Navigate

Article List

- Editorial

By KL Yap, SBMA

- Metalor Technologies Singapore Pte Ltd – Innovation in Southeast Asia’s Precious Metals Market

By Daryl Low, Founder, CEO, Hydra X

- Singapore-Based Gold Producer Boroo Sets Sights on Growth

By Dulguun Erdenebaatar, Director, CEO, Boroo Pte. Ltd.

- How Long Can The War Support Precious Metals?

By Nikos Kavalis, Managing Director, Metals Focus

- Shanghai Platinum Week: Strengthening China’s Links with the Global PGM Market

By Weibin Deng, Head of Asia Pacific, World Platinum Investment Council

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By KL Yap, SBMA

- Metalor Technologies Singapore Pte Ltd – Innovation in Southeast Asia’s Precious Metals Market

By Daryl Low, Founder, CEO, Hydra X

- Singapore-Based Gold Producer Boroo Sets Sights on Growth

By Dulguun Erdenebaatar, Director, CEO, Boroo Pte. Ltd.

- How Long Can The War Support Precious Metals?

By Nikos Kavalis, Managing Director, Metals Focus

- Shanghai Platinum Week: Strengthening China’s Links with the Global PGM Market

By Weibin Deng, Head of Asia Pacific, World Platinum Investment Council

- SBMA News

By Albert Cheng, CEO, SBMA

How Long Can The War Support Precious Metals?

By Nikos Kavalis, Managing Director, Metals Focus

NIKOS KAVALIS is a founding partner of Metals Focus. He has over 18 years of experience in precious metals, having previously worked for the Royal Bank of Scotland and GFMS. Since September 2019, Nikos has been based in Singapore, where he also runs the local subsidiary of Metals Focus.

Over the past few weeks, the Ukrainian crisis has dominated global markets, including precious metals. The price of gold, silver and platinum group metals (PGMs) have experienced wild fluctuations, enjoying strong rallies, followed by sharp corrections.

There are several reasons why the war in Ukraine has and will likely continue to support precious metals prices. First, the extent of the conflict, its proximity to Western Europe and the risk that it could spread to include other countries, whether intentionally or accidentally, have all pushed investors towards defensive assets. This has been particularly supportive of gold, that rallied to levels not far off its 2020 peak (in US dollar terms), and to a lesser extent silver and platinum.

Second, reacting to the events, Western countries have imposed widespread sanctions on numerous Russian individuals and entities. This has fuelled supply concerns for key industrial commodities. Russia is a major producer of numerous energy and industrial commodities. So far, there have been no widespread bans of commodity exports from the country, however markets have been concerned that this could happen later, for instance should attacks on Ukraine intensify. Meanwhile, even if bans are avoided, companies have been voluntarily withdrawing from the Russian market, including the use of Russian products, so there is a risk of de-facto supply tightness emerging. Among precious metals, the impact of this risk has been most pronounced for palladium, given that Russia accounts for nearly 40% of global mine production.

Third, even assuming commodity export bans continue to be avoided, trade frictions are already emerging and could get worse. These stem from sanctions on key local banks, some Western financial institutions pulling back or out of the country and reciprocal bans on airlines from using Russian and European airspace, affecting logistics supply chains. Such frictions have also boosted the appeal of commodities in general, which is also helping precious metals.

It is impossible to predict how the crisis will evolve and what the ultimate impact it will have on precious metals prices.

Geopolitical crises’ boost to precious metals is normally short lived

It is impossible to predict how the crisis will evolve and what the ultimate impact it will have on precious metals prices. However, looking at past geopolitical events of comparable magnitude, experience suggests that the boost they provide to gold and silver prices tends to be short-lived.

Given this conflict’s proximity to Western Europe and Russia’s importance as a commodity exporter, the risks are higher. However, Metals Focus base case forecast is still that sooner or later, the boost for safe haven assets will dissipate. Recent price moves lend some support to our view, with all precious metals (indeed most commodities) falling sharply following their early-March rallies, in spite of the war continuing to rage.

Figure 1: Gold Prices

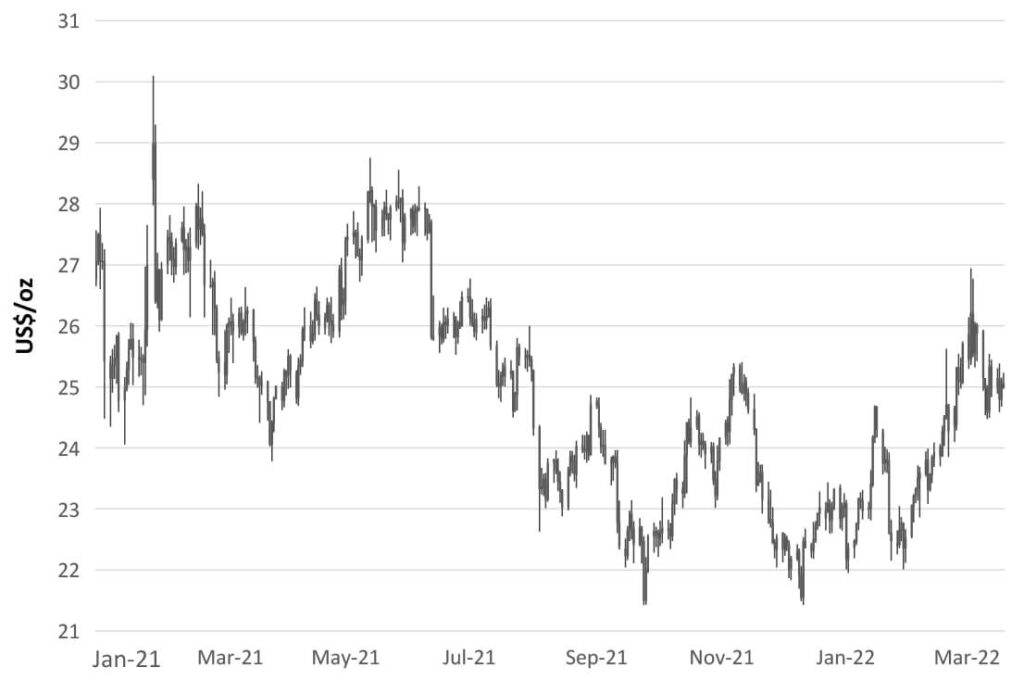

Figure 2: Silver Prices

Ukraine risks are different for PGMs

While this reasoning holds for gold, silver, the war comes with some added risks for palladium, given its heavy reliance on Russian mine production, and to a lesser extent platinum. Clearly the biggest disruption for these two markets would come from direct sanctions/a ban on trading/consuming Russian PGMs. Such a situation would create extreme tightness in the palladium market, as Western original equipment manufacturers (OEMs) and fabricators could be stopped from accessing nearly 40% of global mine production of the metal. The implications for platinum would be less severe, as Russia only accounts for 10% of global mine supply. Metals Focus believes that this scenario is unlikely, as Western governments avoid risking the damage such a measure would have on their auto industries.

Persisting or even increasing frictions in accessing metal from Russia seem a more likely and less dramatic scenario. We may also see a growing number of Western traders, fabricators and OEMs opting to limit or avoid, where possible, buying/using Russian PGMs, due to concerns over reputational damage. Ultimately, although not as devastating for the market as an outright ban on Russian metal, all these frictions would result in tighter conditions for PGM brands from outside Russia and potentially fuel a two-tier market in these metals.

One should also not underestimate the impact that the crisis could have on demand.

One should also not underestimate the impact that the crisis could have on demand. Russia is a sizeable auto market (it accounts for 2% of global light vehicle output) and prolonged sanctions will no doubt affect local vehicle production and by implication PGM demand. The impact of the crisis and sanctions on economic activity around the globe may also affect car sales. Finally, Ukraine, is a major producer of neon, a noble gas that is crucial to the manufacturing of semiconductors. Disruptions to exports of neon could impact chip production volumes. In turn, this could perpetuate the headwinds to global vehicle production growth, at a time when the sector is only starting to recover from last year’s chip-shortage crisis.

Figure 3: Light Vehicle Production

Macro drivers expected to once again take centre stage

Turning back to gold, we expect its traditional drivers, namely interest rates, inflation and other macroeconomic factors, will reassert themselves over the rest of 2022. Following the March hike, both the Fed’s dot-plot and the Fed Funds Futures now point to a 25-basis point hike on each of the six remaining Federal Open Market Committee (FOMC) meetings, taking the US policy rate upper bound to 2% by year-end. Metals Focus believes this is a little aggressive and expects a slower pace towards monetary policy normalisation. As market expectations are adjusted in the near future, this should support precious metals prices.

Figure 4: Fed Funds Futures Implied Rates

Elsewhere, the Fed’s hawkish tone may, counter-intuitively, boost interest in safe havens. This would be on the back of concerns a Fed policy mistake, where hikes bring about a recession and an equity markets correction. Such concerns are likely amplified by the fact that a large portion of the inflationary pressures we are currently experiencing are clearly supply-driven rather than purely the result of past monetary policy. There is a very real risk that rising borrowing costs combined with ever higher input prices could end up shocking the system.

We believe that these factors will support gold and silver, and to a lesser extent platinum, prices in the next few months, helping them remain elevated even after any remaining Ukraine “bid” dissipates. Later in 2022, however, liquidations and by implication lower prices, seem inevitable. Even if US policy rate increases are slower than markets expect, they will no doubt weigh on precious metals. This pressure will likely also be amplified by inflation easing in the second half of the year, as some of the supply chain frictions that are currently in place improve and as the boost on energy and industrial metals prices from the current crisis fades.

“White” metals’ fundamentals healthy overall

While macro factors certainly play a key role in driving “white” precious metals prices, especially silver, their supply-demand fundamentals are also important to consider. Starting with silver, we expect these fundamentals will remain attractive in 2022. It is worth remembering that after being mostly a surplus market from 2010 to 2020, silver saw a deficit in 2021. We expect the same will happen in 2022 and in fact our forecasts over the next few years suggest the metal will be structurally undersupplied. This could offer silver prices some support, however this will be limited, given the sizeable above-ground inventories that exist for the metal.

Figure 5: Silver structurally undersupplied over the next few years

Strong demand conditions are expected to be the main driver behind this shift in silver’s fundamentals. Healthy gains in industrial fabrication are a key contribution. In part this is due to secular drivers, such as rising solar capacity installations and rising demand for silver-bearing components within automotive applications. Cyclical factors, relating to the ongoing post-pandemic recovery, are also helping industrial fabrication. Elsewhere, following last year’s exceptional gains, we expect bar and coin investment to remain strong this year, whereas jewellery and silverware should enjoy strong post-COVID gains.

Before the invasion of Ukraine, Metals Focus had anticipated strong gains in automotive demand for platinum and palladium. This would be the result of a combination of easing chip shortages and higher PGMs loadings on the back of tighter emissions legislation in certain markets. Assuming the crisis does not worsen materially, we maintain this broad outlook for automotive demand.

This would see the palladium market move from surplus conditions at the start of the year to a deficit towards its end and into 2023. Although platinum is forecast to remain in a surplus throughout 2022, signs that it will move into a deficit next year should encourage investor interest in the metal. As such, even after PGM prices lose their current “crisis premium”, we believe that they will generally trend upwards over the rest of 2022.

NIKOS KAVALIS is a founding partner of Metals Focus. He has over 18 years of experience in precious metals, having previously worked for the Royal Bank of Scotland and GFMS. Since September 2019, Nikos has been based in Singapore, where he also runs the local subsidiary of Metals Focus.