Navigate

Article List

- Key Insights From SBMA’s Asia Pacific Precious Metals Conference 2025

By JONI TEVES, Chief Precious Metals Strategist, UBS Investment Bank

- How Four Generations’ Experiences Built the Foundation for Singapore’s Premier Bullion Company

By BRIAN LAN, Managing Director, GoldSilver Central Pte. Ltd.

- Outreach to Shanghai: Deepening Regional Market Access

By ALBERT CHENG, CEO, SBMA

- China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

- Critical Role of Precious Metals in Hydrogen Energy: Understanding the Science Behind Clean Technology

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

- WGC – Middle East Update

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

- SBMA News

By SBMA

Article List

- Key Insights From SBMA’s Asia Pacific Precious Metals Conference 2025

By JONI TEVES, Chief Precious Metals Strategist, UBS Investment Bank

- How Four Generations’ Experiences Built the Foundation for Singapore’s Premier Bullion Company

By BRIAN LAN, Managing Director, GoldSilver Central Pte. Ltd.

- Outreach to Shanghai: Deepening Regional Market Access

By ALBERT CHENG, CEO, SBMA

- China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

- Critical Role of Precious Metals in Hydrogen Energy: Understanding the Science Behind Clean Technology

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

- WGC – Middle East Update

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

- SBMA News

By SBMA

WGC – MIDDLE EAST UPDATE

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

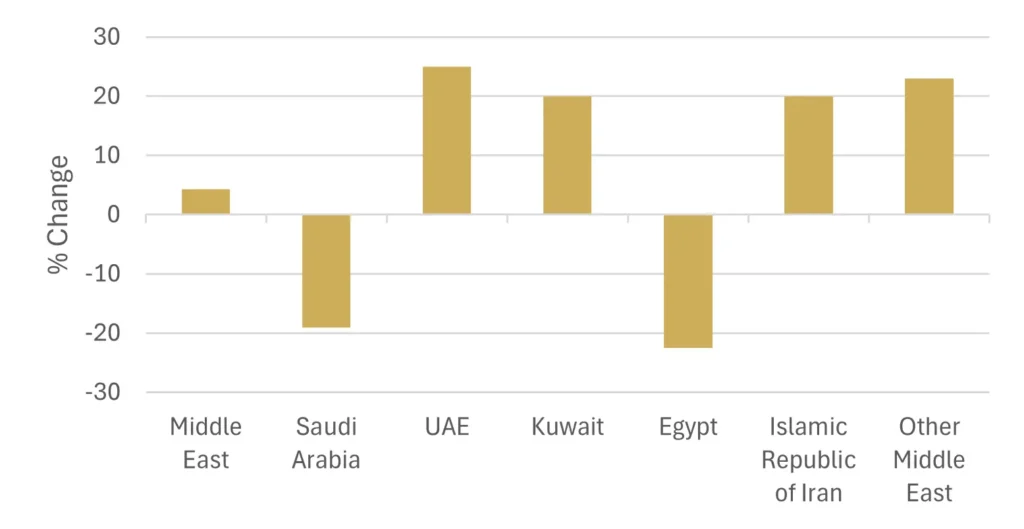

Notable regional bar and coin demand insights

Consumer Bar and Coin Demand - Y/Y Change (2025Q2)

- China led the way with a 44% increase to 115 tonnes.

- Indian demand totalled 46 tonnes in Q2, the eighth consecutive quarter of buying.

- European demand more than doubled y/y to 28 tonnes, led by German investors.

- US bar and coin demand halved to 9 tonnes, the lowest since Q4 2019.

- Middle Eastern demand was healthy at 31 tonnes, concealing a mixed picture in different countries across the region.

- Singapore bar and coin demand was up 22% y/y.

its performance in times of crisis, ability to act as a store of value, and its role as an effective diversifier, continue to be cited as key reasons for an allocation to gold.

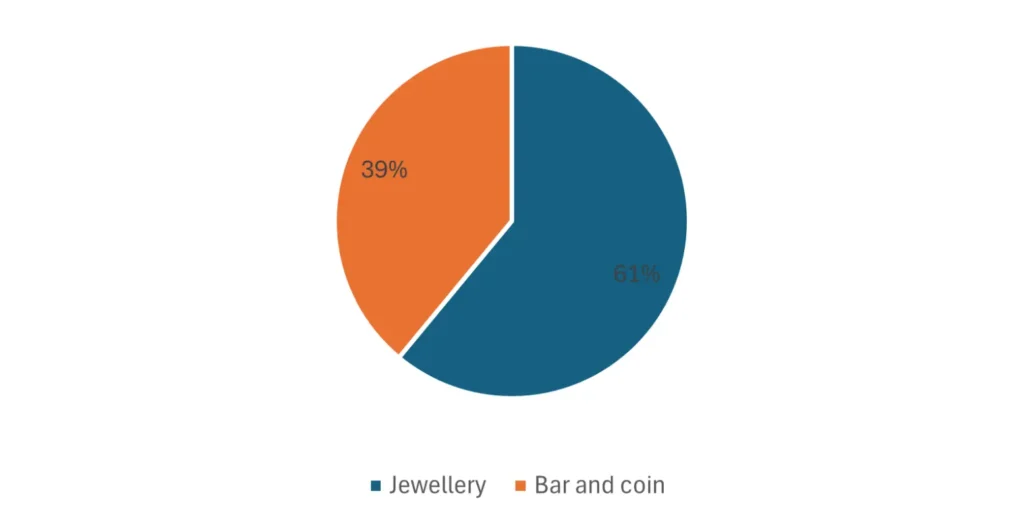

Middle East Gold Demand

% Consumer Demand - Middle East (2024)

Developments the United Arab Emirates

- Decree Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations – acts as the foundational legislation setting out the structure, obligations and framework for tackling money laundering in the UAE. Subsequent editions to the legislation, including 2019 Cabinet Resolution 10, clarify the requirements for the DNFPB sector, including the gold industry. This includes CDD and EDD requirements, reporting suspicious transactions via the UNODC-developed “goAML” platform, and undertaking periodic AML risk assessments, amongst other requirements.

- Due Diligence Regulations for Responsible Sourcing of Gold (2022) – requires all – and not just UAE Good Delivery – refineries operating onshore to comply with the OECD Due Diligence Guidelines. Since 2024 refineries have had to submit mandatory third-party audits on their compliance with the provisions.

- UAE Good Delivery – UAED replaced Dubai Good Delivery and is a voluntary accreditation for both onshore and offshore refineries covering the financial health, operating history, and technical capabilities (including capacity) of the refinery. Benefits of UAEDG accreditation include delivering onto the Dubai Gold and Commodities Exchange and supplying feedstock to India under the terms of the UAE-India CEPA (onshore UAEDG refineries only). Oversight of this now sits with the Emirates Bullion Committee – a federal body covering the whole of the UAE.

WGC Middle East Work Programme

- Increasing consumer protection through the introduction of the WGC’s Retail Gold Investment Principles in the UAE.

- Supporting professional development through the running of the Gold Industry Training Programme in Dubai and Istanbul.

- Undertaking consumer insights research to better understand gold buying behaviour and preferences in the UAE.

- Working with the Dubai Jewellery Group on a programme to identify and support young jewellery designers based in the Emirates.

The Middle East is a major gold market and the growth of the region is powering the gold industry across the GCC and beyond.