Navigate

Article List

- Editorial

By Albert Cheng, CEO, Singapore Bullion Market Association

- The Golden Future of Thailand’s Bullion Industry

By Pawan Nawawattanasub, CEO, YLG Bullion International

- LBMA/LPPM Conference: Gràcies Barcelona

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Central Bank Gold Buying Reaches Record Levels

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Why Platinum is a Strategically Important Metal

By Edward Sterck, Director of Research, the World Platinum Investment Council

- A Paradigm Shift in Japan’s Gold Market

By Bruce Ikemizu, Representative Director, Japan Bullion Market Association

- Gold’s Rush to the East

By Ronald-peter Stöferle, Managing Partner, Incrementum AG

- SBMA News

By SBMA

Article List

- Editorial

By Albert Cheng, CEO, Singapore Bullion Market Association

- The Golden Future of Thailand’s Bullion Industry

By Pawan Nawawattanasub, CEO, YLG Bullion International

- LBMA/LPPM Conference: Gràcies Barcelona

By Shelly Ford, Digital Content Manager & Editor of the Alchemist, LBMA

- Central Bank Gold Buying Reaches Record Levels

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Why Platinum is a Strategically Important Metal

By Edward Sterck, Director of Research, the World Platinum Investment Council

- A Paradigm Shift in Japan’s Gold Market

By Bruce Ikemizu, Representative Director, Japan Bullion Market Association

- Gold’s Rush to the East

By Ronald-peter Stöferle, Managing Partner, Incrementum AG

- SBMA News

By SBMA

Gold’s Rush to the East

By Ronald-peter Stöferle, Managing Partner, Incrementum AG

When one considers the world’s leading gold market hubs, London, New York and Zurich often come to mind. However, the global political order is undergoing a major readjustment, and so too is the global gold market. Gold flows and consequently, the global gold market, is increasingly shifting from the West to the East, as succinctly put by James Steel, “Gold goes where the money is”.

Demand From the East

Central banks in Eastern countries have emerged as strong gold buyers, even surpassing some of their Western counterparts. This is also reflected in the continuing enthusiasm of central banks for gold, especially among non-Western countries. In 2022, central banks made their largest purchases of gold since records began more than 70 years ago, acquiring a total of 1,136 tonnes. This trend continued into the first three quarters of 2023, with central banks increasing their gold reserves by a total of 800 tonnes – a 14% increase over the previous year. China led the way in purchases, followed by Poland, Singapore, Libya, India, and the Czech Republic. So even in the West, it was countries in the East that made significant purchases.

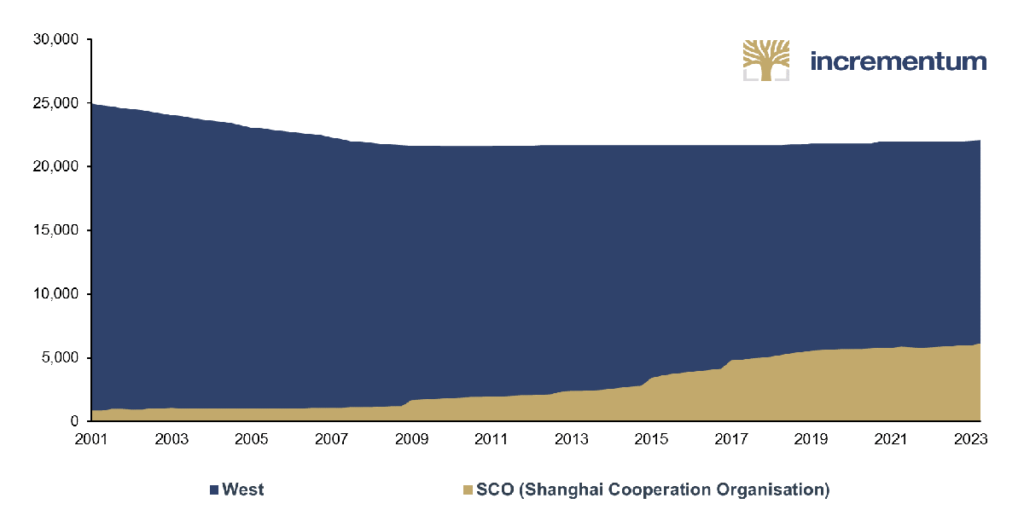

To illustrate the shift in institutional gold demand to the East, consider the cumulative gold sales of Western central banks compared to the cumulative gold purchases of the Shanghai Cooperation Organization (SCO) since 2001.

Central Bank Gold Reserves, in Tonnes, Q2/2001 – Q3/2023

Looking at the BRICS, we also see a striking overlap, with central banks from four of the five BRICS countries – Brazil, Russia, India and China – collectively acquiring 2,932 tonnes of gold between 2010 and 2022.

Growing Infrastructure for Gold Trading

The East is not only amassing gold but mining gold itself on a large scale. China and Russia have ranked among the top three gold producing nations for years.

Countries such as China, the United Arab Emirates and even Russia are expanding their gold trading infrastructure, aiming to establish a self-sustained infrastructure for gold trading, reducing reliance on trading centres in the West, such as London, New York and Zurich. This shift reflects a changing perspective, with the East increasingly taking on the role of a provider of infrastructure rather than solely a customer.

Key developments include:

- SGE & SFO NRA: Cooperation between the Chinese and Russian gold markets

China and Russia have been working to connect their gold markets through cooperation between the Shanghai Gold Exchange (SGE) and the Russian National Financial Association (NFA), a professional association representing the entire Russian financial sector, including its precious metals market.

In the face of Western sanctions, Russian gold exports to China have already surged since mid-2022. With three Russian banks – VTB, Sberbank and Otkritie – already members of the SGE International Board, this cooperation between is set to intensify.

AS EASTERN GOLD MARKETS GAIN PROMINENCE, THEY ARE OBTAINING GREATER REPRESENTATION AND INFLUENCE IN GLOBAL INSTITUTIONS LIKE THE LBMA AND THE WORLD GOLD COUNCIL (WGC).

- Memberships in gold-related institutions

As Eastern gold markets gain prominence, they are obtaining greater representation and influence in global institutions like the LBMA and the World Gold Council (WGC). Chinese refineries and gold producers have increased their presence in these organizations, signaling their growing influence.

In 2009, only six Chinese refineries were on the LBMA’s Good Delivery List, but now there are thirteen. While just 15 years ago there was only one regular (full) member of the LBMA from China, the Bank of China, there are now seven. China’s growing influence is also reflected in the World Gold Council. In February 2009, only one Chinese gold producer was a member of the WGC; now there are four

- India International Bullion Exchange (IIBX)

In addition to its sophisticated OTC gold trading market, India has also established a trading infrastructure for gold futures contracts on the country’s Multi Commodity Exchange (MCX). In July 2022, the India International Bullion Exchange (IIBX), supported by the Indian government, was officially opened for trading spot gold contracts backed by physical metal. IIBX is located in a special economic zone in GIFT City in the Indian state of Gujarat, and the gold underlying the contracts is stored there. One goal of IIBX is to allow qualified buyers to import gold directly into India without the need for banks or authorized agencies. So far, however, trading volumes have been minimal.

Private Gold Demand Shifts to the East

The surge in interest in gold is also visible among private consumers in the East. Chinese consumer demand, for example, increased by 181% from 292.6 tonnes at the turn of the millennium to 824.9 tonnes in 2022. Annual consumer demand in India has also increased during this period, albeit from an already high level in 2000.

China and India, which together accounted for 28.7% of consumer demand in 2000, accounted for almost half of global consumer demand (48.4%) in 2022 and together acquired 1,600 tonnes of gold last year. This shift underscores the East’s growing attraction to gold as an investment and wealth preservation asset.

Consumer Demand for Gold – 2000 vs. 2022

| 2000 | % of Global Demand | 2022 in Tonnes | % of Global Demand | 2022 vs. 2000 in Tonnes | 2022 vs. 2000 in % | |

|---|---|---|---|---|---|---|

| India | 723 | 20.40% | 774 | 23.40% | 50 | 7.00% |

| China | 292.6 | 8.30% | 824.9 | 25% | 532.3 | 181.90% |

| Japan | 105.1 | 3.00% | 4.3 | 0.10% | -100.8 | -95.90% |

| Middle East | 457.9 | 12.90% | 268.2 | 8.10% | -189.7 | -41.40% |

| Türkiye | 177.4 | 5.00% | 121.5 | 3.70% | -55.9 | -31.50% |

| United States | 368.5 | 10.40% | 256.6 | 7.80% | -111.9 | -30.40% |

| France | 19 | 0.50% | 19.9 | 0.60% | 0.9 | 4.50% |

| Germany | 15.6 | 0.40% | 196.4 | 5.90% | 180.8 | 1,159% |

| Italy | 92.1 | 2.60% | 17.8 | 0.50% | -74.3 | -80.60% |

| UK | 75 | 2.10% | 35.6 | 1.10% | -39.4 | -52.50% |

| Rest of Europe | 142.4 | 4.00% | 115.1 | 3.50% | -27.3 | -19.20% |

| Other | 1,076.0 | 30.40% | 669.1 | 20.30% | -406.9 | -37.80% |

| Global Demand | 3,544.6 | 100.00% | 3,303.3 | 100.00% | -241.3 | -6.80% |

Recent developments point in the same direction. In the first eight months of 2023, Asian gold ETFs increased their holdings by 7.7%, while North America and Europe recorded outflows of 2.3% and 6.1%, respectively. Significantly, in the bars and coins demand segment, Turkey and Iran replaced Germany and Switzerland in the top five in the first half of the year. China now leads this sub-segment of gold demand – in the first half of 2022, Germany was still in the lead – followed by Turkey, the US, India and Iran. This is because while demand for bars and coins in Turkey shot up from 9.5 tonnes to 47.6 tonnes in the second quarter of 2023, it fell by around three quarters in Germany.

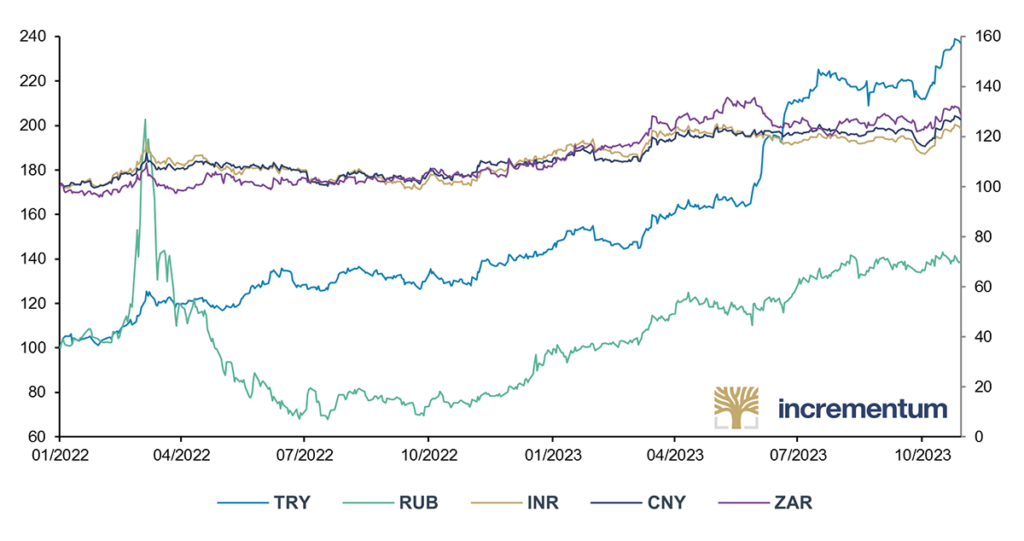

Growing Price of Gold in Eastern Currencies

Furthermore, the price of gold in Eastern currencies has risen significantly, demonstrating its value-preserving properties in challenging geopolitical and macroeconomic environments. As of the end of October, gold was 23.3% higher in Indian rupees than at the beginning of 2022, 26.9% higher in Chinese renminbi and 29.1% higher in South African rand (all left-hand side), while in Russian rubles gold increased by 39% and by 137.2% in Turkish lira (right-hand side). In comparison, gold in US dollars rose by 8.5% compared to the start of 2022.

Gold in TRY and RUB (lhs), and in INR, CNY and ZAR (rhs), 100 = 01/01/2022, 01/2022-10/2023

Moreover, the significantly increased premium on the gold price in China since July is an unmistakable sign that there is a structural shortage of gold in the Chinese market and thus an expression of the strong demand for gold in the Middle Kingdom. This is likely to be related to the country’s ongoing economic problems, especially in the real estate sector, which was hitherto of great importance for retirement provision.

Summary

This shift in demand from West to East extends beyond governments or governmentrelated entities to include institutional and private investors. Gold is flowing to where it is most valued and where economic prosperity and savings rates have increased. In the medium term, the shift in demand should therefore find support from the higher growth prospects in Asia and the Middle East.

“Ohne Geld, ka Musi” (“Without money, no music”) – this is how the vernacular formulates this economic truism in German. With the IMF’s most recent economic forecast indicating stronger growth in emerging and developing Asia compared to the West, the influence on gold pricing is likely to shift from West to East.

RONALD-PETER STÖFERLE CMT is managing partner of Incrementum AG, responsible for research and portfolio management. With a background in business administration and finance, he started his career at Erste Group, where in 2007 he published his first “In Gold We Trust” report. He serves on the boards of Tudor Gold Corp. (TUD), and Goldstorm Metals Corp. (GSTM), and advises Matterhorn Asset Management. He co-authored the international bestseller Austrian School for Investors (2014) and The Zero Interest Trap (2019).