Navigate

Article List

- How Geopolitics Could Make Singapore the World’s Most Important Gold Market

By Gregor Gregersen, Founder, Silver Bullion

- Why You Should Consider Investing in Platinum

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Connecting Asia to Global Market Opportunities

Feature: INTL FCStone

- Hedging Strategies with Gold Derivatives

By Jonathan Chan, Investment Analyst, Phillip Futures

- Entering the Singapore Precious Metals Market – An Insider’s Perspective

By Joshua Rotbart, Managing Partner, J. Rotbart & Co.

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- How Geopolitics Could Make Singapore the World’s Most Important Gold Market

By Gregor Gregersen, Founder, Silver Bullion

- Why You Should Consider Investing in Platinum

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Connecting Asia to Global Market Opportunities

Feature: INTL FCStone

- Hedging Strategies with Gold Derivatives

By Jonathan Chan, Investment Analyst, Phillip Futures

- Entering the Singapore Precious Metals Market – An Insider’s Perspective

By Joshua Rotbart, Managing Partner, J. Rotbart & Co.

- SBMA News

By Albert Cheng, CEO, SBMA

Hedging Strategies with Gold Derivatives

By Jonathan Chan, Investment Analyst, Phillip Futures

Published on June 1, 2017

Gold derivatives, such as gold forwards, futures and options, currently trade on various exchanges around the world and over-the-counter in the private market. In this article, Phillip Futures investment analyst Jonathan Chan explains how they work and why they are important, particularly given recent spikes in gold price volatility, driven by greater central bank interventions and heightened geopolitical risks.

Gold derivatives are financial instruments whose prices are derived from physical gold. The gold derivative itself is a contract between a buyer and a seller that wants exposure to the physical gold price. They have many useful applications, such as price discovery and price risk management, for those involved in the physical bullion business. In recent times, they have become more important, given the recent spikes in gold price volatility driven by greater central bank interventions and heightened geopolitical risks (Figure 1). This is a scenario we may continue to see in the days ahead.

Figure 1: GVX (CBOE/COMEX annualised gold volatility index)

Types of gold derivatives

Gold futures

Gold futures are financial contracts obligating the buyer to purchase gold or the seller to sell gold at a predetermined future date and price. Having future settlement dates means that future selling price and buying price of your physical inventory for your business can be hedged accordingly if you are of the view that prices may move against your favour. Futures prices are price efficient as they are expected to converge to the spot prices on the day the future contracts expire. These futures contracts are standardised to facilitate trading on a futures exchange with the quality and quantity of the gold specifically detailed. The advantage of using exchange-traded futures products is that any counterparty credit risk is almost negligible, as the derivative exchange will facilitate the transaction, settlement and collateral management of the traded contract. The most popular gold contract traded in US dollars is the COMEX Gold Futures, which is used to manage cash market price risk.

Hedging allows gold fabricators and dealers to lock in prices and reduces exposure to price risk.

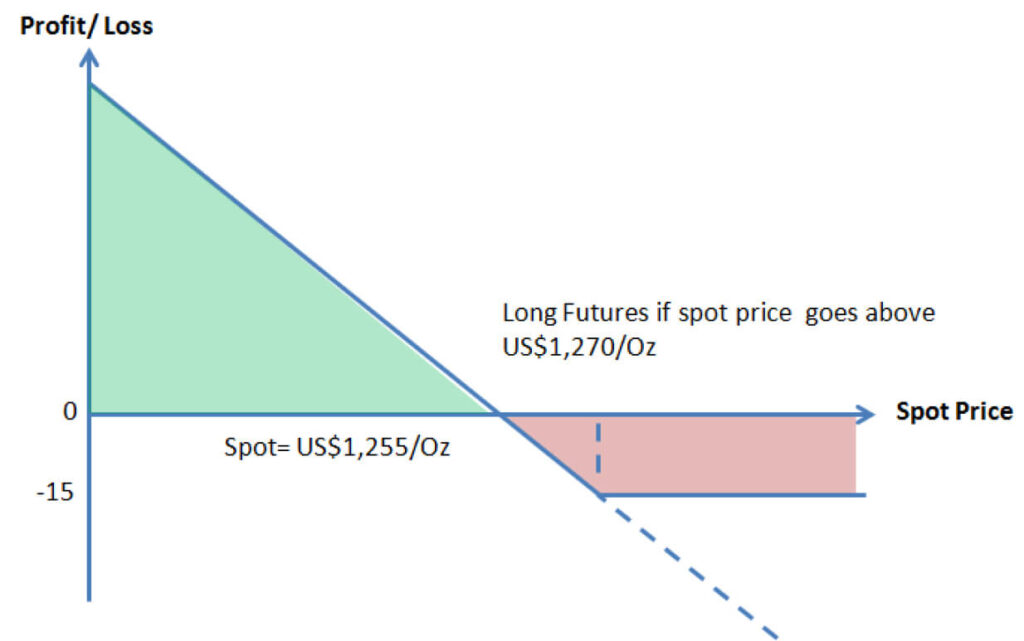

Hedging allows gold fabricators and dealers to lock in prices and reduces exposure to price risk. A gold smelting company that wishes to manage their input cost and can go long on gold futures to hedge against any upward movement in the cost of their gold inputs beyond US$1,270/oz. This long hedge would establish a fixed cost for the raw material (Figure 2).

Figure 2: Combined payoff of buying futures

Spot gold over-the-counter (OTC) contracts

The spot gold OTC price is the current price of a troy per ounce of gold that can be bought or sold for immediate cash settlement. It is also broadly known as the Loco London Spot. Trading is usually done directly between the two parties involved in the agreement. OTC markets trade around the clock, with trading done electronically or by telephone. There is no formal structure or centralised clearing through an exchange. Prices are usually quoted and traded against the US dollar. Generally, positions are maintained over time without any concerns over maturity. Each contract has a size of 100 ounces with a minimum bid unit of US$0.10 per troy ounce. Over the years this contract has served market participants well – it has been used by gold bullion dealers to hedge their physical inventory against fluctuating prices while allowing speculators to move in and out of the spot market with ease, yet still enabling investors to hold on to their positions for a long period of time without concerns about the maturity or delivery of physical gold.

The spot gold OTC price is the current price of a troy per ounce of gold that can be bought or sold for immediate cash settlement. It is also broadly known as the Loco London Spot.

Spot low leveraged gold contracts

Investors who are more risk-averse and do not prefer the high leverage of Loco London spot, can trade the Gold Direct Investment (GDI), which is the one of the newer low leveraged gold derivatives in the market. It has a higher relatively margin collateral as compared to spot gold, which virtually eliminates the risk of a margin call. It is designed as an affordable investment product with a contract size of a troy ounce of gold with a fineness of 995. Although the collateral needed to trade the GDI is only slightly less than the cost of a gold ETF or physical gold, it allows participants to short sell as well, unlike ETFs, and has no storage cost as compared to physical gold.

Gold options

Gold options are financial derivatives with pricing intrinsically linked to the price of gold. These derivatives are contracts that grant the right, but not the obligation, to buy or sell the underlying gold asset on or before a certain date. A call option is the right to buy and a put option is the right to sell. The option buyer would have to pay the seller an option premium to complete the transaction. Intrinsically, owning a call option gives you a long position in the market and for the seller of a call option a short position. Inversely owning a put option gives one a short position and selling a put is a long position.

Advantages of options over futures are its smaller cash outlay and greater flexibility in selecting the price at which to hedge from. When buying options, one is only required to pay the option premium, which represents a small percentage of the notional to be hedged. For options, one has the advantage of selecting the price to hedge the physical gold position against, while for futures, one can only accept the price that is quoted by the market at any point of time.

Advantages of options over futures are its smaller cash outlay and greater flexibility in selecting the price at which to hedge from.

Options are often used by miners wanting to lock-in and secure a minimal selling price. Miner X wishing to secure US$1,240/oz for its gold production in the month of October 2017 would buy gold put options to hedge against any downward price risk. With spot gold trading currently at US$1,255/oz, the cost or premium of put options with a strike of US$1,240 is US$0.24/oz (Figure 3).

Figure 3: Production and put options payoff

The put options thus permit the miner to cover the forward risk of falling prices and the hedge enables it to carry his inventory until October 2017. If gold prices do fall, the mining company would have minimised its loss due to the protective cover of the options.

Advantages of gold derivatives

Most gold derivatives, especially Loco London Spot Gold, are highly liquid trading instruments that are easily accessible electronically or with a phone call at anytime of the day. Transaction costs are low and investors can tailor leverage according their risk appetite. Gold is also priced in multiple currencies, which allows for arbitrage opportunities. As a result of the fluctuation in the USD/JPY currency pair, gold is often mispriced in Japan as compared to the United States, and traders can utilise gold futures traded on TOCOM and COMEX to profit from this gold price anomaly.

Jonathan Chan is an investment analyst with Phillip Futures. He covers the commodity space, primarily focusing on precious metals and energy derivatives. He has written for or has been quoted by the following media outlets: CNBC, Reuters, Wall Street Journal, Channel NewsAsia, The Business Times, The Straits Times, Today Newspaper and S&P Global Platts. Prior to joining Phillip, he held roles in Global Markets and Market Risk in banks. Jonathan holds a Master’s degree in Economics from National University Singapore (NUS) and a Bachelor’s degree with honours in Economics from Nanyang Technological University (NTU).