Navigate

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

Published on September 10, 2021

PAWAN NAWAWATTANASUB is the CEO of YLG Bullion Singapore and the CEO and founder of YLG Bullion International. She has almost 40 years of experience in the jewellery industry and established YLG in Thailand in 2003. In 2012, she brought YLG to Singapore. She sits on the Board of Directors of the Thailand Gold Traders Association, and is a SBMA Committee member.

YLG has been operating in the gold jewellery and bullion business for the last forty years. Our business partners include reputable financial institutions, fund managers, jewellery manufacturers, wholesale gold traders, licensed gold mining companies and LBMA-accredited refineries across the globe.

Given our geographic proximity, we have maintained a very close working relationship with our customers across Southeast Asia. Per our observation, the Covid-19 pandemic has completely changed the landscape of their business operations.

First, the lockdowns in many countries triggered a massive supply chain disruption, which led to material shortages. Customers no longer have the assurance that the bullion they ordered will arrive on time. Worst of all, the supply chain can be cut off with little warning, due to manpower shortages or flight suspensions.

This development has changed the way they order their stock. For example, during pre-pandemic times, they cast a wider net in search of competitive pricing, often venturing into other parts of the world such as Europe and North America. But now, they look for suppliers closer to home to minimise the risks of transport disruptions and shorten transportation time, which in turn, ensures the certainty of supplies.

Second, the back-to-back “just-in-time” ordering pattern that used to operate like clockwork for these customers, is no longer valid. Instead, customers are now adopting a “just-in-case” model in which they hold a larger quantity of stock. This is in anticipation of supply chain disruptions that may be triggered by another wave of virus infections.

NAVIGATING THE CHANGING LANDSCAPE IN SOUTHEAST ASIA

There is another distinctive observation among our Southeast Asia customers that is noteworthy. Over the past year, their preferred offtake and/or trans-shipment location has been Singapore, instead of other popular locations in Asia.

Given Singapore’s strategic geographic location, this may not come as a surprise to many bullion counterparties and participants. One can reach most of the region’s capitals by plane within three hours. Moreover, in five hours, one can reach major Asian cities in China, India, Japan, Hong Kong, and Taiwan.

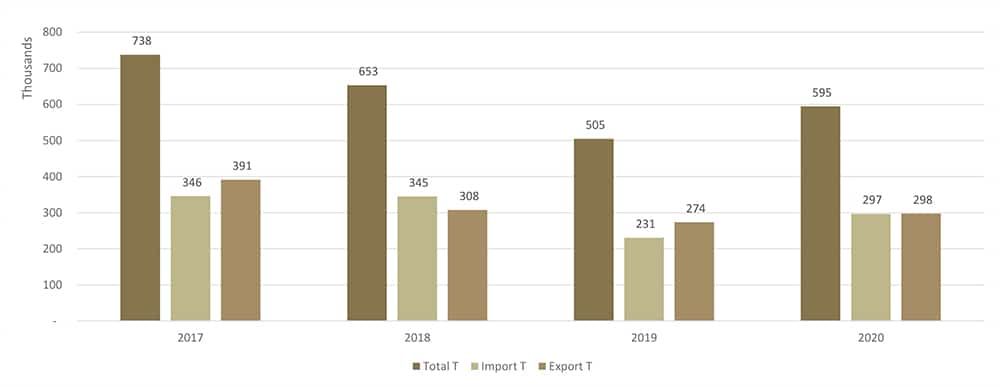

Figure 1 shows import and export levels matching closely in 2020. Even when Singapore faced uncertainty in 2020, the volume grew compared to 2019. This demonstrates that even more business was done through Singapore.

Additionally, as far as physical bullion trading is concerned, Singapore for the past few decades has been the major trans-shipment centre serving Malaysia, Indonesia, Vietnam, Thailand, Cambodia and, to a smaller extent, China and India.

In addition, there are many well-established bullion banks, refineries and reputable gold traders that are ready to serve these customers in Singapore. Most importantly, the suppliers have financial prowess, international reputation, competitive pricing, ready stock in Singapore, ample supply for replenishment and timely release of gold for collection.

Figure 1: Tonnage of Gold Imports and Exports in Singapore, 2017–2020

RESHAPING THE ROLE OF SINGAPORE

Another positive development has been taking place in the wealth management space, whereby more and more international investors, particularly Asians and Europeans, are buying and storing physical gold in Singapore.

Singapore was ranked as the most preferred offshore wealth management hub, according to Asian Private Banker. The World Gold Council also noted that gold would play a more important role in the precious metals investment arena.

In our opinion, gold will certainly play a pivotal role in the wealth management industry. Although many other cities are also strategically located, what sets Singapore apart are other qualities that are critical when it comes to dealing with wealth, and in particular, precious metals. Singapore is ranked among the top four financial centres in the world. It has a low crime rate, and was recently ranked third by the Economist Intelligence Unit as the world’s safest city. And all the international credit rating agencies have given the Singapore government a AAA credit rating with a stable outlook.

POSITIONING AND CONTRIBUTION OF THAILAND

On the other hand, Thailand, also plays a critically important role in the global gold industry. Before the pandemic, the data from World Gold Council for the period 2015-2019 shows that Thailand led gold consumption in Southeast Asia, and was sixth in the world after China, India, USA, Germany, and Turkey. Consumer demand per capita was 1.1 g per person per year – among the top tier in Asia after Hong Kong and Singapore.

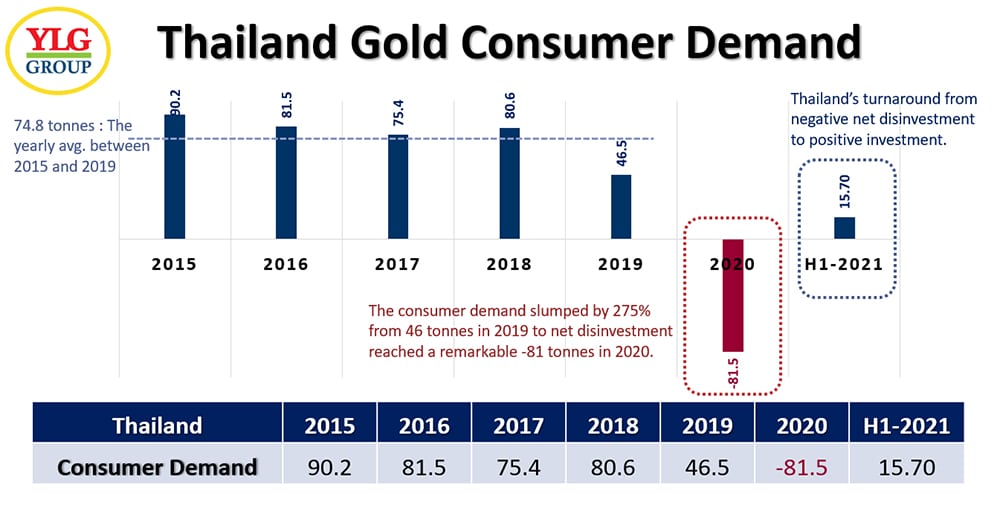

But like many other countries, Thailand’s economy was hit hard by the Covid-19 pandemic. The country’s GDP fell by over 6% in 2020 and many workers, especially those related to the tourism sector, lost their jobs. A higher local gold price and concerns over shrinking incomes curtailed gold consumer demand for that year. Consumer demand slumped by 275% from 46 tonnes in 2019 to net disinvestment, which reached a remarkable 81 tonnes in 2020. The contraction was due to a combination of lower levels of gross buying and a fresh wave of selling back.

Even though the country is still battling its worst coronavirus outbreak, Thailand continues to show its resilience. The pullback in the local gold price during October 2020 and March 2021 was seen as a buying opportunity. With expectations of higher gold prices in the long term, investors responded with conviction, adding to their holdings.

Gold consumer demand in Thailand continued to recover although has some way to go before returning to pre-pandemic levels. Having been all but decimated by the pandemic between Q2 and Q4 2020, gold consumer demand recovered towards the end of last year and into Q2 2021.

Gold consumer demand in Thailand totalled 15.7 tonnes in H1 2021, which marks a significant shift from the net sale of 32.4 tonnes seen in H1 2020. But longer-term comparisons show that it remains relatively subdued, falling short of the quarterly average and remains well below average first half-yearly levels too.

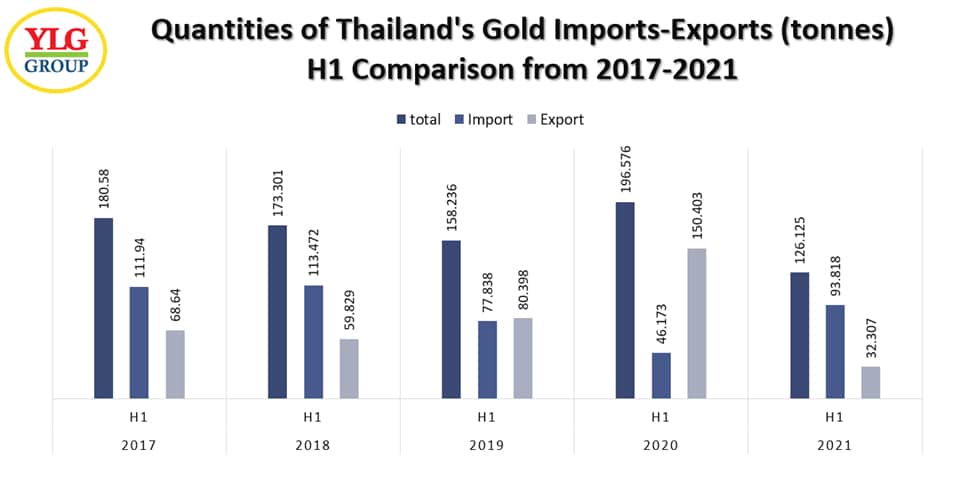

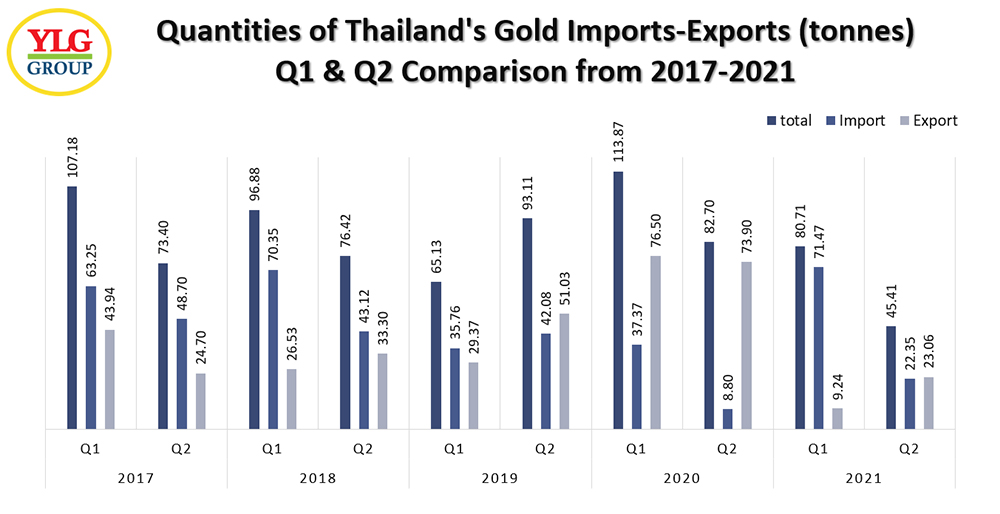

Retail demand improved as the price pullback enticed some investors to replenish their vastly depleted holdings; as a result, official gold imports rebounded. Thailand official gold imports totalled 93.8 tonnes in H1 2021, some 103.19% higher than H1 2020. On the opposite side, the country exported 32.3 tonnes of gold in H1 2021 – 78.5% lower year-on-year.

The outlook for the coming quarter is, however, cautious. As lockdowns are imposed in various areas of the nation in response to rising COVID-19 cases, consumer confidence has dipped. This is likely to impact gold demand in Q3, although the effect may be tempered by digital and omni-channel retail strategies being developed over the last year.

SOUTHEAST ASIA OUTLOOK

The tradition of saving gold has infiltrated into every Southeast Asia country’s culture. Gold serves as a security, investment and gift for every occasion. Consumers believe that saving in gold is the best savings method. While those with high incomes prefer collecting gold bars, people in general prefer collecting gold jewellery.

Apart from the aforementioned factors, including inflation, value of money, urbanisation and rising income, the large unbanked population in rural areas also influences gold saving.

Singapore has started to allow business and official travellers from Germany and Brunei to use the Vaccinated Travel Pass (VTP) to enter the country. It is relaxing its border controls so we foresee that physical activities will soon pick up dramatically. Many of our Southeast Asia customers, accustomed to the efficiency of Singapore’s suppliers, will undoubtedly return and make Singapore even stronger as the regional bullion centre navigating out of the post Covid-19 era.

Gold has always been well-loved by Southeast Asians for its beauty and intrinsic value. With vaccination rates growing, Covid-19 infections should taper off and economies will normalise over time. We envision a wave of pent-up buying interest in the jewellery sector. The long-awaited recovery for the physical market may soon emerge at the end of the tunnel.

PAWAN NAWAWATTANASUB is the CEO of YLG Bullion Singapore and the CEO and founder of YLG Bullion International. She has almost 40 years of experience in the jewellery industry and established YLG in Thailand in 2003. In 2012, she brought YLG to Singapore. She sits on the Board of Directors of the Thailand Gold Traders Association, and is a SBMA Committee member.