Navigate

Article List

- Key Insights From SBMA’s Asia Pacific Precious Metals Conference 2025

By JONI TEVES, Chief Precious Metals Strategist, UBS Investment Bank

- How Four Generations’ Experiences Built the Foundation for Singapore’s Premier Bullion Company

By BRIAN LAN, Managing Director, GoldSilver Central Pte. Ltd.

- Outreach to Shanghai: Deepening Regional Market Access

By ALBERT CHENG, CEO, SBMA

- China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

- Critical Role of Precious Metals in Hydrogen Energy: Understanding the Science Behind Clean Technology

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

- WGC – Middle East Update

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

- SBMA News

By SBMA

Article List

- Key Insights From SBMA’s Asia Pacific Precious Metals Conference 2025

By JONI TEVES, Chief Precious Metals Strategist, UBS Investment Bank

- How Four Generations’ Experiences Built the Foundation for Singapore’s Premier Bullion Company

By BRIAN LAN, Managing Director, GoldSilver Central Pte. Ltd.

- Outreach to Shanghai: Deepening Regional Market Access

By ALBERT CHENG, CEO, SBMA

- China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

- Critical Role of Precious Metals in Hydrogen Energy: Understanding the Science Behind Clean Technology

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

- WGC – Middle East Update

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

- SBMA News

By SBMA

CRITICAL ROLE OF PRECIOUS METALS IN HYDROGEN ENERGY: UNDERSTANDING THE SCIENCE BEHIND CLEAN TECHNOLOGY

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

The Scientific Foundation: Why Precious Metals Are Indispensable

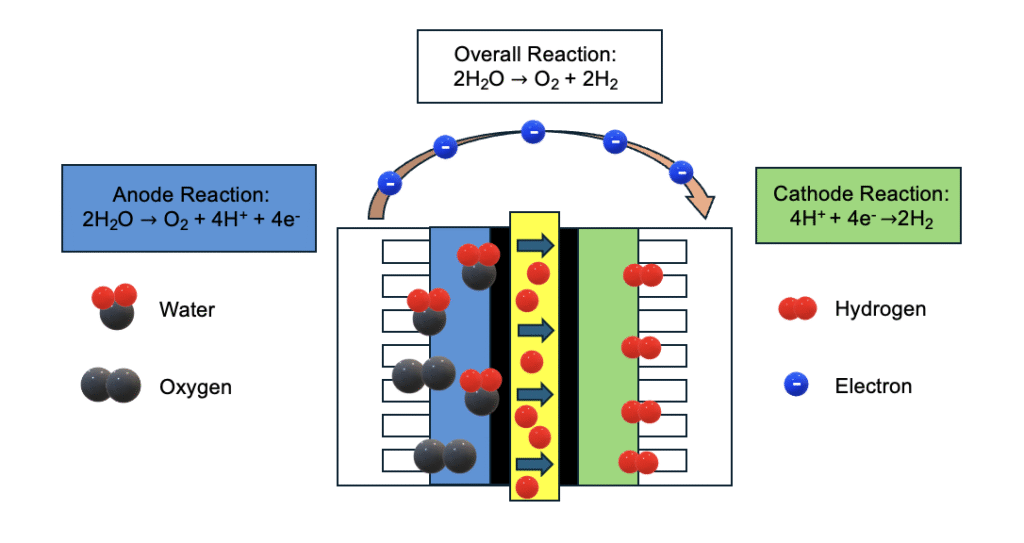

Iridium Catalyst for PEM Water Electrolysis: The Driving Force Behind Green Hydrogen

- Anode reaction: Water molecules are oxidized at the anode, splitting into oxygen (O2), protons (H+), and electrons (e–).

- Proton conduction: H+ ions pass through the proton exchange membrane.

- Cathode reaction: H+ and e– combine at the cathode to generate high-purity hydrogen (H2).

Modern PEM catalysts feature iridium-based anodes (including iridium oxide, iridium black) and platinum-based cathodes (platinum on carbon). These catalysts are engineered for high surface area, abundant active sites, and exceptional catalytic performance. They also demonstrate strong resistance to oxidation, acid, and alkaline corrosion. The catalyst inks can be customised for different electrolyser designs, allowing for optimisation based on specific operational requirements and system configurations.

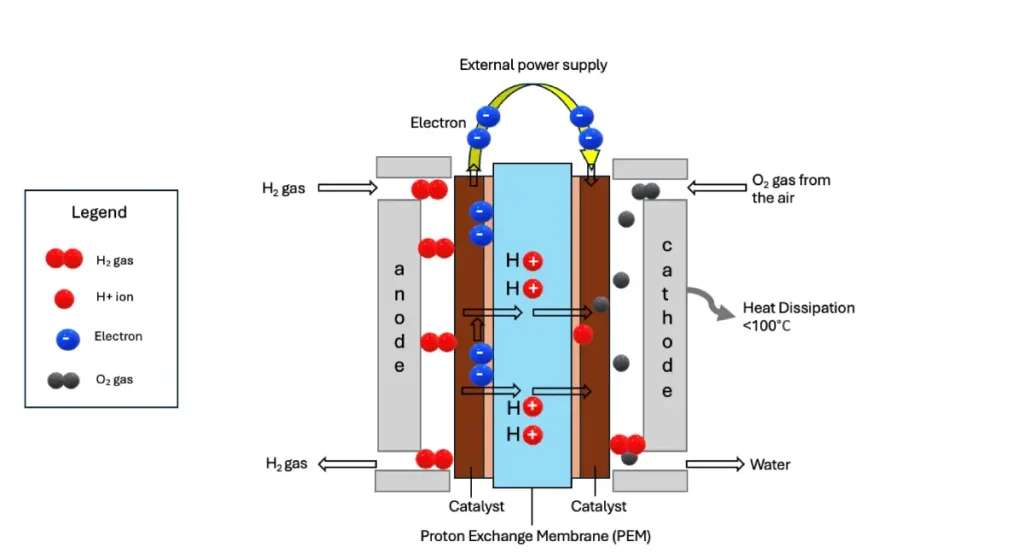

Platinum Catalyst for PEM Fuel Cells: Efficient Power Conversion

- Anode (hydrogen side): H2 molecules split into H+ and e– on the catalyst surface.

- Cathode (oxygen side): O2 reacts with H+ and e– to form water, releasing electricity in the process.

These catalysts feature 2–5 nm platinum nanoparticles with uniform distribution and minimal impurities. They meet commercial standards in electrochemical surface area (ECSA), mass activity (MA), power output, and durability.

Hydrogen Purification: Palladium Catalysts for Ultra-Pure Hydrogen

- Selective absorption: Hydrogen atoms (H–), with a diameter of just 0.046 nm, can diffuse into the palladium crystal lattice.

- Size exclusion: Larger gas molecules (e.g., O2, CO) cannot penetrate the palladium structure, effectively filtering them out.

Paving the Way for the Green Hydrogen Economy

- Efficient recovery: Successfully recovering and purifying precious metals from core components such as catalysts and membrane electrode assemblies (MEAs).

- Cost reduction: These advancements not only reduce dependency on primary resources but also significantly lower production costs.

- Enhancing the circular economy: Supporting sustainable growth within the hydrogen value chain.

Building a Sustainable Hydrogen Future