Navigate

Article List

- SBMA News

By SBMA

- Thailand Gold Forum 2025

By SBMA

- Thailand’s Gold Market at a Turning Point

By TANARAT PASAWONGSE, Chief Executive Officer, Hua Seng Heng Group

- Advancing Asset Transparency in Tokenised Gold (Matrixdock Tokenization)

By CICI LU, Head of Research, Matrixdock

- GLOBAL GOLD PERSPECTIVES: INVESTMENT TRENDS, MARKETS AND SUSTAINABILITY AT KYOTO’S LBMA/LPPM GLOBAL PRECIOUS METALS CONFERENCE

By SHELLY FORD, Digital Content Editor, LBMA

- Revolutionising Wellness with Platinum: Smart Jewellery and the Rise of a Billion-Dollar Market

By LU XIAOHUI, Founder, Shenzhen Zhijie

- STRENGTHENING GLOBAL CONNECTIONS: SBMA AT THE LBMA CONFERENCE 2025

By MARGARET WONG, Business Director, SBMA

Article List

- SBMA News

By SBMA

- Thailand Gold Forum 2025

By SBMA

- Thailand’s Gold Market at a Turning Point

By TANARAT PASAWONGSE, Chief Executive Officer, Hua Seng Heng Group

- Advancing Asset Transparency in Tokenised Gold (Matrixdock Tokenization)

By CICI LU, Head of Research, Matrixdock

- GLOBAL GOLD PERSPECTIVES: INVESTMENT TRENDS, MARKETS AND SUSTAINABILITY AT KYOTO’S LBMA/LPPM GLOBAL PRECIOUS METALS CONFERENCE

By SHELLY FORD, Digital Content Editor, LBMA

- Revolutionising Wellness with Platinum: Smart Jewellery and the Rise of a Billion-Dollar Market

By LU XIAOHUI, Founder, Shenzhen Zhijie

- STRENGTHENING GLOBAL CONNECTIONS: SBMA AT THE LBMA CONFERENCE 2025

By MARGARET WONG, Business Director, SBMA

Thailand’s Gold Market at a Turning Point

By TANARAT PASAWONGSE, Chief Executive Officer, Hua Seng Heng Group

Thailand’s gold industry has been evolving from a predominantly savings-driven market into a sophisticated financial ecosystem.

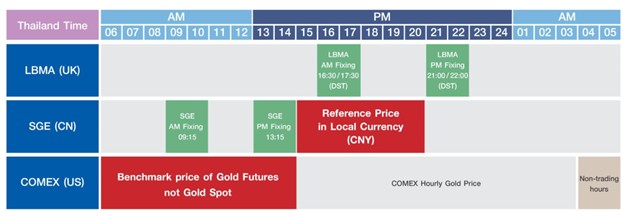

Addressing a Regional Gap: An Asian‑Hour Benchmark

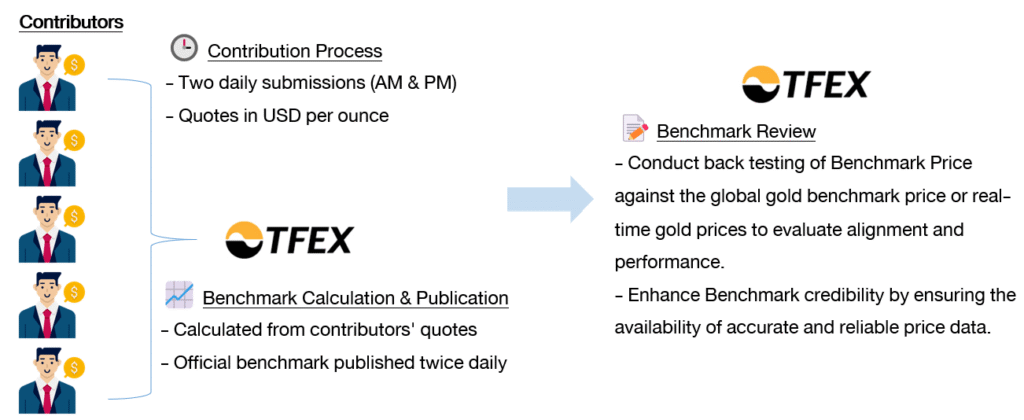

Design, Governance & Phased Roll‑Out

TFEX will be responsible for data submission, validation, and calculation under a transparent and auditable methodology that aligns with global best practices. Contributor identities will remain confidential, but anonymised disclosures may be published to reinforce market confidence.

- Phase 1: Establish the USD-denominated Thailand Gold Fixing and demonstrate stability and correlation with existing global benchmarks.

- Phase 2: Integrate the benchmark into domestic wholesale transactions and develop financial products tied to it, including structured notes and futures contracts.

- Phase 3: Encourage cross-border adoption, positioning the Thailand Gold Fixing as a broader regional benchmark used by market participants across Asia.

Why the Benchmark Matters

A benchmark set during Asian working hours provides regional participants with a reliable pricing anchor when they are most active. This facilitates accurate inventory valuation, real‑time risk management, and efficient pricing during the trading day, reducing exposure to overnight volatility and improving liquidity across the market.

A trusted benchmark supports the development of new financial products – from exchange traded derivatives (ETDs), ETFs and structured products to new futures formats, a credible fixing enables innovation in hedging, investment, and distribution. Standardisation creates opportunities for institutional investors seeking exposure to Asian gold markets under globally accepted risk‑management frameworks.

Developing benchmark infrastructure enhances Thailand’s position within Asia’s gold value chain. The initiative will reduce transaction and hedging costs, improve transparency, and foster greater participation from international institutions. Over time, it will deepen market liquidity and contribute to a more integrated regional bullion ecosystem.

Thailand’s Golden Future