Navigate

Article List

- Hot Topics Under the Microscope at LBMA/LPPM Global Precious Metals Conference

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Recent Portfolio Application of Gold ETFs

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Digital Transformation of Precious Metal Supply Chains

By Philipp Stockinger, Business Development Engineer, aXedras Group AG

- World Gold Council Singapore – 2022 In Review

By Andrew Naylor, Regional CEO, APAC (ex China) and Public Policy, World Gold Council

- The Next Generation of Tokenised Commodities

By Paul Kelley, Sales & Partnerships, Trovio

- Robust Gold Yields in the Cards

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Where Beach Meets Bullion

By Strategic Wealth Preservation

- SBMA News

By SBMA

Article List

- Hot Topics Under the Microscope at LBMA/LPPM Global Precious Metals Conference

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Recent Portfolio Application of Gold ETFs

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Digital Transformation of Precious Metal Supply Chains

By Philipp Stockinger, Business Development Engineer, aXedras Group AG

- World Gold Council Singapore – 2022 In Review

By Andrew Naylor, Regional CEO, APAC (ex China) and Public Policy, World Gold Council

- The Next Generation of Tokenised Commodities

By Paul Kelley, Sales & Partnerships, Trovio

- Robust Gold Yields in the Cards

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Where Beach Meets Bullion

By Strategic Wealth Preservation

- SBMA News

By SBMA

The Digital Transformation of Precious Metal Supply Chains

By Philipp Stockinger, Business Development Engineer, aXedras Group AG

As a business development engineer, PHILIPP STOCKINGER supports aXedras to establish an entirely new and innovative decentralized ecosystem on the Corda Blockchain for the global precious metal industry. He brings around eight years of experience in the global corporate banking industry. In his former role as relationship manager, he helped to ramp up the SME business in Switzerland for a global German bank.

Swiss fintech company aXedras, with its Bullion Integrity LedgerTM, is playing a vital role in the Gold Bar Integrity (GBI) program, which was jointly launched by the LBMA and the World Gold Council earlier in 2022 to foster the integrity of gold along its supply chain, in particular in the areas of provenance and chain of custody. Following a thorough assessment phase, aXedras was selected to be part of its official pilot in Q2 and Q3 2022.

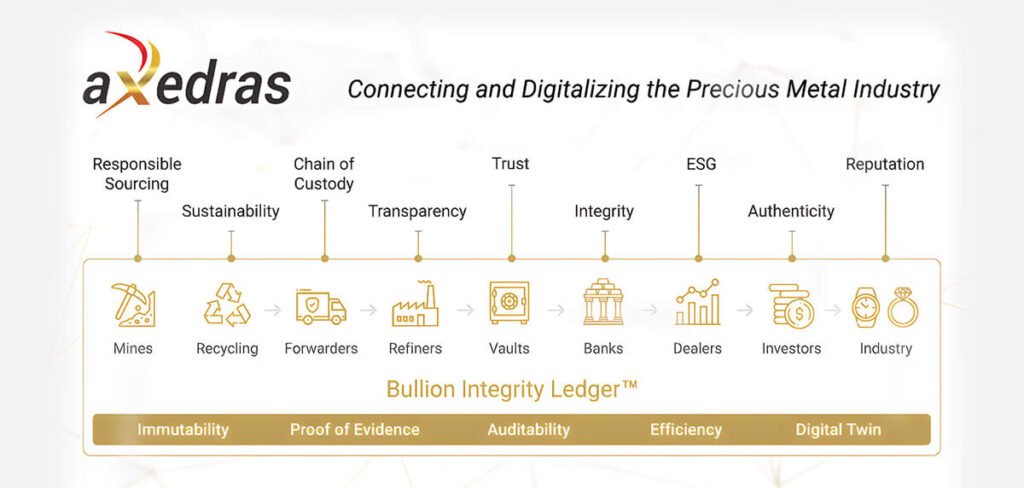

AXEDRAS DEVELOPS A TRUSTED, BLOCKCHAIN-BASED PLATFORM TO DIGITALIZE B2B PROCESSES ALONG THE VALUE CHAIN OF PRECIOUS METALS: FOCUSING ON PRODUCT AND DATA INTEGRITY.

For the pilot, aXedras onboarded more than 30 organisations that are distributed globally: 8 mines, 9 refiners, 4 carriers and 10 banks or dealers. The overarching goal was to demonstrate a successfully digitalised, end-to-end use case for the industry on a global scale. The pilot’s participants, spanning the value chain of gold, from mine via refinery to investors, demonstrated an efficient digital flow of gold, enabling for a more transparent future of the industry.

A Holistic Approach to Transforming the Value Chain of Precious Metals

As an independent software provider, aXedras has pursued its industry-aligned approach from the very beginning. Its blockchain-based solution is based on mutual data standards and harmonised taxonomy to streamline business processes and communication among business partners along the precious metals value chain. The current solution is specifically designed for gold, silver, platinum and palladium. In a nutshell, the product flows are digitalised as follows:

- Suppliers such as mining organisations (ASM, MSM or LSM) or recycling companies can issue a digital provenance documentation (which can be conceptualised as a birth certificate) for their mined or recycled products.

- Digital shipment processes empower the suppliers to share their provenance data (e.g., certificate of origin) with both the carrier in charge and the receiving refinery. The carrier can upload its shipment documents (e.g., AWB) to the digital shipment process.

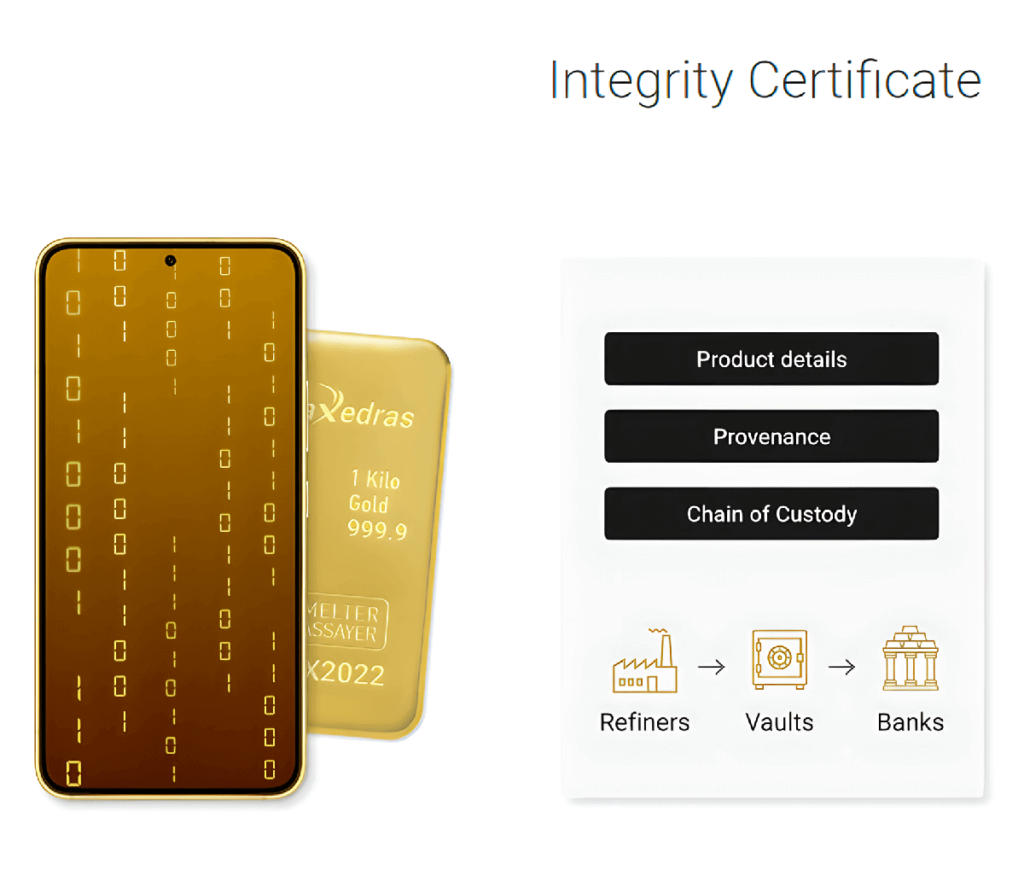

- Refiners give each refined product its unique Integrity Certificate, including its provenance data, whereby smart contracts ensure that provenance data is not used twice.

- Investors benefit from the digitalised compliance records provided at the product level by suppliers and refiners.

- Auditors can access, and assayers can contribute to the digital twin representing products or processes to increase the integrity of the products and their respective data.

- An additional layer to improve the integrity of the products is provided through aXedras’ collaboration with security feature providers, for upstream or downstream products. Any security feature can be integrated, in other words, a one-stop solution for the industry.

Benefits of DLT/Blockchain Technology for the aXedras Ecosystem

The Bullion Integrity LedgerTM is based on the Corda-Enterprise version of R3’s Distributed Ledger Technology (DLT). Among others, the following DLT/blockchain components are used to strengthen the integrity of precious metals:

- The Bullion Integrity LedgerTM represents a private and permissioned B2B network. Only reputable organizations may join the network and their identities are known to each other across the network.

- Each transaction (i.e., each update of data along supply chains) is digitally signed on the DLT. This cryptographic component ensures the transparency along the supply chain.

- The DLT-based confidentiality architecture has been on aXedras’ agenda from the very beginning. The Bullion Integrity LedgerTM is designed following a strict need-to-know principle. Each company remains in control and selectively shares data with their business partners. Sensitive business and transactional data are protected from competitors.

- Business partners agree bilaterally or multilaterally on the data and synchronise them across their blockchain nodes. A so-called notary service ensures the uniqueness of transactions and time-stamps them respectively. There is no need for an energy-intensive consensus mechanism (e.g., proof of work) to achieve consistency and conformity on exchanged data.

Finally, each physical product is represented as a digital twin on the DLT-based platform. It carries all relevant data along the products’ lifecycle. Cryptography ensures that the data cannot be altered. For instance, whenever a shipment leads to an update of the physical location of a product, the chain of custody is being updated in real time.

How Industry Players Can Benefit

aXedras focuses on the expansion of its ecosystem by onboarding new members to the Bullion Integrity LedgerTM. As a next step, aXedras will extend its global footprint to the Asia Pacific region, with Singapore as its hub.

After having already attended the last two editions of the Asia Pacific Precious Metal Conference as panellist, aXedras looks forward to being in Singapore again in February 2023 to continue discussions with local key stakeholders. Since aXedras’ software solutions are designed for any organisation along the precious metals supply chain, their benefits are both manifold and tailor-made. The following list, which is not exhaustive, provides an overview of individual benefits for each stakeholder:

- Suppliers such as mines, can digitalise and streamline their logistics and business processes with refiners. The integration of the assaying process – possibly conducted by an external party – means faster payment terms and lowers costs.

- Logistics companies get access to digital bar lists and concise sets of data and documents for the shipments. The traditional exchange of data and documents via email becomes obsolete, as the exchange takes place via a streamlined and digital platform.

- Refiners are often described as “gatekeepers of precious metals for the market”, which is duly taken into account:

- Refiners can receive digital and structured data about their physically sourced materials by their suppliers and carriers, making it easily auditable.

- Refiners can track the physical material throughout their production processes, which streamlines collateralisation processes.

- Refiners can map the digital provenance information to their products, which is increasingly demanded by downstream customers and supports their aligned sustainability mandates long term.

- Vaults benefit from digital bar lists upon of the receipt of new products. In case a duplicate is identified on the Bullion Integrity LedgerTM, for example, if there are two products registered with matching product characteristics (such as metal type, brand, weight, fineness and serial number), the solution alerts the involved vaults about the potential duplicates or even counterfeited product.

- Banks, dealers, investors and (jewellery) manufacturers equally benefit from transparency. Increasing regulatory and consumer demands for ESG and responsible sourcing require a digital and transparent solution to ensure the integrity of physical products and to provide needed compliance data.

- Members can digitally share their data with mandated auditors and authorities, allowing them to check and sign off compliance data more efficiently.

Connecting and Digitalising the Precious Metal Industry

aXedras has developed a novel and unique software solution for and with the precious metal industry. Throughout the GBI pilot, aXedras successfully validated its data standards, taxonomy and holistic process flows with more than 30 stakeholders of the global precious metal industry.

Visit our website www.axedras.com for more information or reach out to us if you’d like to catch up in person or virtually.

As a business development engineer, PHILIPP STOCKINGER supports aXedras to establish an entirely new and innovative decentralized ecosystem on the Corda Blockchain for the global precious metal industry. He brings around eight years of experience in the global corporate banking industry. In his former role as relationship manager, he helped to ramp up the SME business in Switzerland for a global German bank.