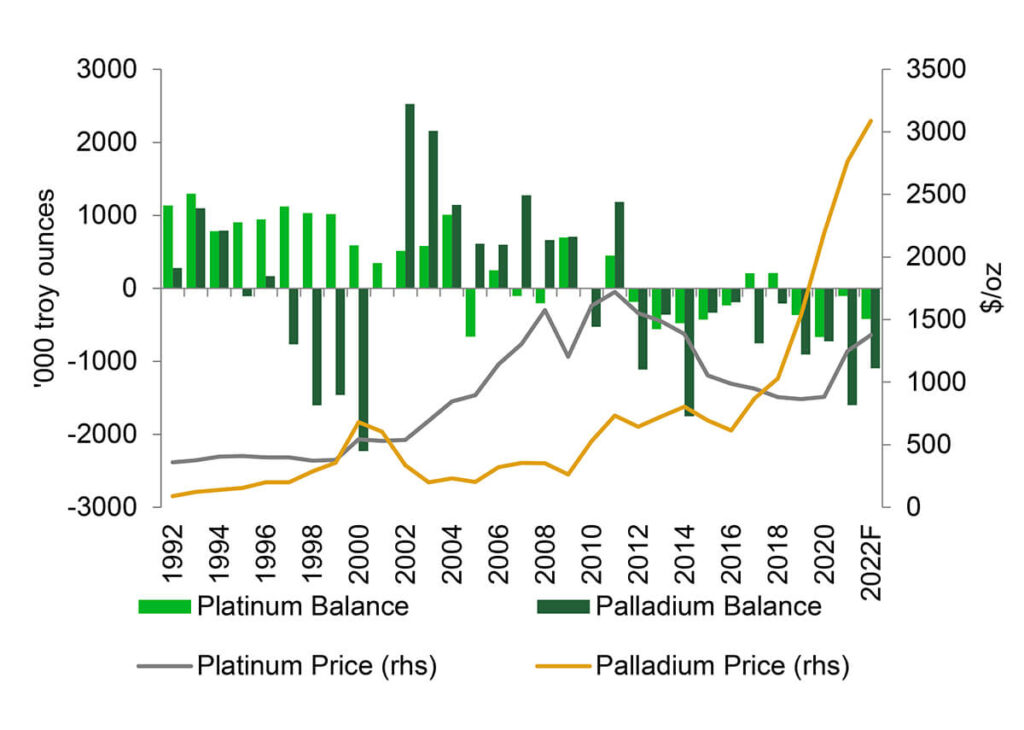

Platinum and palladium have surprised to the upside this year, as supply problems at Norilsk mines and in South Africa, along with post-Covid demand growth tightened the fundamentals. Both metals have also benefitted from the reflation trade and tightening emission standard regulations. Easy money and trillions in government spending, progressing vaccine programs across the Western world and China’s surprisingly economic performance should all continue to be important upside catalysts into 2022 as well, despite the microchip precipitated slowdowns in autos.

As the global economic recovery continues and global pollution standards tighten, the recent mine site disruptions suggest hefty deficits and another attempt at $3,000/oz for palladium and new highs above $1,375/oz for platinum next year.

Should our industrial and investor demand projections materialise into 2022, the recent mine site problems and the resulting lowering of production guidance by Norilsk should see supply-demand fundamentals stay tight, particularly for palladium. It is estimated that 2021 production from the impacted mine operations will directly reduce platinum production by as much as some 185 Koz in 2021, with a reduction of some 681 Koz for mined palladium supply. But there should be a 100 Koz offset for palladium due to the availability of above ground supply on the mine site. Downside production risks remain, as unanticipated issues are common in the remediation of underground water ingress.

Given that only a limited amount of palladium is held by ETFs across the globe, which has been a source of supply in previous years, and the price inelastic nature of bullion holdings, it is not clear how the supply-demand gap will be closed without demand destruction – which is usually accompanied by surging prices.

It should also be noted that autocatalyst demand is dictated by regulations that suggests a segment of demand that is inelastic. While there is chatter that Russian strategic stockpiles could be released into the market, which can take some pressure off, the impact would be limited in a serious scarcity environment as the material is unlikely to be good delivery, nor of sufficient quality for industrial use. As such, these sources of product are unlikely to substantially change the supply-demand situation this year.

According to our models, the palladium market should record large deficits in 2021 and in 2022, with platinum showing modest deficits when investment demand is considered over the same period. This suggests that the PGMs complex could challenge our already optimistic outlook. Traders should also expect very robust jumps in lease rates, as the front end of these markets tightens up.

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations. Previous to joining TD, Bart was a global commodity strategist and senior economist at another major global financial institution.