Navigate

Article List

- Chairman’s Foreword – A Look Back at 2017 And What’s Ahead

By Martin Huxley, Chairman, SBMA

- 2017 Gold Market Recap and 2018 Forecast

By Hawk Namiki, Executive Director, SBMA

- Putting Gold on the Blockchain

By Sergei Vozchikov, Managing Director, Copernicus Gold

- Vietnam: Looking Forward to a More Open Gold Market in 2018

By HT Khanh, Vietnam Gold Traders Association

- Asia’s Role in the Gold Market

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Chairman’s Foreword – A Look Back at 2017 And What’s Ahead

By Martin Huxley, Chairman, SBMA

- 2017 Gold Market Recap and 2018 Forecast

By Hawk Namiki, Executive Director, SBMA

- Putting Gold on the Blockchain

By Sergei Vozchikov, Managing Director, Copernicus Gold

- Vietnam: Looking Forward to a More Open Gold Market in 2018

By HT Khanh, Vietnam Gold Traders Association

- Asia’s Role in the Gold Market

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

2017 Gold Market Recap and 2018 Forecast

By Hawk Namiki, Executive Director, SBMA

Published on January 9, 2018

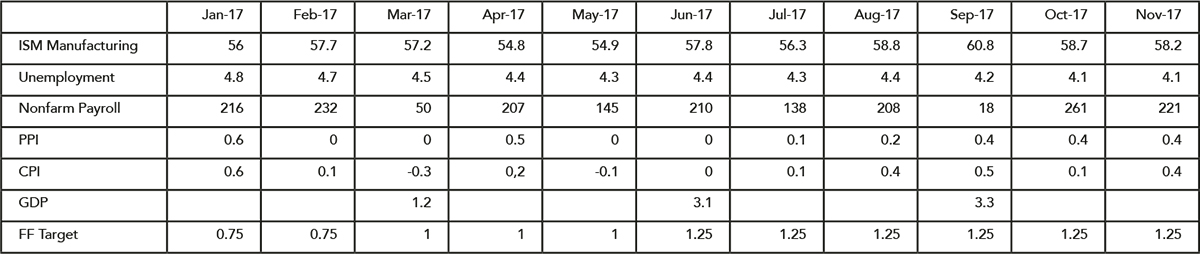

Economic data in 2017 has continued to indicate a moderate global economic recovery. Strong corporate earnings, low unemployment and renewed talk of tax reform optimism in the US is causing investors who missed the stock market rally to chase after higher prices.

On the back of the continued recovery of fundamentals, US and EU central banks have gradually reduced their monetary policy stimulus levels. The Federal Reserve Bank has especially tilted to reduce the size of its balance sheet to reverse the effects of its quantitative easing. There may also be more rate hikes on the cards.

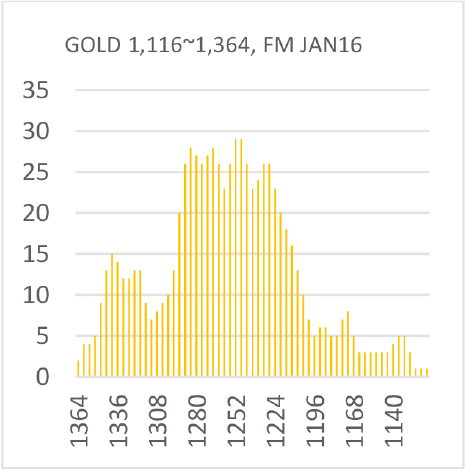

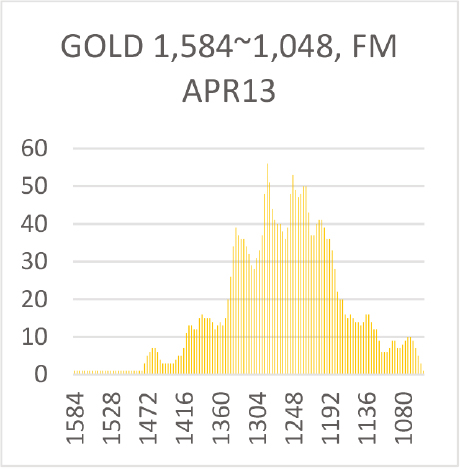

Despite the expectation of continuing rate hikes and a balance sheet reduction, many asset classes performed well in 2017. The S&P 500 has been in the bull channel with a very small dip, and there were no signs of correction. It closed at 2,673 and gained 19.42% in the year to date (29 Dec). Ten-year yields on US Treasury bonds have remained in the range of 2.02–2.62%, closed at 2.40% for the year. Gold has been overshadowed by performance of the equity market, but it has managed to remain in the wide bull channel. The range of the year to date is $1,147–1,357 per ounce, with the closing price at $1,302 – an increase of 13.5% since the end of 2016.

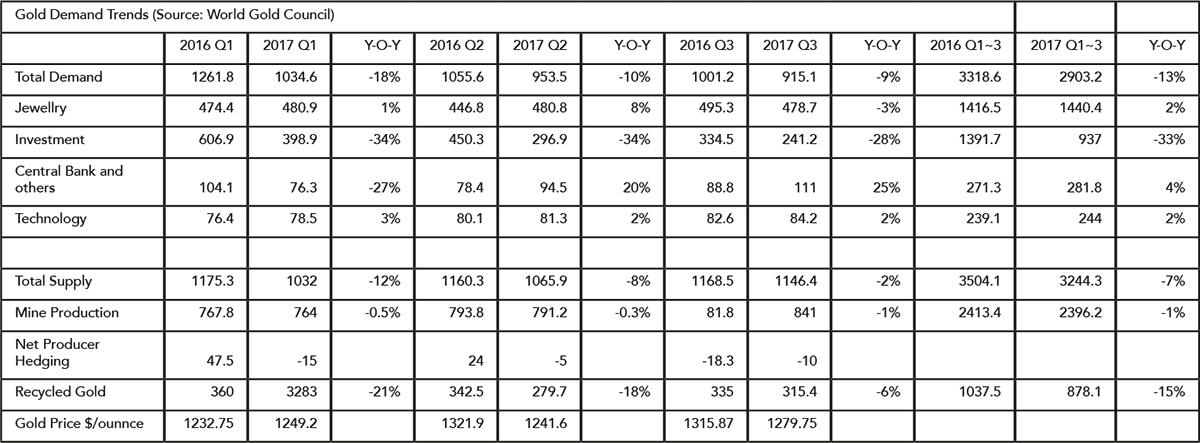

Gold demand trends

A major driver of the contraction on investment has been gold-backed ETFs. The price of gold has been well supported despite a contraction of demand, but it was not the only preferable asset class for the ETF investors as stock markets have taken centre stage throughout the year.

Monetary policy

The Federal Reserve Bank is expected to continue to keep rate hikes on the cards and its intention may be to raise interest rates to 2.25%. However, the 2/10 yield curve, which peaked at 265bp in December 2013 and flattened to 58bp in December 2017, hints at a recession in the future. Besides, a tapering of the balance sheet may create unexpected shocks in the economy and may also impact asset prices. As such, it will not be an easy for the Federal Reserve Bank to carry on with interest rate hikes and tapering.

It is also expected that any European Central Bank (ECB) interest rate hike and tapering may be few years behind the Federal Reserve Bank. As such, it will be an even more difficult ride for the ECB if it carries on with its policy.

Economic growth

Economic data has not shown any signs of weakness, and positive fundamental outlook in the United States should maintain overall sentiment towards the economy at least for the first quarter, but concerns over the pace of Federal Reserve Bank action, wage pressures and higher commodity prices may put a dampener on growth. The International Monetary Fund’s GDP outlook for 2018 is Global: 3.7%, US: 2.3%, Germany: 1.8%, and China: 6.5%.

Risk factors

A number of risk factors could affect investment and growth in 2018. Notably, wage pressures in the US, a flat yield curve, the current high valuation of stocks, the fast pace of Federal Reserve Bank interest rate hike and tapering, high commodity prices, instability in North Korea and the Middle East, the deleveraging of assets in China and also US President Trump.

Investment outlook

The long-term prospects for the US dollar, interest rates and stocks have not changed and show no signs of reversal. Despite the extreme actions that have been taken by the Federal Reserve Bank since the Lehman shock, the current recovery has been very moderate compared to recoveries seen in past crises. The Federal Reserve Bank’s rate hike and tapering process may cause an unexpected shock to the economy and investment of assets, but in the meantime, markets remain in a low interest environment with moderate economic growth.

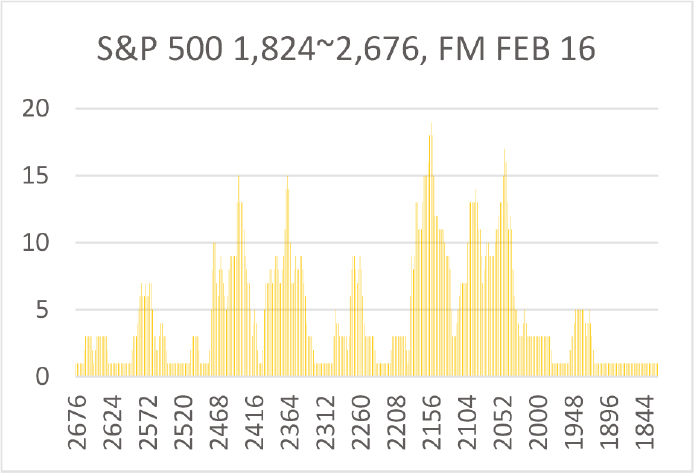

S&P 500: 2,673.61

Higher prices are still attracting buyers and there are no signs of a correction. The chart after the US presidential election (FM Dec 2016) still shows momentum toward 2,684 levels, and 2,908 levels after Bank of Japan’s new policy (FM Feb 2016). Sentiments may therefore be on the long side until market shows signs of reversal from 2,684 or 2,908. It is expected to stay in the 2,366–2,908 range in 2018.

WTI Crude Oil: $60.42

Positions are tilted to the long side and the price is heading towards $64 per barrel. After the test of the $64 level, prices will drop to $46 and will consolidate at this level. However, this scenario is unlikely if oil starts trading below $44, at which point a bear trend is likely. It is expected to hover between $44–64 in 2018.

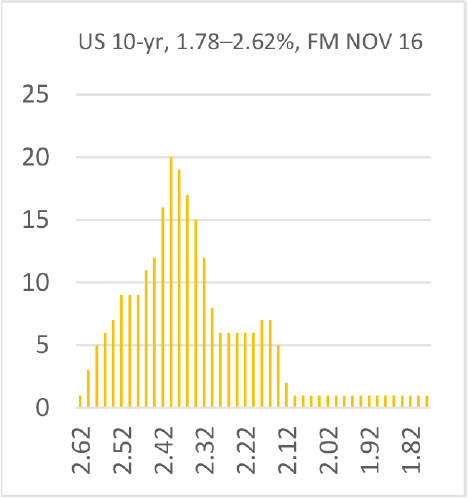

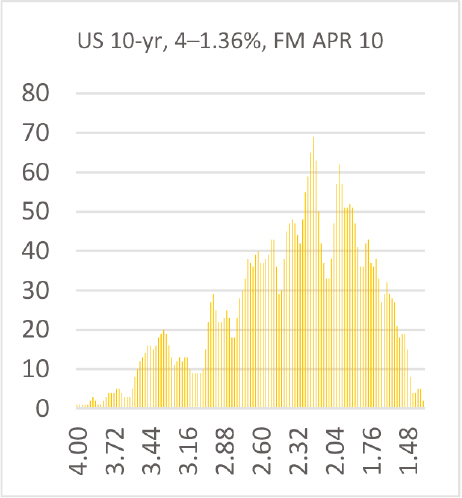

10-Year US Treasury Bonds: 2.405%

- Chart since April 2010 still suggests the 10-year yield will reach new lows.

- Chart from May 2013 is neutral, but positions are getting neutral to short side.

- Chart after US presidential election shows momentum towards 3.02%.

The key levels to watch for the next move are 2.20% and 2.40%. Accepting 2.4% suggests the yield will be heading towards 2.68% and even 3.02%. On the other hand, accepting 2.20% will fix 2.62% as the range high for the year and develop a short squeeze to test below 2%. Under the current fundamentals and the Federal Reserve Bank’s policy, 10-year yields may test 2.68%, but the yield is unlikely to reach 3.02%. Even if 10-year yields reach 3%, the 10-year yield will return to 2.4% and then to 2.2% for a further squeeze as the 2/10 curve hints at a economic slowdown in the future. The range for 2018 is expected to be 1.78–2.68%.

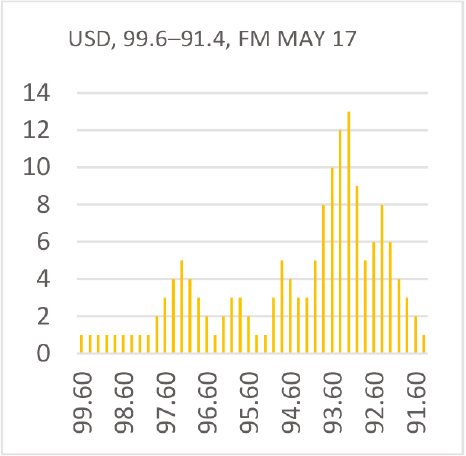

US dollar index: 92.124

The key levels to watch are 95.00 and 91.00. Accepting a value around 95 suggests that the bull run that started in September 2014 is still alive and will be heading to 112.2, while accepting a value below 91 will fix the range high at 103.4 and move towards 86.8 or even lower. The range for 2018 is expected to be 96–85.

Gold: $1,302.8

Positions still lean towards the short side or are not long enough even for the short term. Price action will be favoured on the long side. The current chart hints at a further squeeze towards $1,380/ounce, then another rally toward to $1,440. This scenario is unlikely if gold starts trading below $1,240. It is expected to remain between $1,240–1,450 in 2018.