Navigate

Article List

- Disruptions to the Global Gold Supply Chain and its Implications for Singapore

By Albert Cheng, CEO, SBMA

- The Impact of COVID-19 Shutdowns on the Gold Supply Chain

By Visual Capitalist

- Australia’s Gold Export

By Thuong Nguyen, Economist, Australian Government Department of Industry, Science, Energy and Resources

- Feature | The Investment Case for Gold – Singapore

By Qi Xiu Tay, Manager, World Gold Council

- Rand Refinery – Africa’s Gold Standard

By Praveen Baijnath, Chief Executive, Rand Refinery

- Global Gold Storage Options

By Ronald Stoeferle, Managing Partner, Incrementum AG

- Next-Generation Gold Tracking

By Gregor Gregersen, CEO, CACHE

- Will Gold’s Rally Extend into 2021?

By Eily Ong, Global Analyst, Bloomberg Intelligence

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Disruptions to the Global Gold Supply Chain and its Implications for Singapore

By Albert Cheng, CEO, SBMA

- The Impact of COVID-19 Shutdowns on the Gold Supply Chain

By Visual Capitalist

- Australia’s Gold Export

By Thuong Nguyen, Economist, Australian Government Department of Industry, Science, Energy and Resources

- Feature | The Investment Case for Gold – Singapore

By Qi Xiu Tay, Manager, World Gold Council

- Rand Refinery – Africa’s Gold Standard

By Praveen Baijnath, Chief Executive, Rand Refinery

- Global Gold Storage Options

By Ronald Stoeferle, Managing Partner, Incrementum AG

- Next-Generation Gold Tracking

By Gregor Gregersen, CEO, CACHE

- Will Gold’s Rally Extend into 2021?

By Eily Ong, Global Analyst, Bloomberg Intelligence

- SBMA News

By Albert Cheng, CEO, SBMA

Global Gold Storage Options

By Ronald Stoeferle, Managing Partner, Incrementum AG

Published on September 8, 2020

Legal, geopolitical and economic stability are key factors to consider, but so is a country’s “gold culture” and its relevant traditions and track record when looking for a place to store gold.

The entire reasoning behind investing and holding physical precious metals, especially when kept outside the banking system in private high-security storage facilities, revolves around trust, security, risk diversification, and hedging against the vulnerabilities and worst-case scenarios of the monetary system. Thus, the choice of storage location must also be largely evaluated through the same lens.

The main factors to be considered when choosing a jurisdiction in which to store gold are the levels of protection of individual financial freedoms and private property rights; as well as political and economic stability. According to these measures, three countries stand out from the rest: Liechtenstein, Switzerland, and Singapore.

Liechtenstein’s Advantages

The Principality of Liechtenstein is a member of the European Union (EU) and part of the European Economic Area and Schengen area. Although it became independent in 1806, it can be argued that the history and the values of Liechtenstein were largely formed after the Second World War. It was then that today’s reigning Prince of Liechtenstein, Prince Hans-Adam II, had to take over a bankrupt country and effectively managed to turn it into a competitive, innovative, and agile financial hub of international renown.

The country’s standing as a reliable business and banking centre and the princely house’s reputation for being ahead of the curve are undeniable. The ruling families of Liechtenstein fully embrace the values of individual and financial freedom and recognise the importance of private property rights. Property rights are even further protected given the fact that Liechtenstein has no emergency legislation. Even in times of political or economic upheaval, an ad-hoc expropriation is thus unenforceable.

The system of government is classified as a constitutional monarchy, with the decision-making power being shared by the monarch and the democratically elected parliament. Liechtenstein is built on a system of governance that shows great restraint and respect towards individual freedom, private property, the right to privacy, and the financial sovereignty of its people.

As a clear exception to the global trend, Liechtenstein has been running budget surpluses for years, signalling not only financial prudence but also providing the country financial leeway in case of a severe economic crisis.

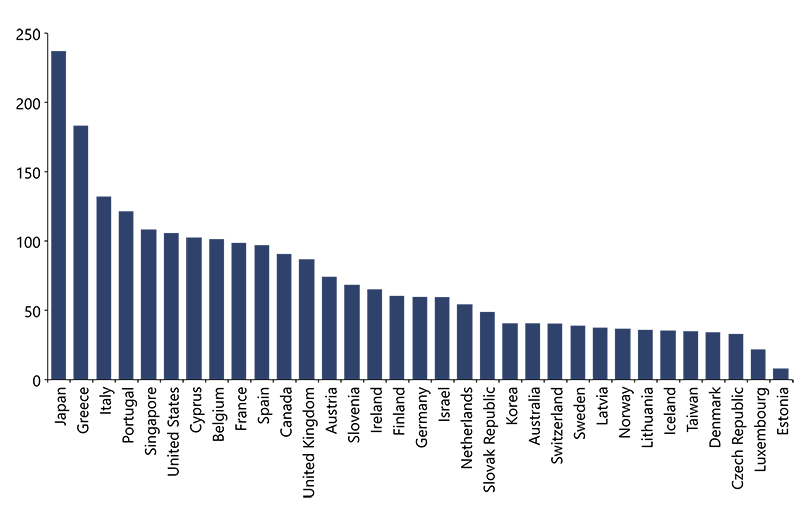

Public debt as a share of GDP, 2018 (%)

The Case for Switzerland

Even before the enforced confederation of 1848, Switzerland was among the most industrialised countries in mainland Europe. Historically, even under intense external pressures, Switzerland retained its sovereignty and remained an armed neutral country, resisting both world wars. It still has one of the most decentralised political structures in the world today. Its constitution outlines the basis of its political system and its government’s limits, according to the principles of subsidiarity and direct democracy.

The practical impact of this key political differentiation, which sets Switzerland apart from other countries, is extensive and often surprising. As a real, direct democracy, Switzerland has time and time again gone against the grain, defying political trends set by its neighbors or the international community.

Switzerland’s economy makes the case for it being an excellent location for physical gold investors. In stark contrast to its EU neighbours and the EU as a whole, the Alpine nation is much more prudent in managing its finances. Its gross federal debt dropped below 100 billion Swiss francs (S$150 billion) in 2018 for the first time since 1997; and the general government debt (confederation, cantons, municipalities, social insurance) amounts to little less than 200 billion francs, with a declining tendency relative to GDP.

Overall, Switzerland’s success is largely based on the fact that it was built on economic rationality and not politics, and thus the Swiss have always been open to innovation. In terms of stability and security, it is clear that Switzerland has withstood the test of time.

Its long-standing neutrality, noninterventionist foreign policy record, and the fact that more than 50% of households in the country are armed, create a safe environment, and provide peace of mind both for citizens and investors. Furthermore, the strict limits placed on its government’s powers and the long track record of the government staying well within those limits make the confiscation of precious metals stored under Swiss law very improbable.

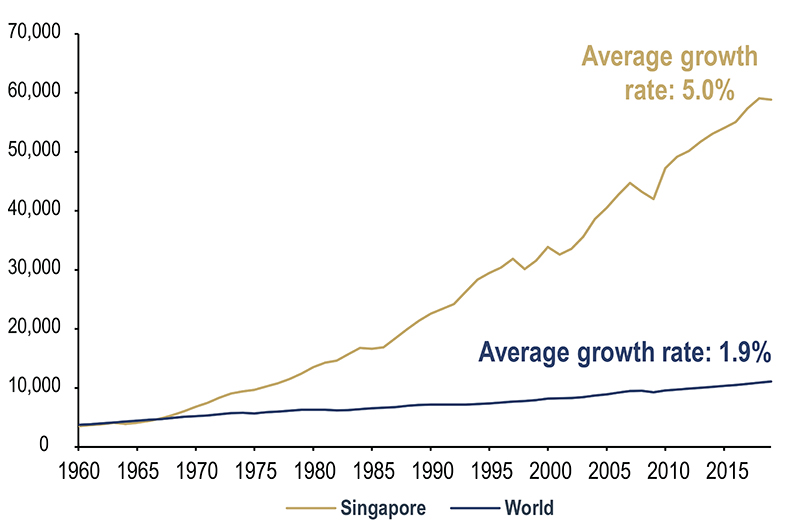

Global GDP per capita, and Singapore GDP per capita, 2019 (USD)

Asia’s Strongest Contender

This brings us to our final candidate, Singapore, a country that has experienced significant capital inflows over the past few decades. The island lying on the equator in Southeast Asia has no capital gains taxes, no goods and services taxes (GST) on investment-grade precious metals, and a strong record of respect for private property rights. Without question, a genuine and impressive success story, especially since its independence in 1965.

The sunny island has been widely celebrated as an economic miracle. It has a unique geographical advantage, being strategically located at the crossroads of key trade and shipping routes of the world, while also enjoying proximity to China. Conceptually created as a “city-state”, it has become one of the most developed economies in Asia and has emerged as a global business and financial hub. It is also recognised as one of the world’s most competitive and business-friendly economies. Additionally, its tax regime and regulatory framework are simple and investor-friendly. Singapore also offers a stable political environment and a robust economic background, with a rapidly and consistently rising GDP.

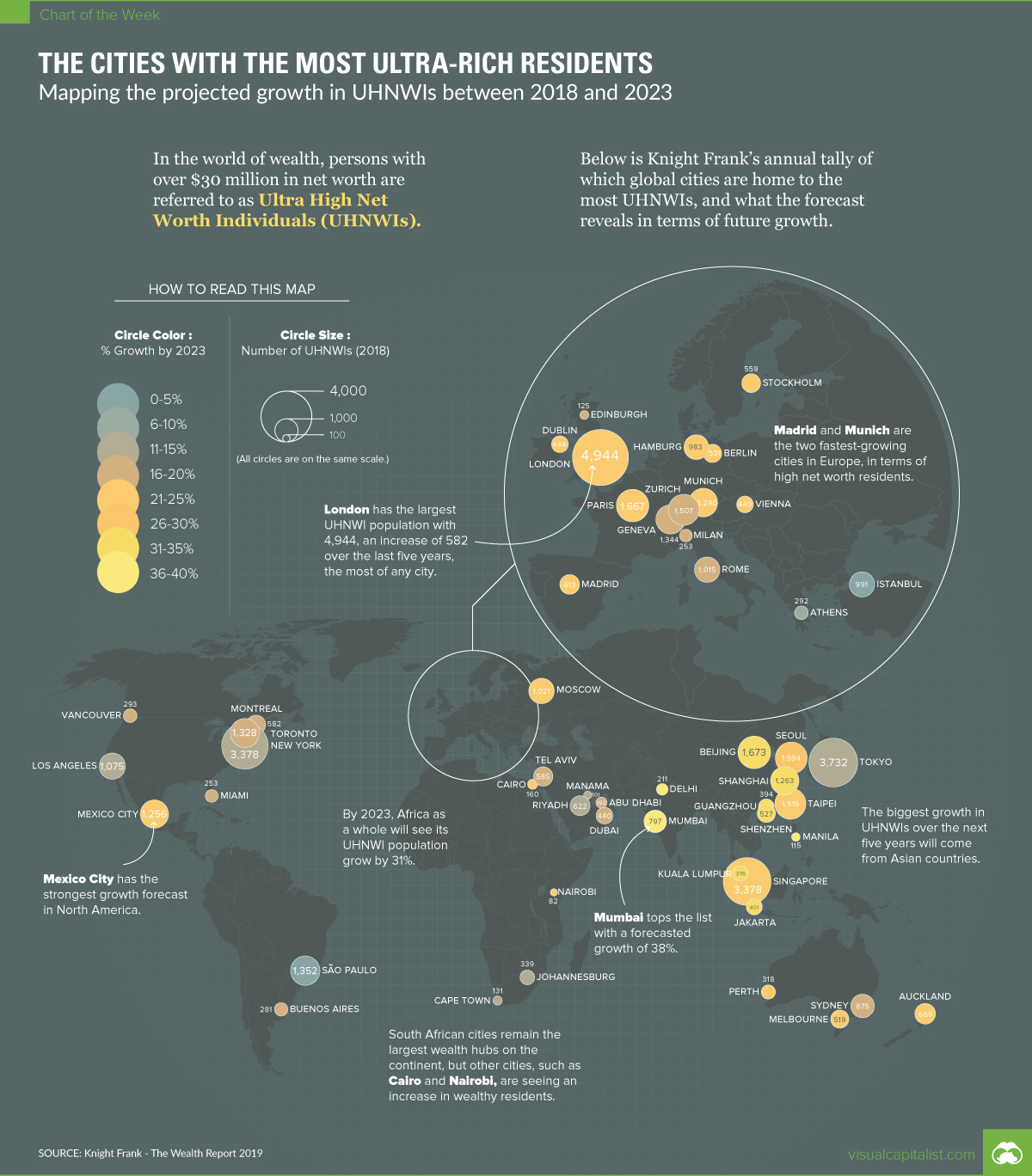

A quick look at the infographic below shows that ultra-high-net-worth individuals, i.e. individuals with a net worth of at least $30 million, from around the globe continue to vote with their feet, choosing to call Singapore home.

As the conversation surrounding wealth taxes increases in the West, capital controls are still socially and culturally not acceptable in Singapore. Economic freedom is viewed as an ultimate right in Singapore, with the government acting as a guardian and arbiter of that right for its citizens.

Weighing the Options

When it comes to prudent and long-term investments in physical precious metals, one size most definitely does not fit all. Each decision and step that forms a comprehensive and solid strategy needs to take into serious consideration the individual needs and aims of the investor. While security and strong property rights play a key role for all investors, specific circumstances and relevant technicalities might make one jurisdiction more attractive than another.

All three jurisdictions make a convincing case for secure gold storage with regard to stability and private property rights, a case that is infinitely strengthened when we compare the risks and uncertainties that most other jurisdictions entail.

As Europe is increasingly going down the road of centralisation and as economic and social tensions are increasingly prevalent throughout the continent, Switzerland and Liechtenstein might be seen as being right in the eye of a coming storm. By contrast, Singapore could be better off and even have a competitive advantage in this regard, not only because of its geographical distance from Europe but also because it may provide additional diversification by being in the Asian, rather than the European, economic and geopolitical sphere.

RONALD STOEFERLE is managing partner of Incrementum AG, responsible for research and portfolio management. In 2007, he published his first In Gold We Trust report. Over the years, the study, which is available in English, Mandarin and German, has become one of the benchmark publications on gold, money, and inflation. He is an advisor for Tudor Gold Corp., a significant explorer in British Columbia’s Golden Triangle, and a member of the advisory board of Affinity Metals.