Navigate

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Is the Gold Run Over?

By Brian Lan, Managing Director, GoldSilver Central Services

- The Importance of Hallmarking Gold

By Eric Law, Vice President and Deputy General Manager, Singapore Test Services

- The Future of Futures Lies in Gold Perpetuals

By Asia Pacific Exchange

- New Era, New Opportunities

By Praveen Baijnath, CEO, Rand Refinery

- Silver to the Stratosphere

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Bringing Operational Efficiency to the Precious Metals Market

By Anoushka Rayner, Head of Growth, Commodities at Paxos, Paxos Trust Company

- The Changing Business Landscape in Southeast Asia Through the Lens of YLG

By Pawan Nawawattanasub, CEO, YLG Bullion

- SBMA News

By Albert Cheng, CEO, SBMA

Interview:

Martin Huxley

SBMA Chairman

By SBMA

Published on September 10, 2021

Martin Huxley, Global Head of Precious Metals, StoneX, will be stepping down from his role as SBMA Chairman later this year, after four years at the helm. In a wide-ranging interview with Crucible, he shares his journey in the precious metals sector, and his observations on its development in Singapore, alongside the challenges and triumphs during his tenure as chairman.

Martin, how did you get started in the business, and what brought you to StoneX and Singapore?

I have been active in the commodities markets since 1999; initially as a credit risk manager with Standard Bank in London, but later relocated to Hong Kong in 2004 as the Asia Head with the mandate to regionalise all approvals, monitoring and reporting. The majority of my time was dedicated to the natural resources sector and required me to travel extensively to visit clients and their operating assets. Our bullion trading activities were one of the many desks I was responsible for.

Having worked closely with the sales and trading desks, I later transferred into a Front Office role that straddled both the financing and trading activities of the bank. This remained focused on commodities; including financing to gold mines structured against physical offtakes, and prepayments to smelters/refineries in exchange for finished products.

In 2013, I was approached by StoneX and asked to head up its precious metal activities for the Asia region. I relocated at the start of 2014 and have not looked back. The growth in our business has been quite phenomenal, especially the last 5 years, and I was later appointed as Global Head of our precious metals business overseeing teams spread across 9 offices in 7 countries.

What were your goals/aims when taking on the role as chairman, and are you satisfied with the outcome?

Firstly, I would like to express my thanks to the Secretariat and our Management Team. Together, we maintain a diverse representation within the bullion industry and have achieved some amazing results building our profile; not just within Singapore, but across Asia Pacific, and the international market. I would of course also like to express my appreciation for the ongoing support from all our members.

In answering this question, I think it is important to recognise the resources that are available; and being realistic in what can be achieved, what are the priorities, and how we can deliver on them. Our overall goal has been to continue to build Singapore into a sustainable global precious metal hub, facilitating access to ASEAN and the wider APAC region, for both regional and international market participants.

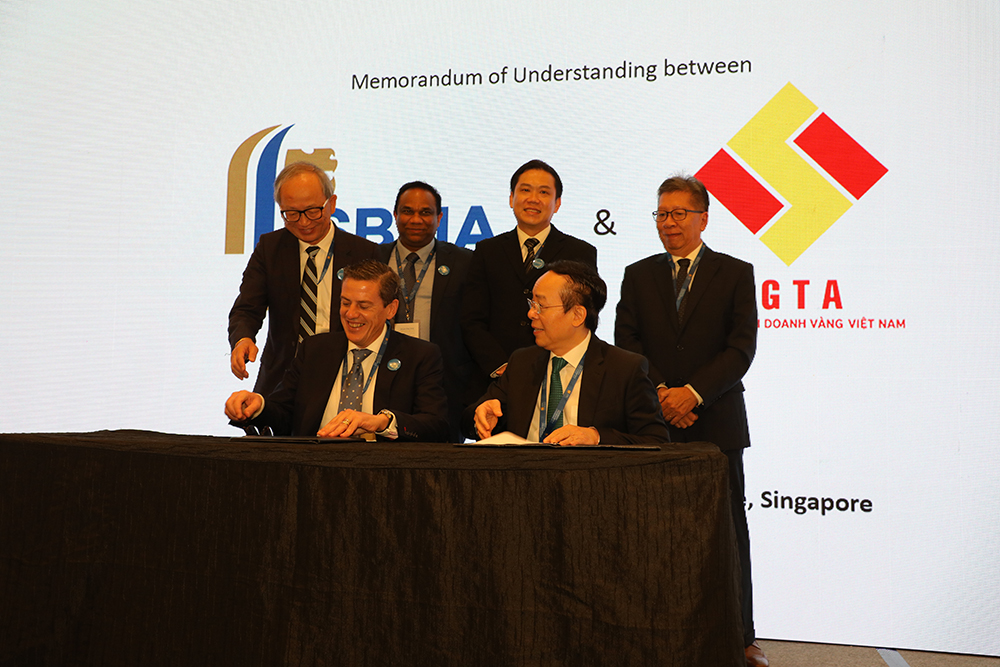

We focus on supporting and facilitating collaboration among our members, whilst seeking to expand and diversify our membership base. This is further complemented by networks we have established and continue to strengthen with prominent organisations such as LBMA, WGC, and CGSE. The Asia Pacific Precious Metals Conference, or APPMC, is of course a key part of the overall connectivity.

Am I satisfied with the outcome? The answer is unquestionably yes! I personally believe what we have achieved, and in a relatively short space of time over the last 5 or so years, has been quite remarkable.

There are other goals and long-term ambitions that we aspire to, but we have to be realistic in what we can deliver on a standalone basis. Lastly, we continue to pay close attention to technology advancements and initiatives and the potential involvement of SBMA.

What are some of the highlights/pivotal moments during your tenure as SBMA chairman?

We are an important global bullion trading hub. Physical gold movement in and out of Singapore reached new highs in 2020. In the last few years we have observed an increasing number of commodity trading companies, foreign fund managers, and financial institutions setting up a presence in Singapore.

APPMC would be the obvious standout. We launched our inaugural event in June 2017. As a non-profit organisation, we have limited financial and people resources, both of which presented challenges, and success, or even breaking even, is not guaranteed. Despite delivering and exceeding expectations, doubts remained after that first event as to whether this could be repeated and whether we could achieve our ambition of holding an annual flagship industry conference. Having overseen three subsequence conferences, I feel we have taken APPMC to another level and it is a huge compliment that many consider us alongside LBMA as the conferences of choice. APPMC is now a permanent fixture on the calendar in the second week of June. Fingers crossed, we can meet in person in June 2022.

The fact APPMC was able to adapt in 2021 to a virtual conference, at short notice, was another milestone; with an added bonus that we could accommodate a higher number of participating registered delegates versus a physical venue.

What have been your biggest challenges as Chairman of SBMA?

No prizes for guessing that this has to be the global pandemic and all the uncertainty that has resulted. Outreach, educational seminars, networking etc. has either slowed, or not been possible, and of course APPMC was cancelled in 2020 and moved to a virtual event this year.

Prior to that, industry consolidation and members exiting the market for strategic decisions had seen a decline in our membership base for the first time.

Both of these factors had implications on the overall financial sustainability of the SBMA, which was further compounded by the fact they occurred shortly after the expiry of a 3-year government grant. Prudent management, successful initiatives, growing profile, hard work, and attractiveness of Singapore as a bullion hub has, however, ensured that we are self-sufficient. Despite all the challenges, our revenue in 2021 will cover all expenditure, and without any change in our membership fees.

How has the role/focus of SBMA changed over the years?

The focus and mandate of SBMA in recent years has expanded considerably whereby we are widely acknowledged and recognised as a key “conduit” both within the region, but also for the global precious metal industry into ASEAN and vice versa. With our growing reputation and profile, we are observing healthy interest in new membership, especially over the last 18 months and when some may have expected this to slow as a result of the pandemic. Ten new members have been added during this period with a pipeline of further applications in progress. Our membership now extends to Singapore, Hong Kong, Malaysia, Vietnam, Thailand, Indonesia, Australia, South Africa, Turkey, Italy, USA, and UK.

Beyond serving our members, we are also privileged to be recognised as the voice of the bullion industry by regulators and market development bodies. We have benefitted strongly under the support and guidance of Enterprise Singapore (ESG), including a government grant that allowed us to take APPMC from aspiration to delivery. ESG remains closely involved in SBMA; as an observer/attendee at our regular management committee meetings, and a member of its Finance Committee. SBMA was also the industry body that Ministry of Law Singapore engaged with on the introduction, and subsequent ongoing monitoring/reporting requirements and considerations, for the Precious Metals Dealers Prevention of Money Laundering and Terrorism Financing Act.

What aspect of the industry excites you the most?

The extraordinary events surrounding Comex in March 2020 and physical being in the wrong place and wrong form are known to all. We have also had the West versus East conundrum for many years. There are no easy or quick fixes to these. However, digitalisation of the industry is something that is going to happen and it will help change the way in which we view gold as an asset (and no doubt other precious metals/commodities). This will help determine how, where, and when it is settled, how it can be used as collateral (greatly improving efficiency e.g. instant title transfer), DVP, etc.

As the benefits and mechanisms used to facilitate this new ecosystem are recognised and accepted, there is the potential for a new global pool of fungible liquidity to be created, which will help drive other positives; such as greatly reducing operational, settlement, and other risks.

What are you looking forward to?

One of the biggest enjoyments in my role with both SBMA and StoneX is travelling, meeting existing and new clients, engaging and feeling the local markets first hand. Having been stationery for the best part of 2 years I certainly look forward to being able to travel again.

With regard to the SBMA, I think if we can achieve the same level of success and progress of that in the last 3 years, it will be very respectable. With the network we are part of, we are very well placed to participate in future regional and global developments and initiatives.