Navigate

Article List

- Gold: What is the Official Sector Telling us?

By Rhona O’Connell, Head of Market Analysis, EMEA & Asia, StoneX Financial Ltd

- Getting to Know FGLD: An Alternative to Physical Gold

By Bursa Malaysia Derivatives Berhad

- Unlock the Powerful Edge of Trading Gold Futures

By Chin Yi Xuan, General Manager, Algopedia

- Malaysia’s Gold Market

By Elvis Chou, Senior Consultant, Metals Focus

- SBMA News

By SBMA

Article List

- Gold: What is the Official Sector Telling us?

By Rhona O’Connell, Head of Market Analysis, EMEA & Asia, StoneX Financial Ltd

- Getting to Know FGLD: An Alternative to Physical Gold

By Bursa Malaysia Derivatives Berhad

- Unlock the Powerful Edge of Trading Gold Futures

By Chin Yi Xuan, General Manager, Algopedia

- Malaysia’s Gold Market

By Elvis Chou, Senior Consultant, Metals Focus

- SBMA News

By SBMA

Unlock the Powerful Edge of Trading Gold Futures

By Chin Yi Xuan, General Manager, Algopedia

With heightened uncertainty around the globe, gold is highly regarded as a way for investors to diversify their portfolios. When it comes to gold trading, FGLD is an excellent choice for investors who are seeking short-term speculative activities or longer-term portfolio hedging for gold.

As a derivative of gold, FGLD provides investors with exposure to gold, with an extra layer of convenience where investors do not need to manage the logistics of the gold they invest in, such as delivery and storage.

Key Reasons to Trade Gold Futures (FGLD)

As a regulated product by the Securities Commission Malaysia, FGLD is designed to be secure and transparent so investors can trade FGLD with confidence. FGLD offers several complementary benefits over buying physical gold.

-

Leveraged trading

FGLD provides leveraged trading, so that investors can gain leveraged exposure to the notional value of a gold futures contract with a relatively small amount of capital. At current notional value (as of late February 2023), this translates to investors getting access to approximately 36x leverage while trading FGLD. Essentially, this amplifies the impact of price changes, which provides a powerful edge, should leverage is utilised with clear intent.

-

Forward price discovery

FGLD also allows for forward price discovery in the gold market as longer-term investors can trade up to 12 months ahead of the current spot month.

-

Flexibility

Investors with directional conviction on gold should consider FGLD as an alternative to physical gold as FGLD offers investors the flexibility to express their conviction and profit from both bullish and bearish market outlook in the gold market.

According to the World Gold Council, the net long positions of gold has been in a significant decline since 2020, from 871.92 tonnes to 527.03 tonnes by the end of 2022. This 65% drop in net long positions may suggest an inclination towards a bearish outlook in gold due to the continuous rate hikes by the Federal Reserve. As FGLD allows investors to initiate short trades in the gold market, it can be used to express speculative bearish outlook.

Contrary to the belief that gold is an excellent inflation-hedge asset, gold provides exceptional directional trading opportunities on either side of the market, despite being in a high-inflation environment.

By filtering for a 50-year time horizon (1972–2022) where US inflation exceeded 4% (1973–1982, 1985, 1988–1991, 2008, 2021–22), the non-inflation adjusted return of gold displayed a fascinating narrative. Rather than hedging against inflation, gold produced performances on both extremes of the spectrum in a high inflationary environment, providing investors with ample directional speculative opportunities.

Gold performance filtered for years where inflation >4%

-

Portfolio diversification

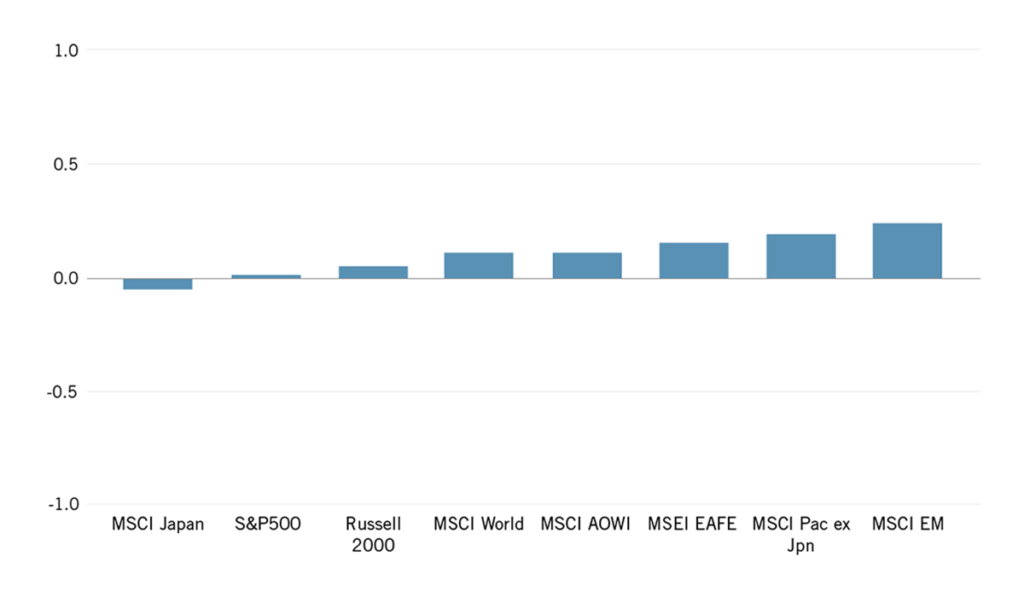

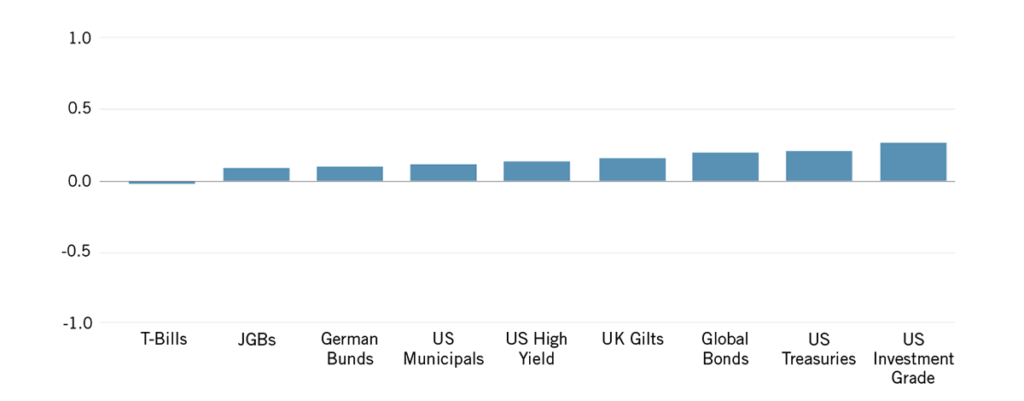

That being said, a lack of historical linear relationship with inflation does not preclude FGLD from being used as an effective portfolio diversifier. Over a 30-year period, gold exhibited low correlation to major equity and fixed income indices. A low correlation between gold and other asset classes can help lower volatility in a multi-asset portfolio and enhance its risk-adjusted returns.

Gold Exhibited a Low 30-Year Correlation to Major Equity Indices

Gold Exhibited a Low 30-Year Correlation to Major Fixed Income Indices

-

Hedging

FGLD can also be utilised as a hedging instrument. For instance, gold futures contracts can be used strategically to hedge against the volatility and uncertainty in the gold market, especially in periods when the gold price fluctuates significantly.

Considering the heightened volatility of the precious metal in 2022, a practical use case of gold futures is for physical gold owners to use FGLD to hedge against the risk of unfavourable price movements in the physical market.

A way to measure the volatility of an asset is through the Average True Range (ATR) indicator, where a higher value of ATR implies higher volatility compared to a lower value of ATR. In 2021, gold’s ATR has stayed mainly below 25 since April, maintaining a range bound market movement throughout the year.

However, the Fed’s seven rate hikes in 2022 to bring inflation under control has led to heightened uncertainty, which inevitably boosted the volatility in the gold market. This resulted in higher volatility in gold – its ATR stayed above 25 for most of the year.

Essentially, the volatility of gold has relatively grown in 2022 compared to the prior year, so hedging with gold futures can play a pivotal role in keeping gold investors’ portfolio value intact.

Unlock the Full Suite of Possibilities with FGLD

FGLD provides solid use cases and benefits from short-term speculation, to long-term hedging activities. As such, FGLD offers massive versatility to investors to participate in the gold market, regardless of time horizon at a reasonable capital requirement.

That said, as with any investment, it is crucial to be aware of the risks associated with gold futures and to ensure that any trades you make are well-researched and based on a sound trading strategy.

CHIN YI XUAN is the general manager of Algopedia, a professional proprietary trading firm in Malaysia. In addition to actively trading the futures market, he is also involved in developing proprietary automated and hybrid strategies to maximise edge in the market. Yi Xuan also drives the marketing strategy of the firm via content creation and idea sharing on all things trading and markets.