Navigate

Article List

- China’s VAT Reform and Its Implications for the Gold Market

By RAY JIA, Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China), World Gold Council

- India’s Precious Metals Reset in 2025: Policy Alignment, Market Structure and the Consolidation of Trust

By SRINIVASA MOORTHY & PRATHIK TAMBRE, Research Desk, Bullion World

- Developing Talent, Sharing Experiences — The Gold Industry Training Programme

By TAN KWAY GUAN, Central Banks and Public Policy Lead (Singapore), World Gold Council

- Regulatory and Policy Shifts in Asia’s Key Bullion Hubs

By LEE LIANG LE, Analyst, Kallanish Index Services

- SBMA News

By SBMA

Article List

- China’s VAT Reform and Its Implications for the Gold Market

By RAY JIA, Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China), World Gold Council

- India’s Precious Metals Reset in 2025: Policy Alignment, Market Structure and the Consolidation of Trust

By SRINIVASA MOORTHY & PRATHIK TAMBRE, Research Desk, Bullion World

- Developing Talent, Sharing Experiences — The Gold Industry Training Programme

By TAN KWAY GUAN, Central Banks and Public Policy Lead (Singapore), World Gold Council

- Regulatory and Policy Shifts in Asia’s Key Bullion Hubs

By LEE LIANG LE, Analyst, Kallanish Index Services

- SBMA News

By SBMA

India’s Precious Metals Reset in 2025: Policy Alignment, Market Structure and the Consolidation of Trust

By SRINIVASA MOORTHY & PRATHIK TAMBRE, Research Desk, Bullion World

In 2025, India undertook a broad recalibration of its precious metals regulatory framework encompassing gold, silver and platinum group metals. Changes spanning trade classification, import access, collateralised lending, investment products and quality assurance amount to more than incremental reform. Taken together, they represent a structural realignment of market architecture, governance standards and regulatory coherence.

For international bullion market participants, developments in India signal a maturing policy approach in one of the world’s largest precious metals consuming and importing jurisdictions – one increasingly aligned with global norms, while remaining adapted to domestic scale and complexity.

Table 1: India Gold Supply (tonnes, fine gold basis)

| India Gold Supply | 2024 | 2025 |

| Standard Gold Bullion | 572.30 | 451.10 |

| Dore (on fine gold basis) | 229.40 | 212.60 |

| Scrap | 114.31 | 92.74 |

| Domestic | 17.74 | 14.71 |

| Total | 933.75 | 771.15 |

Note: Calendar year (January – December). Source: World Gold Council

Trade Classification and Regulatory Consistency

Chart 1: Gold Bullion/Dore Duties and Taxes

Import Access and Market Infrastructure

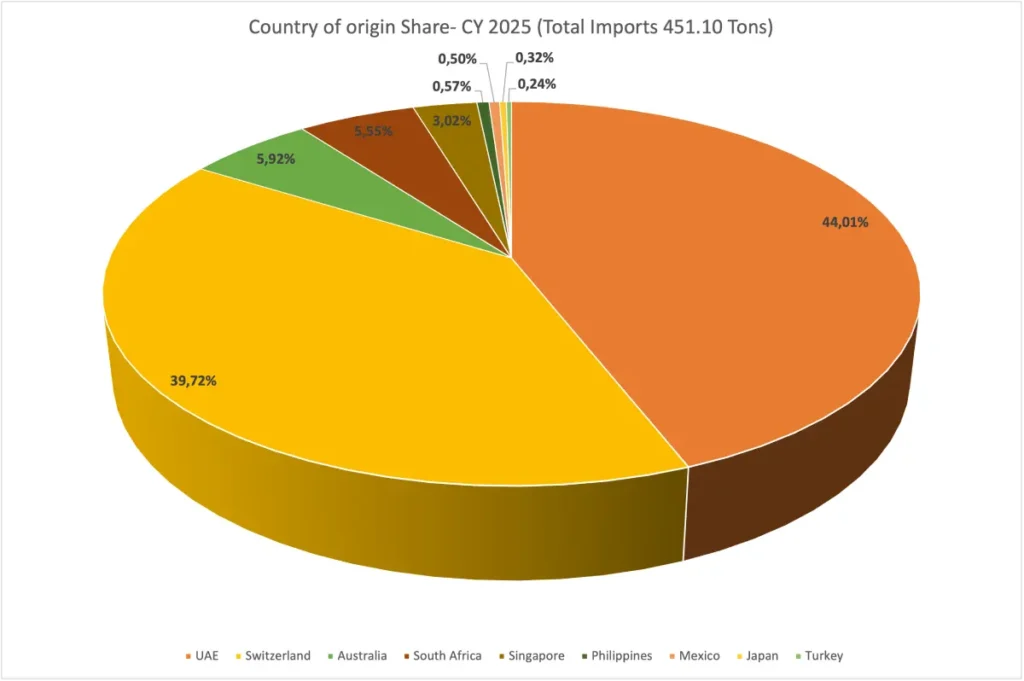

Chart 2: India Standard Gold Bullion – Country-Wise Import Share

Collateralised Lending and Formal Credit Integration

Quality Assurance and Traceability

Investment Products and Price Discovery

Chart 3: India Gold and Silver ETFs

Consolidation and the Road Ahead