Navigate

Article List

- GROWTH & INNOVATION IN GOLD: THE ABC STORY

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- DE-GLOBALISATION, ASSERTIVE WHITE HOUSE & DUAL MANDATE FED KEEPING GOLD BID

By Bart Melek, Managing Director & Global Head Of Commodity Strategy, TD Securities

- SBMA DELEGATION TO JAKARTA 2025: STRENGTHENING CONNECTIONS WITH INDONESIA’S GROWING BULLION MARKET

By Albert Cheng, CEO, SBMA

- MASTERS OF INNOVATION: MTS GOLD’S DIGITAL TRANSFORMATION JOURNEY

By Nuttapong (Golf) Hirunyasiri, CEO, MTS Gold Group

- ASIAn investors BUY INTO THE GOLD RALLY

By Nikos Kavalis, Managing Director, Metals Focus Singapore

- GOLD: THE FUTURE IS ASIAN

By Marissa Salim, Senior Research Lead, APAC, World Gold Council

- SINGAPORE’S GOLDEN MAGNET: THE WEALTH SHIFT FROM WEST TO EAST

By Joshua Rotbart, Founder, J. Rotbart & Co.

- APPMC 2025: GET READY TO CONNECT ASIA TO THE WORLD!

By KL Yap, Chairman, SBMA

- SBMA News

By SBMA

Article List

- GROWTH & INNOVATION IN GOLD: THE ABC STORY

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- DE-GLOBALISATION, ASSERTIVE WHITE HOUSE & DUAL MANDATE FED KEEPING GOLD BID

By Bart Melek, Managing Director & Global Head Of Commodity Strategy, TD Securities

- SBMA DELEGATION TO JAKARTA 2025: STRENGTHENING CONNECTIONS WITH INDONESIA’S GROWING BULLION MARKET

By Albert Cheng, CEO, SBMA

- MASTERS OF INNOVATION: MTS GOLD’S DIGITAL TRANSFORMATION JOURNEY

By Nuttapong (Golf) Hirunyasiri, CEO, MTS Gold Group

- ASIAn investors BUY INTO THE GOLD RALLY

By Nikos Kavalis, Managing Director, Metals Focus Singapore

- GOLD: THE FUTURE IS ASIAN

By Marissa Salim, Senior Research Lead, APAC, World Gold Council

- SINGAPORE’S GOLDEN MAGNET: THE WEALTH SHIFT FROM WEST TO EAST

By Joshua Rotbart, Founder, J. Rotbart & Co.

- APPMC 2025: GET READY TO CONNECT ASIA TO THE WORLD!

By KL Yap, Chairman, SBMA

- SBMA News

By SBMA

DE-GLOBALISATION, ASSERTIVE WHITE HOUSE & DUAL MANDATE FED KEEPING GOLD BID

By BART MELEK, Managing Director & Global Head Of Commodity Strategy, TD Securities

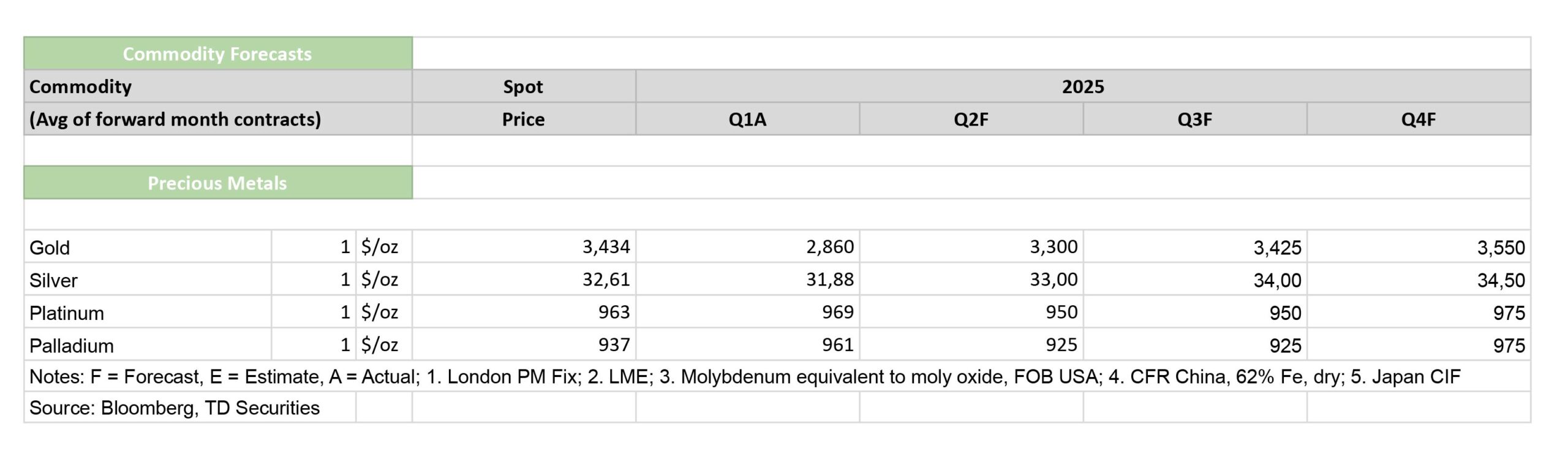

- While physical flows to the US slow and may even start to reverse, and specs reduce long exposure amid mixed signals coming from the White House, the fundamentals underpinning a bullish gold outlook continue to be firmly in place. These include a Fed that seems ready to ease policy to satisfy its maximum employment mandate under the Federal Reserve Act, even as inflation is trending higher, and concerns the US may face challenges in funding its debt under America’s new tariff regime. Worries that Europe may issue trillions of Eurobonds, which will compete with the Treasury market for global investors who now have less USD available from trade, and China’s use of soft and economic power to grow its trade and geopolitical footprints without the US, are additional factors why investors are set to look to gold.

- These, along with ongoing robust official sector and Asian ETF purchasing, and the eventual catchup buying by discretionary traders in the Western world, who currently are underexposed due to their concerns the yellow metal is overbought based on technical indicators and expensive to carry, are all set to play a very important role in driving gold to new highs. We project the average price to hit a record $3,550/oz in Q4 2025.

Tariff Dynamics, Fed's Sanguine Attitude Toward Inflation Sends Gold to New Highs

Easy Money, Sky-High Deficits, De-Globalisation and Messy Geopolitics Make Gold a Must

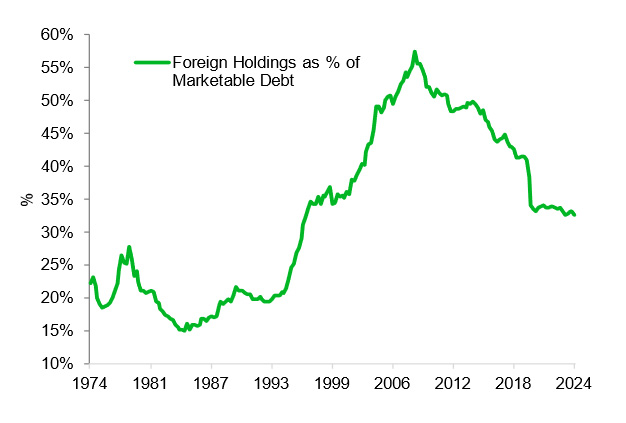

Declining Foreign Investor Appetite to Own Treasuries Increase Monetization Risk

Gold Still Not at Record in Inflation Adjusted Terms

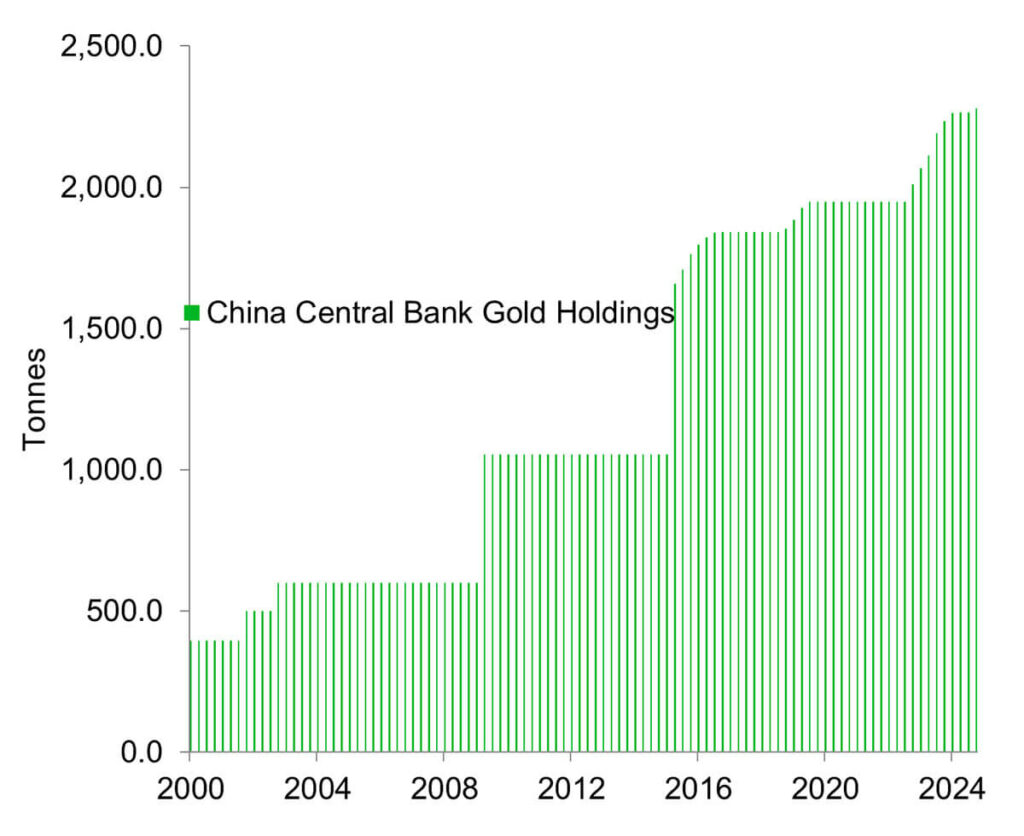

Official Sector Set to Be Key Gold Driver

PBoC Restarts Its Drive to Diversify Massive Reserves

New Record on the Cards

Lower interest rates at a time inflation is increasing, relatively less appetite for Treasuries as US debt surges to new records and fears grow that the world will have less need for US dollars given a high tariff environment and the prospect of trillions worth of Eurobond competing for investor capital, all suggest that demand for the yellow metal should firm into 2025. As such, central banks, ETF investors and the under-positioned discretionary traders are expected to place strong bids on gold during that time. As such, we project the average price to hit a record $3,550/oz in the final three months of this year.