Navigate

Article List

- Vietnam’s Gold Market

By SBMA

- What is Hallmarking and Why is it Important?

By Ng Siew Hua, Chief Assayer, Singapore Assay Office

- Bullion’s Appeal to Singapore’s Mass Market

By Ernest Kwek, Executive Director, SK Bullion

- Meeting the Needs of Gold Investors Today

By Ryoichi Seki, General Manager, Global Business Development, TOCOM

- Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

- Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Vietnam’s Gold Market

By SBMA

- What is Hallmarking and Why is it Important?

By Ng Siew Hua, Chief Assayer, Singapore Assay Office

- Bullion’s Appeal to Singapore’s Mass Market

By Ernest Kwek, Executive Director, SK Bullion

- Meeting the Needs of Gold Investors Today

By Ryoichi Seki, General Manager, Global Business Development, TOCOM

- Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

- Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

- SBMA News

By Albert Cheng, CEO, SBMA

Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

Published on September 25, 2017

William Fyfe is Head of LME’s Singapore office. The Singapore team cover the Asia Pacific region excluding Greater China, engaging with users of the LME Base, Precious and Ferrous metal contracts. Prior to joining LME, William worked for the commodity and futures broking arms of Societe Generale, HSBC and Jefferies in Hong Kong, Singapore and Taiwan.

LMEprecious is a new initiative created by the London Metal Exchange (LME), the World Gold Council and a group of leading industry players to introduce exchange-traded, loco London precious metals products. LME Gold and LME Silver futures provide new opportunities for trading, price discovery and risk management, creating an enhanced market structure for the precious metals community, explains William Fyfe.

The London bullion market is the world’s oldest and most established gold trading and risk management centre, and has remained largely unchanged for centuries. However, the London market has been facing unprecedented change over the past decade, with regulation coming into force that fundamentally changes the behaviour of market participants and the economics of their businesses.

LME is the principal global exchange for metals trading and price discovery. LME used to provide the London gold and silver forward curves to the market based on information provided by major market participants to aid pricing in the market. As the regulatory landscape evolved and as other markets became embroiled in scandals, provision of pricing on this basis became untenable, seeing the end of provision of such curves to the market.

As the approach to benchmarks and reference prices changed under new regulation, LME was awarded the administration of the LBMA London Platinum and Palladium Prices (“LPP”), which it has successfully administered since 1 December 2014 on a customised auction platform, LMEbullion. As a Recognised Investment Exchange (RIE), LME is regulated by the UK Financial Conduct Authority (FCA) and has been at the heart of the evolution of regulation of derivatives markets and metals markets. Since the financial crisis, the direction of global financial regulation has been to encourage a migration of bilaterally traded products towards centrally cleared and exchange traded venues.

The London bullion market has been slow to adapt, with business still largely conducted bilaterally. Recent years have seen the closure of numerous prominent precious metals desks in London, impacting traded volumes, bid/ask spreads and liquidity. As new regulations come into force, pressure on the bilateral model and associated costs of capital are increasing. LME recognises that OTC trading will be uneconomic for many and the justification for committing capital against bilateral credit lines will become harder.

The G20 has committed to promote central clearing by providing economic incentives to clear via a central counterparty clearing house (CCP) in order to reduce systemic risk in financial markets and to support fair and transparent markets.

To this end, LME has been working with a group of leading industry participants that are committed to providing a London based centre of liquidity to reinvigorate the market, remove barriers to trading based on counterparty credit lines and establish transparency in a forward curve that stretches out to five years. Goldman Sachs, ICBC Standard Bank, Morgan Stanley, Natixis and Societe Generale and OSTC have invested in LMEprecious, providing exchange traded and cleared futures contracts in loco London gold and silver. They have provided significant market expertise during the development of the contracts and have been providing liquidity since its launch.

Offering daily and monthly futures for both gold and silver, LMEprecious gives market participants greater choice, updating the gold and silver markets to better reflect the needs of global market players. We believe that LME’s existing structure and experience in the base metals markets gives us a strong basis for building out the precious metals trading environment.

LME’s market structure and pricing are designed to ensure that it supports the OTC market. In particular, LME’s inter-office trade structure allows trades to be negotiated on an OTC basis, but then brought-on to LME under the rules of the Exchange. Unlike other exchanges, LME does not discriminate against such activities by imposing either a block trade threshold (i.e. trade sizes as small as one lot can be brought-on as a telephone trade), or by charging a larger fee for execution away from the central limit order book – indeed these trades benefit from a fee discount.

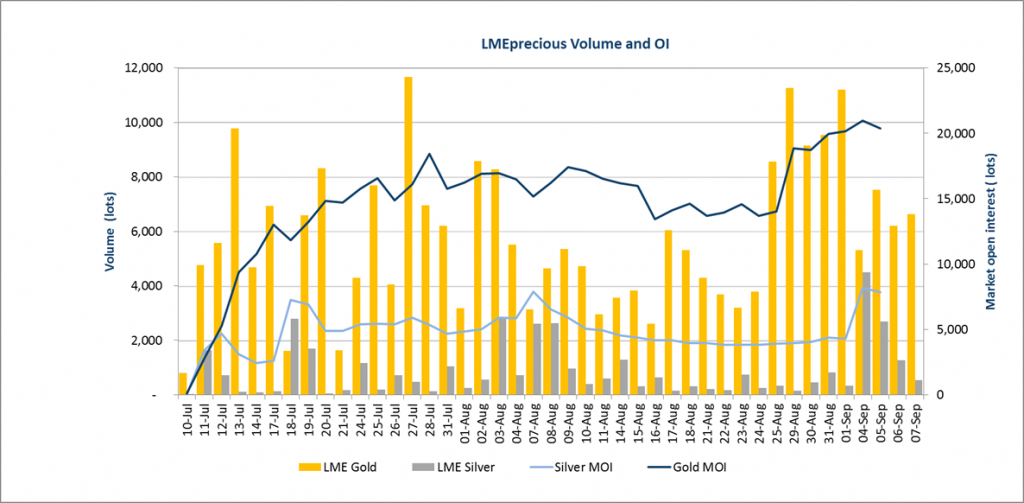

Since launching on 10 July 2017, volumes have been growing rapidly with open interest building along the curve. A total of 212,000 lots of gold (661 tonnes) and 28,500 lots of silver (4,431 tonnes) were traded up until the end of August. The combined weekly average daily volume (ADV) increased from 5,600 lots in week 1, to over 10,000 lots in week 8. Open interest has also had an impressive start with over 22,129 lots of gold and 3,642 lots of silver as of 6 September. This includes positions out to 3 years forward, which are is highly encouraging. On screen liquidity has been building with the spot order books for gold and silver typically US$0.20 and US$0.01 wide respectively, with significant volume either side.

From day one there has been liquid carry pricing in depth out to 5 years, this has provided a transparent real-time forward curve. Feedback from a range of precious market participants across the value chain has been very positive; this includes producers, refiners, banks and financial institutions. We have also seen healthy growth in on-screen carry liquidity, with sizable orders up to 2,000 lots per clip visible. This strong start demonstrates the appetite from the industry to trade on exchange and centrally clear, and is also an indication of the commitment from the industry to the LMEprecious initiative.

William Fyfe is Head of LME’s Singapore office. The Singapore team cover the Asia Pacific region excluding Greater China, engaging with users of the LME Base, Precious and Ferrous metal contracts. Prior to joining LME, William worked for the commodity and futures broking arms of Societe Generale, HSBC and Jefferies in Hong Kong, Singapore and Taiwan.