Navigate

Article List

- Disruptions to the Global Gold Supply Chain and its Implications for Singapore

By Albert Cheng, CEO, SBMA

- The Impact of COVID-19 Shutdowns on the Gold Supply Chain

By Visual Capitalist

- Australia’s Gold Export

By Thuong Nguyen, Economist, Australian Government Department of Industry, Science, Energy and Resources

- Feature | The Investment Case for Gold – Singapore

By Qi Xiu Tay, Manager, World Gold Council

- Rand Refinery – Africa’s Gold Standard

By Praveen Baijnath, Chief Executive, Rand Refinery

- Global Gold Storage Options

By Ronald Stoeferle, Managing Partner, Incrementum AG

- Next-Generation Gold Tracking

By Gregor Gregersen, CEO, CACHE

- Will Gold’s Rally Extend into 2021?

By Eily Ong, Global Analyst, Bloomberg Intelligence

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Disruptions to the Global Gold Supply Chain and its Implications for Singapore

By Albert Cheng, CEO, SBMA

- The Impact of COVID-19 Shutdowns on the Gold Supply Chain

By Visual Capitalist

- Australia’s Gold Export

By Thuong Nguyen, Economist, Australian Government Department of Industry, Science, Energy and Resources

- Feature | The Investment Case for Gold – Singapore

By Qi Xiu Tay, Manager, World Gold Council

- Rand Refinery – Africa’s Gold Standard

By Praveen Baijnath, Chief Executive, Rand Refinery

- Global Gold Storage Options

By Ronald Stoeferle, Managing Partner, Incrementum AG

- Next-Generation Gold Tracking

By Gregor Gregersen, CEO, CACHE

- Will Gold’s Rally Extend into 2021?

By Eily Ong, Global Analyst, Bloomberg Intelligence

- SBMA News

By Albert Cheng, CEO, SBMA

Will Gold’s Rally Extend into 2021?

By Eily Ong, Global Analyst, Bloomberg Intelligence

Published on September 8, 2020

EILY ONG is an equity and industry analyst for Bloomberg Intelligence. She specialises in the global metals, mining and steel sectors. Before joining Bloomberg, Ong gained nearly 20 years of experience in the financial services industry. Her roles at Credit Suisse and Deloitte largely focused on the metals and mining sector. Ong is a Chartered Accountant and was also the investment research manager at the World Gold Council.

Improving gold market fundamentals could support rising prices into 2021, in our view, with our scenario analysis pointing to 13-50% higher levels than consensus. Drivers include shifting consumer behaviour along with stronger haven status amid risks to global economic growth, geopolitics and pandemic concerns.

CONSUMERS, UNCERTAINTY EMPOWER TRUST IN GOLD

Gold consumers’ adjustment to a higher price for the metal, along with greater investment demand, is a recipe for the precious metal’s potential price acceleration in 2021. Market sentiment for gold is likely to strengthen on dollar wobbles amid rising geopolitical risks in a lower-for-longer interest rate environment.

Central banks and investors may absorb the market surplus as they seek gold for portfolio diversification and possibly as a hedge if inflationary pressures return on the substantial stimulus measures injected amid the global health crisis.

We may also see a return to consumer hoarding (jewellery, industrial), especially in India and China. These factors combined bring a sunnier outlook for gold – an asset that offers no coupon or dividends – as an alternative safe-haven, wealth-preservation asset.

TIMELINE OF KEY CATALYSTS

- 2020-21: Covid-19 crisis enhances gold’s safe-haven quality; pandemic impact likely beyond 2020

- 1Q21: Gold’s seasonality tends to be favorable over a three, five and 10-year period

- February: 4Q20 conference call for gold producers, supply growth and cost risks may arise in 2021

- 3Q20-4Q21: Real interest rate may further decline

- 3Q20-2021: Acceleration in inflationary pressure expectation from rising Covid-19 stimulus measures, helps consumers adjust to higher gold prices

- 2Q21-4Q21: Gold consumer purchases may recover especially for India (wedding and festivals amid potential normal monsoon season) and China (sustained metal price rise)

NEW PEAK

The gold price could peak in 2021, in our view, as we believe the metal may meet all the key factors in our Gold Price Matrix. The metal’s price momentum is driven by eight elements, including the use of gold exchange-traded funds as a refuge in times of global financial, health or geopolitical crisis; dollar weakness; inflation; and low or negative interest rates.

Also on the list are increasing demand from China and India, weak confidence in financial markets and net central bank gold purchases. Gold peaked at $1,921/oz. in September 2011, when it met all eight criteria in our study.

Gold’s attribute as a flight-to-quality, safe-haven asset is strengthening amid the Covid-19 pandemic, which we believe may result in rising investor appetite for diversifying portfolios with gold in 2021.

GOLD COULD CLIMB AS HIGH AS $2,583 IN 2021

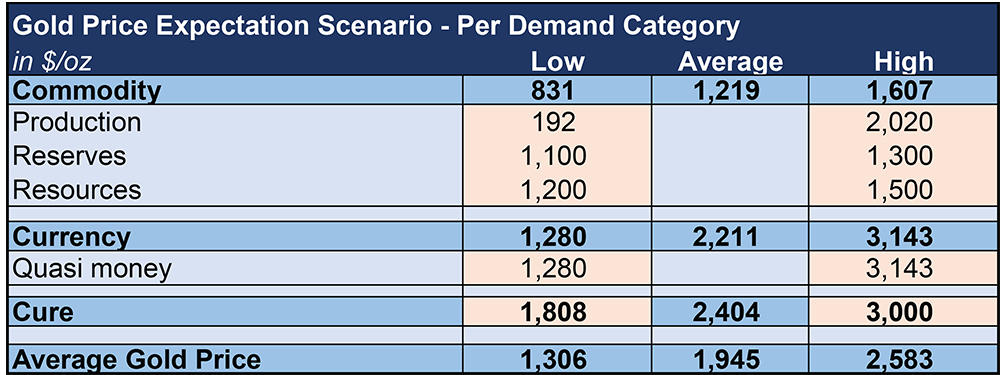

Gold is a versatile, multipurpose and multi-focus asset for buyers, which makes price forecasting hard. Our scenario analysis of the asset’s annual average price expectation for 2021 indicates a potential metal-price range between $1,306-$2,583/oz. This implies an upside of 13-50% when compared with consensus’ price estimate of $1,721.88/oz. for 2021, and a 24% downside risk on lower price expectations. We also calculated an upside of as much as 56% vs. the 2020 year-to-date average price of $1,653.80 as of July 17.

Our demand scenario for gold’s general use has identified three categories: a commodity (metal produced for use in industrial applications); a currency (hedging risks to preserve an investor’s portfolio); and a cure-all to enhance prospects for the purchaser (during a crisis, superstition or culture).

GOLD MARKET DYNAMICS TO IMPROVE

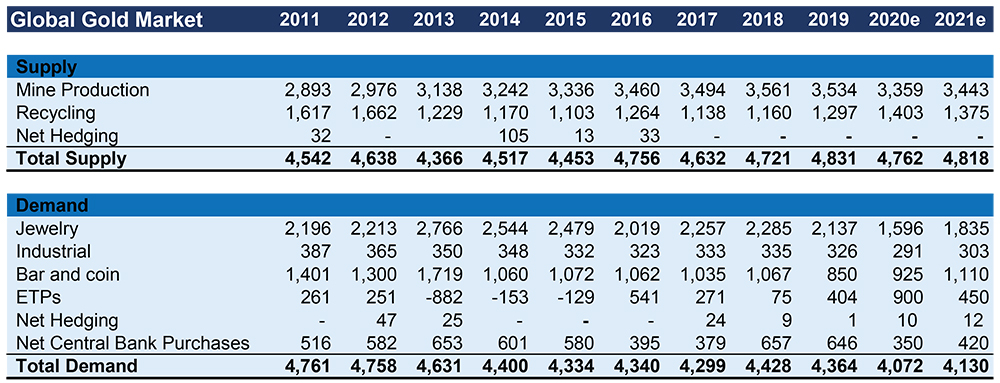

Annual global gold demand could improve year-over-year in 2021 to 4,130 metric tonnes, based on our base-case scenario analysis. This may help reduce the metal’s excess supply over world consumption, especially since the coronavirus outbreak in December. The market could remain in surplus, albeit at a slightly lower volume of about 688 tonnes at the end of 2021 vs. 2020’s 690 tonnes, according to Metals Focus data. We see strong sentiment from safe haven investment purchases, especially in the case of a new Covid-19 outbreak, and as jewellery consumption recovers as consumers adjust to higher prices.

This could bolster gold prices and potentially bring higher earnings in 2021 for the world’s leading miners, including Newmont, Barrick Gold, AngloGold Ashanti, Polyus Gold, Kinross, Gold Fields, Agnico Eagle Mines and Freeport-McMoRan.

EILY ONG is an equity and industry analyst for Bloomberg Intelligence. She specialises in the global metals, mining and steel sectors. Before joining Bloomberg, Ong gained nearly 20 years of experience in the financial services industry. Her roles at Credit Suisse and Deloitte largely focused on the metals and mining sector. Ong is a Chartered Accountant and was also the investment research manager at the World Gold Council.