Navigate

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

ERMIN SIOW joined Poh Kong Jewellers as managing partner in 1989 and was appointed executive director when Poh Kong Holdings Bhd was listed on Bursa Malaysia in 2004. He was also the president of FGJAM from 2014 to 2018 and currently its advisor. He is also the council member of the ASEAN Gems and Jewellery Association (AGJA).

Malaysia is a relatively small country, with an area of about 300,000 square kilometres and a population of 33 million. In terms of Gross Domestic Product (GDP), the country ranks fifth in the Association of Southeast Asian Nations (ASEAN), with almost US$1 trillion in 2021. Malaysia also ranks third in per capita income within ASEAN, at about US$11,000. It is a multi-racial country, with Malays being the dominant race (65%), followed by Chinese (22%) and Indians (6%).

Gold Demand

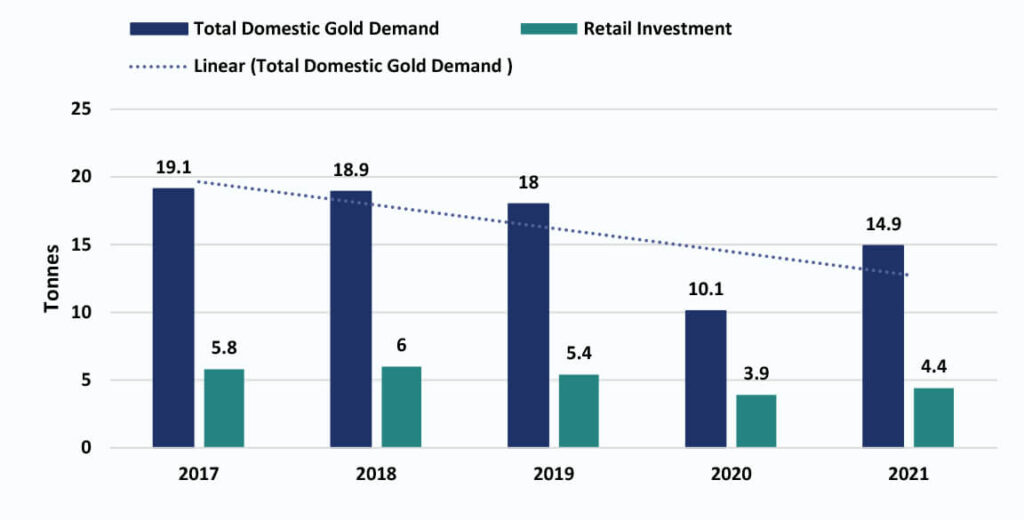

The country’s domestic gold demand ranks fourth among ASEAN countries, behind Indonesia, Vietnam and Thailand. According to Metals Focus, the domestic gold demand from 2017 to 2021 was as follows: 2017: 19.10 tonnes, 2018: 18.90 tonnes, 2019: 18.00 tonnes, 2020: 10.10 tonnes, 2021: 14.9 tonnes (fig.1).

As for retail investment, which is the purchase of gold wafers and gold bars for investment purposes, annual demand from 2017 to 2021 was as follows – 2017: 5.8 tonnes, 2018: 6.0 tonnes, 2019: 5.4 tonnes, 2020: 3.9 tonnes, 2021: 4.4 tonnes (fig. 1).

Fig. 1: Malaysia’s Gold Demand, 2017–2021 (Tonnes)

The figures quoted above reflect the consumption of “new gold”, not including scrap gold or old gold jewellery. It is common practice in Malaysia for consumers to trade in old gold jewellery for new pieces of gold jewellery. Assuming that 35–40% of the gold retail trade involves trade-ins, domestic gold demand would amount to approximately 25 metric tonnes annually.

Similar to Singapore, India and other Middle East countries, gold jewellery in Malaysia is primarily 22K or 916 gold fineness, with more than 90% of gold jewellery sold being 22K. Locals produce most, if not all, of the country’s 22K gold jewellery. There are more than 100 gold jewellery manufacturers, big and small, located mainly in the northern state of Penang. The country also has 24K yellow gold and 18K white gold on the market, with some imported from mainland China, Italy and Turkey.

Based on estimates, there are 3,500 to 4,000 gold jewellery outlets in Malaysia. Most retailers are single-shop operators, while a few chain-store operators have 40 to 100 stores each. Like other cities across Asia, it is common to find jewellery retail outlets located inside shopping malls. Plain gold jewellery probably takes up about 85%, if not more, of the total gold and gems jewellery market, similar to other Asian countries.

Gems And Gem-Set Jewellery

Like many other countries, the popular gems and gem-set jewellery are diamond, blue sapphire, ruby, and emerald. Jade and pearls are also popular, especially among the more affluent crowd. Based on estimates, the domestic market size for this segment is amounted to approximately US$500 million annually, with most high-end pieces imported from Hong Kong.

On the other hand, semi-precious stones like amethyst, topaz, and aquamarines are not as popular in the country, perhaps due to the lack of publicity or promotional activities. The recent introduction of lab-grown diamonds (LGD), being quite a hit in mainland China and the United States, has not gained popularity here. Most consumers, who are traditional, do not view LGD as a gem, and consider them to have no resale value. There was an initial fear that LGD may impact the diamond trade adversely, but it has not made any headway thus far.

Gold Jewellery Exports

Not many people, even those in the trade, are aware that Malaysia is a considerable gold jewellery exporter. Interestingly, Malaysia exports more gold jewellery (916) than it consumes locally.

The country has posted strong numbers in annual gold jewellery exports, save for a dip in 2020, owing to the COVID-19 pandemic (fig. 2).

Fig. 2: Value of Gold Jewellery Exports

Fig. 3: Quantity of Gold Jewellery Exports

The annual gold jewellery in tonnes is as follows: 2016: 35 tonnes, 2017: 31 tonnes, 2018: 34 tonnes, 2019: 30 tonnes, 2020: 14 tonnes and 2021: 33 tonnes (fig. 3).

The main export markets are the Middle East – mainly the United Arab Emirates (UAE), Singapore and Hong Kong.During the early ‘90s and the year 2000, Malaysia exported more than 50 metric tonnes of gold jewellery annually and was among the top five exporters globally. The decline in tonnage in recent years was caused by 1) more competition from other exporters, and 2) new production bases set up in the Middle East. The introduction of VAT in the UAE in 2019 also negatively impacted the country’s gold jewellery exports.

Trade During The Pandemic

Malaysia had its first lockdown from 18 March till 4 May 2020 – a total of 47 days. During this period, only essential services and businesses were allowed to operate. All gold retail outlets were closed, and factories had to stop their operations. There was another lockdown from 1 June to 16 August 2021, a total of 77 days. Similar to the first lockdown, gold and jewellery businesses were not allowed to operate.

Given the tremendous adverse effects of these lockdowns, the Malaysian government, fortunately, provided some financial support. During these two years, the country provided aid packages that amounted to RM530 billion (US$119.03 billion), including cash handouts and wage subsidies up to RM83 billion. The other indirect financial aid packages came in the form of loan moratoriums, loan guarantees, provident fund withdrawals, grants and soft loans for small and medium enterprises, and tax incentives, among the other measures introduced to support the recovery of the economy.

Moving Forward

The Federation of Goldsmiths and Jewellers Association of Malaysia (FGJAM) is the central and coordinating body of the gold and gems trade. It has 18 state-level associations with about 1,500 individual trade members, including retailers, wholesalers, manufacturers and bullion dealers.

The gold and gems industry will depend, among others, on the recovery of Malaysia and the global economies from the Covid-19 pandemic. As mentioned above, the economic stimulus packages provided by the government aided the recovery of Malaysia’s economy. Barring unforeseen circumstances, the country’s gold and gems industry will rebound in line with the economy, forecasted to grow around 4–5%.

ERMIN SIOW joined Poh Kong Jewellers as managing partner in 1989 and was appointed executive director when Poh Kong Holdings Bhd was listed on Bursa Malaysia in 2004. He was also the president of FGJAM from 2014 to 2018 and currently its advisor. He is also the council member of the ASEAN Gems and Jewellery Association (AGJA).