Navigate

Article List

- SBMA at the Bund Summit 2021

By SBMA

- Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Alex Stewart International Commissions New Precious Metals Laboratory in Liverpool, UK

By Rob Smith, Business Development Executive, Alex Stewart International

- Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

- Hybrid India Gold Conference 2021

By Bullion World

- Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Annual General Meeting 2021

By SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- SBMA at the Bund Summit 2021

By SBMA

- Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Alex Stewart International Commissions New Precious Metals Laboratory in Liverpool, UK

By Rob Smith, Business Development Executive, Alex Stewart International

- Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

- Hybrid India Gold Conference 2021

By Bullion World

- Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Annual General Meeting 2021

By SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

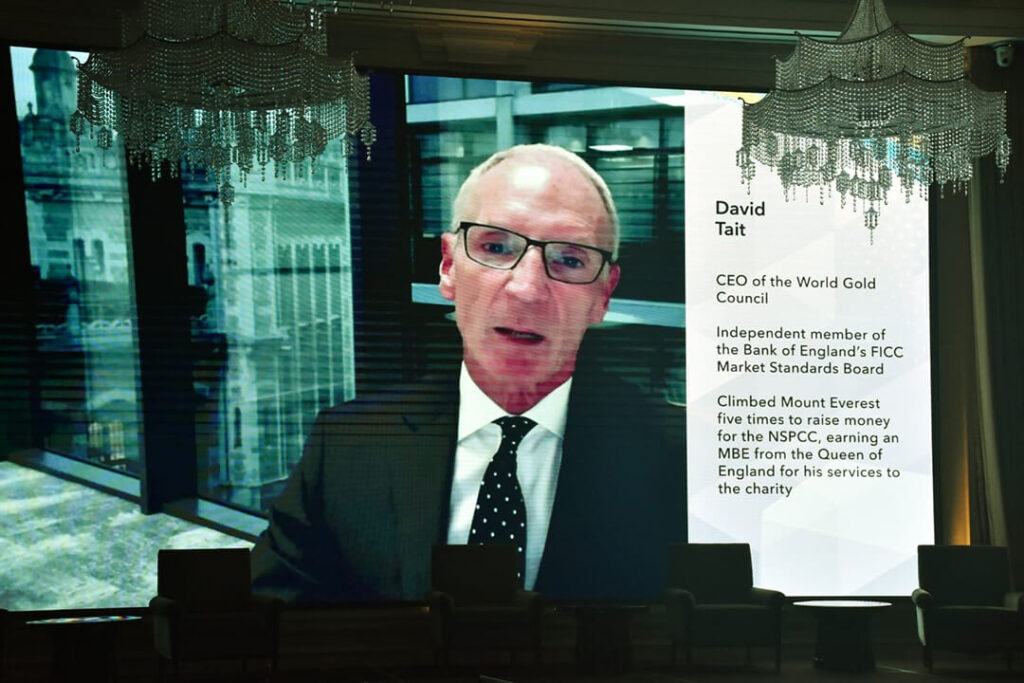

Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

Published on December 10, 2021

On November 9 the World Gold Council held its first EVOLVE APAC Investment Summit in Singapore, which brought together senior leaders and decision makers from the institutional investment and wealth management industries for a discussion on the future trends shaping the global economy and financial services industry.

With inflation a key theme emerging from the discussions, it is clear that gold could play an increased role in portfolios in the future.

Discussions for the summit revolved around the wider issue of investing and asset allocation in today’s VUCA (volatile, uncertain, complex and ambiguous) environment. More specifically, some of the key themes addressed were:

- Global trends shaping the future of finance;

- Asset allocation in a post-COVID era;

- Next generation investment – innovation in financial services;

- ESG evolution – meaningful measurement; and

- Emerging markets – untapped opportunities and unexpected challenges.

Speakers included Dr Nassim Nicholas Taleb, Dr Parag Khanna, Haiyan Wang, Dr Deborah Elms, Junice Yeo, and Sir Lynton Crosby.

Thank you to everyone who attended, and we look forward to hosting EVOLVE APAC again in Singapore in 2022.

World Gold Council, Singapore

It has been an active year for the World Gold Council in Singapore. We have significantly increased our research, communications, and marketing efforts, which include a series articles exploring the strategic case for investing in gold in Singapore, Australia and Japan. Consumer insights research was undertaken in Vietnam, ASEAN’s largest gold consuming market, and we are planning to launch similar consumer research in Thailand early next year.

Our institutional sales team in Singapore has been actively working with institutional investors across the region, but particularly in Singapore, Australia and Japan. Helping institutional investors understand the role of gold in a portfolio is key to ensuring gold continues to play a major role in the international financial system.

On the policy and market development front, we have been working with the domestic retail market on the launch and adoption of the Retail Gold Investment Principles (RGIPs). These are designed to increase the adoption of best practices in the sector and ensure that gold remains an asset that consumers can trust. We will be launching a local version of the RGIPs in Singapore early next year, followed by Australia.

Finally, we are working on a professional development curriculum for gold. This will be launched in Singapore in 2022, before a global roll-out. The programme is targeted at people working in the bullion industry, and covers the entire gold supply chain.

* This article was published in partnership with World Gold Council