Navigate

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- The Effects of Covid-19 on Australia’s Precious Metals Market

By Bron Suchecki, Senior Precious Metals Project Analyst, Pallion

- Will Covid-19 Slow Gold Production in Russia?

By Sergey Kashuba, Chairman, Union of Gold Producers of Russia

- Consumer Behaviour Towards Gold Jewellery in Indonesia

By Jennifer Heryanto, Chief Executive Officer, SKK Jewels

- Korea’s Gold & Jewellery Market

By Da Young Kim, Senior Researcher, Wolgok Jewelry Research Center

- Feature | Gold Rush 2.0: Australia to Become World’s Biggest Gold Producer

By Shae Russell, Chief Editor, The Daily Reckoning Australia

- Special Focus | Japan Bullion Market Association

By Bruce Ikemizu, Chief Director, Japan Bullion Market Association

- Global Overview of Precious Metal Logistics

By Allan Finn, Director of Global Commodities, Malca-Amit

- Gold Demand Trends and The Impact of Covid-19

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- Road Toward $2,000+ Gold Set to Be a Bumpy One

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- The Effects of Covid-19 on Australia’s Precious Metals Market

By Bron Suchecki, Senior Precious Metals Project Analyst, Pallion

- Will Covid-19 Slow Gold Production in Russia?

By Sergey Kashuba, Chairman, Union of Gold Producers of Russia

- Consumer Behaviour Towards Gold Jewellery in Indonesia

By Jennifer Heryanto, Chief Executive Officer, SKK Jewels

- Korea’s Gold & Jewellery Market

By Da Young Kim, Senior Researcher, Wolgok Jewelry Research Center

- Feature | Gold Rush 2.0: Australia to Become World’s Biggest Gold Producer

By Shae Russell, Chief Editor, The Daily Reckoning Australia

- Special Focus | Japan Bullion Market Association

By Bruce Ikemizu, Chief Director, Japan Bullion Market Association

- Global Overview of Precious Metal Logistics

By Allan Finn, Director of Global Commodities, Malca-Amit

- Gold Demand Trends and The Impact of Covid-19

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- Road Toward $2,000+ Gold Set to Be a Bumpy One

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- SBMA News

By Albert Cheng, CEO, SBMA

Road Toward $2,000+ Gold Set to Be a Bumpy One

By Bart Melek, Global Head of Commodity Strategy, TD Securities

Published on June 10, 2020

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations. Previous to joining TD, Bart was a global commodity strategist and senior economist at another major global financial institution.

Spot gold has more than rebounded from the mid-March Covid-19 driven collapse and is now trading in a range near $1,700/oz. The yellow metal rallied along with risk assets following the reduction of extreme volatility, after the United States (US) Federal Reserve and other central banks announced measures to provide potentially unlimited support to credit markets and governments around the world provided countless trillions of dollars in fiscal support to keep consumers and corporations solvent.

However, before prices move into a significantly higher range, a drift lower is a significant risk. Somewhat higher real interest rates amid reduced systemic risk, the Fed’s commitment to positive policy rates, transitory disinflation, a firm USD, ample availability of physical metal to deliver against Comex futures (which may soften the “gold shortage” narrative, albeit misplaced) and a firm appetite for equities are all reasons why the yellow metal may straddle the lower bound of the trading range before surging higher.

The resumption of a downward trend in real rates, which remain in negative territory, along with a low cost of carry and concerns surrounding fiat currency debasement as skyrocketing debt makes various forms of debt jubilee appealing in some circles, likely mean the gold price could test TD Securities’ target of $2,000+/oz in the latter part of 2021. A normalising global economy and the fraying of global supply chains in the aftermath of the coronavirus crisis likely mean that policy rates will continue to be set below the rate of inflation. This, along with monetisation pressures, as fiscal deficits surge in the US and across the world, should see investors choose the yellow metal as protection.

A NORMALISING GLOBAL ECONOMY AND THE FRAYING OF GLOBAL SUPPLY CHAINS IN THE AFTERMATH OF THE CORONAVIRUS CRISIS LIKELY MEAN THAT POLICY RATES WILL CONTINUE TO BE SET BELOW THE RATE OF INFLATION.

ENVIRONMENT NOT RIPE FOR BREAKOUT TO HIGHER RANGE

Gold has rallied along with risk assets, as volatility dropped from record levels, following the end to the dash-for-cash which included aggressive selling of the yellow metal during the worst of Covid-19 market instability. The reversal came after the Fed announced measures to provide unlimited liquidity to support public and private fixed income markets and as the market was convinced the US Treasury and other governments will introduce a stimulus package worth trillions of dollars designed to provide funds to stabilise household and business balance sheets that have been beaten down by the coronavirus outbreak.

After declining for some two weeks, which prompted many investors to question gold’s safe-haven bona fides, the metal started to see a resurgence, as the pressures to grow dollar positions eased. Once the funding stresses that drove prices lower alleviated further, as the Fed and other key central banks monetise Covid-19 related market dysfunctions and major governments spend trillions of borrowed money to fortify stressed households and corporates, such that liquidity problems don’t morph into a solvency crisis, investors pivoted their focus towards gold as a hedge again.

Normalising liquidity conditions, negative real rates, low cost of carry and concerns surrounding fiat currency debasement, not unlike which were present post-global financial crisis period, were all important in generating gold’s outstanding performance to make it the best performing major asset class.

However, after a very strong March and April, which saw spot prices surge some 20% off the Covid-19 induced lows, gold has had a few bad days in late April and early May, and has now stalled in a narrow trading range near $1,700/oz. The recent market disappointments in the policy narrative by the European Central Bank (ECB) and the German Federal Constitutional Court’s landmark decision that the ECB’s current quantitative easing bond purchasing program conflicts with German basic law was one of the major catalysts prompting a pullback of investor interest away from the yellow metal.

Figure 3 : Economic weakness suppressing inflation, lifting real rates — keeping gold in the lower bound of the range for now

Figure 4 : Liquidity takers exacerbate intraday momentum amid shallow markets

Figure 5 : Ample amounts of gold in registered inventories

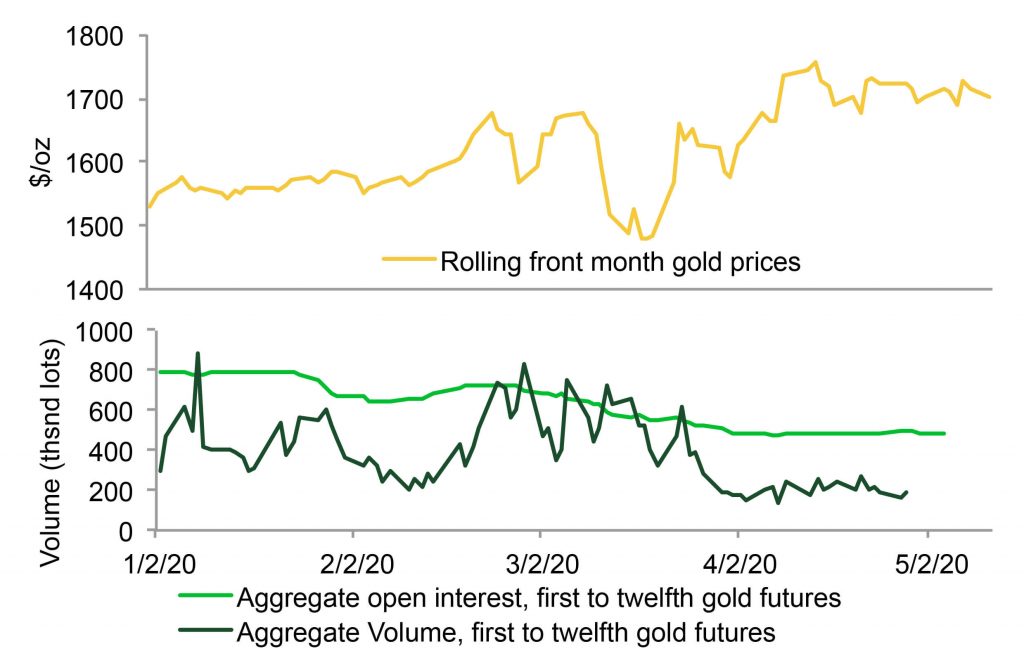

Figure 6 : Open interest continues to wane amid low volume despite bullish narrative

LOW REAL RATES, CURRENCY DEBASEMENT CONCERNS AND SKYROCKETING DEBT POSITIVES LONGER-TERM UPSIDE CATALYSTS

Once the post Covid-19 economic trajectory is well defined and health issues are managed with some certainty, the economy should have a good base to start a sustained recovery, albeit a prolonged one given the massive dislocation and insolvencies faced by small business and individuals. Negative real interest rates will likely be the order of the day for a long time, which make gold relatively cheap and desirable to hold in absolute and relative terms.

And, since it is no one’s liability, which is quite opposite to the government paper that will be issued to support all the spending needed by the trillions to fund the various stability programs throughout the G7, gold has a clear path towards $2,000+/oz.

There is strong evidence that gold performs well when debt is skyrocketing. And, debt is at a record high, with a very high probability it will reach much higher levels. We can only hope it does not go out of control, forcing aggressive monetisation.

To avoid sudden deleveraging, rates must be kept low and liquidity high, including central bank purchases (or quasi-monetisation). Thus far and in the post great recession central bank interventions, inflation only manifested in financial assets, but it did not move into the sphere of real goods and services as was feared – likely due to the cyclical components but also due to structural components such as globalisation, demographics and technology.

THERE IS STRONG EVIDENCE THAT GOLD PERFORMS WELL WHEN DEBT IS SKYROCKETING. AND, DEBT IS AT A RECORD HIGH, WITH A VERY HIGH PROBABILITY IT WILL REACH MUCH HIGHER LEVELS.

DEBT A MANA FOR THE YELLOW HEDGE

With the coronavirus fiscal response in full swing, the global debt burden is set to rise dramatically in 2020; gross government debt issuance soared to a record high of over $2.1 trillion in April, more than double the 2017–19 average of $0.9 trillion.

As social distancing and sheltering-in-place became the norm across most mature economies, the current global recession will begin with $87 trillion more in global debt than at the onset of the 2008 financial crisis driven slowdown. Based on Institute of International Finance (IIF) data, using a simple top-down projection, if net government borrowing doubles from last year’s levels – and there is a 3% nominal global economic contraction (which could be significantly worse) – the world’s debt is set to surge from 322% ($255 trillion) of GDP to over 342% ($263 trillion) this year.

To stimulate employment, it is likely that the Fed and other key central banks will keep rates low for longer and will no doubt be very pragmatic in how they respond to an inflationary drift higher in order to avoid a deleveraging. Given the massive amount of global debt, markets will worry about monetisation and purchasing power debasement via the use of negative rates for a prolonged period. Considering it has been a challenge to hit inflation targets for so long, it’s almost a given that that central bankers will not worry if core inflation moves above the 2% target touted by most central banks in some form for a while.

The current price range near $1,700/oz or a sell-off in the near-term should be considered temporary, with the previously discussed bullish macro factors eventually set to take charge. Further, the fact that some 6 million oz of annualised mining gold production is shutdown due to Covid-19 measures and lingering logistical issues making physical shipments extremely hard, will likely serve as additional catalysts moving the price toward $1,900/oz before the yellow metal reaches escape velocity toward a $2,000+ handle next year.

Figure 7 : Gold targeting historic high longer-term

Figure 8 : A bullish outlook with no bulls in sight

Figure 9 : Outsized net decline in GDP implies lots of slack and a very accommodative Fed policy for prolonged period

Figure 10 : Covid-19 to see world’s debt surge to 342% in 2020

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations. Previous to joining TD, Bart was a global commodity strategist and senior economist at another major global financial institution.