Navigate

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

ESG & Precious Metals Provenance : The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

JEFFREY PREMER is the founder and CEO of Vaultex Exchange Pte Ltd., a Singapore based allocated spot gold and commodities exchange launching this fall. Jeffrey has extensive experience as an entrepreneur, team builder and company scaler in a variety of industries, including finance, software and electronic hardware development, supply chain management, telecom and infrastructure. He has been advising companies, venture funds and family offices in Asia for over 25 years.

DIGITAL GOLD ENABLES TRANSPARENCY AND TRACEABILITY – A METHOD OF “TRACK AND TRACE” THROUGH THE SUPPLY CHAIN.

Digital gold enables transparency and traceability – a method of “track and trace” through the supply chain. This is achieved by providing provenance proof using a distributed ledger and corresponding technologies that further increase the benefits of digital gold. Provenance proof has been the focus of investor concerns and its integrity has been a key component of a recent World Gold Council survey, in which over 1 in 4 participants see provenance as a major concern. The use of digital gold in secondary trading markets has highlighted a potential solution to storing permanent digital records of any particular bullion’s provenance.

Additionally, environmental, social and governance (ESG) issues are a concern among investors. The environmental cost of proof-of-work blockchains, such as bitcoin, has become an important consideration for investors in their investment process. Providers of secondary markets today need to lower this carbon cost by using distributed ledgers that address this concern. This is achieved by using alternative consensus mechanisms built into ledger-based technology solutions for primary and secondary markets.

Asset managers report that the biggest challenges around ESG data are the lack of standards, data availability and data inconsistency. The use of public distributed ledgers with a secondary market infrastructure, and subsequent access to integration and pricing, enables broader access to ESG data, which up until now has been one of the biggest roadblocks. The impact of regulation like the European Union’s Sustainable Finance Disclosure Regulation and the establishment of regulated secondary markets will allow access and development of the industry as investors demand more disclosure. Ultimately, the secondary market will allow the emergence of products, such as carbon-offset precious metal products, to flourish and establish a benchmark for future ESG investment growth.

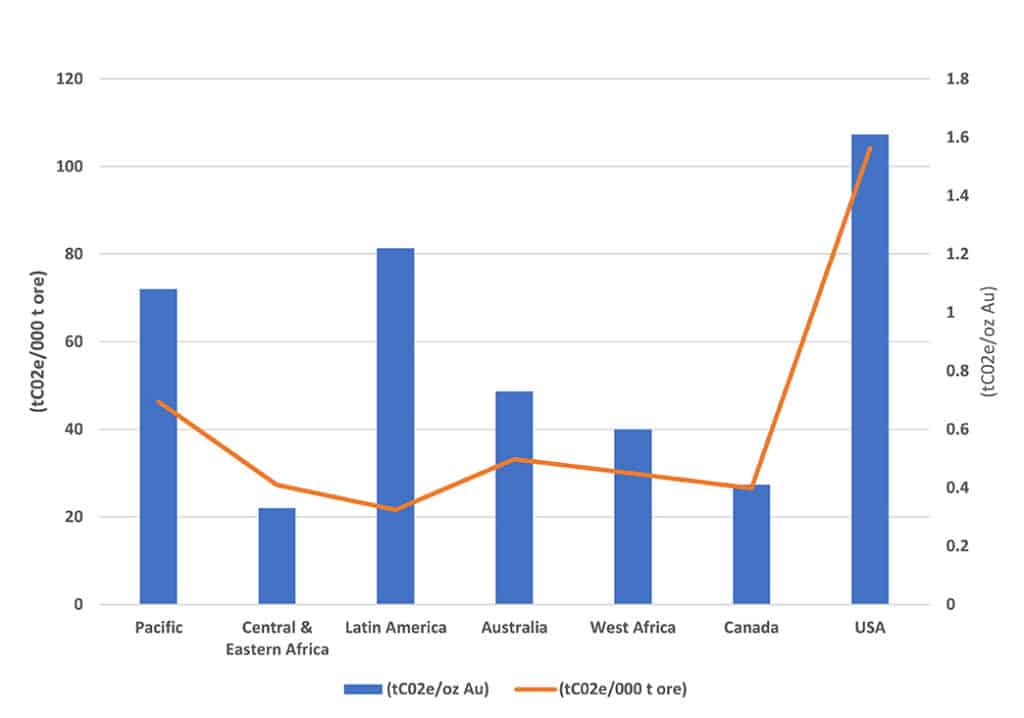

The ESG rating and carbon footprint of precious metals production vary considerably across different mine sources and supply chains. Mining as an industry consumes 11% of total global energy consumption. Open pit mines emit on average around 0.79 tCO2e and underground mines 0.47 tCO2e. Open pit mines process roughly five times the number of ore at an average grade of around 1.05 g/t Au, versus 3.25 g/t Au for underground mines, according to S&P. Gold mining’s carbon footprint also varies dramatically from region to region (see the following chart).

Fig. 1: Regional gold production (tCO2 footprint).

Considering gold producers currently do not purchase voluntary carbon offset credits, and furthermore that refiners do not purchase voluntary carbon offset credits for gold that they mine, ESG conscious investors who want to allocate a portion of their portfolio to gold would need to buy voluntary carbon offset credits on the market, which is impractical for most investors. One solution is to create a secondary exchange to trade allocated spot gold contracts with the average gold carbon footprint certified offset credit attached to the digital gold representing the allocated gold, i.e., 1 kilobar with 25 tCO2 offset credits attached. This “Green Gold” would trade at the combined price of gold and carbon offset credits.

In summary, carbon offset spot gold products would provide a near to mid-term solution for ESG-centric investors who want to invest in precious metals, and this is what Vaultex will provide upon launch. In the long term, the market could develop ESG and CO2 footprint track and trace mechanisms and offset the CO2 footprint of individual supply chains and price that into the supply pricing. Until then, investors should have the option to trade in CO2 offset precious metal products.

JEFFREY PREMER is the founder and CEO of Vaultex Exchange Pte Ltd., a Singapore based allocated spot gold and commodities exchange launching this fall. Jeffrey has extensive experience as an entrepreneur, team builder and company scaler in a variety of industries, including finance, software and electronic hardware development, supply chain management, telecom and infrastructure. He has been advising companies, venture funds and family offices in Asia for over 25 years.