Navigate

Article List

- Chairman’s Foreword – A look back at 2016 and what’s ahead

By Sunil Kashyap, Chairman, SBMA

- Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

- Advancing Islamic Finance Through Gold

By Shaokai Fan, Director, Central Banks and Public Policy, World Gold Council

- Expanding Access to Physical Gold

By Martin Huxley, Managing Director, INTL FCStone

- Feature: Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

- Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

- Creating New Markets, Enabling Accessibility: From Traditional to Digital

By Loh Mun Chun, Director, GoldSilver Central

- A Golden Resurgence: Re-establishing Singapore as Asia’s Precious Metals Hub

By Lester Lu, Divisional Director, Metals & Minerals, IE Singapore

- Developments in the LBMA Gold Price

By Matthew Glenville, COO, ICE Benchmark Administration

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Chairman’s Foreword – A look back at 2016 and what’s ahead

By Sunil Kashyap, Chairman, SBMA

- Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

- Advancing Islamic Finance Through Gold

By Shaokai Fan, Director, Central Banks and Public Policy, World Gold Council

- Expanding Access to Physical Gold

By Martin Huxley, Managing Director, INTL FCStone

- Feature: Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

- Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

- Creating New Markets, Enabling Accessibility: From Traditional to Digital

By Loh Mun Chun, Director, GoldSilver Central

- A Golden Resurgence: Re-establishing Singapore as Asia’s Precious Metals Hub

By Lester Lu, Divisional Director, Metals & Minerals, IE Singapore

- Developments in the LBMA Gold Price

By Matthew Glenville, COO, ICE Benchmark Administration

- SBMA News

By Albert Cheng, CEO, SBMA

Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

Published on March 9, 2017

Geoff Howie is the Singapore Exchange’s Market Strategist and is the author of the SGX My Gateway Report and Market Updates published at http://sgx.com/research/. He previously held lead broking and market strategist roles across the Asia Pacific offices of a large international futures broker. He has also served as the Treasury Adviser to the Leader of the Queensland Liberal Party in Queensland Parliament. He has received a bachelor’s and master’s degree in Economics at the University of Queensland.

Gold is an important part of Singapore’s stock market. In addition to the SPDR Gold Shares – Singapore’s most actively traded exchange-traded fund (ETF) in 2016 – Singapore Exchange (SGX) also lists three gold miners, each at different stages of exploration, development and production, predominantly focusing on Malaysia and Indonesia.

SPDR Gold Shares

The objective of the SPDR Gold Shares is for the ETF to reflect the performance of the price of gold bullion, less the trust’s expenses. The shares represent fractional, undivided interests in the trust, the primary asset of which is allocated gold. The ETF also uses the LBMA Gold Price PM as the reference benchmark price in calculating the net asset value (NAV) of the trust.

Since its inception in November 2004, the ETF has generated an annualised return of 7.9% through to the end of 2016. The SPDR Gold Shares ETF was subsequently listed on SGX in October 2006 with the intention of lowering barriers such as access, custody, and transaction costs that had traditionally prevented investors from investing in gold.

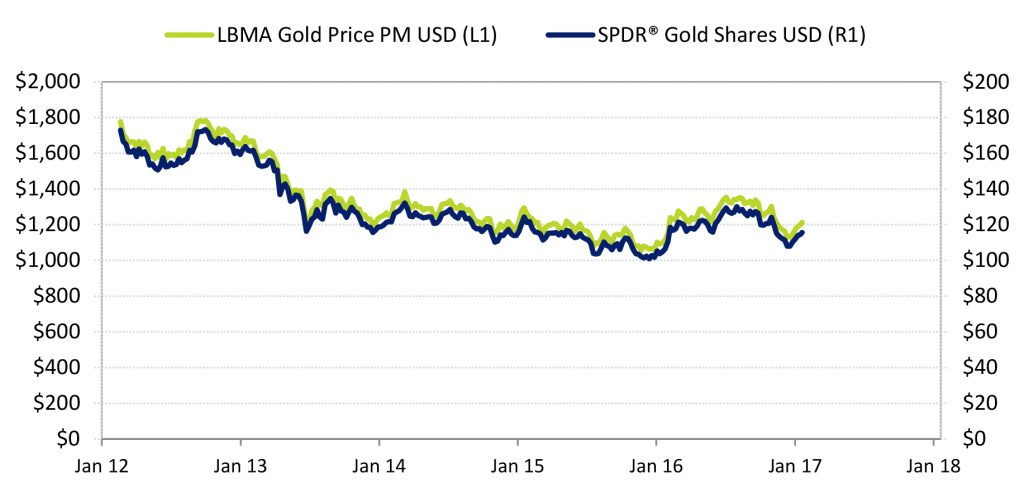

The moves of the LBMA Gold Price PM have correlated with the moves of the SPDR Gold Shares in recent years (Figure 1).

Figure 1: LBMA Gold Price PM & SPDR Gold Shares Weekly Prices (USD)

SPDR Gold Shares are also traded on four other global exchanges, showcasing the global interest in this particular ETF. When the price of gold peaked in 2011, SPDR Gold Shares was briefly ranked the world’s biggest ETF by assets under management (AUM). With almost 26 million ounces, or about 810 tonnes of gold in the trust and a unit price of US$115.0 at the time of writing, the AUM of the trust is currently more than US$33 billion. Singapore accounts for 70% of SPDR Gold Shares’ Asian AUM.

The value of each unit is based on the price of 1/10 of an ounce of gold. Hence with the minimum board transaction quantity of 10 units, the minimum transaction size is equivalent to 1 ounce of gold. This means, at present prices, the minimum transaction of SPDR Gold Shares listed on SGX would be US$1,150.0 (equivalent to holding 1 ounce of gold), not including transaction fees or the 0.4% total expense ratio associated with this ETF.

Even though the transaction size is relatively small, the typical transaction for the SPDR Gold Shares ETF is significantly bigger. The typical bid offer spread for the ETF is US$0.10 with 1,000 units on both the bid and offer. For investors who wish to transact more than the implied US$115,000 transaction value at market, market makers are active in the market and block trades can be conducted in sizes of at least 50,000 ETF units or a transaction value of at least S$150,000. Please note that SGX currently waives clearing fees for ETF block trades (expiring 31 December 2017).

Gold Mining Stocks

Of the 16 mining stocks listed on SGX, three stocks, all listed on Catalist, focus on gold mining. They are CNMC Goldmine Holdings (5TP), Wilton Resources Corporation (5F7) and Anchor Resources (43E).

Headquartered in Singapore, CNMC Goldmine Holdings started operations in 2006 and is principally involved in the exploration and mining of gold and the processing of mined ore into gold dorés. CNMC Goldmine Holdings is currently focused on developing the Sokor Gold Field Project located in the Malaysian state of Kelantan. Spanning an area of 10 km2, Sokor had 618,000 ounces of JORC-compliant gold resources (including ore reserves) as of 31 December 2015.

Wilton Resources is engaged in the business of exploration and mining of gold, and production of gold doré. The group’s concession blocks, collectively termed the “Ciemas Gold Project”, are located in West Java, Indonesia, and cover a total area of 3,078.5 hectares. As at 30 June 2016, the Ciemas Gold Project contains JORC-compliant estimated total mineral resources amounting to approximately 39,000 kg of gold (around 1,250,000 troy ounces).

Anchor Resources listed in 2016 and engages in the exploration, mining, processing, production, and sale of gold and related minerals. The company holds interests in the Lubuk Mandi mine and Bukit Panji property in Terengganu, Malaysia. It also provides mining consultancy services. As of 30 September 2015, JORC reported that the estimated total mineral resources for the Lubuk Mandi project amounted to approximately 115,000 ounces of gold.

CNMC Goldmine Holdings, the largest capitalised of the trio, achieved its first gold pour in 2010 and saw share trading volumes increase threefold from May 2016 to June 2016, then threefold again, from June 2016 to July 2016. Following the Brexit vote on 24 June 2016, the World Gold Council reiterated the diversifier role of gold, noting that it was fulfilling its classic role as a haven asset, with its history of maintaining low correlations to most other asset classes.

Geoff Howie is the Singapore Exchange’s Market Strategist and is the author of the SGX My Gateway Report and Market Updates published at http://sgx.com/research/. He previously held lead broking and market strategist roles across the Asia Pacific offices of a large international futures broker. He has also served as the Treasury Adviser to the Leader of the Queensland Liberal Party in Queensland Parliament. He has received a bachelor’s and master’s degree in Economics at the University of Queensland.