Navigate

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

- India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

- India to See Strong Uptick in Jewellery Demand

By Chirag Sheth, Principal Consultant, Metals Focus

- Renminbi Internationalisation and its Effects on Gold

By Chinese Gold and Silver Exchange

- Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

- Thailand’s Crucial Role in the ASEAN Gold Market

By Nuttapong Hirunyasiri, CEO, MTS Gold Group

- Thailand: Gold Provides Liquidity Amid Pandemic

By Pawan Nawawattanasub, CEO, YLG Bullion International

- #SilverSqueeze – What Actually Happened and Why it Didn’t Work Out as Planned

By Brian Lan, Managing Director, GoldSilver Central

- Japan Exchange Group: Reinventing Japan’s Precious Metals Derivatives Market

By Ryoichi Seki, General Manager, Business Development, Osaka Exchange

- Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

- India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

- India to See Strong Uptick in Jewellery Demand

By Chirag Sheth, Principal Consultant, Metals Focus

- Renminbi Internationalisation and its Effects on Gold

By Chinese Gold and Silver Exchange

- Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

- Thailand’s Crucial Role in the ASEAN Gold Market

By Nuttapong Hirunyasiri, CEO, MTS Gold Group

- Thailand: Gold Provides Liquidity Amid Pandemic

By Pawan Nawawattanasub, CEO, YLG Bullion International

- #SilverSqueeze – What Actually Happened and Why it Didn’t Work Out as Planned

By Brian Lan, Managing Director, GoldSilver Central

- Japan Exchange Group: Reinventing Japan’s Precious Metals Derivatives Market

By Ryoichi Seki, General Manager, Business Development, Osaka Exchange

- Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

Published on April 10, 2021

KERRY STEVENSON is the founder of the Australian Gold and Virtual Gold conferences, and is an investor and entrepreneur who has a passion for helping people understand the ever-changing world of money and investing. She also points out that she is not a financial advisor or an accountant and that everybody should do their own research and stop watching Netflix.

Can bitcoin and gold sit well together or does bitcoin pose a challenge to gold in the digital world?

As the old Chinese saying goes, “May you live in interesting times”. Like it or not, we live in very interesting times. A time of uncertainty and money printing, but also a time of incredible creativity.

As an investor and also the founder of the Australian Gold conference, I have spoken with many intelligent people around the world and each of them has a different perspective on how to grow and protect wealth in these turbulent and ever-changing times.

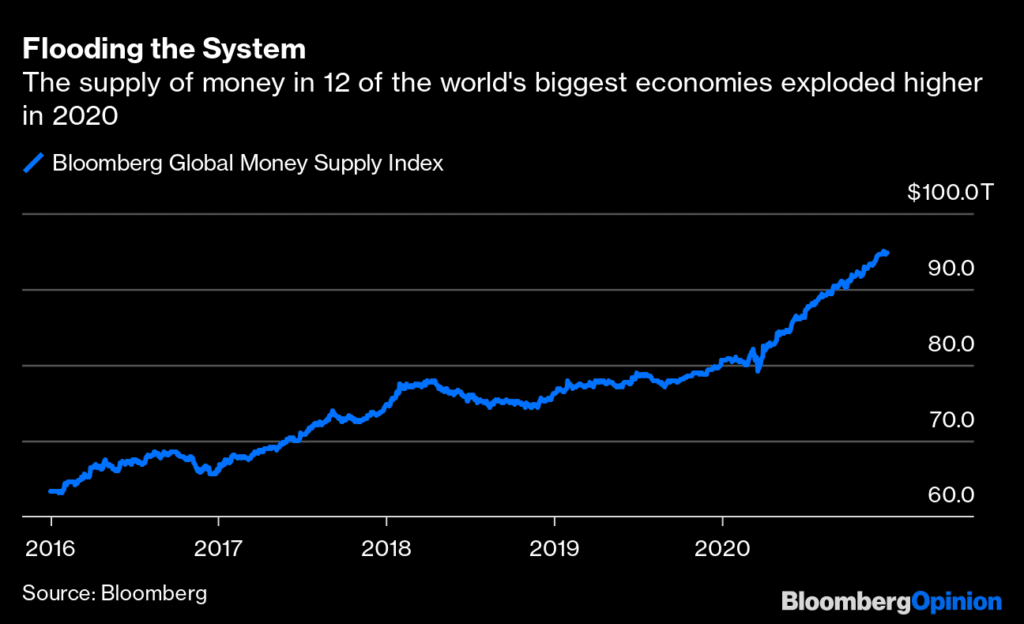

It is abundantly clear that governments around the world are doing their best to keep the current system afloat by continuing to print “funny money”, commonly known as fiat currency. At the same time, they are making a strong case for a reset to a full digital money system, citing issues such as funding terrorism and crime as the reasons for the switch.

While the price of bitcoin and other cryptocurrencies have risen in price in a spectacular fashion and much has been made of institutional money moving into bitcoin, the fiat price for gold has remain stagnant. Many observers have said that gold is being replaced by bitcoin due to it being fast and digital, but will there always be a place for gold and silver in a well-balanced portfolio?

In my opinion, gold is an insurance policy against the relentless money printing machine whereas crypto, and more specifically bitcoin for this commentary, is a more speculative option but one that, in a tsunami of liquidity, should continue to rise in price against the continued printing of fiat currency.

Figure 1: Change in annual production – Precious metal coins vs money 2019 vs. 2020

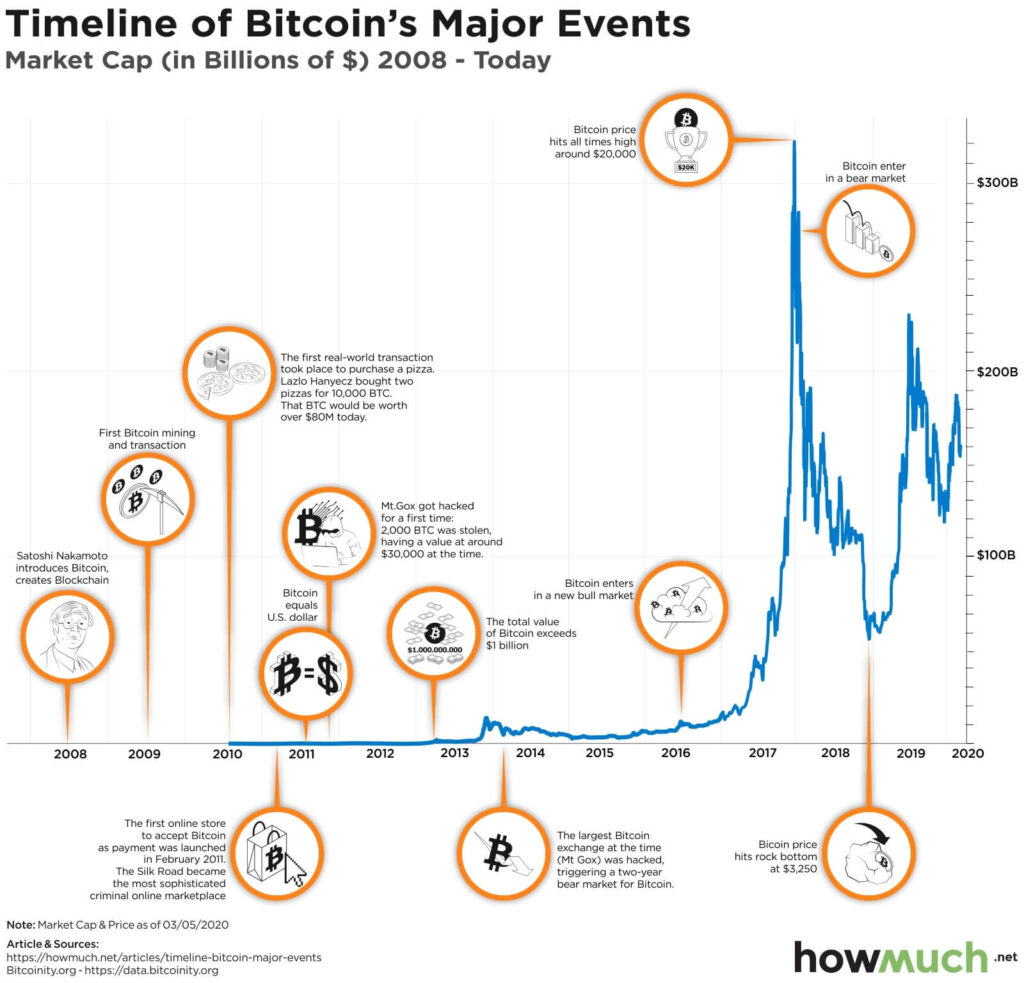

We have to also bear in mind that bitcoin has only been around for just over 10 years and is purely digital, whereas owning physical gold (not the paper exchange-traded funds or ETFs) means that you have control of the asset. What happens if the government decides to step in and put a lot more regulation around the crypto space? What happens if one of the main exchanges suddenly closes like Mt Gox did back in 2014 without warning?

A recent report from J.P. Morgan found that institutional investors are flocking to bitcoin and leaving gold out to dry. So, is the yellow metal dying? Bitcoin, which has rallied over 150% in 2021, has greatly outpaced other assets including the Dow and gold. The Grayscale Bitcoin Trust has seen inflows of almost $2 billion since October 2020, compared with outflows of $7 billion for ETFs backed by gold, according to J.P. Morgan.

With institutional investors now getting interested in the crypto space, will we see a greater inflow of funds to the sector and, as a result, the price being driven higher? Well that certainly seems to be the case at the moment, with one tweet from Michael Saylor, the co-founder of MicroStrategy, about investing in bitcoin sending the price higher. Mainstream media is also now starting to take notice, with CNBC including bitcoin on its ticker at the bottom of the screen.

Two-thirds of millennials prefer bitcoin to gold as an investment because millennials are more comfortable with technology and can grasp the way to use and transfer funds more easily. Will that see the next generation moving away from the traditional safe haven asset of gold? Only time will tell.

Figure 2: Timeline of bitcoin’s major events

With all that being said, bitcoin should complement gold rather than replace it. Both have a place at the table and with the amount of uncertainty in the market and the continuing money printing by central banks, fiat currency looks like the one to avoid at all costs.

Ray Dalio, founder of Bridgewater Associates, has previously spoken out against bitcoin but has recently said that he thought bitcoin and other cryptocurrencies had “established themselves over the last 10 years and were interesting gold-like asset alternatives”.

Jim Powers, director of investment research at Delegate Advisors, isn’t convinced. “Bitcoin is not the new gold because the old gold (i.e., gold) still works just fine,” he said. “While similarities exist between gold and bitcoin (e.g., store of value, price determined by supply and demand), gold has been recognised as a store of value for millennia. Bitcoin has been recognised as a store of value for less than a decade”.

Then there’s bitcoin’s reliance on the Internet. “In an end-of-the-world-style financial apocalypse, individuals can still hold and trade physical gold”, adds Powers. “Try buying a loaf of bread with bitcoin if the Internet stops working”.

So, can bitcoin and gold play well together in the sandpit of life or do we, as investors, have to make a choice? I believe that in a world full of change, uncertainty and money printing, and governments that are wildly out of control, there will be a need to hedge and diversify. I am not saying that you need to go all in with either asset but exposure to both will ensure that you are best placed to take advantage of the swings and roundabouts in the new digital world.

In the end, it depends on your goals. Bitcoin is a better investment for short-term potential gain – but you also have the potential to lose a lot of money. Gold, however, is a stable investment that is almost guaranteed to hold its value in the long term.

The last word will go to Mike Venuto, co-portfolio manager of the Amplify Transformational Data Sharing ETF, a US$1 billion ETF. “I would probably pick bitcoin but why not both? Gold and bitcoin have a very similar aspect to the portfolio. I would add gold as a diversifier. I would add bitcoin as a diversifier. The hedge is diversification. Bitcoin is a tool to get there. Bitcoin is a hedge to losing money to something stable”.

KERRY STEVENSON is the founder of the Australian Gold and Virtual Gold conferences, and is an investor and entrepreneur who has a passion for helping people understand the ever-changing world of money and investing. She also points out that she is not a financial advisor or an accountant and that everybody should do their own research and stop watching Netflix.