Navigate

Article List

- SBMA News

By SBMA

- Thailand Gold Forum 2025

By SBMA

- Thailand’s Gold Market at a Turning Point

By TANARAT PASAWONGSE, Chief Executive Officer, Hua Seng Heng Group

- Advancing Asset Transparency in Tokenised Gold (Matrixdock Tokenization)

By CICI LU, Head of Research, Matrixdock

- GLOBAL GOLD PERSPECTIVES: INVESTMENT TRENDS, MARKETS AND SUSTAINABILITY AT KYOTO’S LBMA/LPPM GLOBAL PRECIOUS METALS CONFERENCE

By SHELLY FORD, Digital Content Editor, LBMA

- Revolutionising Wellness with Platinum: Smart Jewellery and the Rise of a Billion-Dollar Market

By LU XIAOHUI, Founder, Shenzhen Zhijie

- STRENGTHENING GLOBAL CONNECTIONS: SBMA AT THE LBMA CONFERENCE 2025

By MARGARET WONG, Business Director, SBMA

Article List

- SBMA News

By SBMA

- Thailand Gold Forum 2025

By SBMA

- Thailand’s Gold Market at a Turning Point

By TANARAT PASAWONGSE, Chief Executive Officer, Hua Seng Heng Group

- Advancing Asset Transparency in Tokenised Gold (Matrixdock Tokenization)

By CICI LU, Head of Research, Matrixdock

- GLOBAL GOLD PERSPECTIVES: INVESTMENT TRENDS, MARKETS AND SUSTAINABILITY AT KYOTO’S LBMA/LPPM GLOBAL PRECIOUS METALS CONFERENCE

By SHELLY FORD, Digital Content Editor, LBMA

- Revolutionising Wellness with Platinum: Smart Jewellery and the Rise of a Billion-Dollar Market

By LU XIAOHUI, Founder, Shenzhen Zhijie

- STRENGTHENING GLOBAL CONNECTIONS: SBMA AT THE LBMA CONFERENCE 2025

By MARGARET WONG, Business Director, SBMA

GLOBAL GOLD PERSPECTIVES: INVESTMENT TRENDS, MARKETS AND SUSTAINABILITY AT KYOTO’S LBMA/LPPM GLOBAL PRECIOUS METALS CONFERENCE

By SHELLY FORD, Digital Content Editor, LBMA

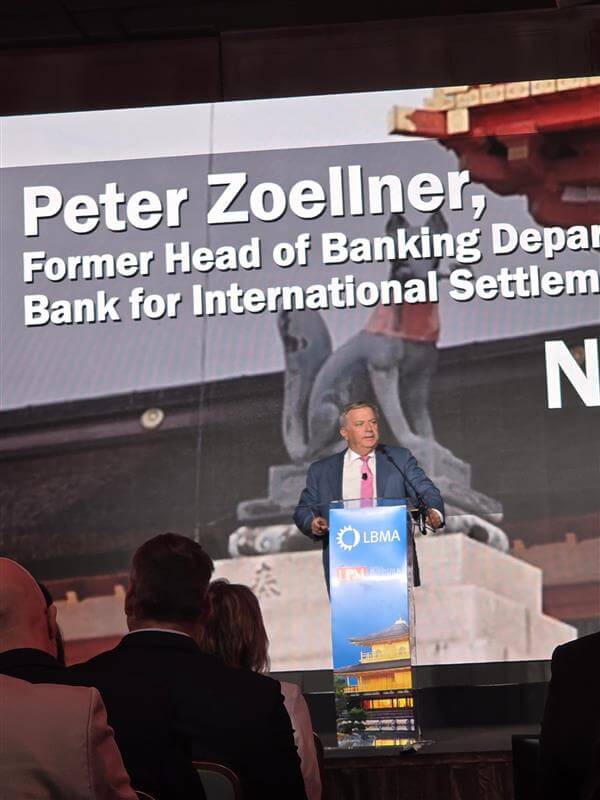

Unusually, though, this year’s opening session included a metaphorical “passing of the baton” as Paul stepped aside and welcomed Peter Zoellner as the new chair. Paul remarked that he was “more than happy to hand the reins over to someone so capable,” while Ruth took the chance to thank Paul for his “wisdom, strategy, and dedication to LBMA” over an impressive nine-year stint. Peter responded with hearty congratulations, applauding Paul’s achievements and sharing his excitement for what lies ahead.

Data-Rich Keynote

Bullish Investment Session

SGE Market Update

Focus on Sustainability and Responsible Sourcing

A New Era of PGMs

Koo on Trump

Central Banks in the Hot Seat

Metals in Motion

Wrapping Up

Wrapping Up

- Demand is broadening and deepening. Conversations across trading, refining, investment and central banking point to sustained, long term allocations from mainstream investors – not just in one region, but across jurisdictions. The question isn’t if the cycle endures, but how we build resilient market infrastructure to support it.

- Asian hubs are complementary, not zero sum. Hong Kong, Singapore and London each bring strengths, from access to regional liquidity to deep OTC connectivity. The thread that binds them is one trusted physical standard. As ever, the LBMA Good Delivery list remains the “golden thread” linking markets, enabling fungibility and integrity.

- Innovation is accelerating. From wholesale digital gold to advances in transparency and market integrity, the momentum is real. The focus now is scaling what works, responsibly.