Navigate

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

Published on September 10, 2021

BRIAN LAN is the Managing Director of GoldSilver Central and a member of the company’s Board of Directors. He is part of the team in charge of overall management of the company and is responsible for sales, operational infrastructure and predominantly, global business development. His passion is using technology to transform business processes and advance client outcomes. He also sits on the board of GoldPlus Assets and Fund Express. This year GoldSilver Central is proud to celebrate its 10th anniversary in business.

On 9 August 2021, gold fell by 4.2% to a five-month low (Figure 1). Many wondered if this was a flash crash or if there was manipulation at play. Well, this is in fact what healthy markets do and it all depends on buyers or sellers in the market, and its not unique to gold. There might be a few reasons behind this dip.

1. Algorithmic traders derived similar sell levels and multiple stop loss or stop out levels were triggered

Many algorithmic traders might have derived similar sell levels based on their technical models and there might have been hundreds or thousands of sell orders once prices hit their sell limit levels. This dip happened during the early hours of Singapore time, also during the wee hours in Europe and late night in the US. Those who had long positions might have had their positions automatically liquidated due to insufficient margins and as prices go lower, this would be further exacerbated into a downward spiral.

2. Lack of liquidity during market open in Asia

Coincidentally, this price dip happened on public holidays in Singapore and Japan. Singapore was celebrating its National Day and Japan was having a holiday in lieu of its Mountain Holiday. There was more trading activity on Friday the week before as US released better-than-expected non-farm payroll figures. This led many to believe that economic recovery was on the way. This probably led to more traders in Asia to leave sell orders before the market opened on Monday.

There are a number of gold desks in banks located in Singapore and Japan. Due to the holiday, there were probably fewer traders physically on desk or less experienced ones left on desk to handle the trades. Also, expectedly more trades were on the sell side when market opened, coupled with a lack of liquidity in the early hours with fewer market makers during Asia hours, which resulted in a 4.2% dip in the gold price before finding a support level. Gold prices then recovered very quickly within two hours and prices recovered from the low at US$1,680 to US$1,720. (Figure 1).

Figure 1: Gold Price Daily Chart

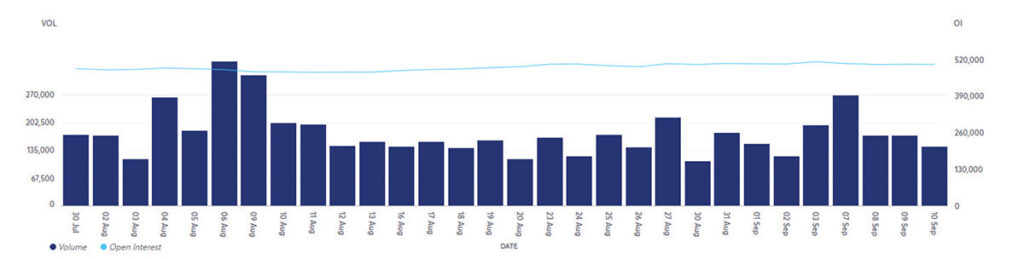

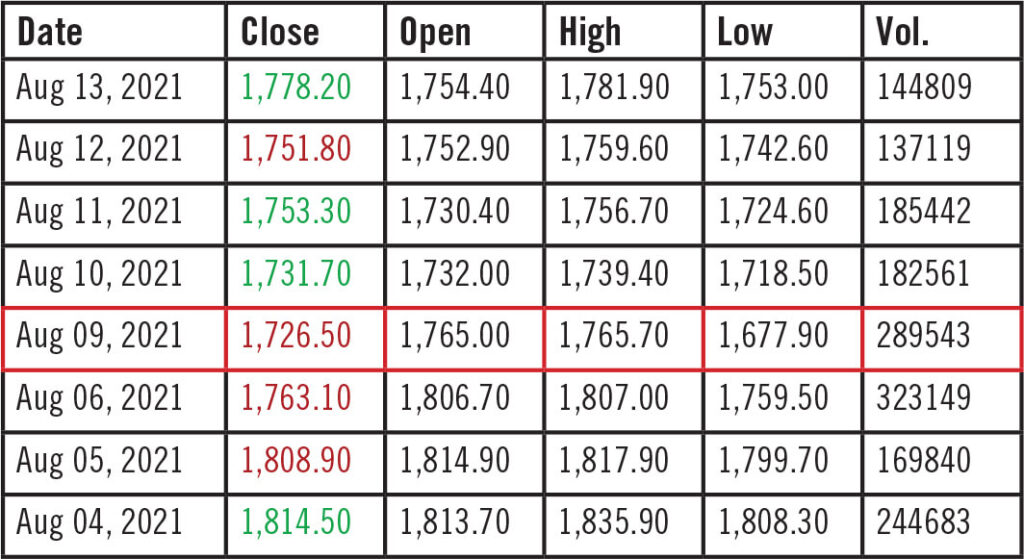

Figure 2 and table 1 show increased activities (volume and open interest) on these two particular days as compared to other trading days, but they are nothing out of the ordinary. It is also very unlikely there was “manipulation” as many unhappy investors claimed. There were many market participants that contributed to this dip, as opposed to a single big trade by a market player.

Figure 2: Gold futures – Volume and open interest

3. “Summer doldrums” and other asset classes have generated higher returns

The annual seasonal weakness for gold happens during the summer months, which many call the summer doldrums. During this period many family offices, fund managers and traders are on vacation, which means fewer trades executed and hence lesser volatility or price action during this period. Refineries use this period to retool and collect gold dust in their facility as physical demand tends to be lower. As we know, when markets are trading in narrow ranges, not much activity happens and more often than not, investors who are looking for prices to appreciate to make a profit will then lose interest and look at other asset classes to generate their alpha.

Capital will always flow to asset classes that can generate higher returns. This year equity and cryptocurrencies have done well. The S&P has posted 50 new highs this year and a return of about 20% so far. Cryptocurrencies such as bitcoin and ethereum have also done well, with more than 100% returns at their highs. Short-term gold investors were disenchanted as they were expecting gold to hit new highs from what they have seen last year, but prices went persistently lower than the market open on 2 January this year. This probably played a big part in the sell orders we’ve seen, especially when prices fell.

Table 1: Gold futures – Volume and open interest

Is the gold run over then?

It seems like gold will do well during the last quarter, hence I remain bullish on the precious metal. There are three main reasons why I believe gold prices will be supported. First, weak hands have been cleared out by this dip and prices can climb from here. Second, central banks that were not usual buyers have been buying gold in big quantities. For example, Brazil bought 62.3 tonnes, Hungary bought 63 tonnes, Japan bought 80.8 tonnes and Thailand bought 90.2 tonnes this year. Prices they bought into were in the range of US$1,780 to US$1,840, hence we might expect to see more central banks buying into gold at current levels, which would be a good support for gold. Finally, jewellery buying from China and India has picked up sharply compared to last year and as we move into the wedding seasons for both countries, we expect demand to pick up during the last quarter. Coupled with the October Comex Gold roll that will be rolled over to December, we could see an exciting end for gold in 2021.

Updates on silver premiums

In Crucible 17, I shared that the premiums for 100 oz. silver bars shot up by 687% in February, exacerbated by the silver squeeze. Currently, supply has more or less caught up with demand and we have seen the easing of premiums, though it is still elevated at 250%. However, ready inventory supply is still not at pre-Covid levels, hence we expect premiums to rise if there is a sharp increase in physical demand.

BRIAN LAN is the Managing Director of GoldSilver Central and a member of the company’s Board of Directors. He is part of the team in charge of overall management of the company and is responsible for sales, operational infrastructure and predominantly, global business development. His passion is using technology to transform business processes and advance client outcomes. He also sits on the board of GoldPlus Assets and Fund Express. This year GoldSilver Central is proud to celebrate its 10th anniversary in business.