Navigate

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

ANOUSHKA RAYNER leads the leads the growth division for commodities at Paxos. She joined the company in 2020 to drive innovation in the precious metals market both in settlement and infrastructure and to lead the effort for transformation into commodities tokenisation. Rayner has also been in the financial markets for 20+ years, with a range of roles covering electronic execution, post-trade and settlement infrastructure in the foreign exchange market.

In the last 25 years, Singapore has emerged as a fast-growing financial hub that serves as the global gateway to Asia. Bridging western and eastern markets, the city-state appeals to participants across all asset classes. This is especially true when it comes to the gold market, where Singapore has an opportunity to establish stronger market leadership. The country’s tech-forward approach to finance, along with its globally respected financial regulator, means it has an opportunity to build a marketplace purpose-built for a truly digital future for both retail and institutional investors.

Historically, London has been the hub for the global institutional over-the-counter (OTC) gold market. London became the primary home for allocated gold storage, and due to the natural physical attributes of gold, it became too costly and time-intensive to move the asset out of London for settlement between counterparties. Instead of moving the gold to other locations, counterparties came to London to trade and settle gold. The innovation of unallocated gold opened the market somewhat as the value of the asset was divorced from its physicality in order to increase liquidity and velocity. While this innovation changed all aspects of gold trading and settlement, it also introduced new issues and risks that traders work to mitigate on a daily basis.

So, What Can Singapore Learn From The Challenges The Institutional Market Faces As A Result Of A Single Global Hub Managing Custody, Trading And Settlement?

To truly grow the gold market on a global scale, which is critical to maintaining its relevance in an increasingly 24/7, tokenised asset world, a marketplace is needed where supply, storage and settlement are automated and standardised in a way that makes it trustworthy and available to any global investor, small or large.

Singapore is known as a first-mover with a sound regulatory environment for innovators and consumers. Singapore can break away from legacy practices that weigh down the current gold market and align it with new initiatives to improve integrity, accessibility and fungibility. The opportunity to establish its global position hinges on Singapore’s ability to expand on the positive aspects of the London gold market, while also streamlining settlement to increase speed, reduce risk and open accessibility to more participants. To do so, Singapore needs to be able to service cross-border settlement as well as link back to the current London OTC market.

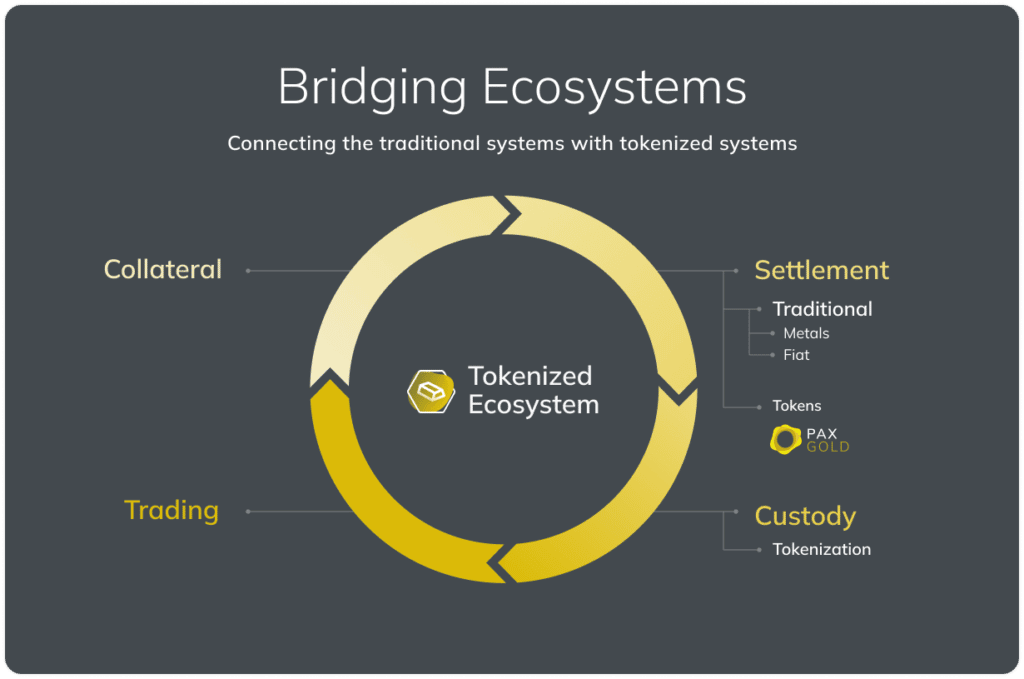

The path forward is to build a tokenised settlement hub, where cross-border settlement of allocated gold is unlocked through tokenisation of the asset. Tokenisation will also reduce market risk by allowing new clearing parties to offer services and create a competitive market place, which benefits the investor and market alike.

By learning from the London market and embracing new technological innovations, Singapore can be the tokenised settlement hub for global gold trading. Tokenisation of gold blends the benefits of full ownership of allocated gold and the operational efficiency of unallocated gold. It allows the market to improve its integrity, increase its accessibility and create a fungible global market.

So, How Can Paxos Help Singapore To Become The Gateway To Asia And Move To A Tokenised Market?

By giving retail investors access to institutional investment-grade gold.

The challenge for the average retail buyer globally is navigating the disparity in understanding gold as an attractive metal for ownership (like its use in jewellery) and its importance in a well-rounded investment portfolio. Additionally, investment-grade gold is not readily available to the average retail buyer. However, Singapore is well-positioned to overcome this challenge. The average Asian retail investor has a better understanding of and acquaintance with gold and its investment value, with roughly 55% of global retail investment gold being held by Asian investors, according to Refinitiv data. When it comes to the use of new technology, Singapore and Asia significantly outpace the rest of the world with more 10% of retail buyers using digital asset exchanges, according to Chainalysis.

Paxos specifically has addressed the challenges of the gold market for retail investors by creating PAX Gold (PAXG) – the only regulated gold token, delivering investment-grade gold to all. By making it available on digital platforms, anyone can access the highest quality allocated gold without any investment minimums. PAXG gives retail investors a safe and new way to own gold instantly by bridging the institutional investor to both traditional OTC settlement and tokenised settlement with an interoperable platform.

So where is the institutional market in relation to tokenised gold? Institutional market participants understand gold, its real value as an investment that’s passed the test of time and – thanks to the London market – have access to the highest quality supply. They have also found alternative ways to gain exposure to gold due to the high barriers to entry into the allocated and unallocated market. However, these mechanisms introduce risk, specifically when it comes to the infrastructure this segment relies upon to execute trading and settlement. What the institutional market lacks is new technology that makes investment into allocated gold seamless.

Paxos helps the institutional market by offering technology that can service settlement for both traditional and tokenised assets. We’ve built an interoperable settlement platform that is designed to introduce incremental improvements, like safe settlement, to OTC settlement. For the first time, the cash and metals settlement networks are connected to allow for transparent simultaneous settlement, which has already been launched in the London market and settling daily. This same technology bridges to tokenised settlement. However, Paxos is realistic and for the majority of the traditional market, there will not be an immediate move into tokenisation, hence the importance of platform interoperability. Paxos is positioned to support the market as it evolves into the tokenised world. We serve clients seeking to enter and take advantage of the tokenised markets today and those needing to future-proof their technology strategy in readying themselves for this global financial infrastructure change that is upon us.

So how could this technology help a new gold settlement hub like Singapore? And how can technology help Singapore capture 10% of the global gold trading volume by 2025? Tokenisation – and the solutions Paxos has built around settlement – will allow Singapore to advance and lead the way in market transformation. The tokenisation of assets is the only way to safely and quickly settle cross-border transactions whilst transferring full ownership of the underlying asset. At the same time, this technology will bridge the Asian market with the London OTC market and create a safe settlement link between the two hubs.

Today, Singapore has a unique opportunity to open up Asia and allow for investors of all types to access the allocated gold market through tokenisation and allow for new institutions to participate in tokenised clearing services, which would bring global diversification to the market, along with localised services. This expansion will not only benefit the region, but also help to mobilise the asset and contribute to the allocated gold liquidity, which will unlock more use cases for allocated gold and enhance the value of holding the asset.

As Singapore becomes a global hub for gold custody and trading, with the increase in demand for gold in the region, it is now for the city-state to set some rules. It should embrace tokenisation to future-proof itself and become the gold settlement hub for the new economy. If Singapore adopts this technology, it will differentiate itself from London and build its profile as a forward-looking global hub that can accommodate the settlement of traditional and digital gold.

ANOUSHKA RAYNER leads the leads the growth division for commodities at Paxos. She joined the company in 2020 to drive innovation in the precious metals market both in settlement and infrastructure and to lead the effort for transformation into commodities tokenisation. Rayner has also been in the financial markets for 20+ years, with a range of roles covering electronic execution, post-trade and settlement infrastructure in the foreign exchange market.