Navigate

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- Hong Kong & China Q1 Market Update

By Jeremy East, Senior Representative for the Asia Region, London Bullion Market Association

- Gold in the Time of Coronavirus

By Nikos Kavalis, Founding Partner, Metals Focus

- Covid-19: Potential Impacts on China’s Economy and Gold Market

By Ray Jia, Research Manager, World Gold Council

- Protecting Your Portfolio Against Covid-19

By Joshua Rotbart, Founder and Managing Partner, J. Rotbart & Co.

- Covid-19’s Impact on Singapore’s Physical Retail Gold Market

By Loh Mun Chun, Director, GoldSilver Central

- A Snapshot of the Indian Gold Market Amid Covid-19

By Prithviraj Kothari, National President, India Bullion and Jewellers Association

- Gold: The Collateral of Last Resort

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Why Investors Should Always Hold a Position in Gold

By Nicolas Mathier, Founder, Global Precious Metals

- Bringing About Traceability to the Gold Industry

By Abhinav Ramesh, Director, Chainflux

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- Hong Kong & China Q1 Market Update

By Jeremy East, Senior Representative for the Asia Region, London Bullion Market Association

- Gold in the Time of Coronavirus

By Nikos Kavalis, Founding Partner, Metals Focus

- Covid-19: Potential Impacts on China’s Economy and Gold Market

By Ray Jia, Research Manager, World Gold Council

- Protecting Your Portfolio Against Covid-19

By Joshua Rotbart, Founder and Managing Partner, J. Rotbart & Co.

- Covid-19’s Impact on Singapore’s Physical Retail Gold Market

By Loh Mun Chun, Director, GoldSilver Central

- A Snapshot of the Indian Gold Market Amid Covid-19

By Prithviraj Kothari, National President, India Bullion and Jewellers Association

- Gold: The Collateral of Last Resort

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Why Investors Should Always Hold a Position in Gold

By Nicolas Mathier, Founder, Global Precious Metals

- Bringing About Traceability to the Gold Industry

By Abhinav Ramesh, Director, Chainflux

- SBMA News

By Albert Cheng, CEO, SBMA

Gold: The Collateral of Last Resort

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

Published on March 20, 2020

EMIL KALINOWSKI joined Wheaton Precious Metals Intl. in 2014 as Manager, Metals Market Research. His present focus is on the 2007 malfunction of the monetary system and its continuing disorder. He earned the CFA designation in 2013 and holds a Bachelor of Finance and MBA from Arizona State University. He previously held positions at State Street and Goldman Sachs. Presently living in the Cayman Islands, he is also radio talk show host and newspaper contributor but ratings and letters to the editor suggest he’s probably going to have to keep his regular job.

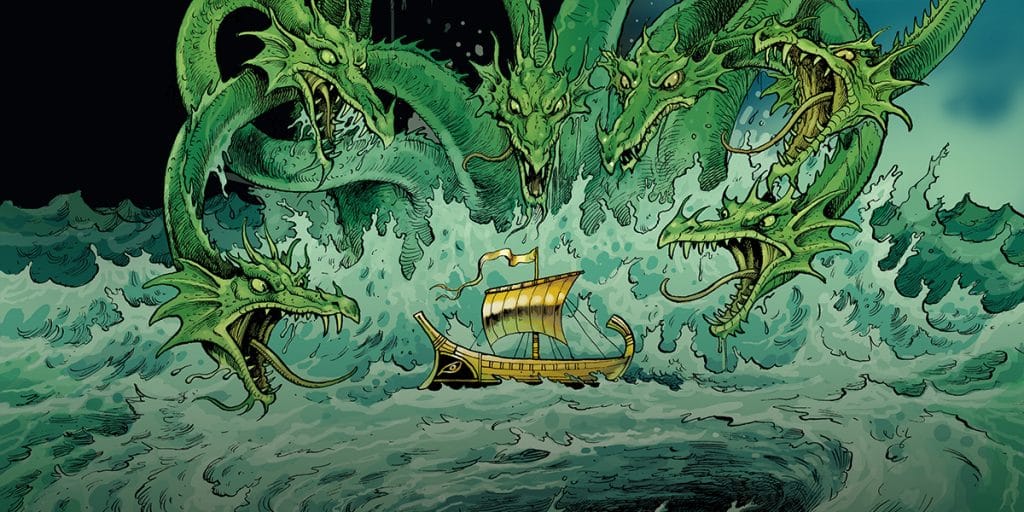

In 2020, gold investors find themselves sailing the wine-dark sea, with currents inexorably pulling the good ship into a strait flanked by Scylla and Charybdis.

The imagery is, of course, courtesy of Homer from his epic poem Odyssey, in which Odysseus and his men have no choice but to sail through a chokepoint on which two mythical, monstrous sentries stand. Scylla was a six-headed sea monster that had a bad attitude and a taste for sailors. Charybdis? A ship-eating whirlpool. Scholars identify Italy’s Strait of Messina – bracketed by the island of Sicily and the Calabrian coast – as the geographic inspiration for the legend. This author identifies the year ahead – bracketed by fear and monetary disorder – as the economic inspiration for the metaphor.

THE MALFUNCTION OF THE GLOBAL MONETARY ORDER HAS, SINCE 2007, PLACED A PREMIUM ON COLLATERAL.

The malfunction of the global monetary order has, since 2007, placed a premium on collateral. Before that fateful year, the financial institutions that funded an ever-expanding cross-border movement of goods, people and capital did so on an unsecured basis. Short-term interbank loans required to square books, meet regulatory requirements, extend credit and speculate in markets were, indeed, unsecured. The network policed itself; its exponential growth smoothed over inconsistencies, incentivised banks to cooperate and ensured the order’s functionality.

But during the global economic crisis of 2007–09, banks that met all statutory capital requirements had, rather unexpectedly, become insolvent and then needed rescue, dismemberment or burial. The survivors turned rather squeamish about it all. Uncollateralised funding became unpalatable.

THE FINANCIAL SYSTEM, WHICH HAD EVOLVED OVER FIVE DECADES TO RELY ON UNSECURED FUNDING, WAS SUDDENLY FORCED TO HAVE AN EXISTENTIAL LEVEL OF INTEREST IN COLLATERAL.

The financial system, which had evolved over five decades to rely on unsecured funding, was suddenly forced to have an existential level of interest in collateral. The problem was, and remains, that there was hardly enough collateral to back the funding that supported the level of economic activity that then existed, let alone the sustainable expansion of it.

This dilemma became all the more acute when the once-in-a-lifetime banking crisis repeated itself just a few years later, this time across the sovereign bond markets of nations that bordered the sea Odysseus sailed. Then, it happened again, just two years later, this time the epicentre was in emerging markets, of which China was the most prominent victim.

THEN, IT HAPPENED AGAIN, JUST TWO YEARS LATER, THIS TIME THE EPICENTRE WAS IN EMERGING MARKETS, OF WHICH CHINA WAS THE MOST PROMINENT VICTIM.

This is where gold enters the picture; it is the collateral of last resort. Gold has over the past 13 years developed a relatively consistent pattern. As the preconditions for the next financial denouement proliferate across the horizon, investors begin to batten down the hatches by placing a higher value on collateral, be it US Treasury securities, German bunds, or gold. These safe harbours appreciate either absolutely or relatively, the change in valuation a consequence of the rising anxiety levels felt by financial institutions. They fear being caught out, of being short funding, of lacking collateral to post. This is the fear of being pulled underwater. This is Charybdis.

Gold hasn’t been a cross-cultural monetary standard for millennia just because it is pretty to look at. It has a job – one that it is exceedingly qualified for – and that is to be accepted as money when other financial instruments that were thought to be money are revealed to be credit. That is when gold is sold. Sacrificed. This is Scylla.

During the global economic crisis, the demand for gold rose as fear escalated but then suffered severe bouts of selling when what was thought to be money-good (i.e. mortgage-backed securities) was repudiated. The same sequence was repeated in 2011–12. Sovereign bonds that had been considered money-good were being given haircuts by Sweeny Todd. What is there to sell that will be accepted by everyone, everywhere, in every era by every generation and culture? The answer is obvious.

THIS IS WHERE GOLD ENTERS THE PICTURE; IT IS THE COLLATERAL OF LAST RESORT.

The cycle is repeating itself today. In the fourth quarter of 2017, the reflation, known as globally synchronised growth, reached its apex. Throughout 2018, different pieces of the reflation edifice sloughed off. First, esoteric money markets began to crinkle. Then, emerging markets currencies crackled. By the third quarter, growth was no longer synchronised. By the fourth, it wasn’t even growth. In 2019, central banks began to pause interest rate hikes, then began to cut them outright. The US stopped its quantitative tightening in August, and by September, it was expanding its balance sheet at the fastest pace this side of quantitative easing. Gold rose throughout all of this. Fear. Disorder. In early 2020 the new managing director of the International Monetary Fund gave a speech in which she strongly implied the world was at risk of a global depression. Fear. Disorder. Now Covid-19.

If this general economic deterioration crosses over into an outright, interbanking liquidity panic, it should not surprise anyone that gold will be sold.

Keep an eye on the collateral markets, not the stock markets. Are central banks comfortable holding their US Treasury securities in custody with the Federal Reserve? Or are they pulling them to subsidise the local banking network that may be experiencing difficulties in securing Treasuries on the open market? Are primary dealers freely distributing Treasuries? Or are they hoarding them for their own use? Are banks returning collateral as part of their overnight operations? Or has a disorder convinced them to fail to deliver, even at penalty rates? Are overnight rates in the repurchase agreement market narrowing? Or are they spreading outwards from the unsecured funding offered by the Federal Reserve?

IF THIS GENERAL ECONOMIC DETERIORATION CROSSES OVER INTO AN OUTRIGHT, INTERBANKING LIQUIDITY PANIC, IT SHOULD NOT SURPRISE ANYONE THAT GOLD WILL BE SOLD.

Atop the mast, looking down the horizon as far as I can, it seems like gold investors may confront volatile waves in 2020. But one day, likely not that far off, the calm waters of inflation will present itself and will make gold’s sailing smooth.

EMIL KALINOWSKI joined Wheaton Precious Metals Intl. in 2014 as Manager, Metals Market Research. His present focus is on the 2007 malfunction of the monetary system and its continuing disorder. He earned the CFA designation in 2013 and holds a Bachelor of Finance and MBA from Arizona State University. He previously held positions at State Street and Goldman Sachs. Presently living in the Cayman Islands, he is also radio talk show host and newspaper contributor but ratings and letters to the editor suggest he’s probably going to have to keep his regular job.