Navigate

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

Over the three-year period ending April 2023, the price of the SGX-listed SPDR Gold Shares ETF gained 14% in US dollar (USD) terms. Due to appreciation of the USD to the JPY over the past three years, JPY-based investors who bought the USD-denominated SPDR Gold Shares ETF more than tripled the baseline returns to 46%. This, of course, assumes the investor made a lump-sum investment on the 30 April 2020 close and held the position through to 30 April 2023.

Going all-in or lump-sum back in any market in April or May 2020 was much easier said than done. The SPDR Gold Shares ETF had already gained around 15% from its March lows through to the end of April, while the month of May 2020 saw officially reported global COVID-19 cases double from 3 million to 6 million. Investors who adopted a more conservative dollar-cost averaging approach mitigated some of the potential risk of going all-in at market highs, in return for missing out on going all-in at a potential market low.

For JPY-based investors, putting the same amount of JPY to work every month into the SPDR Gold Shares ETF over 36 months yielded a theoretical 8% compound annual growth rate (CAGR).

The number of monthly units bought under a dollar-cost averaging plan over the three years through to the end of April would have been a function of both the price of the SPDR Gold Shares ETF, and the strength of the JPY against the USD.

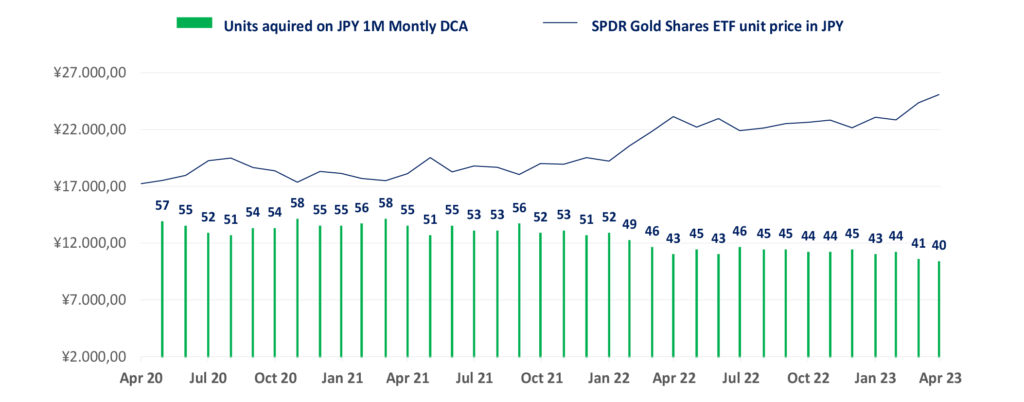

Theoretically, as an educative example, consider an institutional investor investing JPY 1 million at the end of every month into the USD-denominated SPDR Gold Shares ETF listed on SGX. This investor would have on average, bought 50 units each month over the three years, as shown in Chart 1. However, due to changes in the USD/JPY rate and the price SPDR Gold Shares ETF there were some months the investor would have acquired as many as 58 units, while in April 2023, the investor would have acquired just 40 units.

Chart 1 – DCA Educative Example

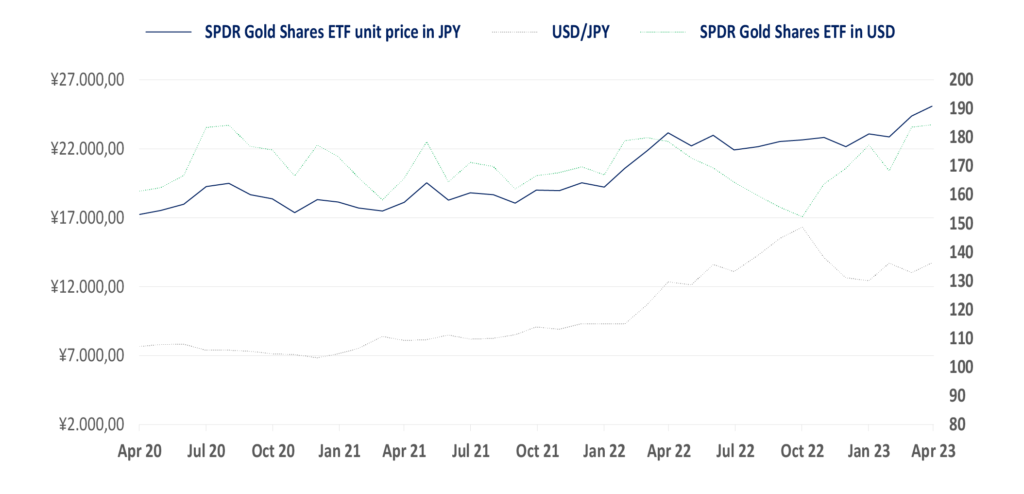

This was tied to the purchasing power of the monthly JPY 1 million dollar-cost averaging plan. When the unit price of the SPDR Gold Shares ETF declined compared, to say the preceding month, it meant the investor was potentially poised to buy more units, and less units when the SPDR Gold Shares ETF unit price increased. At the same time, if the USD/JPY exchange rate declined, meaning JPY appreciated against the USD, it meant the investor was also poised to acquire more units, and less units if the JPY depreciated against the USD. Thus, developments in both the unit price and the exchange rate impacted how many units would be acquired under the dollar-cost averaging plan.

As an example, in August 2020, 51 units would have been purchased in the plan, versus 58 units in November 2020. As seen in Chart 2, over the three months, the JPY strengthened against the USD, with USD/JPY declining from 105.91 to 104.31, while the SPDR Gold Shares ETF declined in price from US$184.16 per unit to US$166.56 per unit. Both markets moved in a direction conducive to buying 7 more units in November 2020 compared to August 2020.

Chart 2 – Monthly Moves

As illustrated in Chart 1, there were also instances when both the JPY strengthened and SPDR Gold Shares ETF has gained in price, thus providing an offsetting impact on the number of monthly units purchased. For instance, USD/JPY declined from 148.7 at the end of October 2022 to 130.1 at the end of January 2023, increasing the purchasing power of JPY-based investors, however at the same time the SPDR Gold Shares ETF gained from US$152 per unit to US$177 per unit. The offsetting impact of the gains in gold and appreciation of the JPY meant than the investor bought 44 units under the plan 2023.

AS OF THE END OF APRIL 2023, THE SPDR GOLD SHARES ETF HAD A THEORETICAL THREE-YEAR CAGR OF 7.8%, COMPARED TO A 2.8% CAGR FOR USD-BASED INVESTORS.

As of the end of April 2023, the SPDR Gold Shares ETF had a theoretical three-year CAGR of 7.8%, compared to a 2.8% CAGR for USD-based investors. This means that JPY-based investors who invested in the ETF during this period gained exposure to both the appreciation of gold and the strengthening of the USD. However, it’s important to note that even though dollar-cost averaging is generally considered less risky than lump-sum investing, it is still subject to market risk. For instance, if the JPY-equivalent unit price of the SPDR Gold Shares ETF declined to JPY 19,000 at the end of April, the dollar-cost averaging three-year CAGR would have been -1.7%.

It’s worth noting that the SPDR Gold Shares ETF unit price as of the end of April was JPY 25,086, despite ongoing global macroeconomic concerns such as decelerating global growth, persistent inflation, more potential nudges to financial stability and potential escalations in geopolitical tension. Meanwhile, for Japan, much attention is focused on the road ahead for new BOJ governor Kazuo Ueda and BOJ deputy governors Shinichi Uchida and Ryozo Himino.

The SPDR Gold Shares ETF seeks to track the price of gold bullion, less the fund’s expense ratio of 0.4% per annum, offering investors a convenient, cost-efficient and secured way to gain exposure to the gold asset class without incurring the costs related to transportation, storage and insurance costs of owning physical gold. The ETF is cross-listed on the Singapore Exchange and available to trade in two currencies – USD and SGD, and included under the CPF Investment Scheme (CPFIS) – Ordinary Account and Supplementary Retirement Scheme (SRS).

GEOFF HOWIE is the Singapore Exchange’s market strategist, with more than 20 years of experience in financial markets and economics. He has a strong background in global macroeconomics and a reputation for expeditiously identifying key market drivers and their impact across major asset classes.