Navigate

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

Published on September 10, 2021

As financial institutions and their clients continue to focus on capital efficiency and cost savings, whether driven by regulation or an internal-cost cutting strategy, post-trade costs are at the heart of the discussion. Other asset classes have used innovative ways to cut costs and precious metals must not be left behind.

Currently, settlement is a fragmented process that often lacks automated controls. Cash is settled via a traditional correspondent banking network whilst metal is settled via metal clearing banks. Operations are managed by unconnected processes across different banking networks and infrastructure. This causes multiple pain points and risks, including reconciliation between different banking systems and teams and settlement risk due to the lack of control in the movement of assets versus cash. The current system exposes participants to additional risk and increased cost.

DEVELOPING THE RIGHT SOLUTIONS

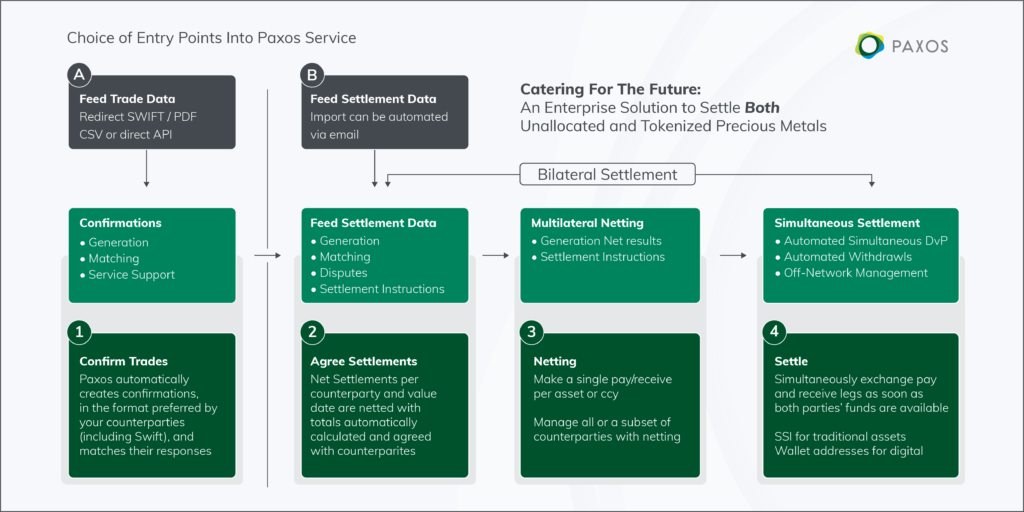

Having standardised post-trade confirmations and settlement affirmations for its clients, Paxos is now focusing on settlement. Participants using the Paxos Settlement Service can safely settle LBMA good delivery precious metals against cash through one system. By layering its technology over a traditional cash account and an LPMCL metal clearing account, Paxos has delivered a simultaneous settlement solution. Ownership of assets/cash changes only when both parties have funded their accounts, allowing settlements to be fulfilled simultaneously, removing inherent risks. Clients can leave cash and metal in their own Paxos accounts to settle further obligations, or it can be withdrawn automatically. Paxos envisions this solution being used in other regions.

To improve efficiency, Paxos is also working with leading market participants to allow for daily net funding of all precious metal settlements. Paxos Settlement Service will then facilitate bilateral simultaneous settlements before returning any net receipts back to participants. This additional feature will give clients even more flexibility with their settlement choices. This can reduce settlement risk, as funds are not released until all parties have funded their settlement obligations in their accounts.

Paxos believes digitisation is the way forward. Taking operational efficiency a step further, consider the impact of digitisation on settling cross-border precious metals transactions. Today metal is a cumbersome asset to settle; by digitising the asset you mobilise it, reduce costs and even allow for same day settlement. Paxos has demonstrated how this works with PAX Gold, a Paxos-issued digital gold token that is 100% backed by LBMA Good Delivery bars and regularly audited. Paxos is able to support peer-to-peer settlement of precious metal without needing to impose cut-offs, allowing the market to settle 24 hours a day and removing time zone issues, whilst eliminating logistical inefficiencies and high costs associated with moving physical gold. Now, replicate that regionally and consider how open the precious metals market can become for cross-border trading. Digitisation allows for gold to be used more effectively as an asset.

The solutions Paxos has introduced help reduce barriers to entry for new market participants. This is crucial as precious metals is a notoriously difficult market to enter due to the operational requirements like metals clearing accounts. By working with Paxos, more participants can enter the market, bringing a diverse liquidity pool and healthier market overall.

ABOUT PAXOS

Paxos Trust Company operates a regulated blockchain infrastructure platform. It builds enterprise blockchain solutions for institutions like PayPal, Interactive Brokers, Bank of America, Credit Suisse, Societe Generale and Revolut. The company has raised more than $540 million raised from leading investors including Oak HC/FT, Declaration Partners, Mithril Capital and PayPal Ventures. The company has offices in New York, London and Singapore.

ANOUSHKA RAYNER has 25 years experience in the financial markets. She has worked in the foreign exchange market for HSBC, UBS, as well as leading electronic broking houses and NEX Optimisation, a group focused on post-trade solutions. Her role at Paxos is to bring efficiency to Commodities settlement and to mobilise the asset class through digitisation.