Navigate

Article List

- Asia, Australia and Gold

By Nicholas Frappell, General Manager, ABC Bullion

- LMEprecious – New Opportunities for the Asia Pacific Precious Metals Market

By David Mears, Assistant Vice-President, Precious Metals Market Development, London Metal Exchange

- Building a Belt and Road Gold Corridor in Asia

By The Chinese Gold & Silver Exchange Society

- Working Together to Achieve the Mutual Benefits in the Golden Era

By Wang Zhenying, President, Shanghai Gold Exchange

- INTL FCStone – Supporting the Bullion Market’s Growth in Asia

Feature: INTL FCStone

- Transforming India Gold Market

By Sameer Patil, Head – Business Development, BSE

- Canada’s Mining Finance Ecosystem a Model for Late-Cycle Precious Metals Capacity Expansion

By Bart Melek , Director and Global Head of Commodity Strategy, TD Securities

- Bridging Gold and Cryptocurrency

By Richard Melbourne, Head of Member Services, Kinesis Money

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Asia, Australia and Gold

By Nicholas Frappell, General Manager, ABC Bullion

- LMEprecious – New Opportunities for the Asia Pacific Precious Metals Market

By David Mears, Assistant Vice-President, Precious Metals Market Development, London Metal Exchange

- Building a Belt and Road Gold Corridor in Asia

By The Chinese Gold & Silver Exchange Society

- Working Together to Achieve the Mutual Benefits in the Golden Era

By Wang Zhenying, President, Shanghai Gold Exchange

- INTL FCStone – Supporting the Bullion Market’s Growth in Asia

Feature: INTL FCStone

- Transforming India Gold Market

By Sameer Patil, Head – Business Development, BSE

- Canada’s Mining Finance Ecosystem a Model for Late-Cycle Precious Metals Capacity Expansion

By Bart Melek , Director and Global Head of Commodity Strategy, TD Securities

- Bridging Gold and Cryptocurrency

By Richard Melbourne, Head of Member Services, Kinesis Money

- SBMA News

By Albert Cheng, CEO, SBMA

Canada’s Mining Finance Ecosystem a Model for Late-Cycle Precious Metals Capacity Expansion

By Bart Melek , Director and Global Head of Commodity Strategy, TD Securities

Published on June 4, 2018

Bart Melek has over 20 years of experience analyzing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations including Bloomberg, Reuters, CNBC, WSJ and Barron’s. Previous to joining TD, Bart was a Global Commodity Strategist and Sr. Economist at another major Canadian bank. He also had senior roles in Mining Equity Research, Treasury, Risk Management, and Senior Credit Committee. Bart holds a master’s degree in economics from York University in Toronto, with a Specialization Certificate in International Finance/Banking.

Considering the Fed-driven roller coaster that gold, silver and platinum were riding over the past 12 months, nobody would be blamed for thinking the precious metals complex would be directionless over the next two years. Gold and its peers tend

Given that the market is expecting at least three federal funds rate increases this year, with a sizable contingent of market watchers calling for four hikes and arguing for a shift in the dots to reflect that expectation, it is quite likely that the precious metals complex will be volatile for much of the year. But while this volatile cycle will no doubt be a fact of life for investors for a while yet, we judge that gold, silver and platinum should be well supported and follow a smoother upwards path starting sometime in the latter part of 2018. The reasons for this optimism is predicated on our view that real and nominal interest rates will not rise to restrictive levels, industrial and physical demand should improve along with a robust global economy, while a weaker USD and sliding mining supply should also help.

Since TD Securities expects gold to trend toward $1,400/oz, silver to reach $19/oz, and platinum group metals (PGMs) to break above $1,150/oz by the end of next year, some new mining projects will look viable at reasonable discount rates. With the current mine project pipeline unlikely to keep up with projected physical demand growth, there also are likely to be upside risks to our price forecast and meaningful interest in new capacity investment.

We expect that there will likely be a need for new projects to assure long-term demand is met and to compensate for ore body depletions as many projects owned by senior producers mature (Figure 1). There will no doubt be a requirement to lift capital expenditures from today’s dismal levels, spurred by the likely improvements in free cash flows and the need for many producers to show growth to shareholders (Figure 2). As such, Canada’s successful mining finance ecosystem, which includes specialised equity markets, banks, technical, legal, mining and hedging expertise, which can help to finance and de-risk these projects and serve as inspiration for the global community.

Favourable outlook – a requiem for gold and friends not required

Notwithstanding recent gold and precious metals market corrections that pointed towards aggressive Fed tightening into 2019, we judge recent gold and precious metals market corrections and the associated volatility, which have been generated by relatively aggressive Fed tightening expectations into 2019, to be transitory in nature. Ultimately, the complex is projected to reach escape velocity, which should take gold toward $1,400/oz, with silver reaching $19/oz, and both PGMs breaking above $1,150/oz by the end of next year, with an upside risk related to weak mine supply growth expectations.

The new Fed Chair Jerome Powell, whom some in the precious metals market expected to have a hawkish tilt toward monetary policy, is unlikely to be very keen to aggressively hike expectations for this cycle. While the US unemployment rate, at 4.1%, is consistent with full capacity, the Fed’s favorite core inflation measure is still below target, and there are signs that the core CPI is not accelerating, wage growth is modest, and there are still too many people who are not fully participating in the labour market – which suggests that there is no hurry to get restrictive. At the same time, the growth of internet retail, along with other technologically driven structural changes that are limiting corporate pricing powers, and a precarious work environment for many Americans suggest that wage growth is unlikely to aggressively accelerate for a while yet.

Conversely, there does not seem to be the imminent impetus for Mr Powell or Federal Open Market Committee (FOMC) members to signal a more hawkish tone into 2018. Recent talk of a potential global trade war in response to the Trump administration’s steel and aluminium tariffs, which may precipitate a material slowdown in the US and across other world economies, also suggest that the Fed will tread carefully on rates. Central bankers may want to assess how elastic the economy is to higher rates at a time of sky-high debt levels before becoming convincingly more hawkish. The emerging idea that monetary policy should not react to a specific inflation target, but rather to a range, also helps to promote the “go-slow” approach.

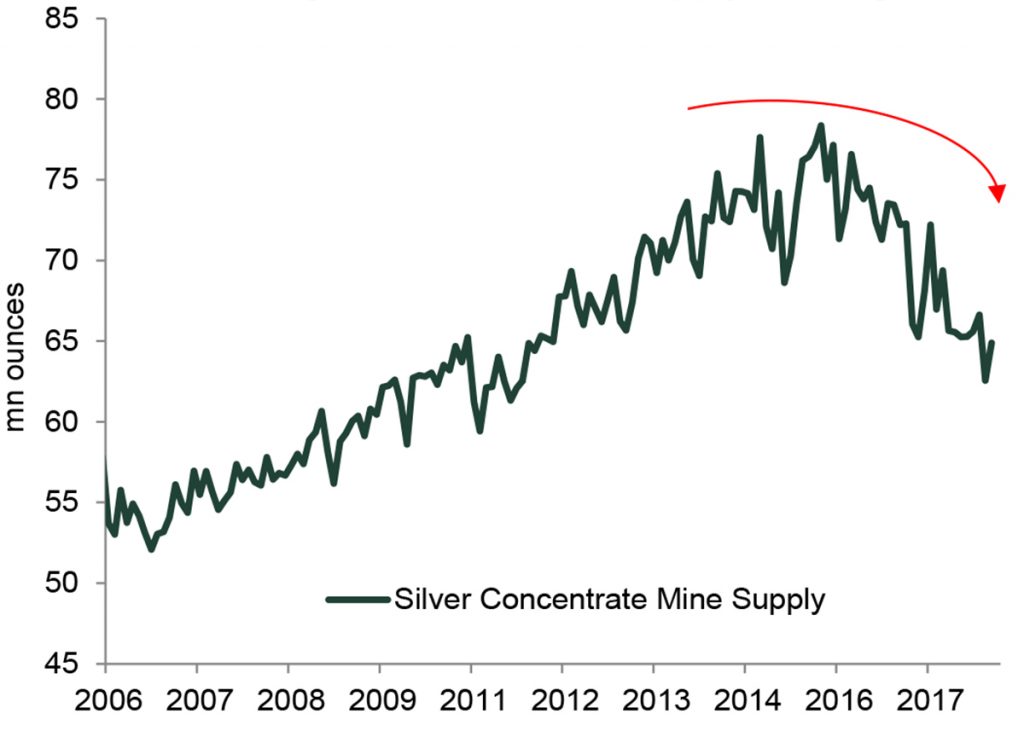

Figure 1: Silver Mine Supply Slowing

Figure 2: Need for Capital Expenditures To Maintain Growth

Food for thought: after positive US data surprises since October, the market is starting to see disappointments in the US, with global data very much surprising on the negative. It may be that the market has priced in too many positives as a result of recent US tax changes and did not factor in less activity outside of America. Plus, the business cycle is getting very long in the tooth, with the yield curve flat as a pancake.

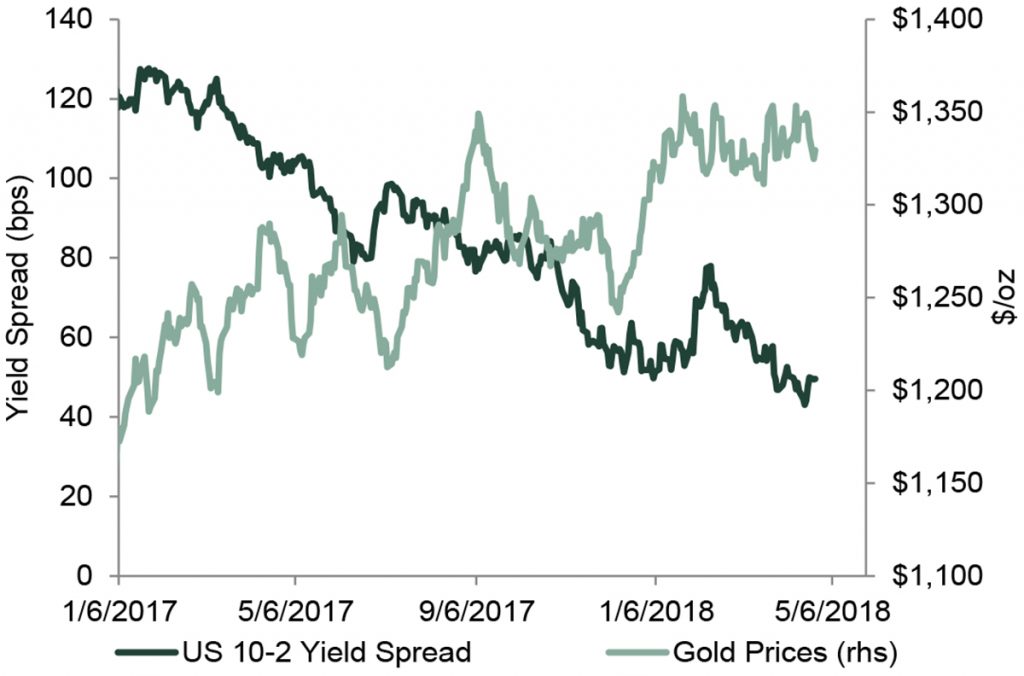

As 10y-2y, 30y-10y treasury yield spreads hover not too far above the point of inversion (Figure 3), there are many gold market observers who believe that the Fed may be headed towards a policy mistake. Conversely, it could also be that the 10-year and 30-year bond yields are also being artificially held down by retiring boomers, some of which are playing catch-up due to the Great Recession, as their money managers are seeking stable incomes and are matching duration to obligations.

To the extent that the old saying that only bad policies cause recessions has any validity, in this case, monetary policy and the fact that the curve is flattening at a time when inflation is supposed to be accelerating, is troubling to many.

Notwithstanding the many central bank balance sheet and capital flow dynamics that are likely keeping long yields suppressed, this no doubt is a concern for FOMC members as well, just in case and despite the fact that they do not publically say it.

A “go-slow” approach on the part of the Fed as we approach the end of the US tightening cycle – a resulting weakening of the USD as other central banks such as the European Central Bank (ECB) ready themselves to remove the extraordinary monetary accommodation – should be quite supportive of gold and friends. This is in line with history — low carry and USD opportunity costs tend to push precious metals north on a sustainable basis.

The significantly higher market volatility this year, with equities gyrating wildly, geopolitical and trade tensions increasing between the US, China, Russia and the Middle East should see the appetite for gold, silver and even PGMs grow as a hedge. And, there are the issues surrounding massive debt levels and growing deficits in the US and across the world, with many central banks and portfolio managers rotating out of USD, which can help gold and the rest of the precious metals complex.

Figure 3: Flat Yield Curve Supports Gold

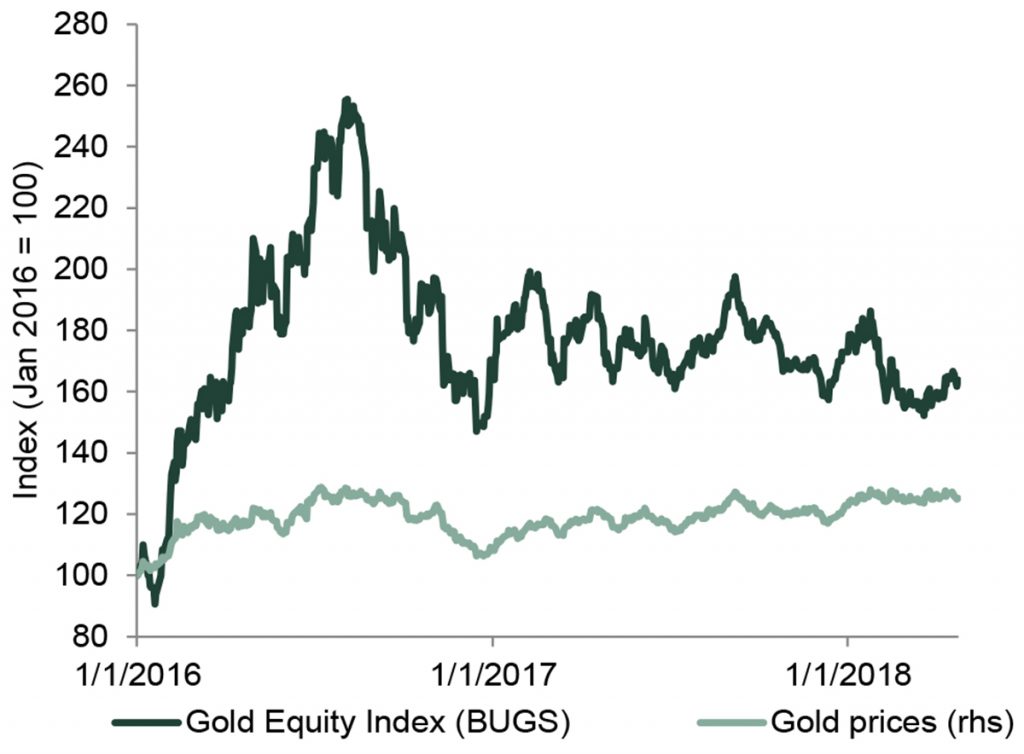

Figure 4: Valuations Begin To Signal Interest in Gold

New projects are coming: Canadian ways can help

The low opportunity cost of holding precious metals due to modest real interest rates, a weakening USD, and firm investor demand means the fairly large precious metal inventories that are very characteristic of this market are unlikely to leak into the market to compensate for a weak mine supply profile. With more investors holding on to their gold, silver and PGM physical bullion, we should see a growing reliance on primary production to satisfy new investor and industrial demand.

Given that primary precious metals supply has been on the decline, as is the case of silver and platinum, or flat, as with gold and palladium, and given that few funded large projects are on the horizon, there is likely to be a scramble in the next several years to fund the supply expansions required to balance future demand. In addition, the proven and probable reserves for key senior gold and other precious metal miners have fallen sharply since 2011, and they will need to grow to re-energize valuations.

A strong mine financing ecosystem is required for this to be accomplished in a timely and cost-effective manner, especially now that raising capital traditionally is made more difficult by modest interest in the mining sector and a general lack of risk appetite for commodity projects in general. Although outpacing metal prices, equity valuations are not at the peaks they were during this stage of the previous commodity cycle (Figure 4). Generalist equity funds have relatively little interest in the mining space relative to where they historically were at this stage of the cycle, there are fewer specialist funds managing less capital, and the growing influence of a few specialized private equity funds is increasing the cost of capital.

This means that traditional sources of mining finance such as the bought-deal (which has investment dealers purchase stock from an issuer at a discount and then resell those securities to third-party investors) pioneered by Canadians, for example, has moderated relative to previous cycles. The risk that issuers will be unable to place all holdings has increased. For example, such risk was a contributing factor to the decline in value of Canadian secondary financings — down some 44% to $3.3 billion in 2017.

The market has shifted to relying more on private equity funds (which tend to focus on “shovel-ready” projects), streaming-based financing, royalties and senior mining companies making so-called strategic investments. As such, a strong mining finance ecosystem is more important than ever. The Canadian model can help fund and serve as a model during these difficult conditions.

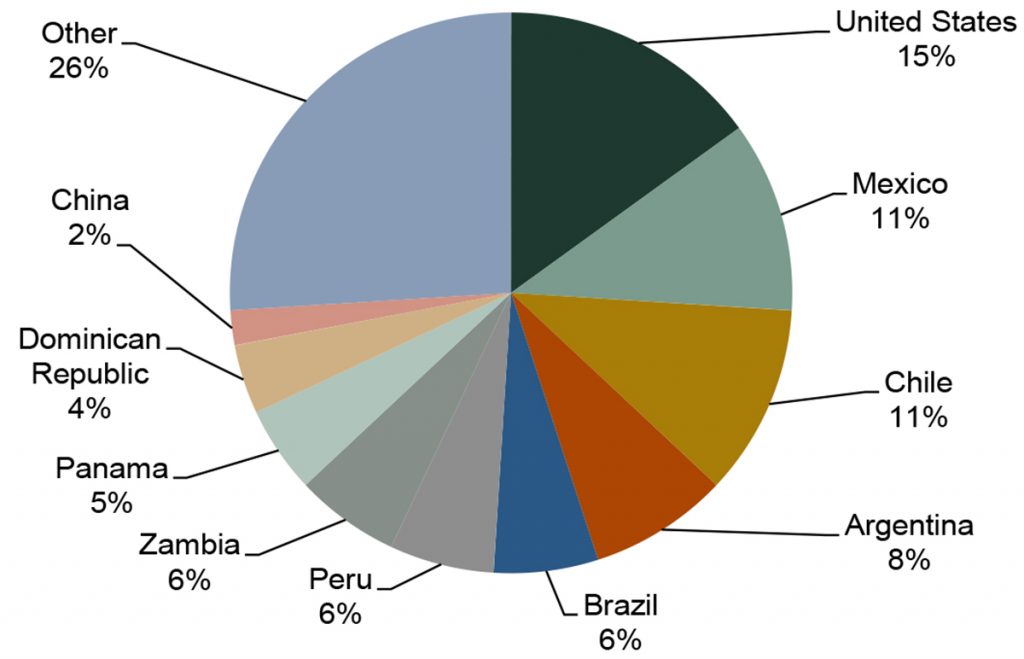

A strong and international mining sector makes the Canadian mining finance ecosystem among the most robust in the world (Figure 5).

Figure 5: Canadian Exchange Dominates Mining Finance

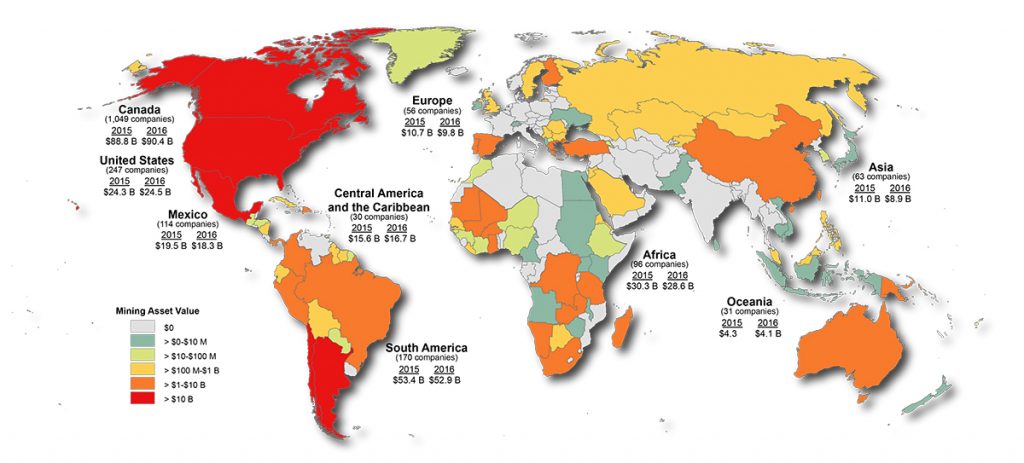

Figure 6: Canadian Mining Assets Aboard Highlight Global Footprint

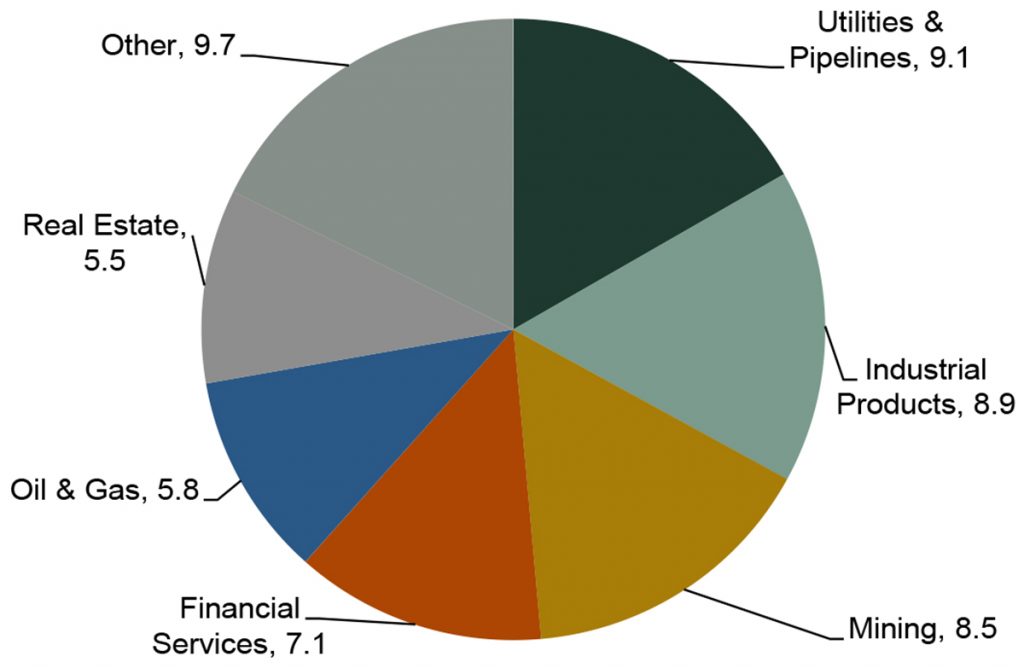

Figure 8: TSX Equity Capital By Sector Highlights Canadian Mining Expertise

Canadian miners and their partners are not only among the most ethical, environmentally and socially responsible operators in the world, they are also the most technically capable, with a proven ability to move projects from the early exploration stage to the production stage.

Canada is a mining nation with a long history in the sector, producing 162t of gold in 2017, which was worth some $7 billion. The country mines zinc, iron ore, nickel, diamonds, silver, platinum and many others for a total of 60 minerals and metals, with a total value of some $44 billion based on the latest available data.

Canadian miners are also very global, with a presence in over 100 countries (Figures 6 and 7). The latest available data, in 2016, reveals that out of the $254 billion worth of assets held by some 1,344 Canada-domiciled miners, 651 companies held assets abroad valued at around $164 billion.

In past cycles where precious metals supply capacity was being funded and built, Canadian miners, financial institutions, lawyers, geologists, engineers, analysts and a myriad of other professionals in many ways dominated the financing of the mining sector. The Canadians have an unmatched ability to connect senior miners with junior miners, banker analysts, streamers, equity investors and specialty private equity funds.

The Canadian equity market family, the TMX Group, which includes TSX and TSXV exchanges, has and continues to have the most and largest gold and silver companies listed (Figure 8). Miners in the early stage of exploration, advanced-stage explorers and producers are all extremely well represented, which provides liquidity across the board. At the same time, there are north of 200 analysts providing coverage and global exposure to listed names. The equity analyst community can keep the investor public well informed, which helps the financing process. Of course, Canada’s strong and proven rule of law makes the entire system work well.

The banks in the country can provide financing for the right projects and have the ability to help reduce price risk during production ramp-up. Given the financing challenges and price volatility, commodity hedging will very likely play an increasingly large role, as it reduces the probability of financial impairment that can occur when prices drop to levels significantly below the cost of production due to volatility.

Locking in a price, particularly at the production ramp-up stage, has been accretive to equity valuation for companies that have gone that route over the last year or so. Hedging can reduce the risk of financial impairment, which helps to keep the discount rate low and should increase NAVs. In addition, permitting and feasibility studies are other ways to lower risks in new projects.

Producers, bankers, geologists, engineers, commodity traders, equity analysts and investors have made Canadian miners very successful in building new projects around the world. This makes the country’s mine financing system worth emulating and engaging to help fund future expansions.

Bart Melek has over 20 years of experience analyzing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations including Bloomberg, Reuters, CNBC, WSJ and Barron’s. Previous to joining TD, Bart was a Global Commodity Strategist and Sr. Economist at another major Canadian bank. He also had senior roles in Mining Equity Research, Treasury, Risk Management, and Senior Credit Committee. Bart holds a master’s degree in economics from York University in Toronto, with a Specialization Certificate in International Finance/Banking.

Disclaimer: The views and opinions expressed in this article belong solely to the author, and do not reflect the view of BSE.