Navigate

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

Article List

- 2022 Asia Pacific Precious Metals Conference Summary

By Joni Teves, Precious Metals Strategist, UBS Investment Bank

- Regulatory Reforms In The Precious Stones & Precious Metals Dealers Sector

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism Division (ACD), Ministry of Law

- ESG & Precious Metals Provenance: The Use Case For Digital Gold

By Jeffrey Premer, CEO, Vaultex

- Creating A Safe Haven For Generational Wealth

By Gregor Gregersen, Founder & Director, The Reserve

- Singapore – A Tokenised Gold Settlement Hub Built For The Future

By Anoushka Rayner, Head of Growth Commodities, Paxos

- China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

- Malaysia’s Gold & Gems Industry

By Ermin Siow, Advisor, Federation of Goldsmiths and Jewellers Association of Malaysia

- SBMA News

By SBMA

China To Take Leading Role In Global Fuel Cell Electric Vehicle Market

By Trevor Raymond, Director of Research, World Platinum Investment Council (WPIC)

TREVOR RAYMOND leads research and investor development for the World Platinum Investment Council (WPIC). He joined from Anglo American Platinum, where he was the head of market intelligence and market relations. A precious metals specialist with over 30 years’ experience in the equity and metals markets, Trevor moved into the platinum industry in 2000 following 17 years in gold mining, where he held roles in engineering, mineral economics, and corporate finance.

With demand for platinum from fuel cell electric vehicles (FCEVs) set to equal current platinum automotive demand, possibly as early as 2033, China looks ready to take the biggest share of this growing market as it matures.

Platinum FCEV Demand Outlook

Achieving net zero in the automotive sector calls for a multi-pronged approach incorporating not only battery electric vehicles (BEVs) and FCEVs, but also more CO2-efficient internal combustion engine vehicles (ICEs), including mild-hybrid gasoline and mild-hybrid diesel powertrains. It is worth mentioning that diesel vehicles still emit far less CO2 than their gasoline equivalents and are now comparable in terms of non-CO2 emissions.

ICE vehicles are expected to be a significant part of the global drivetrain mix well into the 2030s. From a platinum demand perspective, as the energy transition progresses, any decline from falling ICE vehicle production volumes will be offset by tighter emissions standards and correspondingly higher platinum loadings – plus platinum substitution for palladium in gasoline vehicles.

Fuel cells as a technology have a surprisingly long history, having been invented around 180 years ago, deployed widely in aerospace since the 1960s and since used in a variety of stationary and mobile applications. However, the first commercially available FCEV – the Toyota Mirai – was only launched in 2014, but small production volumes and limited refuelling opportunities means FCEVs have been relatively expensive and impractical for early adopters. These challenges are being overcome, with an increasing number of FCEVs available today in all vehicle categories, and supportive government policies enacted in many parts of the world increasing economies of scale in both hydrogen and FCEV production.

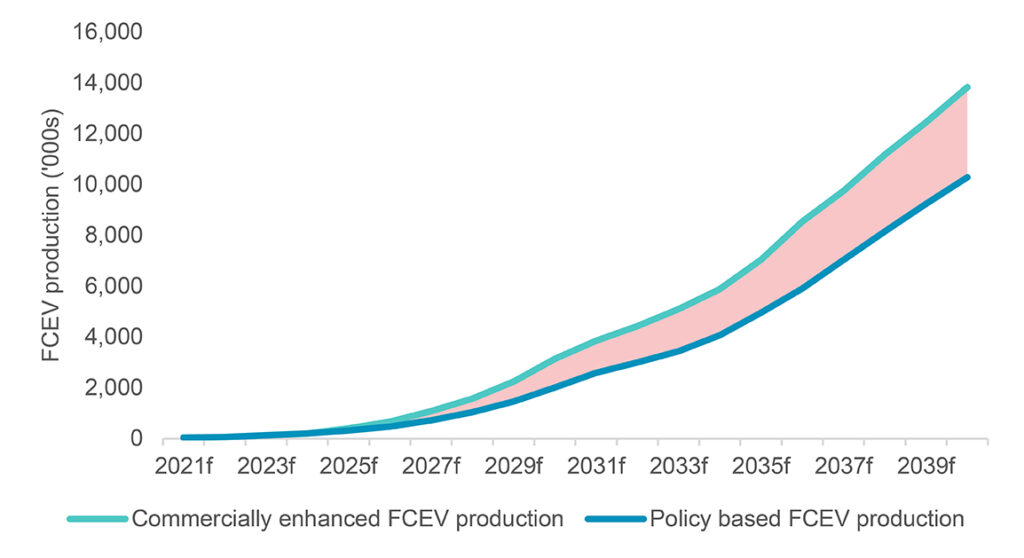

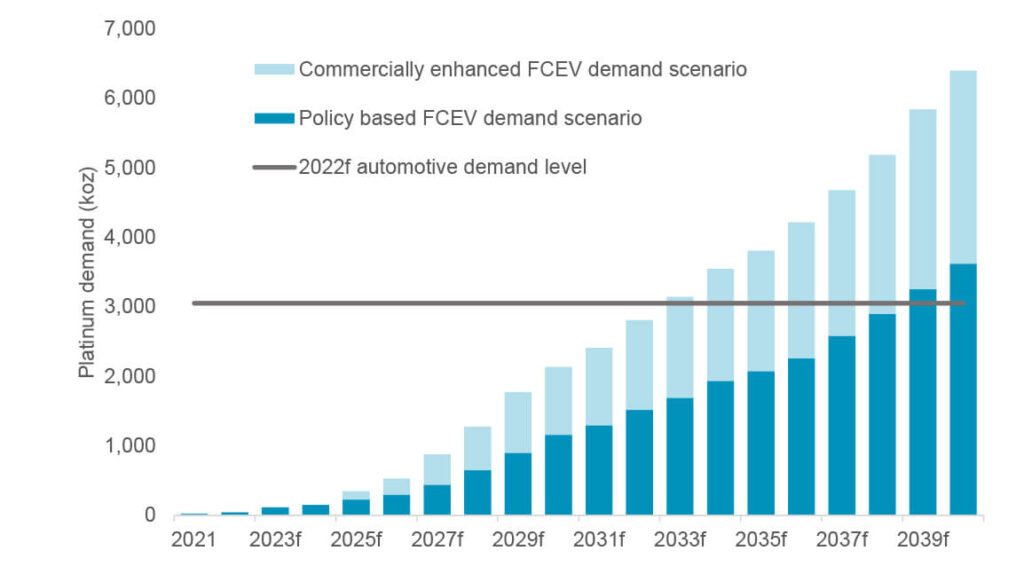

Depending on the outlook, it is just a matter of time until FCEV demand for platinum equals current platinum automotive demand, as recent research by the World Platinum Investment Council (WPIC) assesses through the examination of two different scenarios. First, a more conservative policy-driven scenario, where FCEV adoption is driven by government and regional subsidies, incentives, and legislated targets. Under this scenario, FCEV demand for platinum equals current platinum automotive demand by 2039. Second, a scenario of broad-based commercial adoption, whereby the impact of the successful delivery of government and regional policies engenders FCEV production and infrastructure critical mass resulting in production economies of scale sufficient to promote widespread adoption on the grounds of costs and practicable usability. Under this scenario, FCEV demand for platinum will match current automotive demand for platinum as early as 2033.

Figure 1. Global adoption of FCEVs is expected to accelerate dramatically under both policy-based and commercially-enhanced scenarios.

The FCEV Market And China

China is well positioned to be one of the leading forces in the FCEV market under either scenario, especially in the mass transport and heavy-duty (HD) sectors. This is perhaps not surprising, given that, in 2019, China was home to approximately 7 million heavy-duty trucks – or one-third of the world’s 20 million heavy-duty trucks. Based on Bloomberg NEF predictions, by 2040, 50% of the world’s heavy-duty trucks will be powered by clean energy.

China is well positioned to be one of the leading forces in the FCEV market under either scenario, especially in the mass transport and heavy-duty (HD) sectors.

The further expansion of the new energy vehicle (NEV) industry under China’s 2060 carbon neutral directive is highly supportive of FCEV growth. According to China Association of Automobile Manufacturers (CAAM) statistics, from January to July 2021, the country’s domestic new vehicle sales reached 14.756 million units, of which 1.478 million were NEVs, an increase of over 190% year-on-year.

Recent plans (NEV Industry Development Plan and NEV Technology Roadmap 2.0) will also help to stimulate the market for FCEVs. By 2035, the market share of NEVs in China is expected to exceed 50%, with the number of FCEVs reaching around 1 million.

Similarly, plans to stimulate green hydrogen production (the National Development and Reform Commission’s 2021-2035 plan on hydrogen energy development) appear to adopt the successful national model approach – make green hydrogen widely available and consumer demand for FCEVs will follow.

At the local level, more than 20 regions have so far issued phased plans for the promotion of FCEV deployment. Shanghai, for example, recently proposed a 2023 target of 100 hydrogen refuelling stations, 100 billion yuan of industry output, and 10,000 FCEVs deployed.

These efforts already appear to be effective – green hydrogen production capacity additions in China comprise 36% of all planned projects globally, and this alone is the key driver of creating the significant impact that facilitates our commercially-enhanced FCEV growth profile.

Hydrogen Refuelling Stations In China

The biggest early adoption challenges facing FCEVs in all regions are infrastructure and policy-linked. It is somewhat a cause-and-effect dilemma, hydrogen refuelling stations (HRS) are needed to make FCEVs a viable consumer option, but automakers are reluctant to invest in FCEV technology until the supporting infrastructure is in place. For FCEVs, this requires the establishment of hydrogen refuelling stations at a density sufficient to remove consumer concerns regarding easy refuelling.

China has taken an ambitious stance on HRS growth when compared to other countries, targeting 1,000 HRS by 2030. In comparison, the next most ambitious targets are South Korea, at 310 HRS by 2022, and Germany, aiming for 400 HRS by 2023.

Collaboration is also helping with China’s HRS rollout. For example, since 2020, REFIRE, a leading global provider of hydrogen fuel cell technologies based in China, has been working with Sinopec Shanghai to build a strategic hydrogen energy cooperation “ecosystem”, effectively promoting the large-scale application of FCEVs and rapid development of infrastructure such as hydrogen refuelling stations in Shanghai.

FCEV Production Estimates

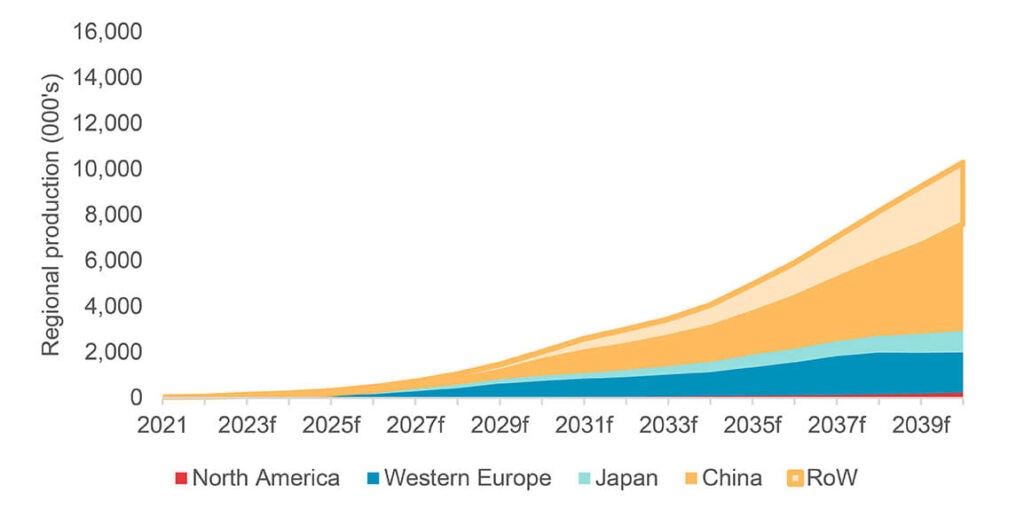

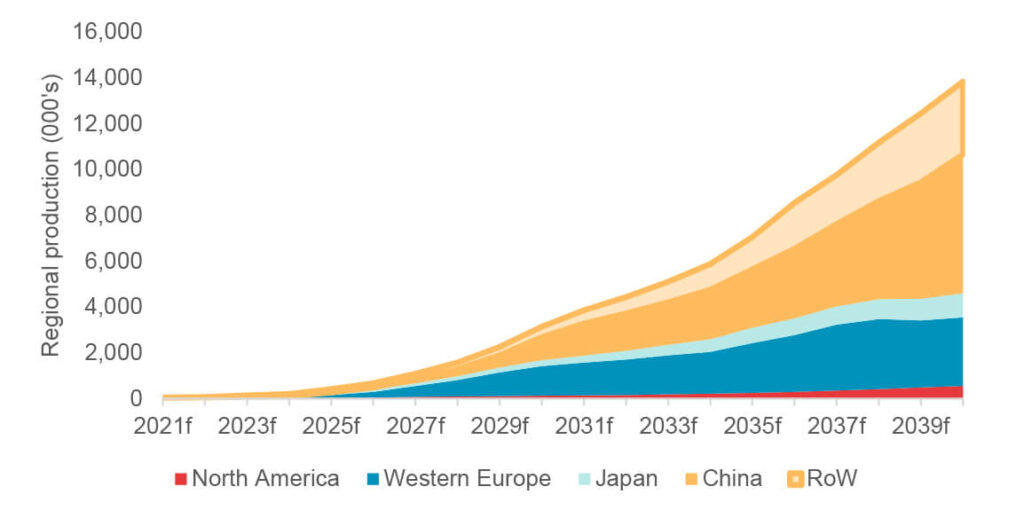

Under both WPIC’s policy-driven and commercially driven scenarios, estimates are based around fuel cell production rather than sales. As far as light-duty FCEVs are concerned, we anticipate that production volumes will ultimately be led by China in both scenarios.

The first mass-produced hydrogen FCEV sedan, the CHANGAN SL03 FCEV, is expected to be launched in China in 2022.

Light-duty commercial (LCV) FCEVs also show strong growth in China under both scenarios. Given that the fuel cell powertrains are likely to be highly interchangeable between LCV and light-duty models there could be substantial variability in the outlook for LCV if relative demand or regulatory policies cause automakers to prioritise one or the other.

Figure 2. China is expected to be a global leader in FCEV production and deployment in a scenario where government policy is the key driver for FCEV adoption.

In the HD segment, it is clear that China dominates in the policy-driven scenario, with a particular focus on buses, which can be supported by dedicated depot based refuelling facilities. Furthermore, China’s ambitious HRS plans are reflected here, and although a large country, an extensive refuelling network is supportive of HD transportation and distribution networks along specific transport corridors.

According to the International Energy Agency Advanced Fuel Cells Technology Collaboration Programme, 5,648 FCEV buses were in deployment globally as at the end of 2020 and China is at the forefront of the growing hydrogen fuel cell bus market, with a fleet of 5,290, giving it an almost 94% share.

Figure 3. Total FCEV adoption will be more significant in a broad-based commercial adoption scenario, with some of the rest of the world keeping closer pace with China.

Forecast FCEV Demand For Platinum

Under both scenarios, global FCEV demand is initially modest. Over time, however, demand becomes meaningful; in the policy-driven scenario reaching 1 million ounces (Moz) a year by 2030 and continuing to grow to almost 4 Moz by 2040. The initial trajectory is similar in the commercially enhanced adoption scenario, before accelerating to 1.3 Moz a year by 2028, and almost 6.7 Moz by 2040. These demand levels are significant in comparison to the current annual global platinum supply of around 8 Moz per annum.

Under the policy-driven scenario, FCEV platinum demand from China accounts for 40% and 32% of global demand in 2033 and 2039 respectively. Under the commercially enhanced scenario this changes to 37% and 25% as other countries are more successful in keeping up with China’s lead.

Figure 4. FCEV demand for platinum could match current automotive demand by 2033 if there is broad-based adoption.

Platinum demand needs for green hydrogen and FCEVs is expected to easily exceed current automotive demand in the 2030’s. This demand outlook, in combination with platinum’s essential role in decarbonising the world, is continuing to increase the number and range of investors, including those with a strong ESG overlay, that are investing in platinum.

TREVOR RAYMOND leads research and investor development for the World Platinum Investment Council (WPIC). He joined from Anglo American Platinum, where he was the head of market intelligence and market relations. A precious metals specialist with over 30 years’ experience in the equity and metals markets, Trevor moved into the platinum industry in 2000 following 17 years in gold mining, where he held roles in engineering, mineral economics, and corporate finance.