Navigate

Article List

- SBMA at the Bund Summit 2021

By SBMA

- Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Alex Stewart International Commissions New Precious Metals Laboratory in Liverpool, UK

By Rob Smith, Business Development Executive, Alex Stewart International

- Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

- Hybrid India Gold Conference 2021

By Bullion World

- Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Annual General Meeting 2021

By SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- SBMA at the Bund Summit 2021

By SBMA

- Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Alex Stewart International Commissions New Precious Metals Laboratory in Liverpool, UK

By Rob Smith, Business Development Executive, Alex Stewart International

- Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

- Hybrid India Gold Conference 2021

By Bullion World

- Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Annual General Meeting 2021

By SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

Published on December 10, 2021

TREVOR RAYMOND leads research and investor development for the World Platinum Investment Council (WPIC). He joined from Anglo American Platinum where he was the Head of Market Intelligence and Market Relations. A precious metals specialist with over 30 years’ experience in the equity and metals market, Trevor moved into the platinum industry in 2000 following 17 years in gold mining, which saw him undertake roles in engineering, mineral economics and corporate finance. Trevor was Anglo American Platinum’s Head of Investor Relations until 2008 when he joined the platinum marketing team in London to focus on commodity research and market development.

* This article was published in partnership with World Platinum Investment Council

Growth in hydrogen applications could lift annual platinum demand by over 3 million ounces by 2035, a profound increase from annual demand levels of around 8 million ounces today.

More investors around the world are recognising that platinum is at the forefront of proton exchange membrane (PEM) applications, a transformative technology that holds the key to unlocking the zero-emissions potential of hydrogen.

The markets for PEM technology – used in both electrolysers to produce hydrogen and in hydrogen fuel cells – are growing, propelled by the imperative to meet climate change goals.

Platinum demand will benefit as the hydrogen economy grows

With the global hydrogen economy projected to be worth US$2.5 trillion and supporting 30 million jobs by 2050, platinum’s dual role in unlocking green hydrogen and its end applications, including fuel cell electric vehicles (FCEVs), places it in the sweet spot, making it a major beneficiary as PEM technologies take off.

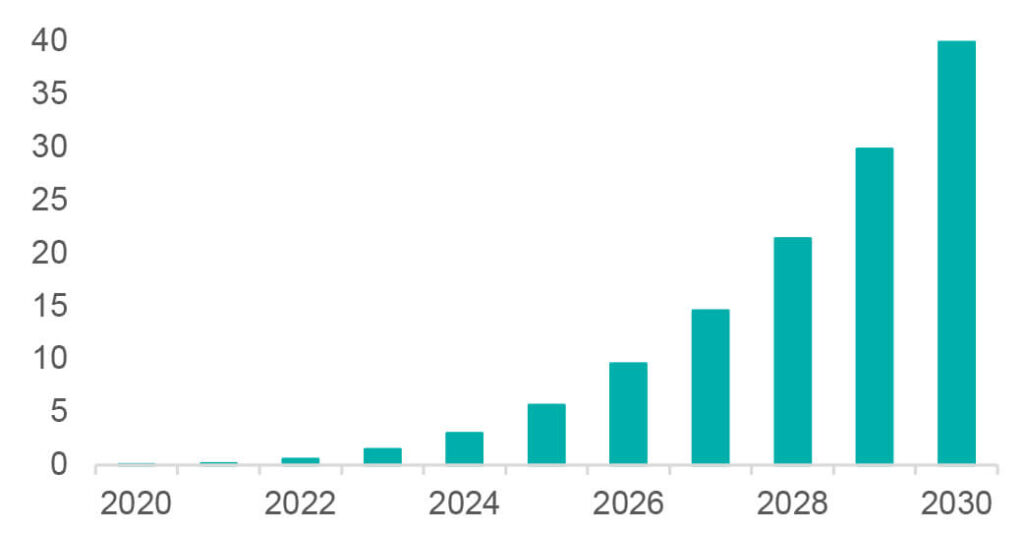

A recent report published by the Hydrogen Council highlights that annual demand for hydrogen could rise from about 90 million metric tons (MT) today to 140 MT in 2030, with green hydrogen having a 20 percent share. Supplying the almost 30 MT of green hydrogen that this growth would require necessitates the build-out of over 250 gigawatts (GW) of electrolyser capacity before the end of the decade.

Longer-term, it is estimated that the supply of clean hydrogen would need to reach 690 MT by 2050 to meet demand from end-users. Between 60 to 80 percent of this would be green hydrogen, necessitating 3 to 4 terawatts of electrolysis capacity.

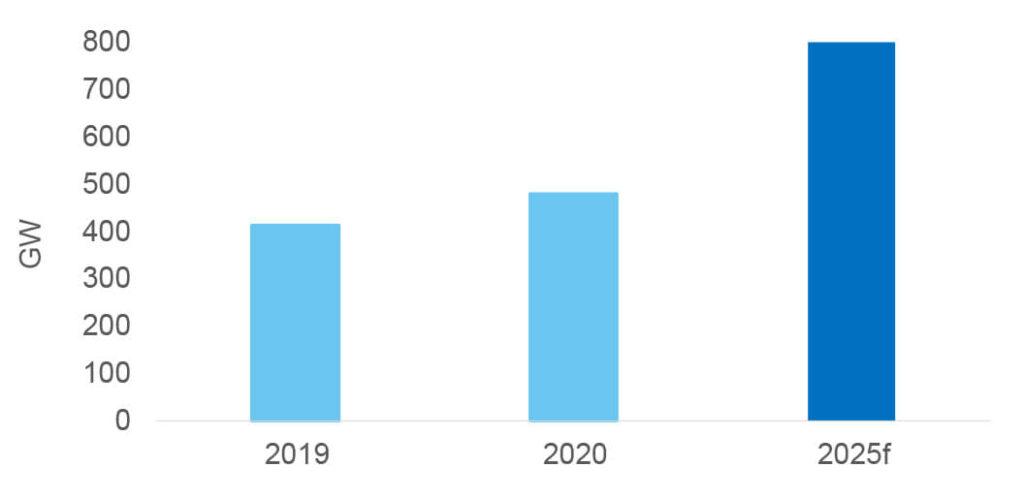

The China Hydrogen Alliance, a state-sponsored hydrogen industry group, is predicting that, given current investment trends, the value of low carbon and green hydrogen energy industry in terms of production, will reach 1 trillion yuan (US$152.6 billion) by 2025 in China alone.

The significant expansion of electrolyser capacity needed to support future demand for green hydrogen is positive for platinum, as PEM electrolysers are especially suited to coping with the intermittent nature of renewable electricity.

While the platinum needed to produce green hydrogen is gradually increasing in line with the expansion of electrolyser capacity, electrolysers use relatively small amounts of platinum and are built to last, meaning infrequent replacement. Cumulatively, over the next 15 years, platinum demand from electrolysers is between 1 million to 2 million ounces, dependent on technology development over that period and including the volume of platinum used in the non-PEM alternative technology, alkaline electrolysers.

However, growth in hydrogen availability supports the wider deployment of hydrogen infrastructure, such as refuelling networks, which could provide a significant boost to platinum by allowing the wider adoption of FCEVs.

Targeted growth in the total number of FCEVs on roads in China, the United States, Europe and Japan – cumulatively and inclusive of commercial and passenger vehicles – is expected to rise from tens of thousands in 2020 to over 10 million by 2035. Demand for platinum in FCEVs based on this growth is expected to increase annual platinum demand in 2030 by well over 1 million ounces (31 tonnes), or over 10 percent of current annual demand. This could exceed 3 million ounces (93 tonnes) per annum by 2035 if growth were to continue to accelerate rapidly as the cost of producing hydrogen falls to levels that make it commercially more attractive than fossil fuels.

Hydrogen is key

The 2021 Glasgow Climate Pact, agreed by nearly 200 participating countries in the closing stages of COP26, is a global agreement to accelerate action on climate change this decade. It consolidates aspects of the 2015 Paris Agreement, keeping the possibility of limiting temperature rise to 1.5°C alive, a goal that is increasingly viewed as necessary to mitigate the effects of climate change. Significantly, the Glasgow Climate Pact is the first climate deal to explicitly plan to reduce the use of fossil fuels, although it stopped short of making a commitment to phase them out altogether.

As global action on climate change accelerates, with over 90 countries, representing more than 80 percent of the world’s GDP, committed to net-zero targets, the deployment of hydrogen is increasingly regarded as a key pillar of energy transition.

According to the Hydrogen Council, 39 countries now have “concrete hydrogen strategies”, with total investment of around US$500 billion currently committed across the hydrogen value chain through to 2030. Europe is leading the way with investments of US$130 billion.

Renewable hydrogen electrolyser capacity (GW)

China is emerging as a hydrogen powerhouse, expecting hydrogen to comprise 10 percent of the energy share by 2050 to reach its climate targets. Fifty-three large-scale projects have been publicly announced in China, and the Chinese government has made US$20 billion of public funding available to hydrogen projects. Fifty percent of China’s announced projects are linked to transport applications, a key sector in its energy transition plan.

China renewable generation capacity (GW)

Hydrogen – the most abundant element on earth – is already used as a fuel source in certain industries. As it contains no carbon, it produces zero emissions, only water. However, its credentials as a truly sustainable fuel source rest on how it is produced. Green hydrogen, which taps on renewable sources of energy such as solar photovoltaic panels or a wind turbine during electrolysis, is completely carbon-free in its production.

The potential growth of green hydrogen in the world’s energy system is significant because of its long-term energy storage capabilities which could help to decarbonise transport, heating and industrial processes. The International Renewable Energy Agency estimates that the world will need 19 exajoules of green hydrogen by 2050, or between 133 million and 158 million tonnes a year, should green hydrogen replace the current use of fossil fuels in these sectors.

PEM integral to hydrogen, platinum integral to PEM

Due to its unique chemical and physical properties, platinum is integral to PEM applications. In conjunction with iridium, it acts as a catalyst in PEM electrolysers, which use a solid polymer electrolyte, one of the two leading electrolysis technologies available in the market.

Electrolysis of water consumes electricity to produce hydrogen and oxygen. The PEM fuel cell works in reverse and here hydrogen and oxygen are combined to generate electricity, with heat and water as the only by-products. Molecules of hydrogen and oxygen react and combine using a PEM which is coated with a platinum catalyst.

Hydrogen fuel cells can power a range of applications, providing energy to homes, mobile homes and boats and back-up power to businesses. Platinum-based hydrogen fuel cells are especially suited to providing fossil-free electric mobility in FCEVs and are already being used to move goods across the supply chain – from hydrogen-powered trucks to fork-lift trucks moving goods around a warehouse. When fuelled by green hydrogen, FCEVs offer ‘well to wheel’ emissions-free transport.

FCEVs combine the zero tailpipe emissions of battery electric vehicles (BEVs) with the quick refuelling times and range of a traditional gasoline or diesel car, being entirely fossil-fuel free when powered with green hydrogen. Unlike BEVs, FCEVs also have the advantage of providing high load capacity, meaning that they maintain a consistent power output even as the load increases, for example when going uphill or towing.

Owners and operators of long-haul commercial fleets looking for fossil fuel-free alternatives with zero tailpipe emissions are increasingly recognising that green hydrogen-fuelled FCEVs are the technology that best meets their needs, and heavy-duty FCEVs are expected to be one of the first segments of the hydrogen economy to achieve scale.

Passenger transportation is also using fuel cells, with the numbers of hydrogen-fuelled buses, trams and trains growing globally. In addition, shipping and aviation are turning to hydrogen fuel cells as they look to decarbonise.

Further, many of the world’s leading automotive companies are developing, or have developed, hydrogen platinum-based fuel FCEVs as a preferred technology in response to the challenge of improving air quality and reducing fleet carbon emissions.

The long-term demand potential for platinum in green hydrogen production and FCEV applications continues to increase the number and range of investors that are considering platinum as an investment asset. These investors soon come to appreciate the significant near-term platinum automotive demand growth that exists from substitution, higher loadings and more hybrid vehicles in the context of constrained supply, in addition to the compelling hydrogen growth picture. We believe this will continue to provide investors with a strong incentive to build platinum exposure from current levels.

TREVOR RAYMOND leads research and investor development for the World Platinum Investment Council (WPIC). He joined from Anglo American Platinum where he was the Head of Market Intelligence and Market Relations. A precious metals specialist with over 30 years’ experience in the equity and metals market, Trevor moved into the platinum industry in 2000 following 17 years in gold mining, which saw him undertake roles in engineering, mineral economics and corporate finance. Trevor was Anglo American Platinum’s Head of Investor Relations until 2008 when he joined the platinum marketing team in London to focus on commodity research and market development.

* This article was published in partnership with World Platinum Investment Council