Navigate

Article List

- Vietnam’s Gold Market

By SBMA

- What is Hallmarking and Why is it Important?

By Ng Siew Hua, Chief Assayer, Singapore Assay Office

- Bullion’s Appeal to Singapore’s Mass Market

By Ernest Kwek, Executive Director, SK Bullion

- Meeting the Needs of Gold Investors Today

By Ryoichi Seki, General Manager, Global Business Development, TOCOM

- Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

- Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Vietnam’s Gold Market

By SBMA

- What is Hallmarking and Why is it Important?

By Ng Siew Hua, Chief Assayer, Singapore Assay Office

- Bullion’s Appeal to Singapore’s Mass Market

By Ernest Kwek, Executive Director, SK Bullion

- Meeting the Needs of Gold Investors Today

By Ryoichi Seki, General Manager, Global Business Development, TOCOM

- Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

- Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

- SBMA News

By Albert Cheng, CEO, SBMA

Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

Published on September 25, 2017

Neil Harby is the LBMA’s Chief Technical Officer. He acts as the Executive’s main contact for the Good Delivery system and as such is responsible for managing the LBMA Good Delivery accreditation system, applications, Pro-Active Monitoring, Proficiency Testing and other GD related projects. The role also involves overseeing the work of the GDL Officer in the administration of the Good Delivery system as well as managing the implementation by gold Good Delivery refiners of the LBMA’s Responsible Gold Guidance and ensuring the efficiency and effectiveness of the Good Delivery work carried out by the LBMA. Prior to joining the LBMA Neil spent most of his career at the Rand Refinery in South Africa where he was Head of Evaluation. He also represented the Rand Refinery as one of the five LBMA Referees, whose primary responsibility is oversee the maintenance of the LBMA’s Good Delivery List.

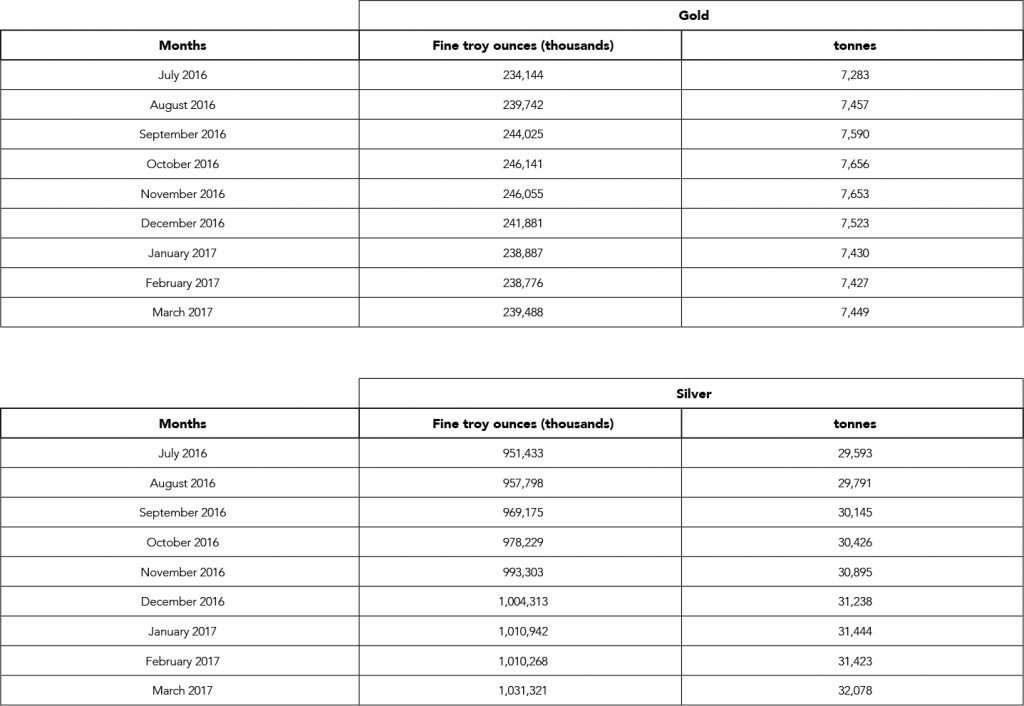

The LBMA vault holding data outlined in Figure 1 represent the volume of Loco London gold and silver held in the London vaults offering custodian services. As at 31 March 2017 there were 7,449 tonnes of gold, valued at US$298 billion and 32,078 tonnes of silver valued at US$19 billion. This equates to approximately 596,000 gold bars and 1,069,255 silver bars.

There are currently seven custodians offering vaulting services (all of which are LBMA members):

- Four security carriers: Brinks, G4S Cash Solutions (UK), Malca-Amit and Loomis International (UK) Ltd); and

- Three clearing banks: HSBC, ICBC Standard Bank and JP Morgan.

In addition the Bank of England (not an LBMA member) also offers gold (but not silver) custodial services to central banks and certain commercial firms that facilitate central bank access to the liquidity of the London gold market. Those clearing banks without their own vault operations – Scotiabank and UBS – utilise their accounts with one of the LBMA custodians or the Bank of England (BoE) and therefore do not contribute to these statistics to avoid double accounting.

The physical holdings of precious metals held in the London vaults underpin the gross daily trading and net clearing in London. The net clearing is undertaken by the members of the London Precious Metals Clearing Limited (LPMCL). London is the largest gold trading centre in the world as demonstrated by the US$18.1 billion worth of gold which was cleared on average each day in March 2017 (Source: LBMA net daily clearing statistics).

Transparency

The BoE started publishing its monthly gold holding figures in January 20172. It stores allocated gold on behalf of its customers (custodian service) which include the UK Government, other central banks and commercial banks. BoE data are included in the LBMA statistics shown below.

The Bank of England

Rolling Spot (“RS”) contracts were first introduced in May 2015 for gold and for platinum in March 2017. Unlike traditional futures, the RS contract has just one series that expires each business day. Open positions are automatically rolled to the next trading day. This feature allows participants to hold positions indefinitely, which facilitates longterm trading strategies.

Initially, Gold RS was well received by Japanese retail investors who needed a platform to execute such strategies. The participation of overseas investors made RS a successful contract for the exchange. It is now the second largest in open interest, and third in volume. Platinum RS is also experiencing similar success, with its open interest ranked fifth, just four-months after its launch (Figure 2).

The success of RS contracts is due the fact that they do not undermine existing contracts, but instead give investors additional liquidity. It also demonstrates that RS contracts address the market demand for new investment tools.

Explanatory notes:

- The data is reported monthly (three months in arrears).

- The data represents the holdings on the last day of the month.

- The LBMA dataset starts from July 2016, which coincides with the current set of custodians being established.

- Loco simply relates to the place or location at which a commodity is physically held, e.g. Loco London gold. Precious metals held within the environs of the M25 are considered to be Loco London.

- All physical forms of metal are included: large wholesale bars, coin, kilo bars and small bars. The data only includes physical metal held within the London environs and does not include precious metals physical holdings readily available at short notice in other secure overseas vaulting facilities.

- Jewellery and other private holdings held by retailers, individuals and smaller vaults not included in the London Clearing system are not included in the numbers.

- Conversion factor: 1 gram = 0.0321507465 troy ounces.

This article appeared in the August 2017 (edition 86) issue of LBMA’s newletter The Alchemist

Notes

- For further details see http://www.bankofengland.co.uk/markets/Pages/fmreview.aspx

- See http://www.bankofengland.co.uk/what/Pages/gold.aspx for these data.

Neil Harby is the LBMA’s Chief Technical Officer. He acts as the Executive’s main contact for the Good Delivery system and as such is responsible for managing the LBMA Good Delivery accreditation system, applications, Pro-Active Monitoring, Proficiency Testing and other GD related projects. The role also involves overseeing the work of the GDL Officer in the administration of the Good Delivery system as well as managing the implementation by gold Good Delivery refiners of the LBMA’s Responsible Gold Guidance and ensuring the efficiency and effectiveness of the Good Delivery work carried out by the LBMA. Prior to joining the LBMA Neil spent most of his career at the Rand Refinery in South Africa where he was Head of Evaluation. He also represented the Rand Refinery as one of the five LBMA Referees, whose primary responsibility is oversee the maintenance of the LBMA’s Good Delivery List.