Navigate

Article List

- SBMA Successfully Concludes First Virtual APPMC

By Albert Cheng, CEO, SBMA

- APPMC: Market Updates

By SBMA

- The Significance of SPDR Gold Shares Dual Currency Trading

By Geoff Howie, Market Strategist, Singapore Exchange

- Our Vision for the Gold Market

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- The New Investment Landscape is Green

By Vikas Shenoy, Head of APAC Origination & Partnerships, Trovio

- Gaining Exposure to Gold via Streaming and Royalty Companies

By Emil Kalinowski, Researcher, Wheaton Precious Metals

- There is Still Mettle Left in the Precious Metals

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- SBMA Successfully Concludes First Virtual APPMC

By Albert Cheng, CEO, SBMA

- APPMC: Market Updates

By SBMA

- The Significance of SPDR Gold Shares Dual Currency Trading

By Geoff Howie, Market Strategist, Singapore Exchange

- Our Vision for the Gold Market

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- The New Investment Landscape is Green

By Vikas Shenoy, Head of APAC Origination & Partnerships, Trovio

- Gaining Exposure to Gold via Streaming and Royalty Companies

By Emil Kalinowski, Researcher, Wheaton Precious Metals

- There is Still Mettle Left in the Precious Metals

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- SBMA News

By Albert Cheng, CEO, SBMA

Virtual APPMC: On Bitcoin and Gold

By SBMA

Published on June 10, 2021

One of the most anticipated panels at the Virtual APPMC was the discussion on gold and bitcoin. For such a young asset class, how does cryptocurenncies compare with gold, which has thousands of years’ head start?

The current market capitalisation of all tracked cryptocurrencies is approximately $1.63 trillion, which comprises $735 billion in bitcoin and $285 billion in ethereum, according to crypto data provider CoinMarketCap. The value of gold above group is seven times as much as $11.9 trillion, while investor holdings stands at $4.7 trillion, moderator Rhona O’Connell, StoneX, noted.

“Clearly these assets have been on something of a roller-coaster in recent months and no doubt the fireworks will continue, while gold plays to its strengths as a relatively stable asset, with established credibility as a mitigator of risk”, O’Connell said.

ABC Bullion’s Nick Frappell repeated the argument that gold is ageless, a durable store of wealth and a portfolio diversifier. He noted gold’s relatively low volatility and the fact that it is widely known and accepted. “Crypto can’t make a similar claim as a durable store of value,” he said.

Gold’s price response to yields is also clear and robust, unlike bitcoin, which is risk-on and reflationary, correlated with growth and new economy equities, and works well in a rising yield environment. As the asset is highly volatile, it is “too early to talk about a store of value in a meaningful way”, Frappell said.

There are also many alternate use cases for gold that sit outside its function as an investment class, which is not so with bitcoin, as its scalability trilemma will probably never be solved, he noted.

Gold and bitcoin are sufficiently different that digital gold appears incorrect, and the lack of real success of digital gold on the blockchain speaks to the difference between the two assets. “The best case is to treat gold and BTC as complementary alternative assets and respect their different strengths”, Frappell said.

Gregor Gregersen, Silver Bullion, however, cautioned against lumping all cryptocurrencies together. Coins behave differently, and there is a distinction between cryptocurrencies and and digital currency. At the same time, he highlighted the similarities between bitcoin and gold: they are both decentralised and finite.

Gregersen noted the “de-dollarisation” of the global economy: “We are moving towards a world where the US dollar is of less importance and towards alternatives”, he said. With the US increasingly using the dollar as a political tool, there is a big demand for countries to trade in manners that do not involve the dollar, Gregersen said, pointing to El Salvador’s recent move to make bitcoin legal tender, which has prompted many other US dollar-dependent countries to explore similar possibilities.

The rise of cryptocurrencies has not affected the demand for gold, nor has it diminished gold’s appeal among retail investors, Adrian Ash, BullionVault, said, pointing to the record spike in the London OTC market in 2020 and the fact that there has been no relationship between bitcoin price moves and net gold investment demand, at least until mid-2020.

Ash also noted that younger investors have not abandoned gold, as shown by the share of new users aged below 30 on BullionVault, and the growing value of assets on the platform. Under-30s fell to 13% of new users in 2020, but that was a record year for new users on BullionVault. The number first-time under-30 users almost trebled that year, and as of May 2021, under-30s already comprise 85% of new users, Ash said.

The environment that gold exists in is fundamentally a positive one. Gold has not shrunk as a market alongside growth in bitcoin, Ash said. A risk of holding crypto assets is that they will not always work when you need it to, he added. Gold shows zero correlation with US equities over shorter periods, but on a five-year horizon, it has traded higher 98% of the time the S&P500 has fallen over five years. This is no small risk, Ash said, pointing out that this has happened 21% of the time over the last five decades.

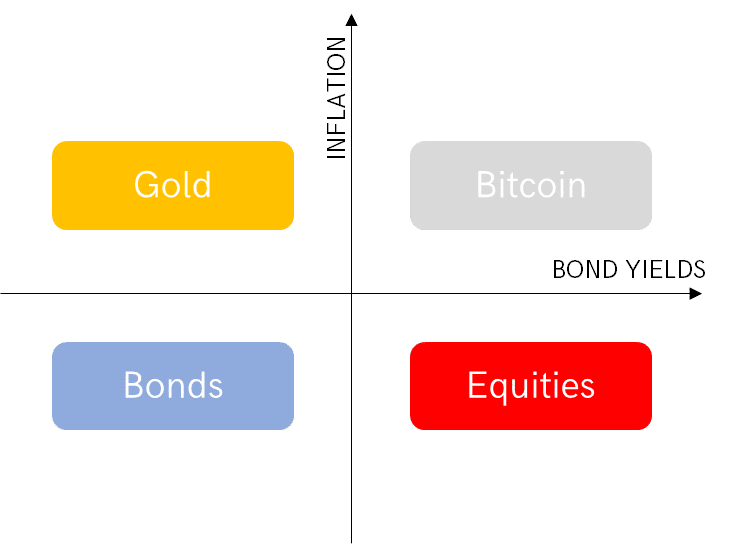

Gold and bitcoin’s sweet spot

- Gold and Bitcoin are positively correlated with inflation

- Gold has performed best when real interest rates have been falling

- Bitcoin has historically performed well risk-on conditions

- Both assets are vulnerable during times of deflation

Gold performs the best when interest rates are falling, while bitcoin, on the other hand, has historically performed well in risk-on conditions. As such, he said a portfolio with a 80-20 mix of gold and bitcoin can maximise benefits.