Navigate

Article List

- Editorial

By Gordon Cheung, Deputy Chief Executive, SBMA

- The Australian Gold Industry, Trade, and Markets

By Thuong Nguyen, Economist, Australian Government Department of Industry, Innovation and Science

- Platinum & Palladium Outlook

By Bruce Ikemizu, Head of Commodities Trading, ICBC Standard Bank, Tokyo Branch

- Our Journey – SBMA’s Humble Beginnings To Our Silver Jubilee And Beyond

By Albert Cheng, CEO, SBMA

- Global Technology With Local Service

By ECO-Mastermelt

- Percolating Market, Policy Risks Point To Weightier Gold Allocations

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Economic Jitters Fuel Gold Rush

By Finews Asia

- Safeguarding Singapore’s Precious Metals Industry

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) division, Ministry of Law

- The Added Value

By Jacek Baranowski, International Sales Manager, Metal Market Asia

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By Gordon Cheung, Deputy Chief Executive, SBMA

- The Australian Gold Industry, Trade, and Markets

By Thuong Nguyen, Economist, Australian Government Department of Industry, Innovation and Science

- Platinum & Palladium Outlook

By Bruce Ikemizu, Head of Commodities Trading, ICBC Standard Bank, Tokyo Branch

- Our Journey – SBMA’s Humble Beginnings To Our Silver Jubilee And Beyond

By Albert Cheng, CEO, SBMA

- Global Technology With Local Service

By ECO-Mastermelt

- Percolating Market, Policy Risks Point To Weightier Gold Allocations

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Economic Jitters Fuel Gold Rush

By Finews Asia

- Safeguarding Singapore’s Precious Metals Industry

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) division, Ministry of Law

- The Added Value

By Jacek Baranowski, International Sales Manager, Metal Market Asia

- SBMA News

By Albert Cheng, CEO, SBMA

The Australian Gold Industry, Trade, And Markets

By Thuong Nguyen, Economist, Australian Government Department of Industry, Innovation and Science

Published on June 5, 2019

THUONG NGUYEN is an economist and gold analyst at the Office of the Chief Economist, Australian Government Department of Industry, Innovation and Science, a position he has held since October 2015. In this role, he is the author of the macroeconomics and gold chapters of Resources and Energy Quarterly, the Australian government’s flagship publication which provides comprehensive analysis and forecasts of global resources and energy commodities. Before this, he was a senior policy officer working on resources and energy strategic policies at the Department of Resources, Energy and Tourism.

The resources sector, including the gold industry, is a major contributor to the Australian economy, accounting for more than half of the country’s exports.

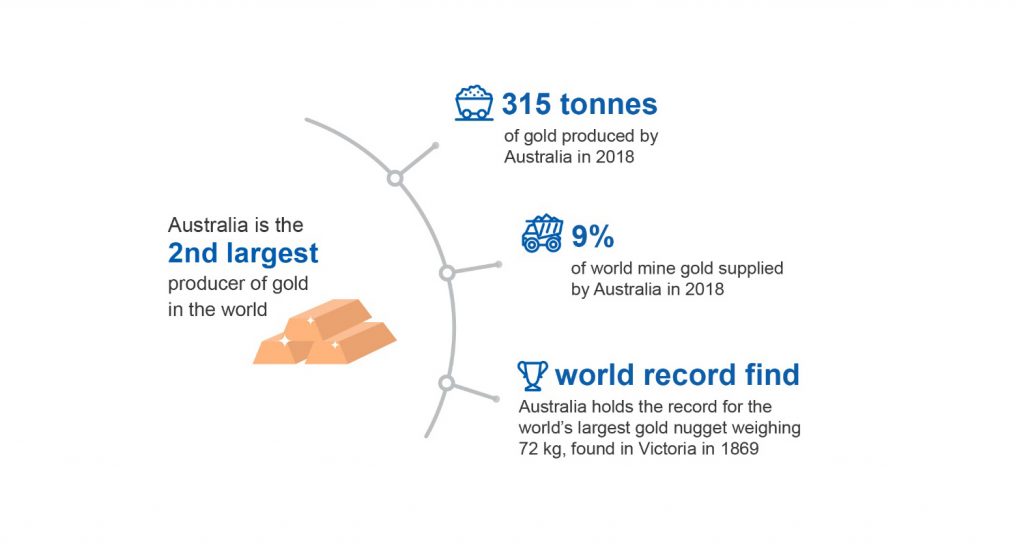

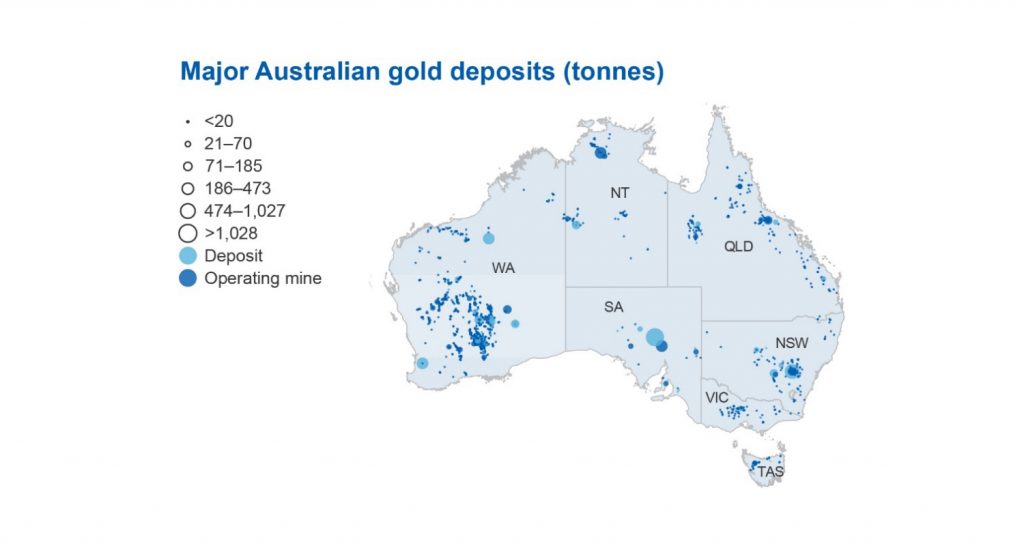

Australia is the world’s second-largest gold producer after China, accounting for 9.4% (315 tonnes) of global gold mined production in 2018 (Figure 1). The Australian gold industry comprises 71 operating gold projects (some containing multiple individual gold mines) across all Australian states and territories, except the Australian Capital Territory. Western Australia leads production, with 68% (215 tonnes) of Australian gold production.

The liberalisation of trade regulations concerning investment precious metals in Southeast Asia and the emergence of new markets have created a unique opportunity for trading companies to shape the preferences, buying habits and product awareness of the region’s growing customer base. One of the easily overlooked and sometimes neglected roles of investment precious metals dealers and manufacturers is educating existing and potential buyers, which is important for the future of the market. In the region’s relatively new markets, this role is even more significant and pronounced since it has a straightforward, direct and immediate impact on the growing but still narrow audience.

Figure 1: Australia’s gold industry

Figure 2: Major Australian gold deposits

Australia is not only a major producer and exporter of gold: it is also a key player in the gold refining industry. Most gold mined in Australia is refined at the Perth Mint Refinery in Western Australia before being exported. Perth Mint is one of the largest refineries in the world, with an annual refining capacity of over 300 tonnes. The refinery is one of a few global gold refiners with accreditation from all of the major gold exchanges – the London Bullion Market Association (LBMA), the New York Commodity Exchange (COMEX), the Shanghai Gold Exchange (SGE), the Tokyo Commodity Exchange (TOCOM), and the Dubai Multi Commodities Centre (DMCC).

ABC Refinery – the exclusive manufacturer of ABC Bullion – is Australia’s largest and most technologically advanced independent gold refinery in Australia, accredited by SGE and LBMA. The accreditation is a testament to its ability to refine and produce gold products to a world-class standard.

Australia is the world’s sixth-largest gold exporter, behind Switzerland, Hong Kong, United Kingdom, United States and United Arab Emirates. In 2018, Australia exported 341 tonnes of refined and unrefined gold bullion, with a value totalling US$14 billion.

In 2018, demand for Australian gold was largely dominated by Hong Kong and China, which accounted for 37% and 31% of Australia’s total gold exports respectively. Hong Kong is a fast-growing market for Australian gold, as the Special Administrative Region’s close links to China and the recent collaboration between the Shanghai Gold Exchange and the Chinese Gold and Silver Exchange has increased physical gold trading activities. Other important destinations for Australia’s gold include the United Kingdom — with an 8.5% share of Australia’s gold export markets — followed by Thailand (8.2%), Singapore (6.2%), and India (3.8%).

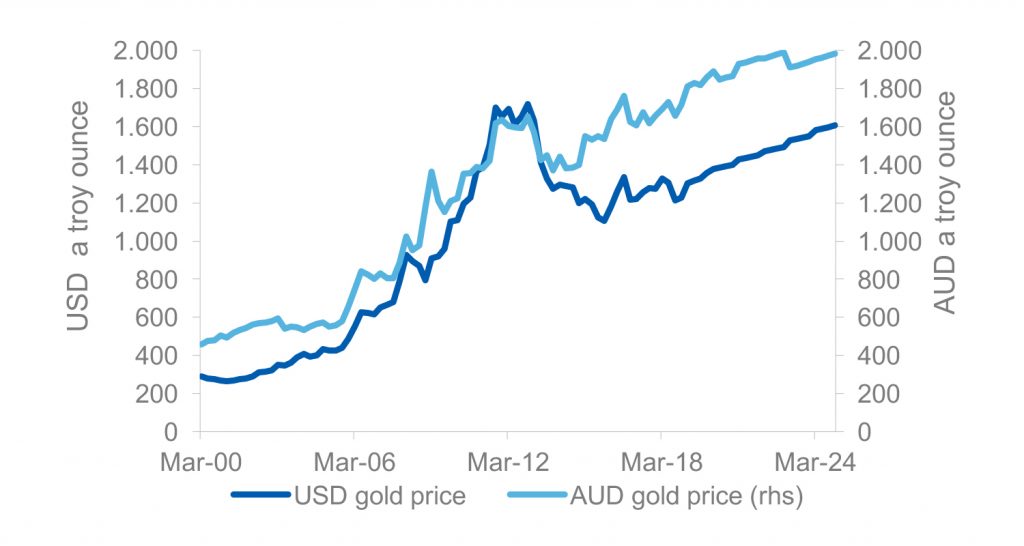

Figure 3: Australia’s domestic gold prices

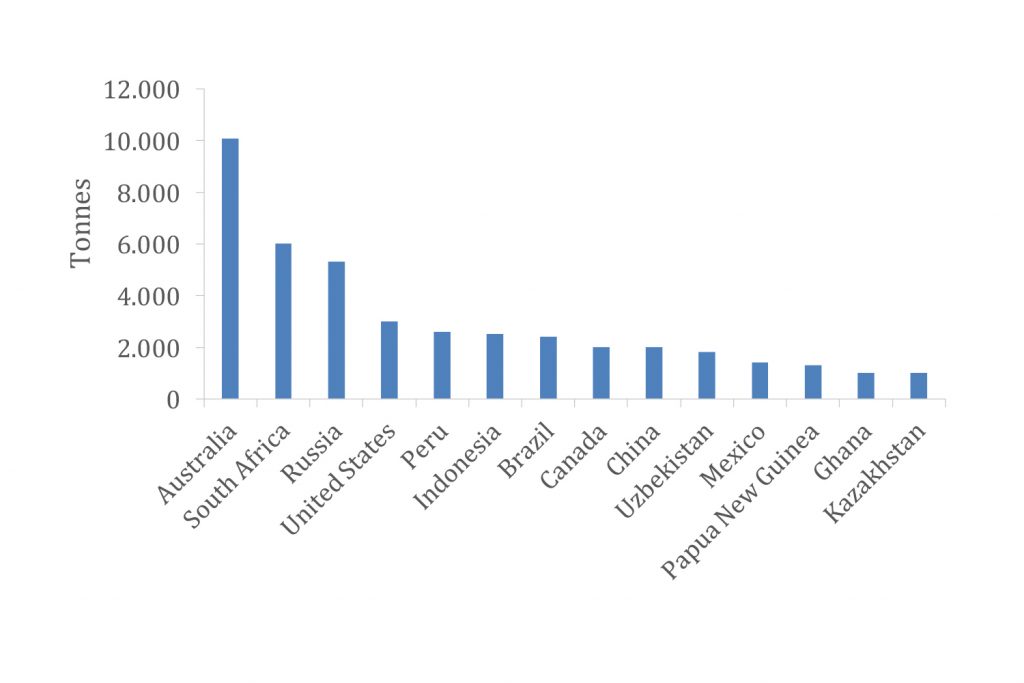

Figure 4: Economic demonstrated resources of gold

Australia’s domestic gold market consumed 54 tonnes of gold in 2018.

Australia imported 112 tonnes of gold in 2018, with a value of AUD$6.1 billion. Of this, 47% came from Papua New Guinea (PNG), 9.3% from New Zealand, and nearly 44% from other countries. Virtually all gold ores from the Ok Tedi mine in PNG are shipped to the Perth Mint refinery for processing and re-export.

Australia’s domestic gold market consumed 54 tonnes of gold in 2018. There are 82 gold bullion traders in Australia which provide facilities to buy, vault and trade physical gold bullion. Despite having no bullion market exchange, the Perth Mint – a member of the LBMA – has been considered as something of a proxy for the Australian gold market. It distributes over AUD$18 billion of pure gold, silver and platinum bullion bars and coins to investors in more than 100 countries every year. Through its depository capacity, the mint also provides the world’s sole government precious metals investment and storage program.

Significant challenges to the sustainability and longevity of the Australian gold industry exist, including the identification of new quality resources to facilitate timely ore reserve replacement. The March 2019 Resources and Energy Quarterly estimated that around 153 tonnes of gold mine capacity (at current production rates) in Australia would be shut down between 2019 and 2024.

The long term future and sustainability of the Australian gold industry is reflected by its economic demonstrated resources (EDR), which refers to resources that are established, analytically demonstrated or assumed with reasonable certainty to be profitable for extraction or production (Figure 4). Australia’s EDR is the largest of any country in the world, with 18% of the total, ahead of South Africa (11%), Russia (10%), the United States (6%), and Peru (5%). At the end of 2017, Australia had an accessible EDR of 10,070 tonnes of gold, of which 38% (3,869 tonnes) was classified as ore reserves. Approximately 75% (2,903 tonnes) of the gold in ore reserves is attributable to 71 operating gold projects.

THUONG NGUYEN is an economist and gold analyst at the Office of the Chief Economist, Australian Government Department of Industry, Innovation and Science, a position he has held since October 2015. In this role, he is the author of the macroeconomics and gold chapters of Resources and Energy Quarterly, the Australian government’s flagship publication which provides comprehensive analysis and forecasts of global resources and energy commodities. Before this, he was a senior policy officer working on resources and energy strategic policies at the Department of Resources, Energy and Tourism.