Navigate

Article List

- Hot Topics Under the Microscope at LBMA/LPPM Global Precious Metals Conference

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Recent Portfolio Application of Gold ETFs

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Digital Transformation of Precious Metal Supply Chains

By Philipp Stockinger, Business Development Engineer, aXedras Group AG

- World Gold Council Singapore – 2022 In Review

By Andrew Naylor, Regional CEO, APAC (ex China) and Public Policy, World Gold Council

- The Next Generation of Tokenised Commodities

By Paul Kelley, Sales & Partnerships, Trovio

- Robust Gold Yields in the Cards

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Where Beach Meets Bullion

By Strategic Wealth Preservation

- SBMA News

By SBMA

Article List

- Hot Topics Under the Microscope at LBMA/LPPM Global Precious Metals Conference

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Recent Portfolio Application of Gold ETFs

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Digital Transformation of Precious Metal Supply Chains

By Philipp Stockinger, Business Development Engineer, aXedras Group AG

- World Gold Council Singapore – 2022 In Review

By Andrew Naylor, Regional CEO, APAC (ex China) and Public Policy, World Gold Council

- The Next Generation of Tokenised Commodities

By Paul Kelley, Sales & Partnerships, Trovio

- Robust Gold Yields in the Cards

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Where Beach Meets Bullion

By Strategic Wealth Preservation

- SBMA News

By SBMA

Recent Portfolio Application of Gold ETFs

By Geoff Howie, Market Strategist, Singapore Exchange Limited

In early November, the SPDR Gold Shares ETF was trading at US$153 per unit (O87) and S$218 per unit (GSD).

While the US dollar counter has held its ground with marginal gains of about US$10 per unit since the end of 2019, there have been multiple instances over the past 34 months of flow rotations and price swings all highly attuned to global investor sentiment. This means monthly trading turnover of the ETF has varied significantly, from as high as S$338 million in March 2020 to as low as S$27 million in June 2022.

As the SPDR Gold Strategy Team maintained in October, from a portfolio perspective, the primary utility for gold is its role as an effective and robust risk-management tool, a durable mechanism to preserve wealth, and an efficient source of portfolio diversification. Over the past three years, there were clear examples of when the SPDR Gold Shares ETF was clearly being utilised strategically than as a reactionary part of portfolios.

THE FIRST OCCASION SPANNED THE SIX MONTHS OF MARCH 2020 THROUGH TO AUGUST 2020, WHILE THE SPDR GOLD SHARES ETF RALLIED 25%.

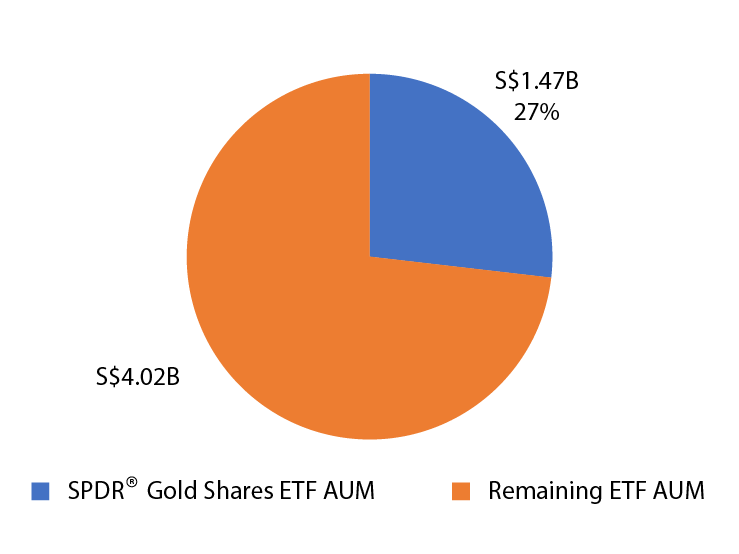

The first occasion spanned the six months of March 2020 through to August 2020, while the SPDR Gold Shares ETF rallied 25%. Investors did not follow the price of precious metal comet with inflows, rather the ETF saw fund outflows of S$300 million. As of the end of 2019, the SPDR Gold ETF comprised 26.8% of the total AUM across the SGX-listed ETF market, which was marginally reduced to 26.1% as of the end of August 2020. From the perspective of collective flows and AUM, SPDR Gold Shares ETF unitholders appeared to have generally rebalanced, rather than closed or added to their positions at the height of the COVID-led economic uncertainty. These six months saw the price of gold rally well-beyond its annualised long-term price returns and significantly outpace other asset classes. This possibly prompted portfolio managers to re-align the comparative weightage of gold to pre-COVID levels, prompting fund outflows of S$300 million.

AUM of SPDR® Gold Shares ETF (GLD SP) as a % of Total SGX ETF AUM Dec 2019

The second occasion that demonstrated strategic allocation was later that year, with the November 2020 rally in global markets that saw the Straits Times Index surge 16%, with S$1.4 billion of net fund inflows into Singapore stocks. The unit price of the SPDR Gold Shares ETF declined 5% over the month. In November 2020, global stocks struck record performances attributed to vaccine developments that met optimistic WHO timelines. While pundits called risk-on, the SGX-listed SPDR Gold Shares ETF also attracted S$54 million of fund inflows, which still represents the highest monthly inflows for the ETF since 2019. This indicates that the risk-on was not without blinders, as the fresh foot forward by global investors that month did include fund inflows to the SPDR Gold Shares ETF.

The next highest monthly inflow to the SPDR Gold Shares ETF over the past 34 months was in September 2020, with S$33 million of fund inflows, which followed the above mentioned six months of outflows. In September 2020, the unit price of the ETF declined 4% and global stocks also declined for the first month in six months. The preceding month of August 2020 also produced the second highest monthly trading turnover for the SPDR Gold Shares ETF since 2019. However, August 2020 saw the ETF ultimately book more outflows than inflows.

The third highest monthly fund inflows over the period, at less than a quarter of the fund inflows seen in November 2020, was in April 2022, at S$13 million. During that month, the price of gold declined 2%, however at the same time, in what was seen as a signature risk-off month for the United States, the FTSE Developed Index declined 8%, following a 3% gain in the preceding month. March 2022 also produced the third highest monthly trading turnover for the SPDR Gold Shares ETF since 2019, however ultimately the ETF also booked more outflows than inflows that month.

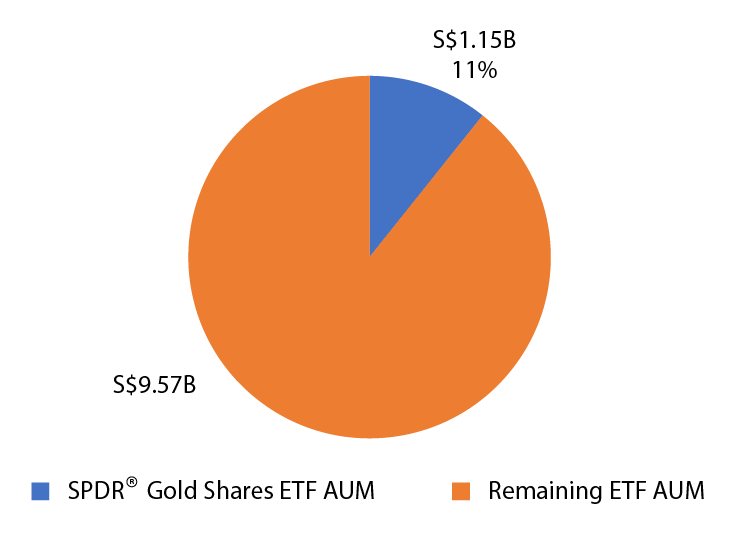

Overall, the SPDR Gold Shares ETF has seen more fund outflows than fund inflows over the 34 months since 2019, with total fund outflows of S$500 million. This has seen the AUM of the ETF decline 22% from S$1.45 billion to S$1.15 billion. During this time, the SPDR Gold Shares ETF generated a 12% gain, while the FTSE Developed Index generated a comparative 20% total return, both in SGD terms.

This indicates that the SPDR Gold Shares ETF had been somewhat utilised as a store of value in portfolios prior to 2020, with investors booking gradual fund outflows over the ensuing 34 months, possibly rotating into other assets such as equities or fixed income. For instance, while the AUM of the SPDR Gold Shares ETF has declined 22% amid a slew of ETFs listed in recent years, it now comprises 11% of the total AUM across the SGX-listed ETF markets. For the 11 of the 34 months that saw fund inflows, there were both gains and declines in corresponding equity markets, however the fund inflows generally corresponded with some level of significance, or size to the gains or declines.

Like most asset classes, the SPDR Gold Shares ETF takes cues from the impact of global growth deceleration, persistent inflation, and geopolitical headwinds. The gains of the US dollar and US Treasury yields over the first 10 months of 2022, have made it more expensive for investors to purchase US dollar denominated gold, while higher US Treasury yields mean greater opportunity costs to investors holding gold. These are two key factors that have weighed the price of gold over the first 10 months of 2022, when some might have thought the ETF would provide gains due to being touted as an inflation hedge in preceding years.

The SPDR Gold Shares ETF was trading at US$170 per unit at the end of 2021, and was 11% lower, near US$152 per unit at the end of October. The key variable was US dollar appreciation, with the US Dollar Index gaining 17% over the 10 months. Thus, in JPY, CNY, and EUR terms, the ETF gained 16%, 3% and 3% respectively for the first 10 months of the year. In INR terms, the ETF maintained its value over the 10 months with flat returns, and in SGD terms the ETF declined 6%. With China and Japan not pursuing tightening monetary policy, the ETF provided a diversified asset and diversified currency investment for onshore portfolios.

AUM of SPDR® Gold Shares ETF (GLD SP) as a % of Total SGX ETF AUM Oct 2022

Still, the outlook for growth, inflation and geopolitics remains fluid. The Federal Reserve subscribes to the theory that inflationary expectations fuel inflation and has thus maintained an increasingly hawkish tone this interest rate hike cycle. This has added to the gains in the US dollar and US Treasuries, which has conversely weighed gold in US dollar terms. And while there have been both elements of cost-push and demand-pull factors behind the current bout of inflation, current expectations are, that if contained rightly, the inflation is less systemic and more structural in nature. This means inflation is expected to gradually decelerate, and over time weigh growth, which will in turn would reduce overall inflation and result in a less hawkish Federal Reserve.

IN OCTOBER, THE IMF MAINTAINED GLOBAL INFLATION WOULD RISE FROM 4.7% IN 2021 TO 8.8% IN 2022, BEFORE DECELERATING TO 6.5% IN 2023 AND DOWN TO 4.1% IN 2024.

In October, the IMF maintained global inflation would rise from 4.7% in 2021 to 8.8% in 2022, before decelerating to 6.5% in 2023 and down to 4.1% in 2024. The IMF also maintained a wage-price spiral in which both inflation and nominal wage growth keeps rising over time is not expected, however that risk is expected to see the FOMC maintain the tough hawk talk, for much of the time before the terminal Fed Funds Rate is lowered. Thus, timing continues to matter, in addition to time in the market, as observed with the S$1.47 billion of AUM in the SPDR Gold Shares ETF ahead of 2020.

Trading Specifications of SPDR® Gold Shares ETF

Fund Details

| SPDR Gold Shares ETF | |

|---|---|

| Base Currency | USD |

| ISIN | SGXC54700155 |

| Management Fees1 | 0.40% |

| Replication | Physical Replication |

| Classification (for retail) | Excluded Investment Product (EIP) |

| Investment Mode | Cash, SRS and CPF-IS eligible. |

Key Trading Specifications

| USD Counter | SGD Counter | |

|---|---|---|

| SGX Stock Code | O87 | GSD |

| SGX Trading Name | GLD US$ | GLD SG$ |

| Trading Lot Size | 1 unit | 1 unit |

| Tick Size | US$0.01 | S$0.01 |

| Designated Market Maker | Flow Traders Asia Pte. Ltd. | Flow Traders Asia Pte. Ltd. Phillip Securities Pte. Ltd. |

GEOFF HOWIE is the Singapore Exchange’s market strategist, with more than 20 years of experience in financial markets and economics. He has a strong background in global macroeconomics and a reputation for expeditiously identifying key market drivers and their impact across major asset classes.