Navigate

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securities

Despite the Federal Reserve’s current commitment to a restrictive policy stance and a drop from its highs, we believe that gold is likely to trend up to a sustained level of $2,100/oz in the latter part of the year. An anticipated early drop in nominal and real policy rates, concerns surrounding USD hegemony, strong physical buying by the official sector and robust retail interest are the key reasons driving our positive outlook.

Financial sector stability concerns in the aftermath of the collapse of several US lenders, Credit Suisse’s forced merger with its Swiss competitor, large deposit losses by American regional banks and the Fed’s dual mandate are additional factors that make us believe that policy rates may drop before inflation is fully tamed. This, along with discretionary investor positioning, suggests that risks to gold prices are to the upside.

Gold Outperforms Despite Fed’s Hawkish Signals

Gold has again outperformed most other major asset classes over the last twelve months. It was able to resist the usually subtractive rising interest rates and Fed narratives pointing to higher rates for longer due to record official sector and strong retail investor buying. Central banks and investors looked to the yellow metal as a safe haven to protect against the ravages of inflation, geopolitical risks, and concerns surrounding the hegemon status of the US dollar.

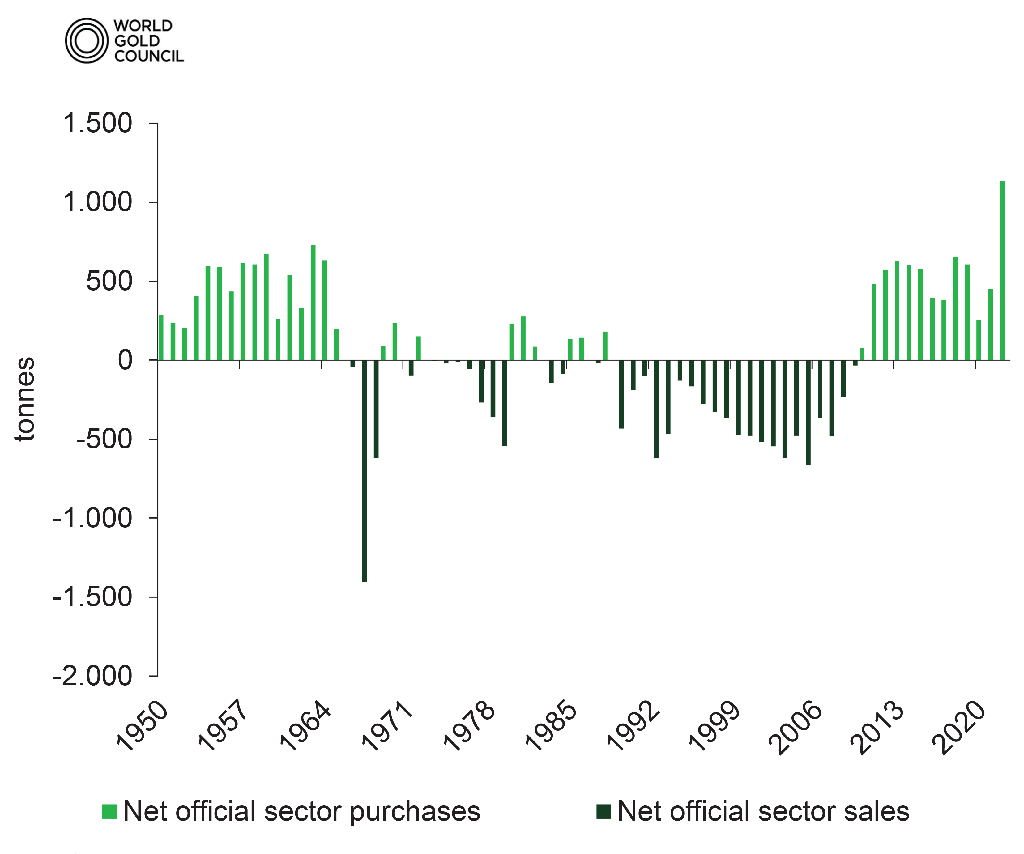

The growing amount of energy transactions in non-dollar terms, and active talk of using alternatives for international transactions to negate the impact of potential US financial sanctions in the aftermath of sanctions on Russia, have fuelled this demand. The official sector bought a record 1,136 tonnes in 2022, with purchases continuing to be firm this year. This will continue to keep the gold market well-supported, even if rates rise modestly over the next six months.

More recently, price support was delivered by the outsized difference between the higher Fed funds rate forecasts from the FOMC dots for 2023 and 2024, and the low levels futures markets are pricing. Indeed, the 50-70 basis points (bps) differential for end-2023 and the some 100-bps spread for end-2024 helped to propel gold to north of $2,045/oz in mid-April, with an assist from a somewhat weaker greenback.

While the market isn’t particularly troubled if rates rise by 25 bps more than expected, traders are looking at when the pivot to a dovish monetary policy stance will occur. At this point, they believe that the Fed will signal lower rates in the second half of 2023, as economic data weakens.

However, policy ambiguity in the face of still firm economic statistics suggests that there may be renewed weakness into the summer, before our predicted sustained move into the $2,100/oz territory manifests. It is still possible that the market comes closer to where the current FOMC dots sit, which would keep specs and other investors on the sidelines in the near-term, until the timing of a pivot lower is more certain. Eventually, the central bank will likely talk cuts before the inflation target is reached, and the yellow metal should then react, increasing long exposure before the rate cuts actually occur. We believe this policy switch will occur at year-end, hence our view that gold starts to firm materially in the summer months.

Fed’s Credibility Problem is Gold Supportive-but Also Represents Correction Risk if Expectations Align

Discretionary Investor Positioning Suggests Upside Risk

Monetary Policy Priorities are in the Eye of the Beholder

With officials emphasising that they are structuring policy to reduce harm on the low end of the income distribution, we and the gold market believe that as soon as inflation is judged to no longer be overly harmful to that cohort and that slow economic growth and unemployment pose the biggest danger, the US central bank may well quickly pivot toward a dovish policy stance.

Based on the income and wealth inequality and equity narratives being propagated by policy makers, it is reasonable to assume that a committed inflation fight is unlikely if it harms the poor. As such, policy can turn on a dime. After all, the Federal Reserve Act mandates the US central bank to maintain price stability and full employment, which are often conflicting objectives that permit a policy skew to either target, depending on the philosophical bend of the policymakers.

Many in the market believe that monetary policy will tilt dovishly considerably before US inflation reaches the implied 2% target. This aligns with our forecast, which expects only modest disinflation before the Fed starts cutting rates towards the end of the year, potentially leaving real rates lower than in previous cycles. The significant differences between the Fed’s policy signals and market pricing present a fundamental credibility problem.

Many gold market participants believe that the current implied 2% inflation target is flexible, and that the recent banking issues may have already tightened policy materially, necessitating earlier rate cuts than anticipated.

Indeed, the fear of a generalised banking crisis has some central banks and investors buying gold, despite the Fed’s hawkish talk. Many investors are concerned that the Fed really doesn’t know how much more tightening can happen before the economy weakens materially and banking stresses reemerge as “there is never just one cockroach”.

Perhaps maintaining full employment and financial stability will take priority over strict inflation targeting. It may be that a high-interest rate environment does not allow the US financial system to operate smoothly, given its current structure.

Bank Deposits Are Declining at the Fastest Annual Pace on Record

Central Banks and Physical Investors Key to Gold’s Success

Gold is no one’s liability and carries no counterparty risk! Since the yellow metal is a physical asset that requires real inputs such as labor, energy and capital to get out of the ground, it tends to offer excellent protection against the loss of purchasing power over the long-term as its marginal costs imbed inflation. It is also a very liquid, scarce asset with intrinsic value through many millennia, and a luxury good as much as it is an investment that is inversely correlated to the US dollar and equities over time. These characteristics make it an excellent diversifier and a vehicle to mitigate losses in times of market stress, and can serve as a hedge against inflation and currency risk.

Given a year of outsized inflation, concerns surrounding the greenback’s reserve currency status and growing geopolitical tensions, it should come as no surprise that central banks, the broader official sector, and retail investors have a ferocious appetite for physical gold. There is a real worry that the US may need to fund its massively growing deficit via stealth monetisation, as tax receipts are not likely to grow sufficiently.

Marginal Cost Rises Along with Higher factor Costs— Making Gold a Good Inflation Hedge

Western Demand Hit Record Levels

Physical Gold Dominant Over Financial Flows

Declining LBMA Vault Holdings Point to Strong Physical Demand Abroad

Official Sector Purchases at Record Highs

Geopolitical Tensions, Sky-High Debt and Monetary Policy to Support Gold

China, which has a massive $3.18 trillion dollars of FX reserves, has started to purchase gold again. The People’s Bank of China purchased 18 tonnes of gold in March, which marked a fifth consecutive month of buying. But China’s gold reserves are still a paltry 2,068 tonnes, representing only 3.6% of the country’s total FX reserves. Contrast this to gold’s 67.1% share of US reserves, Germany’s 66.5% portion, Italy’s 63.6% portion or France’s 58.6% share, and we conclude that China’s bullion purchases have a way to go.

Even a modest increase to 10% would hike demand by some 320 tonnes. A move to 25% (less than half of its geopolitical competitors) would boost demand by over 1,000 tonnes. This could come alongside purchases by other non-western world aligned nations. Emerging market central banks have already been reducing their USD FX shares.

Elevated tensions between the US and Russia, China, and Iran will likely see this trend continue, as these nations believe that America may use financial sanctions such as blocking access to the SWIFT system in order to achieve its political goals. This will be very supportive of gold prices, as it was last year when monetary conditions were not.

In addition, FX reserve managers and private investors fear that the US will continue to live beyond its means, which suggests that monetisation and above-trend inflation are risks. The recently passed US Inflation Reduction Act, which features America-first policies, massive capital spending, and unfunded social security liabilities all support such concerns. As such, official purchases and monetary conditions should work together to support gold in the second half of 2023.

Growing Debt Increases Appetite for Headge

Plenty of Room For China to Grow Reserves

EMs Grow Resources the Fastest — Geopolitics, USD Angst the Reasons

BART MELEK has over 20 years’ experience analysing precious metals, base metals, energy, financial markets, as well as key economies. He has worked closely with commodity, equity and FX trading desks around the world, and has several forecasting distinctions and top global rankings. Bart contributes to the TD Securities strategic view on commodity, various other markets and macroeconomics. Bart is also a sought-after media commentator. Previous to joining TD, he had senior roles in equities, commodities and risk. He holds a master’s degree in economics from York University in Toronto, with an International Finance/Banking Specialization.