Navigate

Article List

- Key Insights From SBMA’s Asia Pacific Precious Metals Conference 2025

By JONI TEVES, Chief Precious Metals Strategist, UBS Investment Bank

- How Four Generations’ Experiences Built the Foundation for Singapore’s Premier Bullion Company

By BRIAN LAN, Managing Director, GoldSilver Central Pte. Ltd.

- Outreach to Shanghai: Deepening Regional Market Access

By ALBERT CHENG, CEO, SBMA

- China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

- Critical Role of Precious Metals in Hydrogen Energy: Understanding the Science Behind Clean Technology

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

- WGC – Middle East Update

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

- SBMA News

By SBMA

Article List

- Key Insights From SBMA’s Asia Pacific Precious Metals Conference 2025

By JONI TEVES, Chief Precious Metals Strategist, UBS Investment Bank

- How Four Generations’ Experiences Built the Foundation for Singapore’s Premier Bullion Company

By BRIAN LAN, Managing Director, GoldSilver Central Pte. Ltd.

- Outreach to Shanghai: Deepening Regional Market Access

By ALBERT CHENG, CEO, SBMA

- China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

- Critical Role of Precious Metals in Hydrogen Energy: Understanding the Science Behind Clean Technology

By LIU FENG, Chairman and General Manager of Sino-Platinum Metals New Energy Technology (Shanghai) Co., Ltd; Deputy General Manager of Yunnan Precious Metals Materials Laboratory Co., Ltd.

- WGC – Middle East Update

By ANDREW NAYLOR, Head of Middle East and Public Policy, World Gold Council

- SBMA News

By SBMA

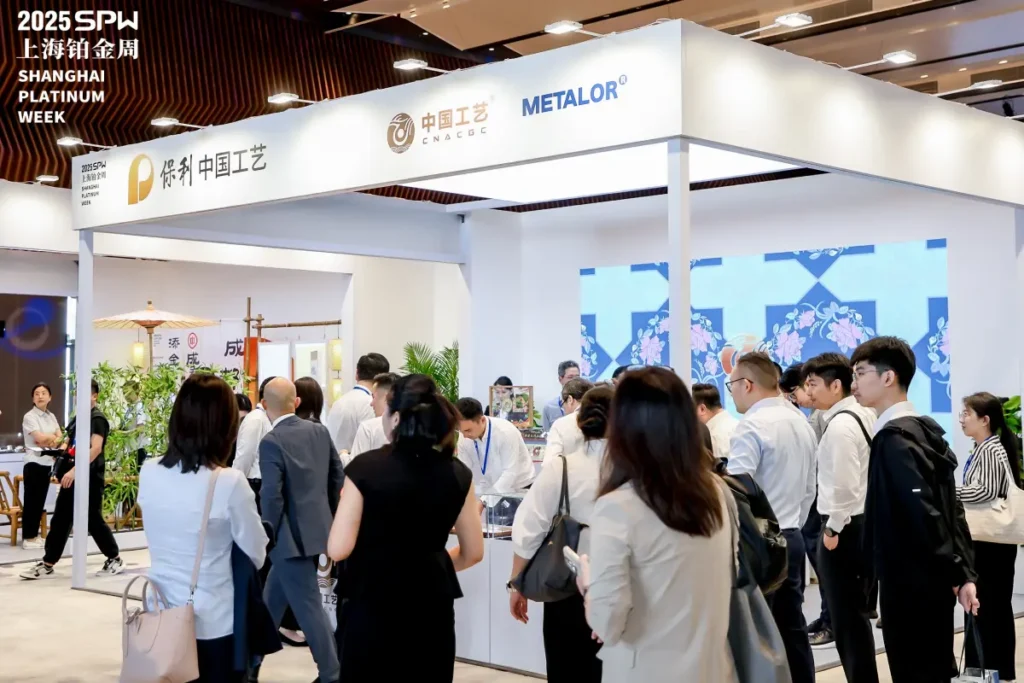

China Emerges as a Key Pillar of the Global PGM Market: Highlights from Shanghai Platinum Week 2025

By WEIBIN DENG, Regional Head of Asia Pacific, World Platinum Investment Council

Marking its milestone fifth successive year, Shanghai Platinum Week 2025 – now a fixture in the second week of July each year – achieved record-breaking attendance, attracting 592 in-person delegates (including 73 international delegates), 291 businesses and organisations, and garnering over 530,000 online viewers.

Industry Leadership Perspectives

Reflecting on Shanghai Platinum Week 2025, Trevor Raymond, chief executive officer of the World Platinum Investment Council (WPIC), said:

“Platinum demand in China is continuing to expand, as the growth in physical platinum investment we are currently witnessing demonstrates. China has become the number one growth market for platinum bar and coin investment, accounting for 64% of global platinum bar and coin demand in 2024, up from 11% in 2019, as market development initiatives continue to bear fruit. Moreover, that this growth has been strongly supported so far in 2025 by a resurgence of platinum jewellery manufacturing in China, in the wake of the extremely high gold price, has been a major talking point at this year’s event.

Strategic Partnerships and New Initiatives

Key Shanghai Platinum Week 2025 Takeaways

1. Tariff impact assessment:

The direct impact of tariffs on forecast platinum demand in 2025 is estimated to total only 112 koz, or 1.4% of total demand. The indirect risks through slower GDP growth over the next few years could be more significant in terms of lower automotive and industrial demand, but currently this is being more than offset by the strength in demand for platinum investment and jewellery products as a result of the high gold price, with platinum market deficits entrenched and expected to continue through 2029. The current tariff uncertainty is expected to persist, especially as the market awaits the findings of the US’ Section 232 Critical Minerals Report.

2. Investment and jewellery demand surge:

The strength in demand for physical platinum investment products and platinum jewellery, driven in part by a response to the high gold price, was a much-discussed topic. Sustained demand momentum could add substantially to annual investment demand over five years. Several refineries in China have attained LPPM good delivery status, with several more applications in progress. China platinum jewellery demand has been led so far by wholesalers commissioning fabrication and making stock available for sale to smaller wholesalers and retailers. The range of platinum jewellery available reflects gold jewellery designs that have sold well in recent years. Sustained retail sales of this newly available platinum jewellery could drive a significant increase in annual demand in 2026 and beyond.

3. Emission standards impact:

China VII/7 emissions standards will be authorised in 2026 and introduced soon after. The inclusion of cold start and real-world driving tests are expected to initially result in upside to PGM loadings per vehicle.

4. Industrial catalyst transition:

Globally, polyvinyl chloride (PVC) manufacturers need to phase out the use of mercury-based catalysts by 2030. A transition to a platinum-based catalyst is the most likely alternative option, which could provide a significant boost to platinum demand.

5. Hydrogen sector growth:

The Orange Group gave an outlook for the hydrogen sector. Installed electrolysis capacity is forecast to reach 100GW globally by 2030, with platinum-based proton exchange membrane (PEM) electrolysers having a 40% market share and with platinum being included in alkaline electrolysers to improve their efficiency.