Navigate

Article List

- How Geopolitics Could Make Singapore the World’s Most Important Gold Market

By Gregor Gregersen, Founder, Silver Bullion

- Why You Should Consider Investing in Platinum

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Connecting Asia to Global Market Opportunities

Feature: INTL FCStone

- Hedging Strategies with Gold Derivatives

By Jonathan Chan, Investment Analyst, Phillip Futures

- Entering the Singapore Precious Metals Market – An Insider’s Perspective

By Joshua Rotbart, Managing Partner, J. Rotbart & Co.

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- How Geopolitics Could Make Singapore the World’s Most Important Gold Market

By Gregor Gregersen, Founder, Silver Bullion

- Why You Should Consider Investing in Platinum

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Connecting Asia to Global Market Opportunities

Feature: INTL FCStone

- Hedging Strategies with Gold Derivatives

By Jonathan Chan, Investment Analyst, Phillip Futures

- Entering the Singapore Precious Metals Market – An Insider’s Perspective

By Joshua Rotbart, Managing Partner, J. Rotbart & Co.

- SBMA News

By Albert Cheng, CEO, SBMA

The ASEAN Gold Market – An Overview

By SBMA

Published on June 1, 2017

Introduction: The ASEAN region

The launch of the ASEAN Economic Community (AEC) on 31 December 2015 was a major milestone in ASEAN’s regional economic integration agenda and the next stage of the organisation’s evolution, which began in 1967 with five member countries. It is now collectively the 7th largest economy in the world in terms of GDP (US$2.4 trillion) and has a population of 625.5 million.

Further infrastructure development commitments made under the ASEAN Free Trade Area (AFTA), such as the East-West Economic Corridor connecting the Greater Mekong sub-region, and the North-South corridor linking China with Southeast Asia, together with development of key sea ports will increase import and export opportunities for ASEAN countries, and will allow ASEAN to become a major production and distribution hub. Besides, ASEAN itself is a huge consumer market, with a middle class that is growing along with its economy, and as a consequence wealth accumulation among this demographic will also increase.

ASEAN’s gold market

Gold has played a very important role in the region and is closely connected with the life and culture of the people in the region. In some countries, gold is seen as more stable than the national currency, and people often use it as a medium of exchange and a unit of measurement. In general, people in this region like to buy gold jewellery, not only for use as accessories or gifts for cultural or religious ceremonies such as weddings, festivals and other special occasions, but also as a storage of wealth. In rural areas, people often convert their excess money into gold, and store it for a rainy day. People can re-sell the gold to jewellery shops for short-term borrowing. Besides the demand for jewellery, political and global macroeconomic uncertainty are prompting people to invest in gold, and is pushing the demand for physical gold, such as bars or coins. Additionally, dinar coins are well-received by a couple of countries as a form of savings, and are even used as a medium of exchange.

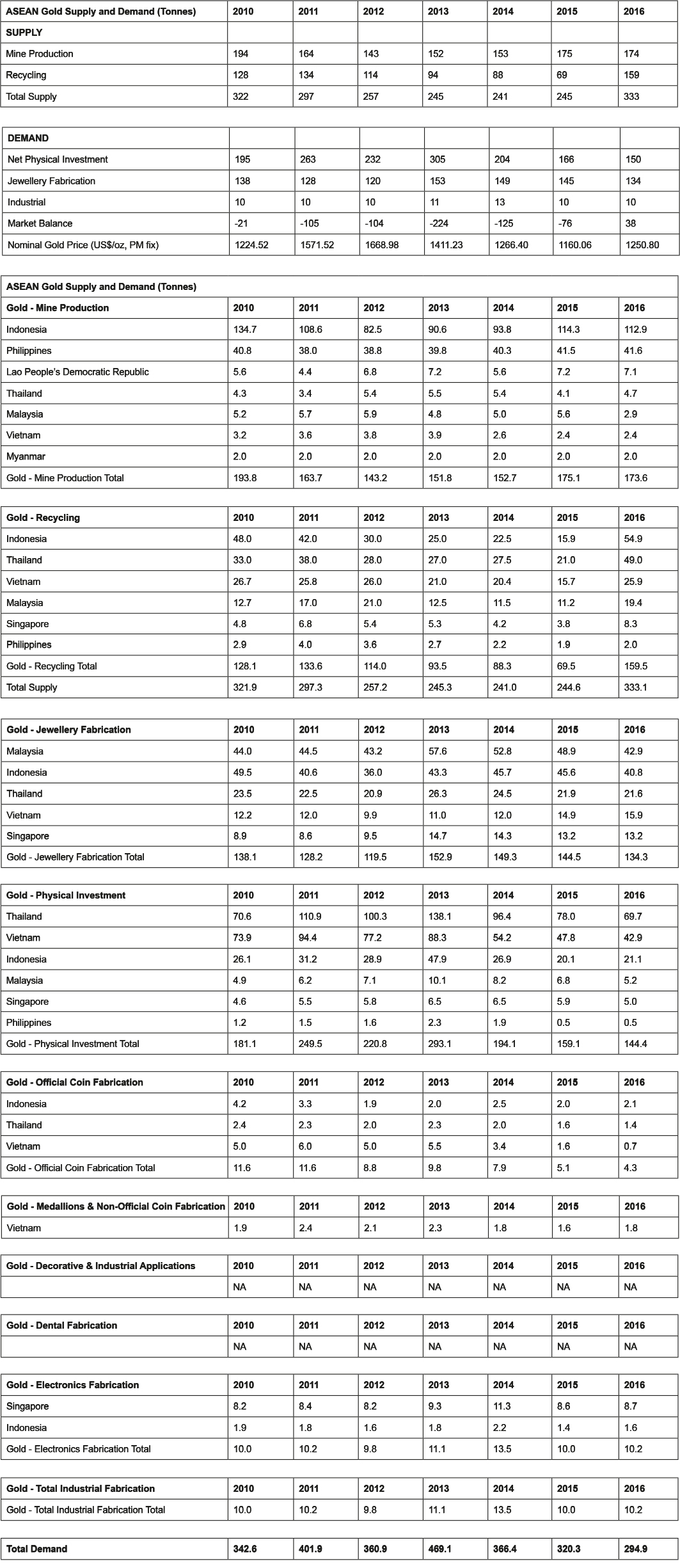

ASEAN does not only comprise gold importing nations, but also includes nations that export gold collected as scrap or from the by-product of mining, though gold mines are located only in a few countries (Table 1). According to Metals Focus, in 2016, ASEAN’s total demand for gold was 295 tonnes, and its total supply was 333 tonnes. In addition, ASEAN central banks hold gold as a part of their reserves. The official gold holdings in ASEAN is 603 tonnes (Table 2).

Table 1: ASEAN gold import/export data

Table 2: Gold holdings of ASEAN central banks

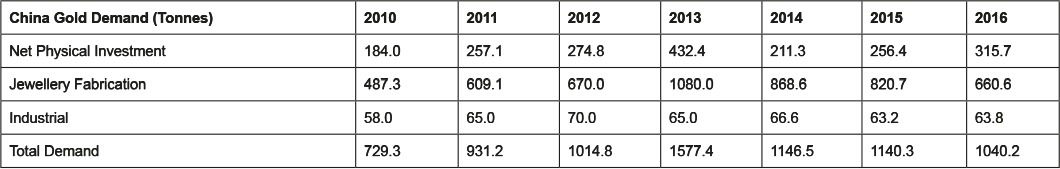

Table 3: China’s gold demand

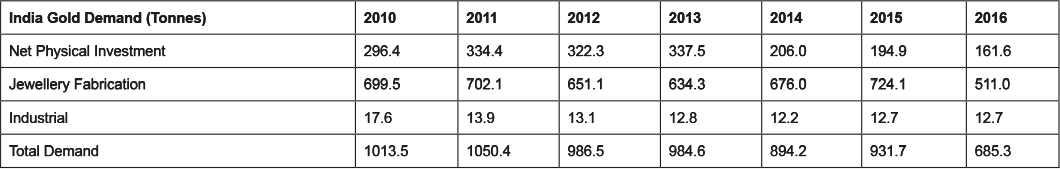

Table 4: India’s gold demand

New demands and participants

Gold travelling from West to East

- China began liberalising gold transactions, including jewellery, in 2001, ending the state’s monopoly of the gold sector. The Shanghai Gold Exchange was established in 2002 by the People’s Bank of China (PBoC), and it is now the largest physical gold exchange in the world. PBoC also has the fastest growing official gold reserves in the world. In 2005, it developed trading infrastructure for individual investors. China’s gold demand was 1,040 tonnes in 2016 (Table 3), or about 31% of total global demand.

- India’s demand in 2016 was 685 tonnes (Table 4), or about 21% of total global demand.

- The introduction of Shari’ah Standard on Gold, which sets out clear guidelines for Islamic investment in gold, is expected to spur the development of new investment asset classes, and Islamic banks and other financial institutions should be able to expand their customer base with new products created under the guidance of the standard. This has the potential to make Malaysia a gateway to ASEAN for Islamic investments from the Middle East and the rest of the Islamic world. Bank Negara Malaysia, the country’s central bank, has been studying gold circulation in the Middle East as the region has a history of accepting gold as money.

India’s free trade agreements (FTA)

Gold jewellery imports from ASEAN to India have surged as a result of the India-ASEAN FTA, which came into effect in 2010. Gold jewellery imports under the India-ASEAN FTA face 1% import duty, as opposed to 10% under the normal trade channel.

Sovereign wealth funds and pension

The increasing income of the middle class is prompting the development of social security systems such as pension funds and social insurance. As a result, the diversification of such portfolios into different asset classes, including precious metals, is becoming more common.

Gold is currently not a popular asset class among institutional investors in ASEAN, except for central banks, which buy gold as a part of their reserves. However, the pension fund system in some countries, such as the Central Provident Fund in Singapore, has approved exchange traded funds (ETF) as an asset class to diversify their portfolio into gold, with a limit of 10% of the total assets.

Currently, many pension fund assets are managed and invested in their respective local markets. The total asset size of major sovereign wealth funds and pension funds in ASEAN was US$1,111 billion.

Notes

- http://www.gic.com.sg/report/report-2015-2016/investment-report.html

- https://www.cpf.gov.sg/Assets/common/Documents/ViewAnnualReport2015inPDF.pdf

- http://www.temasekreview.com.sg/overview/portfolio-highlights.html#sector

- http://www.kwsp.gov.my/portal/ms/web/kwsp/home

- http://www.thestar.com.my/business/business-news/2016/11/26/a-giant-awakens/

- https://www.pwc.com/gx/en/deals/sovereign-wealth-investment-funds/assets/sovereign-wealth-investment-funds-league-table.pdf

- http://www.khazanah.com.my/Our-Performance/Finance-Highlights

- http://www.kwap.gov.my/EN/OurPerformance/Pages/FinancialHighlights.aspx

- http://www.sso.go.th/uploads/eng/files/SSF_01%2010Q4_Eng.pdf

- https://www.gpf.or.th/eng/invest_growth.asp

- http://www.bpjsketenagakerjaan.go.id/assets/uploads/tiny_mce/Annual%20Report/16012017_093528_IR%20BPJS%20Ketenagakerjaan%202015.pdf

- http://www.taspen.co.id/?page_id=422

- https://www.malaysiakini.com/news/328312

- http://www.asabri.co.id/asset/images/media/large/annual_report_2015.pdf

Statistics used in this report are from publicly available sources only, and numbers from a few countries are not available. As ASEAN develops, and import and export numbers become more transparent, statistical numbers will be available for analysis, and ASEAN’s total numbers will be attractive to investors who are looking for an opportunity to expand into the region.