Navigate

Article List

- Launch of Metals Focus’ Gold Focus 2018

By Nikos Kavalis, Director, Metals Focus

- Myanmar: Gold’s Last Frontier

By Khin Maung Han, Chairman, Myanmar Gold Development Public Company

- Will Bitcoin Replace Gold as a Modern-Day Safe Haven?

By Avtar Sandu, Senior Commodities Manager, Phillip Futures

- Why Gold is More than an Insurance Asset

By Wayne Gordon, Executive Director, Chief Investment Office, Wealth Management, UBS

- The Economics of Bitcoin and Gold

By Jan Kursawe, Crypto Economist and Financial Analyst, Vaultoro.com

- Democratising Access to Gold

By Robin Lee, CEO, HelloGold

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Launch of Metals Focus’ Gold Focus 2018

By Nikos Kavalis, Director, Metals Focus

- Myanmar: Gold’s Last Frontier

By Khin Maung Han, Chairman, Myanmar Gold Development Public Company

- Will Bitcoin Replace Gold as a Modern-Day Safe Haven?

By Avtar Sandu, Senior Commodities Manager, Phillip Futures

- Why Gold is More than an Insurance Asset

By Wayne Gordon, Executive Director, Chief Investment Office, Wealth Management, UBS

- The Economics of Bitcoin and Gold

By Jan Kursawe, Crypto Economist and Financial Analyst, Vaultoro.com

- Democratising Access to Gold

By Robin Lee, CEO, HelloGold

- SBMA News

By Albert Cheng, CEO, SBMA

The Economics of Bitcoin and Gold

By Jan Kursawe, Crypto Economist and Financial Analyst, Vaultoro.com

Published on April 17, 2018

In recent years, bitcoin mining has become a multi-billion dollar industry. Instead of searching for rare metals, bitcoin mining involves a computational operation to find a rare number. By its very nature, it is a permissionless and commons-based peer production process. But nowadays, with stronger competition, the profitability of bitcoin mining is getting smaller, while the capital investment required is growing. Bitcoin mining may already exceed the total energy consumption of Singapore. Similarly, gold mining relies on energy resources and capital. It stands to reason to consider a commodity-based review.

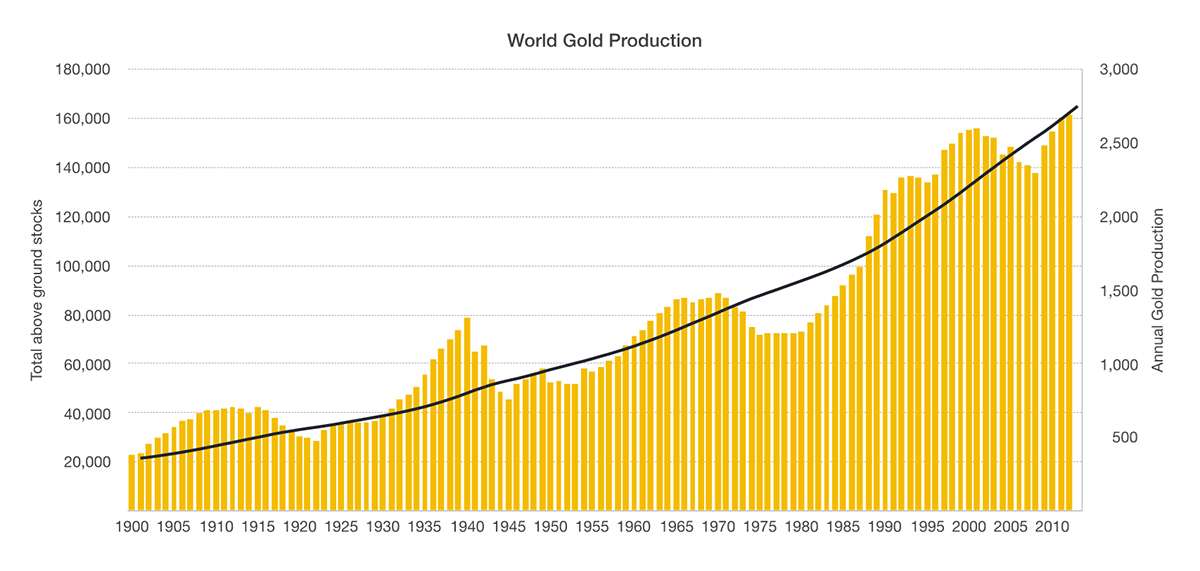

The economic cycle of raw materials tends to regulate itself. Higher demand is followed by a price increase, which in turn encourages investment in exploration and mining technologies. If there is a higher demand the price will usually increase, which implies more effort and more risk for the exploration of new sources. When producers find new recoverable deposits, they can extract more raw materials. With an increased stock, prices will usually fall. In the past, the gold mining industry had enormous problems keeping up with demand shocks, especially during the time of the gold standard, when gold was in high demand. The following graphic shows the increasing gold production in the late 1920s (Figure 1).

In the 1930s, Federal Bank statistician Carl Snyder predicted an annual economic growth rate of 3%. Hence, miners needed to keep up with the growing demand for gold. Right after the introduction of Britain’s gold standard, there was about 40,000 metric tons of gold above ground. The relatively constant annual production of 600-700 metric tons differed from the 3% target. While the extraction of resources is limited, economic growth is not dependent on gold production. In fact, the discovery of orebodies has declined in recent years despite record exploration expenditures. Swedish economist Gustav Cassel coined this observation the “paradox of the gold standard”.

Figure 1: Gold production and total gold stock.

The stable gold price in the 1920s deincentivised mining production (Figure 2). At the same time, the United States and France increased their net gold imports without expanding the monetary base. The unreasonable demands on gold resulted in a decreasing price level (deflation). Meanwhile, there was a massive speculative bubble on the stock market. There was no trust issue with gold, but there was an uncertainty about the ability of central banks to adhere to the gold standard. In the end, 14 countries decided to abandon their currencies’ gold parity. Deflation stopped after central banks released more banknotes. Finally, the increasing gold price incentivised gold production.

Supply shortages of raw materials can also be solved by human creativity. Innovations in the material extraction process can make exploited gold sources relevant again. Other possibilities are the development of innovative recycling process and material flows. Another alternative may be gold substitutes, such as ceramics, metals, and alloys. But in some instances, gold cannot be substituted. Nick Szabo, the inventor of the mechanism for a decentralised digital currency called “bit gold” in the late 1990s was very familiar with gold’s track record:

Precious metals and collectables have an unforgeable scarcity due to the costliness of their creation. This once provided money, the value of which was largely independent of any trusted third party. Precious metals have problems, however. It’s too costly to assay metals repeatedly for common transactions (Szabo, 2008).

In 2004, cryptographer Hal Finney invented a system called Reusable Proof-of-Work. It was the final piece of the bit gold/bitcoin puzzle. The founder of bitcoin, Satoshi Nakamoto, had the same vision about a digital currency that functioned like gold. Instead of minting a certain amount, he came up with the idea of a regulated supply. The mining reward decreases over time as naturally would occur with physical resources. Nakamoto stated that gold and bitcoin mining are both a waste:

The price of any commodity tends to gravitate toward the production cost. If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more. At the same time, the increased production would increase the difficulty, pushing the cost of generating towards the price (Satoshi Nakamoto, 2010).

Calculating the price of digital currencies is a difficult undertaking. The following two approaches are common:

1) Estimate based on production factors

It compares the hash rate with the operating hardware. It is very hard to assume what hardware is currently in use. Changes in climate conditions and energy prices make this calculation even more inaccurate.

2) Comparative analysis of mining profitability

This method is used in the IT industry. The total cost of ownership (TCO) determines the direct and indirect costs of a system (input). Besides energy consumption, the estimate also considers costs of shipping, maintenance, and acquisition. Digicoinomist.com calculated an average energy price of $0.05/kWh. Assuming an efficiency of 60%, input (TCO) and output (revenue) can be converted to a power consumption of 6.2 gigawatts. For example, the entire energy consumption of bitcoin mining is now as big as the output of the 12 biggest atomic reactors. Some say this is a useless waste or even a natural disaster. However, the utility of bitcoin as a medium of exchange could be higher than the costs of its waste. Further, bitcoin miners tend to be located in places with an overcapacity of energy.

Proof-of-work mining could profit from the advent of technologies such as “demand response”. Miners receive a payback for lowering their power consumption during supply shortages. On the downside, bitcoin mining is a long way from providing more net stability – quite the opposite in reality. Unwanted competitive conditions such as energy price subsidies or tax reduction could have a negative impact on energy supply and the environment, and is leading governments to consider regulatory action, as happened in China quite recently.

Usually, the utility of a good is expressed in its price. Nakamoto further implemented a fee system to value high priority transactions. The fee goes to miners and will potentially rise once the block reward gets smaller.

Figure 2: Growth rate and purchasing power of gold.

When [mining] runs out, the system can support transaction fees if needed. It’s based on open market competition, and there will probably always be nodes willing to process transactions for free (Satoshi Nakamoto, 2009).

Today, nine years after that prediction, the fee hovers between 5–10% of the block reward. It appears that if the demand is high the total mining reward increases. This is a revolutionary concept. Bitcoin is the first scarce digital asset that pays miners even after reaching the final supply. This comparison should have made it clear that bitcoin can be viewed as a commodity and has properties comparable to gold.

Vaultoro.com links these two contrasting assets. Our clients trade bitcoin and physical gold because they do not want to hedge with fiat money. Our system even provides a fascinating feature for cryptocurrency miners. With instant orders activated, bitcoin can be automatically converted into allocated bullion by our system watching the blockchain. All gold is secured by Pro Aurum Switzerland, fully insured and audited. Vaultoro’s real-time allocated gold/bitcoin trading platform combines the best of both worlds to make gold liquid and bitcoin stable.

Edited by Joshua Scigala (CEO and founder, Vaultoro.com)

Jan Kursawe was a member of a reading circle about the Freiburg School and ordoliberalism at the age of 16, and later was fascinated with Mises’ theory of money and credit and the work of Friedrich Hayek and the Austrian school of economics. He has worked for several international aid organisations in Nicaragua and Egypt, and is currently researching an economic and legal conception of cryptographic asset tokens.

Joshua Scigala is a serial entrepreneur in the alternative economy space. He helped pioneer the sharing economy in the late 1990s by building the world’s first online barter exchange where people could swap goods without money. His work soon led him to research digital tokens and decentralisation with a fascination of work the cypherpunk movement. He has been working with Bitcoin and blockchain technology since 2010 and is a strong advocate for individual freedom.

References

- Cassel, G. (1932). The Crisis in the World (Oxford: The Clarendon Press).

- Porter, K. E., Amey, E. B., & George, M. W. (2014). Gold Statistics (Historical statistics for mineral and material commodities in the United States No. 140). U.S. Geological Survey. Retrieved from http://minerals.usgs.gov/minerals/pubs/historical-statistics/.

- Szabo, N. (2008, December 27). Bit gold [blog entry]. Retrieved March 16, 2018, from http://unenumerated.blogspot.de/2005/12/bit-gold.html.