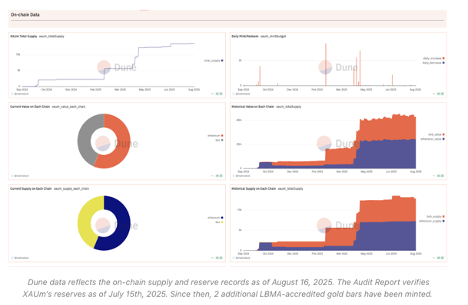

The XAUm model integrates dual complementary verification layers: professional third-party inspections, conducted by the same auditor that serves leading gold ETFs such as SPDR Gold Shares (GLD), and a continuous, real-time blockchain-based third-party data providers such as Dune Analytics. Together, these processes provide investors with enhanced visibility into the gold holdings backing each token.

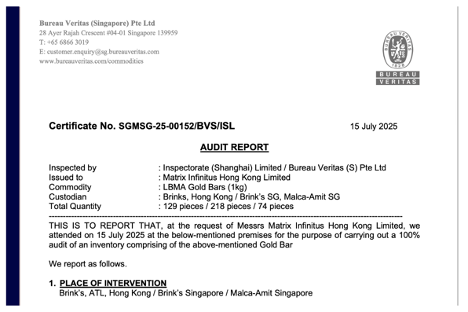

A recent semi-annual audit of the reserves backing XAUm inspected 421 pieces of LBMA-accredited 1 kg bars stored across Brink’s and Malca-Amit facilities. Each bar was individually weighed and measured to confirm its physical specifications matched vault records.

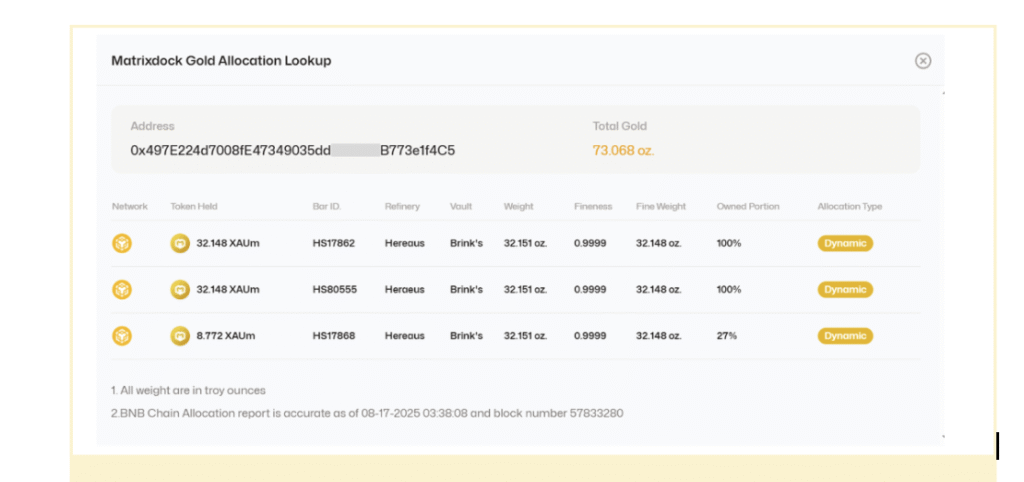

Matrixdock’s Gold Allocation Lookup tool enables token holders to see exactly which gold bars back their holdings, with updated vault information available in real time.

This approach demonstrates how an investor can verify the exact gold reserves backing their XAUm holdings directly from their digital wallet. The interface provides full transparency down to the bullion ID, refiner, vaulting location, and the investor’s proportional ownership of each bar.

This creates a traceable link between a physical asset and a digital token, something that has historically been opaque in precious metals markets.

This transparency practice, combined with semi-annual professional third-party audits, real-time allocation look-up, and onchain analytics, illustrates how tokenised assets can achieve enhanced standards of transparency compared to traditional models.

This approach strengthens confidence for both individual and institutional holders and provides a practical example of how RWA issuers can align with emerging industry best practices.

Tokenisation aims to address two structural inefficiencies in the traditional gold market: limited accessibility and suboptimal capital efficiency.

By bringing the highest-quality, LBMA-accredited gold onto the blockchain, tokenisation introduces a programmable layer on the asset that enables gold to circulate and be utilised with greater flexibility.

According to Eva Meng, head of Matrixdock, “Tokenisation fundamentally shifts trust from intermediaries to verifiable on-chain data, redefining how value moves across the financial ecosystem. This transformation turns gold from a passive reserve asset into an active financial building block as a part of the next generation of financial infrastructure.”

Gold exchange-traded funds (ETFs) revolutionised gold investment by offering exposure through brokerage accounts. However, ETFs are ultimately financial instruments tracking gold prices and incur management fees, which may reduce long-term returns.

Tokenised gold builds upon this model. XAUm offers ETF-like accessibility with a verifiable reserve of fully allocated gold. Token holders also enjoy flexible redemption options, from physical 1 kg bar deliver (available subject to eligibility and jurisdiction) to stablecoin settlement. In essence, tokenisation merges digital market accessibility with the tangibility of real gold ownership.

Purchasing physical gold through dealers or banks remains the most conventional form of investment but is constrained by pricing fragmentation, logistical frictions, and balance sheet inefficiency. Premiums, insurance, and transport costs vary across jurisdictions, leaving gold as a non-productive, static and high maintenance asset once acquired.

Tokenisation addresses these inefficiencies by offering modern solutions. Through blockchain-based representation in a unified onchain ecosystem, tokenised gold such as XAUm can potentially be used as collateral with decentralised finanance (DeFi) applications to borrow against stablecoins or cryptocurrencies such as Bitcoin with instantaneous settlement, without the need to physically move bars from vaults and manual transfer across multiple accounts, which significantly improves asset mobility, collateral velocity, and overall capital efficiency.

For tokenied gold to achieve adoption at scale, the model must balance user accessibility, price transparency, and ecosystem utility. XAUm addresses these objectives with a simplified pricing structure. With all-in mint and redemption prices published in real-time and no ongoing storage or transaction fees, this streamlines the investment journey, making gold investment more accessible for participants.

A common question from traditional market participants centres on the economic viability of this model. The answer is that its sustainability derives from network scalability driven by broader user accessibility and new revenue sources when tokenised gold attains transactional velocity within a programmable, onchain financial system.

At a foundational level, and consistent with traditional market-making frameworks, pricing remains anchored to the global spot gold benchmark, with narrow spreads between minting, redemption, and secondary-market trading that reflect custody, liquidity, and operational costs.

As Singapore strengthens its role as a global hub for both bullion trade and digital-asset innovation, the convergence of precious-metals expertise and blockchain transparency is shaping a more efficient, trustworthy, and interconnected future for gold as an asset class. Platforms like Matrixdock are contributing to building the foundational technology that will support this evolution of gold as an asset.

These materials are provided for general informational purposes only and do not constitute investment advice, financial advice, an offer, solicitation, or recommendation to buy, sell, or hold any digital asset, or to engage in any specific investment strategy. XAUm and any related products or services are subject to jurisdictional and regulatory restrictions and may not be offered, distributed, or made available in certain jurisdictions (including, without limitation, Hong Kong and Singapore).