Navigate

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

- India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

- India to See Strong Uptick in Jewellery Demand

By Chirag Sheth, Principal Consultant, Metals Focus

- Renminbi Internationalisation and its Effects on Gold

By Chinese Gold and Silver Exchange

- Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

- Thailand’s Crucial Role in the ASEAN Gold Market

By Nuttapong Hirunyasiri, CEO, MTS Gold Group

- Thailand: Gold Provides Liquidity Amid Pandemic

By Pawan Nawawattanasub, CEO, YLG Bullion International

- #SilverSqueeze – What Actually Happened and Why it Didn’t Work Out as Planned

By Brian Lan, Managing Director, GoldSilver Central

- Japan Exchange Group: Reinventing Japan’s Precious Metals Derivatives Market

By Ryoichi Seki, General Manager, Business Development, Osaka Exchange

- Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

- India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

- India to See Strong Uptick in Jewellery Demand

By Chirag Sheth, Principal Consultant, Metals Focus

- Renminbi Internationalisation and its Effects on Gold

By Chinese Gold and Silver Exchange

- Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

- Thailand’s Crucial Role in the ASEAN Gold Market

By Nuttapong Hirunyasiri, CEO, MTS Gold Group

- Thailand: Gold Provides Liquidity Amid Pandemic

By Pawan Nawawattanasub, CEO, YLG Bullion International

- #SilverSqueeze – What Actually Happened and Why it Didn’t Work Out as Planned

By Brian Lan, Managing Director, GoldSilver Central

- Japan Exchange Group: Reinventing Japan’s Precious Metals Derivatives Market

By Ryoichi Seki, General Manager, Business Development, Osaka Exchange

- Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

Published on April 10, 2021

Contributor ROSS ANDREW FRIEDMAN is a consultant who is currently based in Bangkok. He has worked in the precious metals industry since 2014 covering the Greater China, LATAM & ASEAN region.

Physical gold is a popular asset in Asia, and this is no different in Thailand, the continent’s third-largest gold market after India and China. Locals use physical gold as an investment and as well as ornament, and the metal is a popular gift for newborns and for weddings.

In Thailand, the standard fineness of gold is 96.5% purity, commonly referred to as 23K, often bought in the form of jewellery, gold bars or coins. Baht is not only the local currency but also the standard gold unit, equivalent to 15.244 grams or 0.4901 troy ounces. Thai gold is also measured in salung, which is a smaller unit compared to baht, where 1 salung is 0.25 baht, or 3.81 grams.

DOMESTIC DEMAND AND PRODUCTION

Global physical investment in 2019 dropped by a fifth to a low for the decade. East Asia accounted for the bulk of the decline in demand, which fell by 36%, of which Thailand comprised a significant portion, along with China and Japan.

The total physical investment demand in Thailand in 2019 fell by 49% from the previous year to 34.7 tonnes, according to Metals Focus. The Bank of Thailand, the country’s central bank, holds 154 tonnes of gold in its reserves.

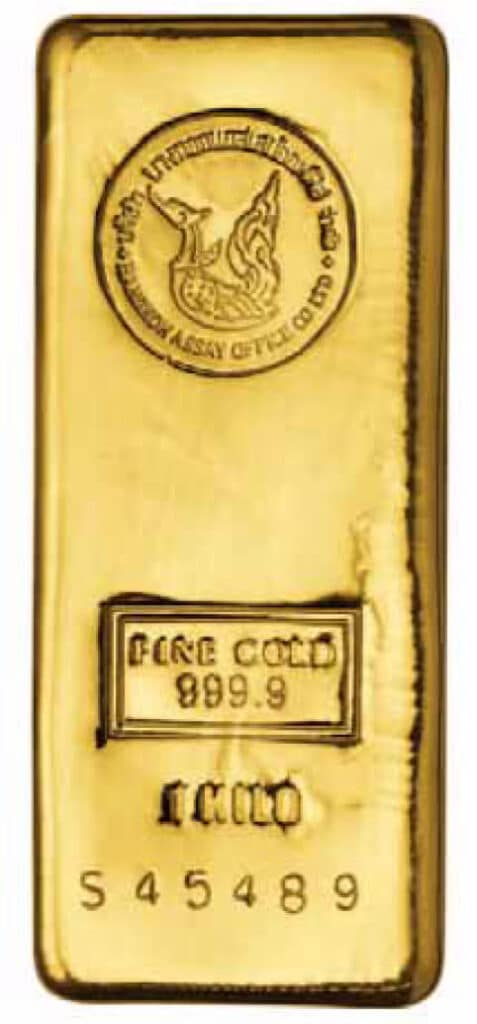

There are nine local gold bar manufacturers that are members of the Thai Gold Traders Association. They manufacture normal investment baht bars, traditional baht bars (in biscuit, square, oval, round, rectangular, boat, and doughnut shape), and innovative thematic bars with a purity of 96.5% (23K) as standard, and also 99.99% (24K).

Additionally, paper gold is available in Thailand, including the 50 Baht Gold Future contract and exchange-traded funds (ETFs), listed on the Stock Exchange of Thailand. Such market activities are well-supported by the members of the Gold Traders Association of Thailand.

GOLD INFRASTRUCTURE

Despite being overshadowed by the larger gold markets of China and India, Thailand boasts a developed and healthy gold market of its own, which is supported by strong domestic demand and well-developed trading and sales infrastructure with its neighbouring countries. Thailand also has larger physical market than any of its regional neighbours, including Vietnam, Malaysia and Singapore.

As countries in the region have the potential to grow economically, there is room for the Thai gold market to grow as a regional centre. Thailand has active Free Trade Agreements with Japan, South Korea, China, India, Australia, New Zealand as well as Chile and Peru – two Latin American countries that are rich in precious metals. No doubt, Thailand plays an important role in connecting countries in the the Asian gold belt.

ROOM TO GROW

The industry was pleasantly surprised when customs duty on precious metals (both bullion bars and dore) was reduced on February 1, 2021. Accordingly, the effective import duty on gold, silver, platinum and palladium bullion bars was reduced from 12.875% (basic customs duty/BCD of 12.5% + higher education cess/SWS of 3% on BCD) to 10.75% (7.5% BCD + 10% SWS on BCD + 2.5% Agricultural Infrastructure Development Cess/AIDC) of the assessable value. In order to maintain the differential between standard bullion and dore, the customs duty for gold dore bar and silver dore bar was cut to 6.9% from 11.85% and to 6.1% from 11% respectively. It is widely believed that lower import duties will make illegal imports less attractive and promote organised business.

APPENDIX

Currency Import and Export Restrictions Related to Gold Trading in Thailand

An importer may purchase or withdraw foreign currencies from their own foreign currency accounts for import payments upon submission of supporting documents. Alternately, importers may use letters of credit, which may be issued without authorisation, to guarantee trades. By law, export proceeds of US$50,000 and above shall be repatriated immediately after payment is received and within 360 days from the export date. The proceeds must be sold to or deposited in a foreign currency account with an authorised bank in Thailand within 360 days of receipt.

10 Baht Bars

Oval / Square / Round / Boat / Doughnut

Kilobar from Bangkok Assay Office

Thailand Economic Data (2019)

| Thailand | 2019 |

| Population | 67.9 million |

|---|---|

| Economic Growth | 2.4% |

| GDP | US$545 billion |

| GDP/P | US$8,021 |

| CPI | 0.9 |

| Exports | US$243 billion |

| Imports | US$216 billion |

| External Debt | 31.6% of GDP |

HS Code:

HS71081100: Non-Monetary gold in powder

HS71081210: Non-monetary gold in lumps ingots or cast bars

HS71081290: Non-monetary gold in other unwrought forms

HS 71081300: Non-monetary gold in semi-manufactured forms

Important Links

- Ministry of Commerce – https://www.moc.go.th/index.php/moc-english.html

- Revenue Department – https://www.rd.go.th/english/index-eng.html

- Customs Department – http://customs.go.th/index.php?lang=en&

- Central Bank of Thailand – https://www.bot.or.th/English/Pages/default.aspx

- Ministry of Finance – http://www2.mof.go.th/

- Thai Gold Traders Association – http://www.goldtraders.or.th/

Contributor ROSS ANDREW FRIEDMAN is a consultant who is currently based in Bangkok. He has worked in the precious metals industry since 2014 covering the Greater China, LATAM & ASEAN region.