Navigate

Article List

- China’s VAT Reform and Its Implications for the Gold Market

By RAY JIA, Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China), World Gold Council

- India’s Precious Metals Reset in 2025: Policy Alignment, Market Structure and the Consolidation of Trust

By SRINIVASA MOORTHY & PRATHIK TAMBRE, Research Desk, Bullion World

- Developing Talent, Sharing Experiences — The Gold Industry Training Programme

By TAN KWAY GUAN, Central Banks and Public Policy Lead (Singapore), World Gold Council

- Regulatory and Policy Shifts in Asia’s Key Bullion Hubs

By LEE LIANG LE, Analyst, Kallanish Index Services

- SBMA News

By SBMA

Article List

- China’s VAT Reform and Its Implications for the Gold Market

By RAY JIA, Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China), World Gold Council

- India’s Precious Metals Reset in 2025: Policy Alignment, Market Structure and the Consolidation of Trust

By SRINIVASA MOORTHY & PRATHIK TAMBRE, Research Desk, Bullion World

- Developing Talent, Sharing Experiences — The Gold Industry Training Programme

By TAN KWAY GUAN, Central Banks and Public Policy Lead (Singapore), World Gold Council

- Regulatory and Policy Shifts in Asia’s Key Bullion Hubs

By LEE LIANG LE, Analyst, Kallanish Index Services

- SBMA News

By SBMA

China’s VAT Reform and Its Implications for the Gold Market

By RAY JIA, Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China), World Gold Council

China’s Ministry of Finance and State Taxation Administration recently announced changes to gold‑related VAT policies, effective from 1 November 2025 to 31 December 2027. This marks the first major VAT adjustment affecting the gold market since April 2019, when the rate was cut from 16% to 13%. While the announcement followed tax changes for platinum and diamonds effective 1 November, the gold VAT changes are distinct in nature.

What’s the change? A VAT system varied by purpose

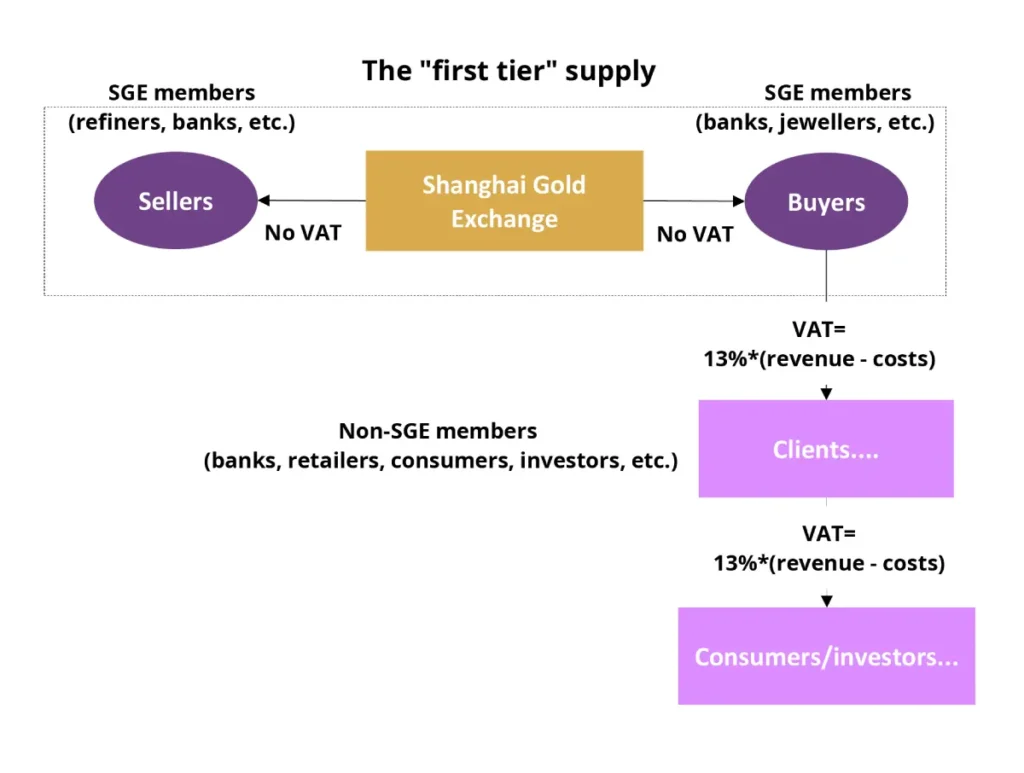

To understand the changes, we need to take a step back and review the VAT policy in place until 31st October. VAT is a circulation tax, meaning it is usually levied on the “value-added” part, at each point in the process of manufacturing, distributing and re-selling (Figure 1):

- First tier: when SGE members/clients buy gold at the SGE from sellers, both the SGE and the purchasing members are basically exempt from VAT via the “immediate levy and refund” policy

- Second tier: when SGE members/clients withdraw gold – to make it into investment or jewellery products – and re-sell, they pay VAT (at 13%) on the value-added part, which is passed on to their clients

- Third tier or further: when retailers buy these products from SGE members/clients and sell to consumers, they also pay VAT only on their value-added part, which they pass on to customers.

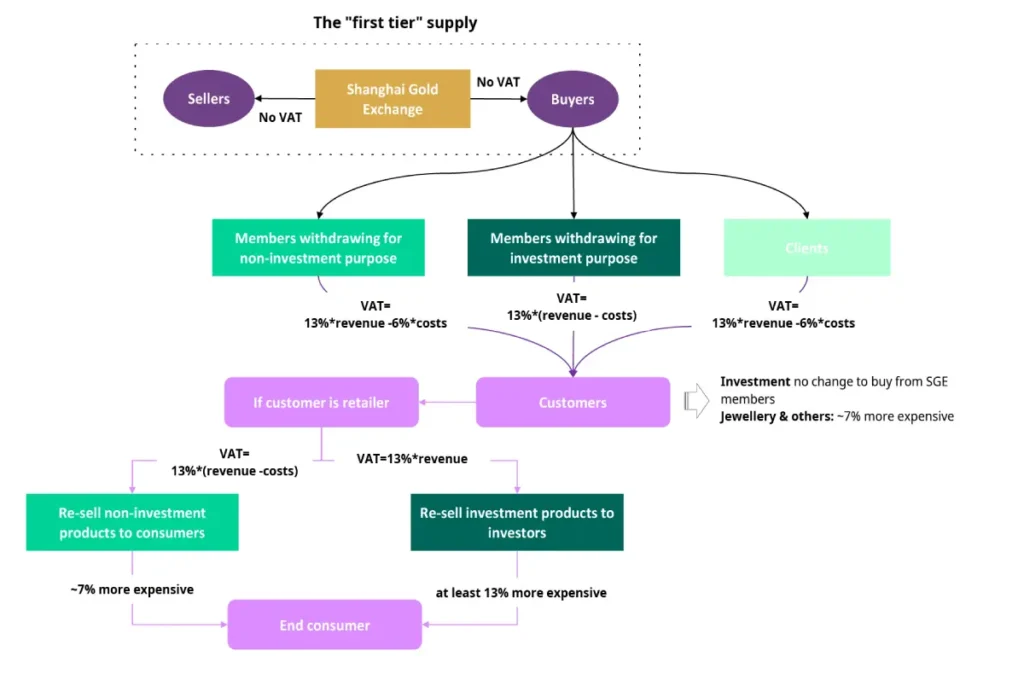

But now it is different. While SGE members that buy and sell gold on SGE in the “first tier” are still VAT exempt, the VAT treatment for members withdrawing gold is different, depending on their purposes, illustrated in Figure 2.

- Scenario 1 SGE members who withdraw gold for investment purposes:

For investment purposes, VAT treatment of SGE members withdrawing gold and re-selling hasn’t changed. When a member withdraws gold from the SGE, VAT free, and re-sell the gold as investment products (branded bars etc.), only VAT (at 13%) of the value-added part is levied – same as before – and passed onto its client.

The only change is that when that client re-sells to others, there is additional VAT burden as they cannot get deductible cost VAT credit from SGE members, which means the final retail sale prices are now at least 13%*(valued added part) more expensive than before. As such, retail investors would obviously choose to buy their investment products from SGE members, as it is cheaper. - Scenario 2 SGE members who withdraw gold for non-investment purposes:

These SGE members can now only deduct their sales VAT (at 13%) by 6% of their costs, instead of 13% previously. And the additional VAT burden will be passed onto their clients and consumers. This means that gold jewellery retail prices are now more expensive for consumers than before as they need to pay retail gold price + additional VAT burden which is around (13%*revenue – 6%*cost). - Scenario 3 SGE non-member clients who withdraw gold:

SGE non-member clients who open accounts via SGE members, are treated the same as SGE members who withdraw gold for non-investment purposes. They will need to sell their products at higher prices as they can only deduct their VAT at 6% of costs, rather than 13% as previously.

Impact summary and outlook

The new VAT policy has had wide-spread impact on China’s gold market since the announcement, particularly in the jewellery sector. We observed:

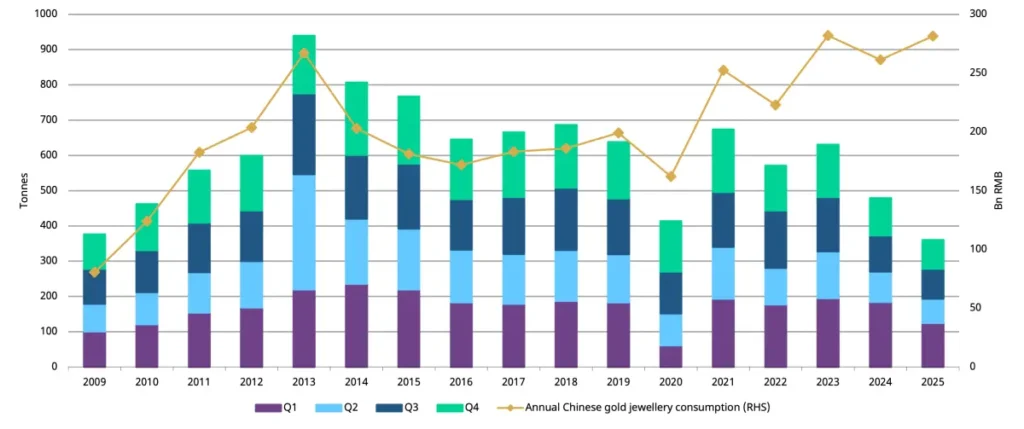

- Gold jewellery demand was dented following the VAT announcement with major manufacturers in Shenzhen experiencing steep y/y declines in November as rising costs deterred their customers initially; but demand recovered to a certain extent in December amid seasonal restocking, slowing gold price momentum and the fact that consumers and retailers were gradually adapting to the VAT change.

According to our Gold Demand Trends report, Q4 gold jewellery demand fell 23% y/y and 3% q/q to 82t, the lowest Q4 since 2008, ending 2025 at 360t, declining 25% y/y – but it is worth noting that consumer spending rose 8% to US$39bn, the second highest in history, reflecting continued interest from Chinese consumers in gold jewellery. - Gold bar and coin sales from SGE members’ channels were not impacted. In fact, their sales boomed supported by global and region geopolitical risks, the strong gold price momentum and the fact that jewellery consumers with investment motives moved to bullion as gold jewellery now faces additional VAT burden.

Q4 bar and coin demand jumped 42% y/y and 61% q/q to the highest fourth quarter ever at 119t, pushing the 2025 total to an unseen level of 432t, 28% higher y/y. - Gold accumulation plans and gold ETFs saw robust inflows, also supported by above-noted factors driving bullions sales from SGE members’ channels higher; and we believe these products also attracted investors unclear with the VAT change’s impact on physical bullion buying

Gold ETFs attracted 54t, lifting total holdings of Chinese gold ETFs to 248t, more than doubled y/y, an all-time high. - Gold jewellery recycling activity was impacted as the widening gap between retail – with additional tax burden and labour charge – and recycled – usually close to the benchmark – prices suppressed interest. Meanwhile, trade-ins rose, as consumers only need to pay labour charges.

Looking ahead, we expect this VAT adjustment to have a more pronounced effect on China’s gold jewellery industry by raising costs for consumers. It also reinforces an existing challenge for jewellers: how to attract buyers in a high-gold-price environment. As we have noted in the past, Hard Pure gold jewellery products have gain traction among consumers – amid their better affordability – and retailers – due to their higher profit margin. We believe this could continue to help retail jewellers’ sales and profits in the future.

With the real estate sector weakening, growth uncertainty remaining, yields potentially declining and household willingness to save hovering around the record high, we see continued strength in China’s gold investment demand, which is increasingly concentrated in SGE members channels.

Chinese consumers continue to increase their gold jewellery spending despite declining volumes

RAY JIA, joined the World Gold Council in early 2019, and works within the Research team as the Head of Research (Asia Pacific, ex-India) and Deputy Head of Trade Engagement (China). He previously held position with China Industrial Futures Ltd, focusing on the market analysis for major commodities classes and international macros for both individual and institutional investors.