Navigate

Article List

- Gold Bar Integrity Programme: Next Steps to Success

By Sakhila Mirza, Executive Board Director, and General Counsel, LBMA

- Leveraging Technology to Modernise Gold

By Brian Lan, Managing Director, GoldSilver Central

- Vietnam’s Gold Market

By Huynh Trung Khanh, Vice Chairman, Vietnam Gold Traders Association

- Strong Institutional Demand Drives Gold Demand in Q1

By Andrew Naylor, Regional CEO, APAC (ex China) and Public Policy, World Gold Council

- How the Covid-19 Crisis Turned Into an Opportunity for Korea’s Gold Market

By Kay Lee, CEO, Wolgok Jewelry Foundation

- Thailand’s Gold Market Updates

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Digital Gold and the Latest Updates in the Industry

By Jeffrey Premer, CEO, Vaultex & Simon Sywak, COO, Vaultex

- SBMA News

By SBMA

Article List

- Gold Bar Integrity Programme: Next Steps to Success

By Sakhila Mirza, Executive Board Director, and General Counsel, LBMA

- Leveraging Technology to Modernise Gold

By Brian Lan, Managing Director, GoldSilver Central

- Vietnam’s Gold Market

By Huynh Trung Khanh, Vice Chairman, Vietnam Gold Traders Association

- Strong Institutional Demand Drives Gold Demand in Q1

By Andrew Naylor, Regional CEO, APAC (ex China) and Public Policy, World Gold Council

- How the Covid-19 Crisis Turned Into an Opportunity for Korea’s Gold Market

By Kay Lee, CEO, Wolgok Jewelry Foundation

- Thailand’s Gold Market Updates

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Digital Gold and the Latest Updates in the Industry

By Jeffrey Premer, CEO, Vaultex & Simon Sywak, COO, Vaultex

- SBMA News

By SBMA

Thailand’s Gold Market Updates

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

PAWAN NAWAWATTANASUB is the CEO of YLG Bullion Singapore and the CEO and founder of YLG Bullion International. She has almost 40 years of experience in the jewellery industry and established YLG in Thailand in 2003. In 2012, she brought YLG to Singapore. She sits on the Board of Directors of the Thailand Gold Traders Association, and is a SBMA Committee member.

Our last two articles (published in Crucible #17 and #19) highlighted the challenges and problems Thailand’s bullion industry faced while navigating the Covid-19 crisis.

In fact, even before the pandemic started, our records showed a downward trend in physical gold demand from 2015 to 2019 (2015: 90.2 tonnes; 2016: 81.5 tonnes; 2017: 75.4 tonnes; 2018: 80.6 tonnes; 2019: 46.5 tonnes). Subsequently, experiencing the full impact of the Covid-19 in 2020, the country witnessed a massive wave of physical gold disinvestment.

Throughout 2021, Thailand moved from net disinvestment to net positive investment due to the combination of a lower gold price and continued economic recovery. Annual gold consumer demand reached 36.7 tonnes, compared with net selling of 81.5 tonnes in 2020.

In 2022, while higher local gold prices and the Omicron surge have prompted many Thai investors to hold back their gold purchases, the government maintained its GDP growth outlook at 3.5–4.5% for the year. Moreover, as travel restrictions are relaxing globally, there is optimism that the Thai tourism industry will soon recover. Hence, we can expect a modest increase in Thai gold consumption for this year, provided that gold price stays under the US$2,000 per ounce level.

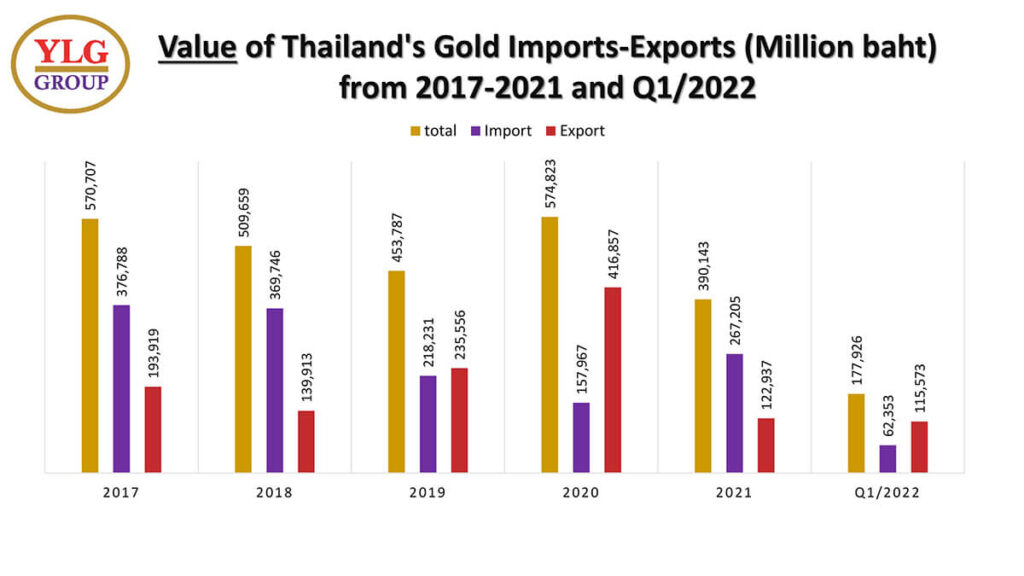

Typically, the volume of gold imports and exports depend on the movement of gold prices. In 2020, the country exported 243.795 tonnes of gold, an increase of 42.63% from 170.925 tonnes in 2019. Meanwhile, imports plummeted -15.51% to 132.979 tonnes. The rise of gold exports was a result of continued growth in the gold price globally during the year.

A falling gold price is a factor that stimulates the buying of gold among investors, who hope to profit from future price appreciation. As a result, the quantity of imports has increased. Evidently, in 2021, the country’s gold imports rose roughly 14% to 151.466 tonnes. Meanwhile, exports slumped by -71.17% to 70.289 tonnes of gold.

The main destinations of gold exports from Thailand in 2021 were Singapore (43%), Switzerland (17%), Hong Kong (13%) and Australia (5%), according to Thai customs data. On the other hand, the main sources of Thailand’s gold imports in 2021 were Switzerland (46%), Hong Kong (23%), Australia (9%) and Singapore (6%), as per Thai customs data.

All imports and exports of gold are VAT exempt. The standard rate of VAT is 10%, but the rate is currently reduced to 7% until 30 September 2023. Corporate tax is 20%.

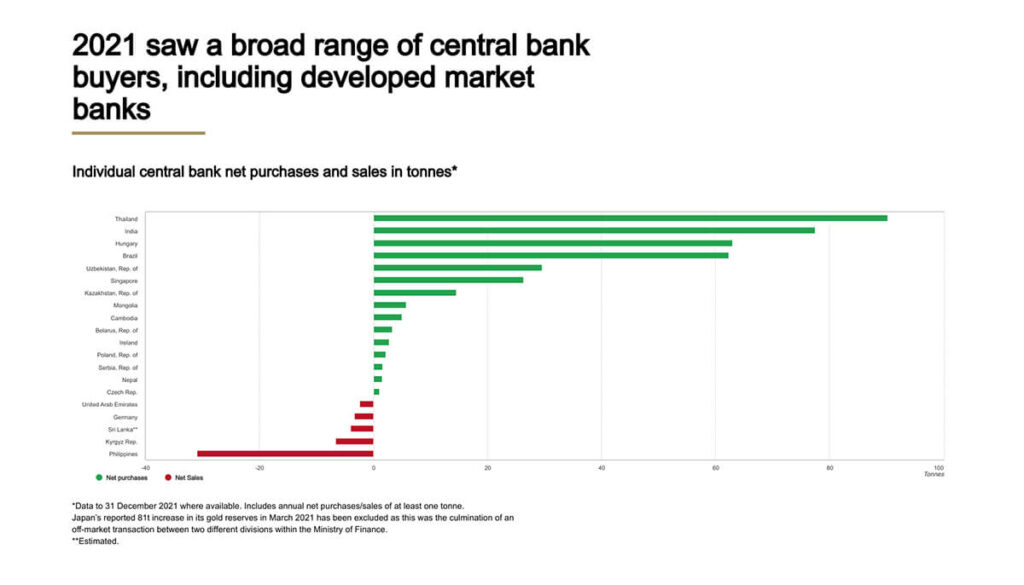

Interestingly, according to the World Gold Council, the Bank of Thailand, the country’s central bank, was the largest buyer of gold in 2021. As a result, its gold reserves grew by 59%, from 90 tonnes to 244 tonnes, as it last bought gold in 2017. As a matter of fact, gold accounted for 6% of Thailand’s total reserves, the highest tonnage level recorded.

According to Bank of Thailand Governor Sethaput Suthiwartnarueput, gold achieves the critical objectives of reserve management, which include security, return, diversification and tail risk hedging.

In Thailand, the popular choice of physical gold investment is the traditional baht bars in various weights and shapes such as square, oval, round, rectangular, biscuit, boat and doughnut, with a purity of 96.5% & 99.99%.

Alternatively, many savvy domestic investors also trade gold futures via the Thai Futures Exchange (TFEX). The 50 Baht Gold Futures contract was launched in 2009. Since then, the good response to the contract has led the exchange to launch a smaller sized 10 Baht Gold Futures contract in 2010.

The TFEX gold futures contract is a non-physical delivery contract. It is cash-settled upon expiry based on a final settlement price that is derived from the London AM Fixing price for Loco London and the USD/THB fixing price (16.30 hrs. Bangkok time) on the last trading day.

To date, there are more than 7,000 gold shops and goldsmiths spread across numerous provinces around Thailand. However, many of these retail outlets and gold shops are relatively small-scale operations with limited capacity to handle large trading volumes. This situation is especially apparent after a sudden overnight movement in the international gold price.

As such, the larger flow of the activity will eventually have to channel to reputable and large-sized wholesale gold traders. However, there are only a few Thai gold trading firms that can handle substantial trading volumes, such as YLG Bullion International. And these wholesale gold traders have been actively trading in the domestic and international markets for more than two decades.

In Thailand, there are some regulatory requirements to fulfil before any gold traders can start importing and exporting gold. These gold traders must have already registered and fulfilled specific business requirements under the Ministry of Commerce, Revenue Department and Custom department.

Also, these traders must be a member of the Thai Gold Traders Association, which has significant influence in the domestic market. It represents the entire bullion community, often communicating with respective government agencies on trade regulations and policy implementation.

Summary

Gold has always been well-liked by the Thai people. And the traditional values of saving for rainy days has not been forgotten, even during crisis periods. This attitude to saving is also why in 2021, Thailand bounced back with a reasonable demand after disinvestment in the previous year.

Globally, we have witnessed runaway inflation as pent-up spending demand, coupled with supply chain disruption, pushed prices up. Furthermore, the ongoing war in Ukraine is also causing many economic shocks and impacts. Under these circumstances, gold will continue to be well sought after because of its safe haven and inflation hedging qualities. Therefore, we remain very bullish on physical gold investment in Thailand in the foreseeable future.

PAWAN NAWAWATTANASUB is the CEO of YLG Bullion Singapore and the CEO and founder of YLG Bullion International. She has almost 40 years of experience in the jewellery industry and established YLG in Thailand in 2003. In 2012, she brought YLG to Singapore. She sits on the Board of Directors of the Thailand Gold Traders Association, and is a SBMA Committee member.